In This Chapter

Deciding your business format

Covering the legalities

Business format? ‘What’s a business format?’ you may ask. We hate to be the ones to tell you, but you can’t just say, ‘I’m in business,’ and be in business. When you started selling on eBay.co.uk, maybe you were happy just adding a few pounds to your income. Now that the money is coming in faster, you have a few more details to attend to. Depending on how far you’re going to take your business, you have to worry about taxes, bookkeeping, and possible ramifications down the line.

We want to remind you that we’re not lawyers or accountants. The facts we give you in this chapter are gleaned from what we’ve learned over the years. When you begin a formal business, involving a lawyer and an accountant is a smart move. At the very least, visit www.startups.co.uk, a great Web site that offers some excellent business startup advice and success stories.

One of the first rules in the eBay.co.uk User Agreement reads ‘. . . your eBay account (including feedback) and User ID may not be transferred or sold to another party’. This rule means that if you begin your business on eBay.co.uk with another person, you need some kind of agreement up front about who gets the user ID in case of a sale. And if you sell your business, the person with the original ID needs to be involved actively with the new company – as the rules say, your feedback can never be transferred or sold. A new owner has to start a new account on eBay.co.uk with a new name – unless the principal from the old company was contractually involved and was the actual eBay seller.

To our knowledge, no one has tested this rule in court, and we bet you don’t want to be the first to face eBay’s top-notch lawyers. Know that this is the rule about feedback and User ID and plan for it.

Types of Businesses

Businesses come in several forms, from a sole trader all the way to a multinational corporation. However, a corporation designation isn’t as scary as it may sound. Yes, Microsoft, IBM, and eBay are corporations, but so are many individuals running businesses. Each form of business has its plusses and minuses – and costs. We go over some of the fees involved in incorporating later in this chapter. For now, we detail the most common types of businesses, which we encourage you to weigh carefully.

Before embarking on any new business format, consult with a professional in the legal and financial fields.

Sole trader

If you’re running your business by yourself part time or full time, you’re a sole trader. ‘A sole trader is the simplest form of business – nothing is easier or cheaper. Most people use this form of business when they’re starting out. Many people then graduate to a more formal type of business as things get bigger.

If a husband and wife file a joint tax return, they can run a business as a sole trader (but only one of you can be the proprietor). However, if both you and your spouse work equally in the business, running it as a partnership – with a written partnership agreement – is a much better idea. (See the next section, ‘Partnership’, for more information.) A partnership protects you in case of your partner’s death. In a sole proprietorship, the business ends with the death of the proprietor. If the business has been a sole proprietorship in your late spouse’s name, you may be left out in the cold.

While being in business adds a few expenses, you can deduct from your taxes many expenses relating to your business. As a sole trader you can run the business out of your personal bank account (although we don’t advise doing so). The profits of your business are taxed directly as part of your own income tax. As a sole trader, you’re at risk for the business liabilities. All outstanding debts are yours, and you could lose personal assets if you default.

Also, you must consider the liability of the products you sell on eBay.co.uk. If you sell foodstuff, vitamins, or neutraceuticals (new age food supplements) that make someone ill, you may be personally liable for any court-awarded damages. If someone is hurt by something you sell, you may also be personally liable as the seller of the product.

Partnership

A business involving two or more people can be a partnership. A general partnership can be formed by an oral agreement. Each person in the partnership contributes capital or services and both share in the partnership’s profits and losses. The income of a partnership is taxed to both partners, based on the percentage of the business that they own or upon the terms of a written agreement.

Make sure that you can have a good working relationship with your partner: This type of business relationship has broken up many a friendship. Writing up a formal agreement when forming your eBay.co.uk business partnership is an excellent idea. This agreement is useful in solving any disputes that may occur over time.

In your agreement, outline things such as

How to divide the profits and losses

Compensation to each of you

Duties and responsibilities of each partner

Restrictions of authority and spending

How disputes should be settled

What happens if the partnership dissolves

What happens to the partnership in case of death or disability

One more important thing to remember: As a partner, you’re jointly responsible for the business liabilities and actions of the other person or people in your partnership – as well as your own. Again, this is a personal liability arrangement. You are both personally open to any lawsuits that come your way through the business.

In most cases, one of the partners has to fill in a self-assessment tax form supplied by HM Revenue & Customs.

Limited company

A limited company is similar to a partnership, but also has many of the characteristics of a corporation. A limited company differs from a partnership mainly in that the liabilities of the company are not passed on to the owners. Unless you sign a personal guarantee for debt incurred, the owners are responsible only to the total amount they have invested into the company. But all owners do have liability for the company’s taxes.

You need to put together an operating agreement, similar to the partnership agreement. This agreement also will help establish which members own what percentage of the company for tax purposes.

A limited company has to pay corporation tax on its income and profits. In a limited company, the owners are responsible for working out how much tax the company needs to pay. A self-assessment form can be submitted to HM Revenue & Customs.

Corporation

A corporation has a life of its own: Its own name, its own bank account, and its own tax return. A corporation is a legal entity created for the sole purpose of doing business. One of the main problems a sole trader faces when incorporating is realising that he or she can’t help themselves to the assets of the business. Yes, a corporation can have only one owner: The shareholder(s). If you can understand that you can’t write yourself a cheque from your corporation, unless the cheque is for salary or for reimbursement of legitimate expenses, you may be able to face the responsibility of running your own corporation.

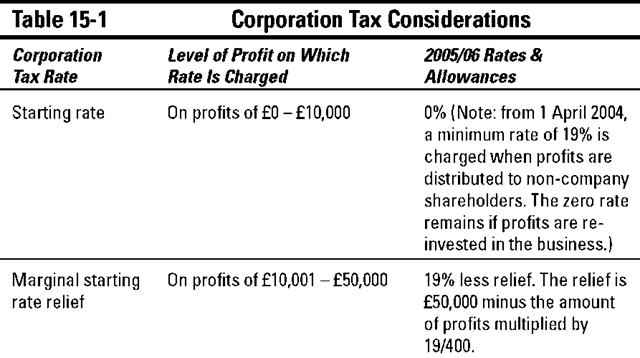

As a corporation, several ways exist to avoid a big tax bill – investing profits back in to the business is one of them. If your business gets so big that tax becomes an issue (congratulations!), you almost certainly need an accountant to deal with your company finances. For a quick guide to tax liabilities, however, see Table 15.1.

| Corporation | Level of Profit on Which | 2005/06 Rates & |

| Tax Rate | Rate Is Charged | Allowances |

| Small companies’ | On profits of £50,001 – £300,000 | 19% |

| rate | ||

| Marginal small | On profits of £300,001 - | 30% less relief. The relief |

| companies’ relief | £1,500,000 | is £1,500,000 minus the |

| amount of profits multiplied | ||

| by 11/400. | ||

| Main rate | On profits of £1,500,001 | 30% |

| and above |

Often in small corporations, most of the profits are paid out in tax-deductible salaries and benefits. The most important benefit for a business is that any liabilities belong to the corporation. Your personal assets remain your own, because they have no part in the corporation.

Taking Care of Regulatory Details

Here are some important words to make your life easier in the long run: Don’t ignore regulatory details. Doing so may make life easier at the outset, but if your business is successful, one day your casual attitude will catch up with you. Ignorance is no excuse. To do business, you must comply with all the rules and regulations that are set up for your protection and benefit. We’ve included some major regulations in this section, but for a complete list go to www.businesslink.gov.uk – the government’s business support service.

Health & Safety

You are legally obliged to create a safe environment when you create your eBay.co.uk office, especially if you have employees. The Health & Safety Executive says you must minimise occupational risk by giving regular breaks, providing training, and establishing safe work stations without the risk of tripping or slipping.

Privacy laws

The Privacy and Electronic Communications Directive regulates the use of unsolicited e-mails (spam), text messages, and cookies (which store details about people coming to your Web site), so you can’t spam people or send out marketing material without people’s say-so.

Product descriptions

eBay.co.uk has its own rules about product descriptions. You must describe your items accurately and not add on any little fictitious details to help them sell (‘this pair of shoes belonged to John Lennon’, for example). This regulation is mirrored in UK law covering product descriptions.

Online contracts

Since 2002, all contracts written online are binding – that means bidding on eBay.co.uk, too. So if you offer something for sale and your offer is accepted, then you’re legally obliged to come up with the goods – literally.