In This Chapter

Understanding first things first:

Bookkeeping basics

Saving your records to save your bacon

Finding bookkeeping software

Using QuickBooks for your bookkeeping needs

Bookkeeping can be the most boring and time-consuming part of your job. You may feel that you just need to add your product costs, add your gross sales, and hey presto, you know where your business is. Sorry, not true. Did you add that roll of parcel tape you picked up at the supermarket today? Although it cost only 99p, that item is a business expense. How about the mileage driving back and forth from car boot sales and flea markets? The costs of those trips are expenses, too. We suspect that you’re also not counting quite a few other ‘small’ items just like these in your expense column.

Once you actually get into the task, you may enjoy posting your expenses and sales. Doing so gives you the opportunity to know exactly where your business is at any given moment. Using an easy software program increases the likelihood of your enjoying the bookkeeping process. In this chapter, we give you the low-down on the basics of bookkeeping, emphasise the importance of keeping records in case HM Revenue and Customs (HMRC) come calling, and explain why using QuickBooks is the smart software choice. This chapter is required reading.

Keeping the Topics: Basics That Get You Started

Although posting bookkeeping can be boring, clicking a button to generate your tax information is a lot easier than manually going over pages of sales

information on a pad of paper. We like to use a software program to speed the process up, particularly QuickBooks (more about that in the later section ‘QuickBooks: Making Bookkeeping Simple’).

You could use plain ol’ paper and a pencil to keep your topics; if doing so works for you, great. But even though bookkeeping by hand may work for you now, it definitely won’t in the future. Entering all your information into a software program now – while your topics may still be fairly simple to handle -can save you a lot of time and frustration in the future, when your eBay.co.uk business has grown beyond your wildest dreams and no amount of paper can keep it all straight and organised. We discuss alternative methods of bookkeeping in the ‘Bookkeeping Software’ section. For now, we focus on the basics of bookkeeping.

To effectively manage your business, you must keep track of all your expenses – down to the last roll of tape. You need to keep track of your inventory, how much you paid for the items, how much you paid in shipping, and how much you profited from your sales. If you use a van or the family car to pick up or deliver merchandise to the post office, keep track of this mileage as well. When you’re running a business, you should account for every penny that goes in and out.

Bookkeeping has irrefutable standards that are set by the Accounting Standards Board. Assets, liabilities, owner’s equity, income, and expenses are standard terms used in all forms of accounting to define profit, loss, and the fiscal health of your business.

Every time you process a transaction, two things happen: One account is credited while another receives a debit. To get more familiar with these terms (and those in the following list), see the definitions in the chart of accounts later in this chapter (in Table 16-1) and in Appendix A (a mini glossary we’ve included for your convenience). Depending on the type of account, the account’s balance either increases or decreases. One account that increases while another decreases is called double-entry accounting:

When you post an expense, the debit increases your expenses and decreases your bank account.

When you purchase furniture or other assets, it increases your asset account and decreases your bank account.

When you make a sale and make the deposit, it increases your bank account and decreases your accounts receivable.

When you purchase inventory, it increases your inventory and decreases your bank account.

When a portion of a sale includes VAT, it decreases your sales, and increases your sales tax account.

Manually performing double-entry accounting can be a bit taxing (no pun intended). A software program automatically adjusts the accounts when you input a transaction.

As a business owner, even if you’re a sole trader (see Chapter 15 for information on business types), you should keep your business topics separate from your personal expenses. (We recommend using a program such as Quicken to keep track of your personal expenses for tax time.) By isolating the business records from the personal records, you can get a snapshot of what areas of your sales are doing well and which ones aren’t carrying their weight. But that isn’t the only reason keeping accurate records is smart; there’s HM Revenue and Customs to think about, too. In the next section, we explain Her Majesty’s interest in your topics.

Records Her Majesty May Want to See

To help you get started with your business, the Department of Trade and Industry maintains a small business Web site (shown in Figure 16-1) at the following address:

![]()

In this section, we highlight what information you need to keep and how long you should keep it (just in case you’re chosen for an audit).

Hiring a professional to do your year-end taxes

When we say that you must hire a professional to prepare your taxes, we mean an accredited chartered accountant – they’re a valuable addition to your business arsenal. Although the people at your local ‘We Do Your Taxes in a Hurry Shop’ may be well meaning and pleasant, they may have completed only a short course in the current tax laws. Doing so does not make these people tax professionals. When business taxes are at stake, a professional with whom you have a standing relationship is the best choice. If you don’t know a professional accountant, ask around or contact your local Chamber of Commerce or a respectable organisation

like the Institute of Chartered Accountants (www.icaew.co.uk/) or the Association of Chartered Certified Accountants (www.acca global.com/).

Posting bookkeeping can be boring. At the end of the year when a professional is doing your taxes, however, you’ll be a lot happier – and your tax preparation will cost you less – if you’ve posted your information cleanly and in the proper order. For this reason, using QuickBooks (see the ‘QuickBooks: Making Bookkeeping Simple’ section) is essential to running your business.

Figure 16-1:

DTI home page for small businesses.

Supporting information

Aside from needing to know how your business is going (which is really important), the main reason to keep clear and concise records is because the taxman may come knocking one day. You never know when the Revenue will choose your number and want to examine your records. In the following list, we highlight some of the important pieces of supporting information (things that support your expenses on your end-of-year tax return):

Receipts: Save every receipt that you get. If you’re on a buying trip and have coffee at a motorway service station, save the receipt – that drink is a deduction from your profits. Everything related to your business may be deductible, so save airport parking receipts, cab receipts, receipts for a pen that you picked up on your way to a meeting, everything. If you don’t have a receipt, you can’t prove the write-off.

Merchandise invoices: Saving all merchandise invoices is as important as saving all your receipts. If you want to prove that you paid £400 and not the £299 retail price for an item that you sold on eBay.co.uk for £500, you’d better have an invoice of some kind. The same idea applies to most collectables, in which case a retail price can’t be fixed. Save all invoices!

Contractor invoices: If you use outside contractors – even if you pay the teenager next door to go to the post office and bank for you – get an invoice from them to document exactly what service you paid for and how much you paid. These invoices provide supporting information that can save your bacon, should it ever need saving.

Business cards: If you use your car to look at some merchandise, pick up a business card from the vendor. If you travel to a meeting with someone, take a card. Having these business cards can help substantiate your deductible comings and goings.

A daily calendar: Every time you leave your house or office on a business-related task, use a Palm Handheld (or a diary if you’re feeling low-tech) to make note of it. Keep as much minutia as you can stand. A Palm Desktop can print a monthly calendar. At the end of the year, staple the pages together and include them in your files with your substantiating information.

Credit card statements: You’re already collecting credit card receipts. If you have your statements, you have monthly proof of expenses. When you get your statement each month, post it into your bookkeeping program and itemise each and every charge, detailing where you spent the money and what for. (QuickBooks has a split feature that accommodates all your categories.) File these statements with your tax return at the end of the year in your year-end envelope (shoe box?).

We know that all this stuff piles up, but you can go to the shop and buy some plastic file storage containers to organise it all. To check for new information and the low-down on what you can and can’t do, ask an accountant. Also visit the HMRC Tax Information for Business site, shown in Figure 16-2, at

![]()

Figure 16-2:

Get tax information from the horse’s mouth here.

How long should you keep your records?

How long do you have to keep all this supporting information? We hate to tell you, but the period in which you can amend a return or in which HMRC can assess more tax is up to six years, and in extreme circumstances can extend even longer, so you must keep records for at least this long. HMRC states that if keeping records for six or more years causes you serious storage problems, then you may be allowed to get rid of some records a bit earlier. Contact the National Advice Service on 0845 010 9000 for more information if this issue applies to you.

Even though we got this information directly from the HMRC Web site, it may change in the future. You can download a PDF copy of the current recommendations by going to the following address:

![]()

If Adobe Acrobat Reader isn’t installed on your computer, you can download the software (for free) from the HMRC Web site. Bottom line: Storing your information for as long as you can stand it and staying on top of any changes HMRC may implement doesn’t hurt.

Bookkeeping Software

Keeping track of your auctions is hard without software, but keeping track of the money you make without software is even harder (and more time consuming). If using software to automate your auctions makes sense, so does using software to automate your bookkeeping. You can afford to make a mistake here and there in your own office, and no one will ever know. But if you make a mistake in the topics, your friendly tax inspector will notice – and be quite miffed. He may even charge you a penalty or two so that you’ll remember not to make those mistakes again.

Penalties for mistakes in your topics aren’t small. A late tax return will cost you a £100 tax penalty, which can be quite an expensive lesson.

Spreadsheet software can be a boon when you’re just starting out in business. A program such as Microsoft Works (which comes free on most new computers) or Excel is an excellent way to begin posting your business expenses and profits. The program can be set up to calculate your expenses, profits, and (we hope not too many) losses. Microsoft Works comes with several free financial worksheet templates that you can easily adapt for an eBay.co.uk small business. Also, you can find current Excel templates to get you started at www.microsoft.com/uk/office/prodinfo/default. mspx. Spending any extra money on templates when you’re first starting out isn’t necessary!

With official bookkeeping software, reconciling a chequebook is a breeze. You merely click off the deposits and cheques when the statement comes in. If you make a mistake when originally inputting the data, the software (comparing your balance and your bank’s) lets you know that you’ve made an error. Efficiency of this kind would’ve put Bob Cratchit out of a job!

We researched various Web sites to find which software was the best selling and easiest to use. We had many discussions with accountants, and bookkeepers. These professionals consider Intuit’s QuickBooks the best accounting software for business, which is why we devote so much of this chapter to it. Some people begin with Quicken and later move to QuickBooks when their business gets big or incorporates. Our theory? Start with the best. This software isn’t that much more expensive than others – we’ve seen new, sealed QuickBooks Pro 2005 software for as low as £100 on eBay.co.uk – and it will see you directly to the big time.

QuickBooks: Making Bookkeeping Simple

QuickBooks offers several versions, from basic to enterprise solutions tailored to different types of businesses. QuickBooks Basic and QuickBooks Pro have a few significant differences. QuickBooks Pro adds job costing and expensing features and the ability to design your own forms. QuickBooks Basic does a very good job too, so check out the comparison at www.quickbooks.co.uk and see which version is best for you. We use (and highly recommend) QuickBooks Pro, so we describe this version in the rest of this section.

QuickBooks 2005 Stephen L. Nelson is amazingly easy to understand. This topic answers – in plain English – just about any question you’ll have about using the program for your bookkeeping needs. Spend the money and get the topic. Any money spent on increasing your knowledge is money well spent (and is a tax write-off).

We update our QuickBooks software yearly, and every year it takes us less time to perform our bookkeeping tasks (because of product improvements). If you find that you don’t have time to input your bookkeeping data, consider hiring a bookkeeper. Professional bookkeepers probably already know QuickBooks, and they can print daily reports to keep you apprised of your business condition. Also, at the end of each year, QuickBooks supplies you with all the official reports your accredited chartered accountant needs to do your taxes. (Yes, you really do need a qualified accountant; see the ‘Hiring a professional to do your year-end taxes’ sidebar elsewhere in this chapter.) You can even send your accountant a backup on a zip disk or a CD-ROM. See how simple bookkeeping can be?

QuickBooks Pro

When you first fire up QuickBooks Pro, you need to answer a few questions to set up your account. Among the few things you need to have ready before you even begin to mess with the software are the following starting figures:

Cash balance: This may be the amount of money deposited from your eBay.co.uk profits. Put these profits into a separate account to use for your business.

Accounts receivable balance: Does anyone owe you money for some auctions? Outstanding payments make up this total.

Account liability balance: Do you owe some money? Are you being invoiced for some merchandise that you haven’t paid for? Add up any outstanding liabilities and enter the total when QuickBooks asks you to.

If you’re starting your business in the middle of the year, gather any previous profits and expenses that you want to include because you’ll have to input this information for a complete annual set of diligently recorded topics. This process is going to take a while. But after you’ve gathered together your finances, even if it takes a little sweat to set it up initially, you’ll be thanking us for insisting you get organised. Having properly organised topic just makes everything work smoother in the long run.

QuickBooks integrates with PayPal

PayPal can provide your payment history in QuickBooks format. They (PayPal) even offer a settlement and reconciliation system download that breaks up your PayPal transactions into debits and credits – a handy feature! One warning though: Only financial transactions are recorded and organised using this feature. When you use QuickBooks to its fullest, your inventory is in the program. When you purchase merchandise to sell, QuickBooks sets up the inventory – and deducts from it each time you input an invoice or a sales receipt. This way your inventory receipts follow recognised standards. eBay Timesaving Techniques, shows you the procedures for posting your weekly (or daily) sales in QuickBooks by using sales receipts.

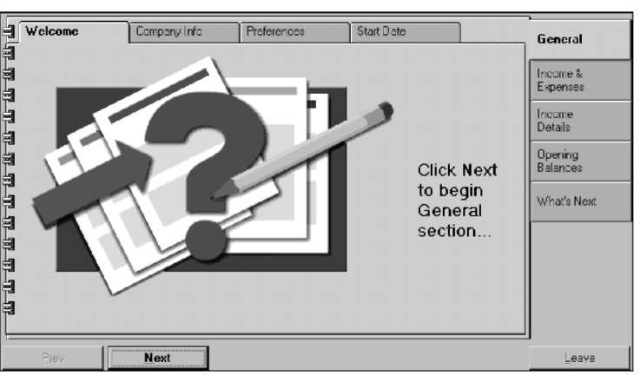

QuickBooks EasyStep Interview

After you’ve organised your finances, you can proceed with the QuickBooks EasyStep Interview, which is shown in Figure 16-3. The EasyStep Interview is designed to give those with accounting-phobia and those using a bookkeeping program for the first time a comfort level. If you mess things up, you can always use the back arrow and change what you’ve input. If you need help, simply click the Help button and the program answers many of your questions. If things go hideously wrong, you can always delete the file from the QuickBooks directory and start again.

Figure 16-3:

The QuickBooks Pro EasyStep Interview start page.

For the whirlwind tour through the QuickBooks EasyStep Interview, just follow these steps (which are only a general guideline):

1. Start QuickBooks, and choose the Create a New Company option.

You’re now at the EasyStep Interview.

2. On the first page of the interactive portion of the interview, type your company name (this becomes the filename in your computer) and the legal name of your company.

3. Continue to follow the steps, answering other questions about your business, such as the address and the type of tax form you use.

4. When QuickBooks asks what type of business you want to use, choose Retail: General.

QuickBooks doesn’t offer an online sales business choice, so Retail: General is the closest to what you need (see Figure 16-4). With the chart of accounts that we feature in the following section, you can make the appropriate changes to your accounts to adapt to your eBay business.

Figure 16-4:

Selecting your company type.

5. When QuickBooks asks whether you want to use its chosen chart of accounts, choose Yes.

See Figure 16-5.You can always change the accounts later. If you want to spend the time, you can also input your entire custom chart of accounts manually (but we really, really don’t recommend it).

Figure 16-5:

Accepting the QuickBooks chart of accounts.

6. Answer some more general questions, which we’re sure you can handle with the aid of the incredibly intuitive QuickBooks help area.

7. When the preferences pages appear, select the ‘Enter the bills first and then enter the payments later’ option.

That way, if you input your bills as they come in, you can get an exact idea of how much money you owe at any time by just starting the program.

8. Decide whether you want to use QuickBooks to process your payroll.

Even if you’re the only employee, using QuickBooks payroll information makes things much easier when it comes to filling out your payroll deposits. QuickBooks automatically fills in forms for your tax processing and prints the appropriate form ready for your signature and mailing.

9. Answer a few more questions, including whether you want to use the cash basis or accrual basis of accounting.

The accrual basis posts sales the minute you write an invoice or post a sales receipt, and posts your expenses as soon as you post the bills into the computer. Accrual basis accounting gives you a clearer picture of where your company is financially than cash basis accounting does. The cash basis is when you record bills by writing cheques – expenses are posted only when you write the cheques. Doing business on a cash basis may be simpler, but the only way you’ll know how much money you owe is by looking at the pile of bills on your desk.

If you’re new to bookkeeping, you may want to go through the interview step-by-step with a tutor at your side. For more details, check out QuickBooks 2005- this topic can teach you almost everything you need to know about QuickBooks.

10. If you’re comfortable, just click Leave and input the balance of your required information directly into the program without using the interview.

QuickBooks chart of accounts

After you finish the EasyStep Interview and successfully set yourself up in QuickBooks, the program presents a chart of accounts. Think of the chart of accounts as an organisation system, such as file folders. The chart of accounts keeps all related data in the proper area. When you write a cheque to pay a bill, it deducts the amount from your current account, reduces your accounts payable, and perhaps increases your asset or expense accounts.

You have a choice of giving each account a number. These numbers, a kind of bookkeeping shorthand, are standardised throughout bookkeeping; believe it or not, everybody in the industry seems to know what number goes with what item. To keep the process simple, we like to use titles as well as numbers.

To customise your chart of accounts, follow these steps:

1. Choose EditOPreferences.

2. Click the Accounting icon (on the left).

3. Click the Company preferences tab and indicate that you’d like to use account numbers.

An editable chart of accounts appears, as shown in Figure 16-6. Because QuickBooks doesn’t assign account numbers as a default, you need to edit the chart to create them.

Figure 16-6:

Your chart of accounts now has numbers generated by QuickBooks.

4. Go through your QuickBooks chart of accounts and add any missing categories.

You may not need all these categories, and you can always add more later. Table 16-1 presents a chart of accounts written by an accountant for an eBay.co.uk business. Figure 16-7 shows a customised chart of accounts.

Figure 16-7:

Customised chart of accounts for an eBay.co.uk business.

| Table 16-1 | eBay.co.uk Business Chart of Accounts | |

| Account Number | Account Name | What It Represents |

| 1001 | Checking | All revenue deposited here and all cheques drawn upon this account |

| 1002 | Money market account | Company savings account |

| 1100 | Accounts receivable | For customers to whom you extend credit |

| 1201 | Merchandise inventory | Charge to cost of sales as used, or take periodic inventories and adjust at that time |

| 1202 | Shipping supplies | Boxes, tape, labels, and so forth; charge these to cost as used, or take an inventory at the end of the period and adjust to cost of sales |

| Table 16-1 (continued) | ||

| Account Number | Account Name | What It Represents |

| 1401 | Office furniture & equipment | Desk, computer, telephone |

| 1402 | Shipping equipment | Scales, tape dispensers |

| 1403 | Vehicles | Your vehicle, if owned by the company |

| 1501 | Accumulated depreciation | For your accountant’s use |

| 1601 | Deposits | Security deposits on leases |

| 2001 | Accounts payable | Amounts owed for the stuff you sell, or charged expenses |

| 2100 | Payroll liabilities | Taxes deducted from employees’ cheques and taxes paid by company on employee earnings |

| 2501 | Equipment loans | Money borrowed to buy a computer or other equipment |

| 2502 | Car loans | When you get that hot new van for visiting your consignment clients |

| 3000 | Owner’s capital | Your opening balance |

| 3902 | Owner’s draw | Your withdrawals for the current year |

| 4001 | Merchandise sales | Revenue from sales of your products |

| 4002 | Shipping and handling | Paid by the customer |

| 4009 | Returns | Total amount of returned merchandise |

| 4101 | Interest income | From your investments |

| 4201 | Other income | Income not otherwise classified |

| 5001 | Merchandise purchases | All the merchandise you buy for eBay.co.uk; you’ll probably use sub-accounts for individual items |

| Table 16-1 (continued) | ||

| Account Number | Account Name | What It Represents |

| 6158 | Credit card merchant account fees | If you have a separate merchant account, post those fees here |

| 6160 | Dues | If you join an organisation that charges membership fees (relating to your business) |

| 6161 | Magazines and periodicals | topics and magazines that help you run and expand your business |

| 6170 | Equipment rental | Postage meter, occasional van |

| 6180 | Insurance | Policies that cover your merchandise or your office |

| 6185 | Liability insurance | Insurance that covers you if someone slips and falls at your place of business (can also be put under Insurance) |

| 6190 | Disability insurance | Insurance that will pay you if you become temporarily or permanently disabled and can’t perform your work |

| 6191 | Health insurance | If provided for yourself, you may be required to provide it to employees |

| 6200 | Interest expense | Credit interest and interest on loans |

| 6220 | Loan interest | When you borrow from the bank |

| 6240 | Miscellaneous | Whatever doesn’t go anywhere else |

| 6250 | Postage and delivery | Stamps used in your regular business |

| 6260 | Printing | Your business cards, correspondence stationery, and so on |

| 6265 | Filing fees | Fees paid to file legal documents |

| 6270 | Professional fees | Fees paid to consultants |

| 6280 | Legal fees | If you have to pay a lawyer |

| Account Number | Account Name | What It Represents |

| 6650 | Accounting and bookkeeping | Fees paid to a bookkeeper or accountant |

| 6290 | Rent | Office, warehouse, and so on |

| 6300 | Repairs | Can be the major category for the following subcategories |

| 6310 | Building repairs | Repairs to the building where you operate your business |

| 6320 | Computer repairs | What you pay the person who sets up your wireless network |

| 6330 | Equipment repairs | When the photocopier or phone needs fixing |

| 6340 | Telephone | Regular telephone, fax lines |

| 6350 | Travel and entertainment | Business-related travel, business meals |

| 6360 | Entertainment | When you take eBay’s CEO out to dinner to benefit your eBay business |

| 6370 | Meals | Meals while travelling for your business |

| 6390 | Utilities | Major heading for the following subcategories |

| 6391 | Electricity and gas | Electricity and gas |

| 6392 | Water | Water |

| 6560 | Payroll expenses | Wages paid to others |

| 6770 | Supplies | Office supplies |

| 6772 | Computer | Computer and supplies |

| 6780 | Marketing | Advertising or promotional items you purchase to give away |

| 6790 | Office | Miscellaneous office expenses, such as bottled water delivery |

| 6820 | Taxes | Major category for the following subcategories |

| 6840 | Local | council tax |

| 6850 | Property | Property taxes |