Abstract

Traditional accounting and product costing methods usually take energy costs, put them into the category of overhead, and then allocate these costs based on the product’s labor usage rate. Often, this does not correctly assign the true energy cost to a given product or cost center. A more modern approach is Activity-based costing which identifies specific cost drivers and then allocates costs based on the details of the facility’s equipment, operation, and product mix. This paper will apply the activity-based costing methodology to allocate energy costs in a manufacturing environment. Energy costs at Double Envelope Corporation, located in Gainesville, FL, are used as an example of this new method. To the authors’ knowledge, this is the first paper to specifically apply the principles of Activity-based costing to detailed energy costing and energy management in an actual manufacturing company.

INTRODUCTION

In many manufacturing operations, fifty percent of a product’s cost can come from material and about five to ten percent from labor. The rest is classified as overhead. Overhead costs generally include all indirect costs such as material handling, warehousing, maintenance, quality control, engineering, setup cost, machine depreciation, and energy.

Most company financial departments use the traditional accounting method for product costing. This method assigns overhead cost based on a single overhead allocation rate—usually directly proportional to the number of labor hours a product consumes during production. Because it assumes that all products require the same proportionate amount of indirect activities based on labor hours utilized, the traditional method distorts product costs and often gives management a poor picture of product mix profitability within complex multi-product companies. This method does not specifically trace the individual indirect activity costs to either the products or the cost centers that require them. It treats all products the same, even though they are very different and require different types and amounts of support.

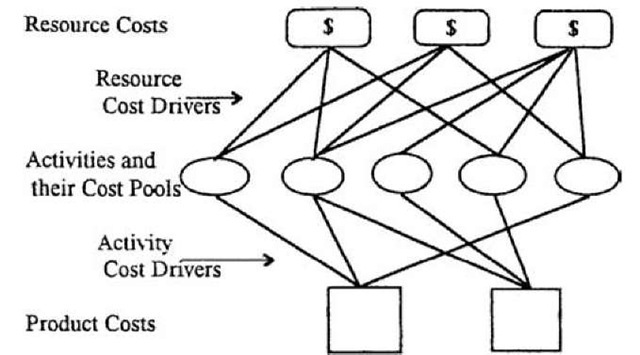

There is an alternative costing method that does directly trace all overhead costs to the specific activities and products that generate them. This new method is called activity-based costing or simply ABC. An activity is defined in terms of a function within the company. Each activity defined must be homogeneous and quantifiable. Examples of activities are: material handling, warehousing, setup, maintenance, engineering, distribution or personnel. Each of these activities consumes resources, such as labor, material, machine depreciation, energy, and capital. All the resources or dollars necessary to perform that function are pooled together into a single activity cost pool for that function. Therefore, each activity has its own cost pool.

Activity-based costing allocates overhead to products via cost drivers, which are the bases used to make the cost assignments. The first-stage cost drivers—or resource cost drivers—allocate resource costs to the various activity cost pools. Examples of first-stage cost drivers are: electricity use in kilowatt and kilowatt-hour, fuel use in gallons or therms, facility space leased in square feet, and contract maintenance directly in dollars. Thus, the first-stage cost drivers allocate a percentage of a resource cost to each activity based on the percentage by which that activity uses each resource.

The second-stage cost drivers—or activity cost drivers—allocate costs from the activity cost pools to the various products or cost centers. Examples of second stage drivers are: number of transactions, number of setups, number of machine hours, number of inspections, number of work orders, or number of labor hours consumed. Thus, the second stage cost drivers allocate a percentage of an activity cost pool to each product or cost center based on the percentage by which that product or cost center uses the activity. The sum of the allocations to a product or cost center is the total cost of the product or total cost allocated to the cost center. Second stage drivers assign costs to products or cost centers. The different types of costs assigned are unit, batch, product, organizational, and corporate costs. These second stage cost drivers determine the accuracy and complexity of the ABC system. Each second stage cost driver is unique to a given activity’s cost pool. These drivers must be configured to match the activities they are associated with.

Fig. 1 Activity-based cost allocation.

In summary, the first stage drivers—or resource cost drivers—allocate expenses, including energy costs, to activities and their cost pools. The second stage drivers— or activity cost drivers—allocate the activity cost pools to products or cost centers. When the activity cost pool contributions to each product are summed, they yield the actual product cost. Similarly, when the activity cost pool contributions to each cost center are summed, they yield the total cost allocated to that cost center. A graphical depiction of this allocation process is shown below in Fig. 1.

ENERGY COST ALLOCATION EXAMPLE

In general, activity-based costing allocates all resource costs in a company to activities or functions in the company. However, the ABC system can be used to determine the allocation of a specific resource cost throughout the company, such as energy costs. With an energy cost allocation system, management can determine which activities and products or cost centers are consuming the most energy and incurring the greatest energy cost. This information can make it easier to identify possible energy waste. Management can focus its efforts on the areas of large energy use and can evaluate them to see whether a redesign will reduce waste and increase energy efficiency. The ABC system also provides actual cost data that can be used to justify energy saving investments in specific areas or functions.

During the first part of 1996, a project was initiated to apply this ABC method for energy costing to an existing manufacturing company. Double Envelope Corporation in Gainesville, FL, agreed to supply data and to participate in this project. Double Envelope is a small business, which produces a variety of envelopes and folders for numerous commercial operations. One of the factors involved in selecting this company was that Double Envelope had started to record detailed machine hour data at each of its cost centers in 1995. This action made it possible to create an energy resource cost allocation based on ABC using energy cost drivers. Double Envelope makes a large number of specialized envelope products, and in order to simplify the effort needed to establish an ABC energy allocation system, it was decided to select six cost centers for detailed cost allocation rather than using the individual products.

Using the modified ABC system, we started by allocating the energy costs to activities or functions in the company. For Double Envelope, the only energy resource used was electricity, and the total energy cost including demand, electric energy, electric surcharge and taxes for 1995 was $183,253.14. The electric energy costs have been divided into five energy resource cost categories and treated as if they were individual resource costs. These five resource cost categories are lighting, cooling, motors, production machines, and miscellaneous use.

Our first task was to determine the actual costs for each of these five categories of equipment. This determination basically requires that a detailed energy audit and energy analysis be conducted for the facility. We counted lamps, determined the types of lamps (and ballasts if the lamps are fluorescent, high intensity discharge (HID) or low pressure sodium) used, and estimated the hours of use of the various lamps. We also collected similar information on wattages, efficiencies, and hours of use of the other equipment categories. Once this type of energy audit data is collected, it can be processed to determine the total energy costs in each of the equipment categories. However, as a practical matter, instead of finding the total cost of each equipment category and then determining how to split it up into the various activities, it is really easiest to locate and identify that part of the equipment which is utilized by the various activities and directly calculate the components of the activity cost pools.

Next we identified the various activities so we could calculate the activity cost pools. The four major activities at Double Envelope are warehousing, shipping and receiving, manufacturing, and general office. In a complete ABC analysis, energy use would be one of the first-stage cost drivers. Since we were studying only the electric energy use, we subdivided the energy cost driver into cost drivers for five groups of energy using equipment. The first-stage energy cost drivers for the Double Envelope analysis are the kilowatt-hours consumed by lighting, cooling, motors, production machines, and miscellaneous use for each of the four activities. For example, the lighting kilowatt-hour cost driver for manufacturing is 332,466 kWh of lighting per year. Once a cost driver is determined for a specific activity, the cost associated with that particular driver can be determined and allocated to that activity cost pool.

The total energy cost for any group of equipment such as lighting is calculated based on the total kilowatt-hour consumed. To be completely correct, the electric cost should be separated into demand (kW) and energy (kWh) costs, and those costs combined. However, the average electric cost was used in this project for simplicity. The total number of kilowatt-hour consumed at Double

Envelope during 1995 was 2,229,600 kWh, and the electric bill was $183,253.14. Therefore, the average cost per kilowatt-hour is equal to $183,253.14 divided by 2,229,600 kWh, or $.0822/kWh. This figure of 8.22 cents/ kWh was used in all the work that follows to calculate the costs of the five energy resource cost categories.

The lighting energy use and costs were calculated and separated into three plant areas, and were then allocated to the four activities using the kilowatt-hour consumed by each activity as the first-stage resource cost drivers. These lighting calculations are shown in Table 1 below. The manufacturing floor was lighted by 240 185-watt lamps. They were operated approximately 6240 h during the period. Adding in a 20% ballast consumption, the manufacturing floor activity used 332,466 kWh and thus had a lighting cost of $27,328.68. The warehouse was lighted by 36 185-watt lamps for 6240 h, and used 49,872 kWh at a lighting cost of $4,099.32. The shipping and receiving area is located in the warehouse and takes up half of the warehouse floor space; therefore, half of the lighting cost was allocated to the warehouse activity and half to the shipping and receiving activity. The general office was lighted by 176 40-watt lamps for 2040 h at an activity cost of $1,446.06.

Table 1 Calculation of lighting and cooling energy resource costs

Cost per kilowatt hour

Total energy cost for 1995 = $183,253.14

Total kilowatt hour consumed during 1995 = 2,229,600

Cost per kilowatt hour = $183,253.14/2,229,600 = $.0822

| Lighting | ||||||||

| Area | Bulb type | Wattage | Number | Ballast usage | Total wattage | Usage time hours | Energy kilowatt hour | Cost 1995 ($) |

| Manufacturing floor | F96P617 | 185 | 240 | 0.2 | 53,280 | 6240 | 332,466 | 27,328.68 |

| Warehouse | F96P167 | 185 | 36 | 0.2 | 7,992 | 6240 | 49,872 | 4,099.32 |

| General offices | Fluorescent | 40 | 176 | 0.2 | 8,448 | 2040 | 17,592 | 1,446.06 |

AC

Manufacturing floor and warehouse: AC = Air conditioner size

H = Number of hours the air conditioner is in service per year SEER = 9 Btu/Wh

CONV = Conversion factor of 3.412 Btu/Wh AC = (12,000 Btu/h/tn) X (60 tn) = 720,000 Btu/h H = 3000 h

Energy consumed = ACXHX1/SEERXCONV

Energy consumed = 720,000X 3000X1/9X 3.412 = 818.88 MMBtu

Cost = 818.88 MMBtuX 1/3.412 Btu/WhX 1 kW/1000 WX$.0822/kWh = $19,728

Warehouse = 0.2($19,728) = $3945.60 Manufacturing floor = 0.8($19,728) = $15,782.40

General offices:

AC = (12000 Btu/h/tn) X (20 tn) = 240,000 Btu/h H = 2000 h SEER = 7 Btu/Wh

Energy consumed = 240,000 X 2000X1/7 X 3.412 = 234 MMBtu/yr

Cost = 234 MMBtuX 1/3.412 Btu/WhX 1 kW/1000 WX$.0822/kWh = $5,637.42

Next, the cooling or air conditioning cost was allocated to the three plant areas, and then to the four activities. These calculations are also shown in Table 1 at the end of the paper. The manufacturing floor and warehouse were cooled by four 15-ton air conditioning units with an average seasonal energy efficiency ratio (SEER) of 9 Btu/Wh. The units were estimated to run for a total of 3000 full-load equivalent hours over the period and consumed 240,000 kWh of energy. This resulted in a total cost of $19,728. It was estimated that the manufacturing floor activity consumed about eighty percent of the cooling energy. Therefore, $15,782.40 was allocated as manufacturing floor activity cooling cost. The remaining $3,945.60 was allocated as warehouse cooling cost. This cost was then allocated half to the warehouse activity and half to the shipping and receiving activity. The general office required 20 tons of cooling by smaller units with an average SEER of 7 Btu/Wh. They were estimated to operate approximately 2000 full-load equivalent hours over the year and consumed 68,582 kWh of energy. The resulting cost was $5,637.42 and was allocated as general office activity cooling cost.

Next, the costs of operating several machines with large motors was allocated to the four activities. The energy cost of the vacuum pumps, bailer machines and air compressor were calculated from the horsepower, efficiency, and usage of their motors. All calculations are shown in Table 2. The costs were calculated as follows: vacuum pumps—$27,210.00, one baler machine—$2403.00, the other baler—$2901.60, and the air compressor— $13,605.12. The costs of the two baler machines were allocated to the warehouse activity. The costs of the vacuum pump and the air compressor were allocated to the manufacturing floor activity. The miscellaneous energy cost category includes copy machines, computers and other small office items. It was estimated to be approximately 5% of the total energy cost which is $9,162.66. This cost was allocated to the general office activity. The remaining energy cost was $69,731.28, which was considered to be the cost of the only remaining cost is $9327.06; the total shipping and receiving activity energy cost is $4022.46; the total general office activity energy cost is $16,246.14; and the total manufacturing floor activity energy cost is $153,657.48. Note that the manufacturing activity consumes over 80% of the total energy cost. This is fairly typical for many manufacturing companies.

Table 2 Calculation of motors and production machines energy resource costs

Motors

EC = Energy consumed HP = Horsepower

EFF = Estimated efficiency of motor N = Number of motors C = Conversion constant = 0.746 kW/hp

LF = Fraction of rated load at which the motor normally operates H = Total hours of operation of the equipment over 1995 EC = HPX N X1/EFFX LFX H X C Cost = EC X $.0822/kWh

| Equipment | HP | N | EFF | LF | H | EC (kWh) | Cost ($) |

| Vacuum pump | 40 | 2 | 0.9 | 0.8 | 6240 | 33,1026 | 27,210.00 |

| Bailer machine | 10 | 2 | 0.85 | 0.8 | 2082 | 29,238 | 2,403.00 |

| Bailer machine (outside motor) | 25 | 1 | 0.88 | 0.8 | 2082 | 35,298 | 2,901.60 |

| Air compressor | 40 | 1 | 0.9 | 0.8 | 6240 | 165,510 | 13,605.12 |

Miscellaneous

5% of Total Cost = 0.05X$183,253.14 = $9162.66

Miscellaneous

5% of Total Cost = 0.05X$183,253.14 = $9162.66

Production Machines

The remaining cost is $69,731.28

All other costs have been identified

This remaining amount is assumed to be the production machine’s energy cost energy consuming activity; the production machine usage. This cost was allocated to the manufacturing floor activity.

Table 3 Energy costs allocated to activity cost pools through first-stage drivers

| Activities | |

| Allocation | Cost ($) |

| (1) Warehousing | |

| 50% of warehouse cooling | 1,972.80 |

| Bailer machine | 2,403.00 |

| Bailer machine | 2,901.60 |

| 50% of warehouse lighting | 2,049.66 |

| Total | 9,327.06 |

| (2) Shipping and receiving | |

| 50% of warehouse cooling | 1,972.80 |

| 50% of warehouse lighting | 2,049.66 |

| Total | 4,022.46 |

| (3) General offices | |

| General office cooling | 5,637.42 |

| General office lighting | 1,446.06 |

| Miscellaneous energy costs | 9,162.66 |

| Total

(4) Manufacturing floor |

16,246.14 |

| Manufacturing floor cooling | 15,782.40 |

| Manufacturing floor lighting | 27,328.68 |

| Vacuum pump | 27,210.00 |

| Air compressor | 13,605.12 |

| Production machines | 69,731.28 |

| Total | 153,657.48 |

Table 3 summarizes all of the energy costs allocated to the four activities. The total warehouse activity energy

Once the energy costs are allocated to the cost pools of each activity using the first-stage cost drivers, the second-stage cost drivers must be identified for each activity, and then costs from each activity cost pool are allocated to one of the six cost centers. The six cost centers at Double Envelope were wide range folders, wide range windows, web folding, specialty, printing and cutting. All calculations and allocations of energy costs from the four activities to the six cost centers via cost drivers are shown in Table 4. This specific process of allocating energy costs is shown in Fig. 2 below.

The manufacturing activity cost was allocated to the cost centers via the cost driver machine hours. Machine hours were used to correctly identify the usage of the manufacturing floor by each cost center. Warehousing is generally driven by product volume. The warehousing activity cost was be allocated to cost centers based on the total volume passing through each cost center. General office activity costs are organizational level costs which are always allocated based on volume. The shipping and receiving activity cost is generally allocated based on the number of orders or transactions processed by the department. This information was unavailable, so an estimate based on cost center volume was used. Since this activity cost was small, this estimate will not result in a significant error in the final results. If a full ABC system is developed for Double Envelope Corporation, a more accurate driver can be identified and used.

The final results of the energy cost allocations to each cost center are shown in Table 5, and are as follows: wide range folders—$49,500.12, wide range windows—$24,060.54, web folding—$37,177.02, specialty—$5150.94, printing—$32,433.12, and cutting—$34,931.04. This cost allocation data will give Double Envelope, an idea of which cost centers are consuming the most energy resources. By identifying a center’s consumption, the company can decide if reductions should be made.

Table 4 Data for second-stage cost drivers

| Cost centers Cost center | Total machine hours | Total volume (thousands) |

| (A) Wide-range folders machines (101-105) | 23,901.00 | 208,162.20 |

| (B) Wide-range windows machines (131-140) | 12,348.00 | 47,313.00 |

| (C) Web folding | 13,870.50 | 457,571.40 |

| (D) Specialty machines (160-166) | 2,682.00 | 7,272.00 |

| (E) Printing | 15,751.50 | 129,682.80 |

| (F) Cutting | 14,392.50 | 329,550.60 |

| Total | 82,945.50 | 1,179,552.00 |

Fig. 2 Energy cost allocation at double envelope.

To show the impact of activity-based costing in this application, it is useful to compare the ABC allocation with the cost allocations that would be obtained with the traditional cost allocation of all overhead—including energy costs—using labor hours. What we have been calling machine hours is also the same measurement of labor hours for each cost center. Table 6 shows the results if the energy costs for each cost center are allocated proportionally to the labor hours utilized in each cost center. The comparison of these two approaches is shown below in Fig. 3.

The results in this example differ between ten to twenty percent for the ABC method vs the traditional method.

This is a significant enough difference to show that the traditional costing method contains a cost distortion. In other examples, the cost distortion could be much greater. In the Double Envelope Corporation case, the large number of different products made it impossible to show individual product costing using the two methods. A study of a company with three to six individual products could illustrate results that show significant differences in final product costing.

For the energy manager of an organization, the ABC method provides an excellent opportunity to move the cost of energy from overhead to a line item in the cost of production, similar to the line item costs for labor and materials. Once the energy cost is known for each unit of production of a particular product, the energy manager will have a much easier time justifying new equipment and new processes that reduce energy costs. Since much of the new equipment and new processes would be expected to

Table 5 Allocation of activity costs to cost centers

| Cost allocation Cost center | Manufacturing floor ($) | General office ($) | Shipping/ receiving ($) | Ware housing ($) | Total ($) |

| A | 44,276.88 | 2,867.04 | 709.98 | 1646.22 | 49,500.12 |

| B | 22,874.82 | 651.66 | 160.98 | 373.08 | 24,060.54 |

| C | 25,695.24 | 6,302.16 | 1560.72 | 3618.90 | 37,177.02 |

| D | 4,968.42 | 100.14 | 24.84 | 57.54 | 5,150.94 |

| E | 29,179.86 | 1,786.14 | 442.08 | 1025.04 | 32,433.12 |

| F | 26,662.26 | 4,538.94 | 1123.86 | 2605.98 | 34,931.04 |

| Total | 153,657.48 | 16,246.14 | 4022.46 | 9327.06 | 183,253.14 |

Allocation Equations

Manufacturing floor = (MH/82,945.5) X $153,657.48 General office = (Volume/1,179,552) X $16,246.14 Shipping/receiving = (Volume/1,179,552) X $4022.46 Warehousing = (Volume/1,179,552) X $9327.06 increase production and also increase product quality, the data from ABC allows determination of the bottom line cost component of energy per unit of production. Thus, a large capital investment in new equipment and new processes which reduces the energy cost component of specific products can often be justified using the ABC method.

Table 6 Traditional cost accounting allocation of energy costs to cost centers

| Cost centers | ||

| Cost center | Total machine hours | Energy cost (thousands) |

| (A) Wide-range folders machines (101-105) | 23,901.00 | 52,804.95 |

| (B) Wide-range windows machines (131-140) | 12,348.00 | 27,280.68 |

| (C) Web folding | 13,870.50 | 30,644.37 |

| (D) Specialty machines (160-166) | 2,682.00 | 5,925.40 |

| (E) Printing | 15,751.50 | 34,800.10 |

| (F) Cutting | 14,392.50 | 31,797.64 |

In the Double Envelope example, the number of individual products is so large that the ABC energy cost data has only been developed for the six major cost centers. However, even with this limited breakdown, some energy management decisions could be evaluated. For example, in the printing cost center (E), the ABC energy cost is $32,433.12 and the volume is 129,682,800 units. If a new printing press were under consideration by management, then the energy efficiency of the new press could be used to determine new energy costs per unit of production, and to help justify the additional cost of a more energy efficient machine.

CONCLUSION

Activity-based costing not only identifies the accurate cost of each product, but is a true decision making tool. Financial data should be accurate. Without correct information, it is impossible to make accurate decisions. Activity-based costing is a tool that can help companies become more profitable and understand the true functions and drivers of their costs. When ABC is used as a continuous improvement system, companies can identify the costs, implement quality programs, promote product and process redesign, reduce setup time, implement Just in Time (JIT), and get all of their costs under control. There are also many software packages available that can assist a company in implementing and managing an ABC system.

| Cost Center | Traditional Cost | ABC Cost | %Diff from ABC |

| A | $52,805.23 | $49,500.12 | 6.68% |

| B | $27,280.83 | $24,060.54 | 13.38% |

| C | $30,643.43 | $37,177.02 | -17.57% |

| D | $5,925.00 | $5,150.94 | 15.03% |

| E | $34,800.00 | $32,433.12 | 7.30% |

| F | $31.796.00 | $34,931.04 | - 8.97% |

Fig. 3 Cost allocation comparison of results.

Although ABC systems are very useful, they cannot be used by all companies. Tracking all of the costs and activities can be very expensive. A company should only implement an ABC system when the information gained from the system is worth more than the cost of implementing and managing the system in the long run. As complex production management systems like MRP-2 and other software systems are further utilized in tracking production, the cost of data measurement will decrease. It is becoming more economical to implement a complex ABC system every day. As more systems are implemented, companies will become more efficient, profitable, and competitive in the world economy.