The essential functions of a bank are to loan funds and serve as a riskless depository, paying interest on deposits. A riskless environment is particularly important to small investors, given their greater information and surveillance costs. Diamond and Dybvig (1983) show that the contract between the depository institutions and depositors is very delicate, using a game-theoretic approach to show that this contract is prone to bank runs. That is, as a depositor, there is an incentive to get in line first, even if you believe the bank to be sound, because a run by other depositors may cause the bank to become insolvent. The depositor at the back of the line is likely to lose. To be a “safe haven” for depositors, the insurance of deposits (implicit or explicit) by a third party , a guarantor, is required. To be credible, the guarantor of deposit insurance must have taxing power. Deposit insurance removes the incentive for bank runs.

There has been a dramatic increase in our understanding of the value of deposit insurance to the bank and correspondingly, the cost of de posit insurance to the guarantor (the Federal Deposit Insurance Corporation (FDIC) in the United States) in the last two decades. An important issue in deposit insurance is the ability to incorporate theoretical developments in the field to the actual pricing of deposit insurance by the FDIC. In many cases, the theoretical developments have largely been ignored by the FDIC’s politics. Although there are still issues which remain unresolved in the theoretical pricing of deposit insurance, we understand the basic mechanics from which the ultimate mode l must come.

Valuing Deposit Insurance as a Put Option

The pioneering work in the pricing of deposit insurance comes from Merton (1977) who identifies an “isomorphic” correspondence between deposit insurance and common stock put options. Merton works in the Black-Scholes (1973) framework of constant interest rates and volatility for expositional convenience. In Merton’s (1977) model, a depository institution borrows money by issuing a single homogeneous debt issue as a pure discount bond. The bank promises to pay a total of B dollars to depositors at maturity. If V denotes the value of the bank’s assets, the payoff structure of the payment guarantee (deposit insurance) to the guarantor at the maturity date if the face value of the debt exceeds the bank’s assets is: – (B -V(T)) while if the value of the banks assets equals or exceeds the face value of the debt, the payoff is zero. In either case the payoff may be expressed as: max (B – V(T),0). Providing deposit insurance can be viewed as issuing a put option on the value of the bank’s assets with an exercise price equal to the face value of the bank’s outstanding debt. Assuming V follows a geometric Brownian motion, and the original a ssumptions of Black-Scholes, valuation of the deposit insurance as a put option follows from Black-Scholes. The value of deposit insurance is:

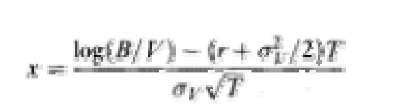

where

O is the cumulative normal distribution, < is the instantaneous standard deviation of V, and r is the instantaneous spot rate.

Empirical Methodology

Though the Merton model (1977) describes the pricing of deposit insurance, empirical and practical applications of his model require two important variables that are unknown: the value of the bank’s assets and the volatility of returns on those assets. In this regard, Marcus and Shaked (1984) and Ronn and Verma (1986) attempt to estimate these unknown inputs from observable data. Ronn and Verma (1986) note an important contribution from Black-Scholes: the equity of the bank, E, can be viewed as a call option on the value of the bank’s assets. This provides one equation with two unknown parameters, the value of the bank’s assets and the volatility of returns on those assets. Moreover, Ronn and Verma employ Merton’s (1974) equation relating the volatility of returns on equity to the volatility of returns on assets. This provides a two-equation system:

and

which can be solved simultaneously for the two unknown parameters. These two papers led to numerous empirical studies examining the over- or underpricing of deposit insurance by the FDIC. More recent work on the determination of the two unknown parameters in deposit insurance pricing by Duan (1994) suggests that the Ronn and Verma methodology is flawed, in that equation (3) is derived from equation (2) under the assumption of constant volatility of equity. Duan (1994) suggests that if bank assets are assumed to follow a process with constant variance (as Merton (1977) assumes) and bank equity is a call option on bank assets, bank equity must have a non-constant variance. This presents two empirical problems. First, one cannot sample bank equity returns for esti mates of bank equity volatility because equity volatility is stochastic. Second, Merton’s (1974) equation relating equity volatility to asset volatility assumes equity volatility is constant and therefore cannot be employed.

Duan (1994) offers an alternative methodology which overcomes some of the shortcomings of the Ronn and Verma (1986) approach. Duan (1994) suggests that the unobserved series of market value of assets and the volatility of ass ets of the bank can be estimated using a time series of equity values of the bank. Equation (3) relating the value of assets and asset volatility to equity values can be transformed in such a way that the value of assets is written in terms of the equity value of the bank and the volatility of assets. Estimation is then carried out on a transformed log-likelihood function of the time series of equity values. This estimation technique provides estimates for the mean return and volatility of a bank’s assets.

Stochastic Interest Rates and Volatility

Although we have come a long way in the pricing of deposit insurance, there are still many issues which are unresolved. An important consideration is the value of extending Merton’s (1977) model to a stochastic interest rate environment. Duan et al. (1995) have empirically tested the effect of stochastic interest rates on deposit insurance using Vasicek’s (1977) model and find that the inclusion of stochastic interest rates has a significant impact on deposit insurance. Au et al. (1995) directly incorporate the bank’s duration gap into the put option’s total volatility. They price the deposit insurance put option following Merton’s (1973) generalization of Black-Scholes and model interest rate dynamics following the no-arbitrage-based Heath et al. (HJM) (1992) model. The HJM paradigm provides a number of important benefits for modeling interest rate dynamics, as it avoids the specification of the market price of risk, allows a wide variety of volatility functions, and easily allows for multiple factors for interest rate shocks.

Another important issue in deposit insurance pricing is the ability of the bank to change the volatility of its assets over time. For instance, a s a bank approaches failure, bank management may have incentives to increase the riskiness of its portfolio because bank management reaps the rewards of a successful outcome, while the FDIC pays for an unsuccessful outcome. Recent papers, such as Boyle and Lee (1994), have developed theoretical extensions to the model to account for stochastic volatility.

FDIC’s Closure Policy and Non-Tradable Assets

Additionally, the Merton (1977) model does not account for the closure policy of the insuring agency. Ronn and Verma (1986) alter Merton’s (1977) model to allow for forbearance on the part of the insuring agent. Forbearance essentially allows the bank to operate with negative net worth. However, the exact amount of forbearance is debatable. Moreover, although some forbearance may be granted, there is some limit at which the FDIC will close the bank. Therefore, perhaps a more appropriate method of modeling the deposit insurance put option is to value it as a down-and-out barrier option, wherein, once a certain level of asset value is exceeded, the bank is closed. Recent papers have begun to examine this question.

Finally, and importantly, an unresolved issue is the appropriateness of Merton’s (1977) model in light of the fact that the assets of the bank are non-tradable. For the isomorphic correspondence between stock options and de posit insurance to hold, one must be able to achieve the riskless hedge, which requires the ability to trade in the underlying.

FDIC and Continuing Developments

Though there are currently limitations in the theoretical pricing of deposit insurance, our knowledge is much greater than it was twenty years ago. Such a guarantee is costly, as is obvious from the failure of FSLIC, the Saving s and Loan deposit-insuring agency. The cost of the guarantee is increasing in the debt level of the bank and the riskiness of the bank’s assets. However, the FDIC has largely ignored theoretical developments, maintaining a constant premium of deposit insurance (per dollar of deposits) regardless of individual bank characteristics. Kendall and Levonian (1991) show that even a dichotomous grouping of banks on individual characteristics improves upon the FDIC’s current policy. It is therefore troublesome that the FDIC would continue to ignore the developments in the area.