A long-term debt instrument that is not collateralized. Because it is unsecured debt, it is issued usually by large, financially strong companies with excellent bond ratings.

DEBT SWAP

Also called a debt-equity swap, a debt swap is a set of transactions in which an MNC buys a country’s dollar bank debt at a discount and swaps this debt with the central bank for local currency that it can use to acquire local equity.

DEFAULT RISK

Default risk is the risk that a borrower will be unable to make interest payments or principal repayments on debt. For example, there is a great amount of default risk inherent in the bonds of a company experiencing financial difficulty. Exhibit 35 presents the degree of default risk for some investment instruments.

EXHIBIT 35

Default Risk Among Short-Term Investment Vehicles

DELTA

In option, delta is the ratio of change of the option price to a small change in the price of the underlying asset. Denoted with S, it is also equal to the derivative of the option price to the security price.

DELTA HEDGE

A powerful hedging strategy using options with steady adjustment of the number of options used, as a function of the delta of the option.

DEPRECIATION

1. A drop in the foreign exchange value of a floating currency. The opposite of depreciation is appreciation. This term contrasts with devaluation, which is a drop in the foreign exchange value of a currency that is pegged to gold or to another currency. In other words, the par value is reduced.

2. The decline in economic potential of limited life assets originating from wear and tear, natural deterioration through interaction of the elements, and technical obsolescence.

3. The spreading out of the original cost over the estimated life of the fixed assets such as plant and equipment.

DEPRECIATION OF THE DOLLAR

Also called cheap dollar, weak dollar, deterioration of the dollar, or devaluation of the dollar, depreciation of the dollar refers to a drop in the foreign exchange value of the dollar relative to other currencies.

DERIVATIVES

Derivatives are leveraged instruments that are linked either to specific financial instruments or indicators (such as foreign currencies, government bonds, stock price indices, or interest rates) or to particular commodities (such as gold, sugar, or coffee) that may be purchased or sold at a future date. Derivatives may also be linked to a future exchange, according to contractual arrangement, of one asset for another. The instrument, which is a contract, may be tradable and have a market value. Among derivative instruments are options (on currencies, interest rates, commodities, or indices), traded financial futures, and arrangements such as currency and interest rate swaps. Firms use derivative instruments to hedge their risks from swings in securities prices or currency exchange rates. They also can be used for speculative purposes, that is, to make risk bets on market movements. See also FINANCIAL DERIVATIVE.

DEUTSCHE MARK

Germany’s currency.

DEVALUATION

The process of officially dropping the value of a country’s currency relative to other foreign currencies.

DINAR

Monetary unit of Abu Dhabi, Aden, Algeria, Bahrain, Iraq, Jordan, Kuwait, Libya, South Yemen, Tunisia, and Yugoslavia.

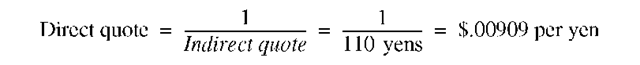

DIRECT QUOTE

The price of a unit of foreign currency expressed in the home country’s currency: dollars per pound, dollars per yen, etc. For example, the direct quote for Japanese yen is $.00909 per yen if the home country is the U.S. Direct and indirect quotations are reciprocals.

Spot (cash) rates, both direct and indirect, are presented in Exhibit 36.

EXHIBIT 36

Foreign Exchange Rates

| Tuesday. March 13. 2001 | U.S. $ EQUIV. | CURRENCY PER U.S. $ | |||||||

| EXCHANGE RATES

The New York foreign exchange mid-range rates below apply |

COUNTRY

Japan (Yen)……………….. |

Tue

.008351 .008387 |

Hon

.008306 .008343 .008408 |

Tue

119.74 11923 |

Mon

120.39 11986 |

||||

| to trading among banks in amounts of $ | 1 million and more, | .008454 | 11829 | 11894 | |||||

| as quoted at 4 | p.m. Eastern time by Reuters and other | .008554 | .008505 | 11690 | 117 58 | ||||

| sources. Retail transactions provide fewer units of foreign currency per dollar. Rates for the 12 Euro currency countries are derived from the latest dollar-euro rate using the ex- | Jordan (Dinar)…………….

Kuwait (Dinar)……………. Lebanon (Pound)……….. |

1.4085 3.2584 .0006604 | 1.4065 3.2616 .0006604 | .7100 .3069 1514.25 | .7110 .3066 1514.25 | ||||

| U.S. $ EQUIV. | CURRENCY PER U.S. S | Malaysia (Ringgit)-b. . Malta (Lira)……………….. | .2632 2.2553 | .2632 2.2789 | 3.8001 | 3.8000 | |||

| COUNTRY | Tue | .4434 | .4388 | ||||||

| Argentina (Peso) Australia (Dollar) Austria (Schilling) Bahrain (Dinar) Belgium (Franc)

Brazil (Real)……………. Britain (Pound) 1-month forward 3-months forward |

1.0001 .5053 .06648 2.6525 .0227 .4850 1.4490 1.4486 1.4474 1.4454 | 1.0001 .5092 .06751 2.6525 .0230 | .9999 1.9792 15.043 .3770 44.0994 | .9999 1.9637 14.813 .3770 43.4253 2.0660 .6828 .6830 .6836 6845 | Mexico (Peso)…………….

Floating rate………………. Netherland (Guilder)…… New Zealand (Dollar)…. Norway (Krone) …………. Pakistan (Rupee)……….. |

.1044 .4151 .4180 .1113 .01668 | .1035 .4215 .4203 .1132 .01689 | 9.5810 2.4091 2.3923 8.9819 59.950 | 9.6600 2.3723 2.3793 8.8376 59.200 |

| 1.4645 1.4641 1.4628 1 4508 | .6901 .6903 .6909 6919 | Peru (new Sol)…………..

Philippines (Peso)……… Poland (Zloty)-d Portugal (Escudo)………. |

.2843 .02077 .2455 .004563 | .2843 .02078 .2479 .004634 | 3.5178 48.150 4.0725 219.17 | 3.5176 48.125 4.0338 215.82 | |||

| Canada (Dollar)

1-month forward……… |

.64 75 .6476 | .6445 .6445 | 1.5443 1.5441 | 1.5517 1.5515 | Russia (Ruble)-a…………

Saudi Arabia (Riyal)…… |

.03487 .2666 | .03489 .2666 | 28.677 3.7506 | 28.661 3.7505 |

| 3-months forward……. | .6479 | .6448 | 1.5434 | 1.5508 | Singapore (Dollar)……… | .5683 | .5677 | 1.7595 | 1.7614 |

| 6-months forward……. | .6483 | .6452 | 1.5426 | 1.5500 | Slovak Rep. (Koruna)… | .02094 | .02126 | 47.758 | 47.032 |

| Chile (Peso)……………. | … .001703 | .001687 .1208 | 587.25 | 592.75 | South Africa (Rand)…… | .1277 | .1285 | 7.8300 | 7.7800 |

| China (Renminbi)…….. | .1208 | 8.2783 | 8.2784 | South Korea (Won)……. | .0007843 | .0007819 | 1275.00 | 1279.00 | |

| Colombia (Peso)……… | … .0004389 | .0004388 | 2278.30 | 2278.75 | Spain (Peseta)……………

Sweden (Krona)…………. |

.005498 | .005583 | 181.89 | 179.11 |

| Czech. Rep. (Koruna). | .0998 | .1013 | 10.0170 | 9.8670 | |||||

| Commercial rate………. | .02647 | .02681 | 37.776 | 37.296 | Switzerland (Franc)……. | .5943 | .6036 .6046 .6061 .6083 .03084 .02283 .00000109 | 1.6827 | 1.6567 |

| Denmark (Krone) Ecuador (US Dol!ar)-e

Finland (Markka)……… France (Franc)………… 1-month forward |

.1224 1.0000 .1539 .1395 .1395 1395 | .1243 1.0000 .1562 .1416 .1417 1417 | 8.1688 1.0000 6.4998 7.1709 7.1688 71664 | 8.0471 1.0000 6.4005 7.0613 7.0590 7 0571 | 1-month forward…………

3-months forward…… 6-months forward. . Taiwan (Dollar)…………… Thailand (Bafcl) ….. Turkey (Lira)……………… |

.5952 .5967 .5990 .03075 .02295 .00000104 | 1.6801 1.6759 1.6694 32.520 43.570 963000.00 | 1.6540 1.6500 1.6439 32.430 43.800 920000.00 | |

| 6-months forward……. | .1396 | .1418 | 7.1628 | 7.0536 | United Arab (Dirham)… | .2723 | .2723 | 3.6729 | 3.6730 |

| Germany (Mark) | .4677 .4678 .4680 | .4750 .4751 | 2.1381 2.1375 | 2.1054 2.1047 | Uruguay (New Peso)…..

Financial…………………….. |

.07871 | .07874 | 12.705 | 12.700 |

| 3-months forward……. | .4752 | 2.1368 | 2.1042 | Venezuela (Bolivar)…….. | .001420 | .001420 | 704.00 | 704.45 | |

| 6-months forward……. | .4682 | .4755 | 2.1357 | 2.1031 | SDR…………………………… | 1.2878 | 1.2907 | .7765 | |

| Greece (Drachma)…… | … .002685 | .002726 | 372.51 | 366.81 | .7748 | ||||

| Hong Kong (Dollar)…. Hungary (Forint) India (Rupee)………….. | .1282 .003434 .02144 | .1282 .003489 .02149 | 7.7999 291.17 46.640 | 7.8000 286.61 46.540 | turn……………………………..9148 .9290 1.0931 1.0764

Special Drawing Rights (SDR) are based on exchange rates for the U.S., German, British, French, and Japanese curren- |

||||

| Indonesia (Rupiatt)….. | … .0000972 | .0000952 | 10287.50 | 10500.00 | a-Russian Centra! Bank rate. | b-Government rate. d-Floating | |||

| Ireland (Punt)………….. | 1.1614 | 1.1795 | .8610 | .8478 4,1330 | rate; trading band suspended on 4/1 l/OO. e-Adopted U.S. | ||||

| Israel (Shekel)…………. | .2420 | .2420 | 4.1330 | dollar as of 9/1 l/OO. Foreign Exchange rates are available | |||||

| Italy (Lira)………………. | … .0004724 | .0004798 | 2116.72 | 2084.36 | from Readers’ Reference Service (413) 592-3600. | ||||

DIRHAM

Monetary unit of the United Arab Republic and Morocco.

DIRTY FLOAT

Also called managedfloat, dirty float is a flexible (market-determined) exchange rate system in which central banks intervene directly in foreign exchange markets from time to time to manipulate short-term swings in exchange rates in a direction perceived to be in the national interest. A country floats “dirty” if it attempts to hold down a strong currency in order to keep its exports competitive, when all objective analysis would suggest that the currency is undervalued.

The total price of a bond, including accrued interest.

DISCOUNTING

1. Deducting anticipated undesirable economic or company’s negative earnings, news from security prices prior to their announcement. For example, a highly anticipated interest rate hike by the Federal Reserve Bank of the U.S. may have already been factored in stock prices a few weeks ahead.

2. Process of determining the present worth of expected future cash flows generated by a project—either a single sum or a series of cash sums to be paid or received. This process is used to evaluate the value of a foreign direct investment (FDI) project.

3. In connection with forward foreign exchange rates, the percentage amount by which the forward rate is less than the spot rate.

4. Interest deducted in advance from a loan, forfaiting, or factoring. For example, the discount rate for forfaiting is set at a fixed rate, typically about 1.25% above the local borrowing rate or the London Interbank Offer Rate (LIBOR).

DISINVESTMENT

1. Also called divestiture, the selling off or closing down of all or part of a foreign direct investment (e.g., foreign subsidiaries) for economic or other reasons.

2. Pulling out of the capital invested in a foreign country.

DIVERSIFIABLE RISK

Also called controllable risk, company-specific risk, or unsystematic risk, diversifiable risk is that part of the total risk of a security associated with such random events as lawsuits, strikes, winning or losing a major contract, and other events that are unique to a particular company. This type of risk can be diversified away and hence is not priced in a portfolio.

DIVERSIFICATION

1. Entry into a different business activity outside of the firm’s traditional business. This may involve a different product, stage of the production process, or country. Some companies wish to diversify their operations by getting into various industries. This can be a long-term, strategic decision on the part of management.

2. Allocation of investments among different companies, different industries, or different regions in order to ease risk. Diversification exists by owning securities of companies having negative or no correlation.

DOBRA

Monetary unit of San Tome and Principe.

DOCUMENTARY COLLECTION

A method of payment for a foreign trade transaction that adopts a draft and other important documents but not a letter of credit.

DOCUMENTARY DRAFT

A sight or time draft that is accompanied by documents such as invoices, bills of lading, inspection certificates, and insurance papers.

DOCUMENTARY LETTER OF CREDIT

Documentary letter of credit (L/C) is a letter of credit for which the issuing bank provides that specified documents must be attached to the draft. The documents are to guarantee the importer that the goods have been sent and that title to the merchandise has been duly transferred to the importer. Most L/Cs in commercial transactions are documentary.

DOLLAR INDEXES

Also called currency indexes, dollar indexes measure the value of the dollar and are provided by the Federal Reserve Board (FRB), Morgan Guaranty Trust Company of New York, and Federal Reserve Bank of Dallas. They show different movements because they include different countries and are based on different concepts and methodologies. The data are provided in nominal values (market exchange rates) and in real values (purchasing power corrected for inflation). The FRB index is published in a press release and in the monthly Federal Reserve Bulletin; the Morgan index is published in the bimonthly World Financial Markets; and the FRB Dallas index is published monthly in Trade-Weighted Value of the Dollar. The FRB and Morgan indexes include 10 and 18 industrial nations, respectively, and the FRB Dallas index includes all of the 131 U.S. trading partners.

DOW JONES GLOBAL STOCK INDEXES

Dow Jones Global Stock Indexes is a grouping of indexes tracking stocks around the globe. The biggest index, the Dow World, tracks shares in 33 countries. The index is based on an equal weighted average of commodity prices. A 100 base value was assigned to the U.S. index on June 30, 1982; a 100 base went to the rest of the world indexes for Dec. 31, 1991. Indexes are tracked in both local currency and U.S. dollars, though the dollar tracking contains far more analytical data, such as 52-week high and low and year-to-date percentage performance. The index appears daily in The Wall Street Journal. The index can be used to examine the difference between performances in various stock markets and exchanges around the globe. That performance can be used to determine if shares in those countries are good or poor values. In addition, stock indexes often hint how a country’s economy is performing, because rising stock markets typically appear in healthy economies.

Note: Currency swings play an important role in calculating investment performance from foreign markets. So if one country’s stock market is performing well but its currency is weak versus the dollar, a U.S. investor may still suffer. Conversely, a country with a strong currency and weak stock market may produce profits for U.S. investors despite the rocky climate for equities.

DRACHMA

Greece’s currency.

DRAFT

Also called a bill of exchange, a draft is an unconditional order to pay. It is the instrument normally used in foreign trade to effect payment. It is simply an order written by an exporter (seller) requesting an importer (buyer) or its agent to pay a specified amount of money at a specified time. There are three parties involved: the drawer, the payee, and the drawee. The person or business initiating the draft is known as the drawer, maker, or originator. The payee is the party receiving payment. The party (usually an importer’s bank) to whom the draft is addressed is the drawee. There are different types of drafts: (1) A sight draft is payable upon presentation of documents; (2) a time draft is payable at some stated future date called usance or tenor; (3) when a time draft is drawn on and accepted by a commercial business, it is called a trade acceptance; (4) when a time draft is drawn on and accepted by a bank, it is called a banker’s acceptance; (5) a clean draft is not accompanied by any necessary documents; and (6) a documentary draft is accompanied by all required papers. See also DOCUMENTARY DRAFT; LETTERS OF CREDIT; TRADE CREDIT INSTRUMENTS.

DRAGON BOND

A U.S. dollar-denominated bond issued in the so-called “Dragon” economies of Asia, such as Hong Kong, Singapore, and Taiwan.

DUAL CURRENCY BOND

A dual currency bond is a bond denominated in one currency but paying interest in another currency at a specified exchange rate. This type of bond can also redeem proceeds in a different currency than the currency of denomination.