VALUATION

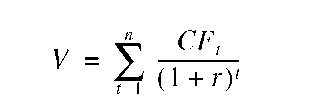

1. The process of determining the intrinsic value of an asset, such as a security, business, or a piece of real estate. The process of determining security valuation involves finding the present value of an asset’s expected future cash flows using the investor’s required rate of return. Thus, the basic security valuation model can be defined mathematically

as follows:

where

V = intrinsic value (or present value) of an asset CFt = expected future cash flows in period t = 1, …, n r = investor’s required rate of return

2. Assessing the value of imported goods by customs to assess the appropriate duty charge.

VALUE DATE

Also called the settlement date.

1. The value date for spot exchange transactions is the date when value is given (i.e., funds are deposited) for those transactions between banks. It is set as the second working day after the transaction is concluded.

2. The point in time when a bank remittance actually becomes available to the payee for use.

VARIATION MARGIN

The amount to be paid to satisfy maintenance margin.

VEHICLE CURRENCY

A currency used in international trade to make quotes and payments, vehicle currency plays a central role in the foreign exchange market (e.g., the U.S. dollar and Japanese yen).

VIRTUAL CURRENCY OPTIONS

Virtual currency options, also called 3-Ds (dollar-denominated delivery), are options that do not require the payment or delivery of the underlying currency. Currently, 3-D options are available on the Deutsche mark and the Japanese yen. They are European-style options that mature anytime from one week to nine months, and they settle weekly.

VISIBLE TRADE

Also called the balance of trade, foreign trade in merchandise.