Abstract

Recently tradable certificates for energy savings have attracted the attention of policy makers as a tool to stimulate energy efficiency investments and deliver energy savings. While such schemes have been introduced in different forms in Italy, France and Great Britain and considered in other European countries, there is an ongoing debate over their effectiveness and applicability. The paper describes the concept and main elements of schemes that involve tradable certificates for energy savings (TCES) and how these have been put into practice in Italy, France and Great Britain. The entry discusses some key design and operational features of TCES schemes such as scope, additionality rules, measurement and verification. The implications of different certificate trading rules and how these can affect the actual structure of the certificate market are also explored.

INTRODUCTION

Market-based instruments (MBIs [MBIs are public policies that make use of market mechanisms with transferable property rights to distribute the burden from a policy. We recognize the difference between policy instruments that are well positioned to harness market forces to achieve a certain policy goal (such as renewable energy quotas or renewable portfolio standards [RPS]) and the market instruments (namely, carbon allowances, and green and white certificates), the latter being a much narrower concept representing just a tradable commodity. This differentiation is not so important in the context of the present entry, and in the text, we refer to complex policy tools/portfolios that include trading of financial commodities (such as certificates or allowances) as that aim at MBIs.) that aim at bringing sustainability to the energy sector have been implemented to promote electricity from renewable energy sources and to cut harmful emissions. Quota systems (also known as RPS) coupled with tradable green certificate (TGC) schemes have been developed and tested in several European countries to foster market-driven penetration of renewable energy sources. Another well-known and widely analyzed type of MBI is the tradable emission allowance.

To stimulate energy-efficiency investments and to achieve national energy savings targets, the attention of policy-makers in Europe has recently been attracted by the possibility of introducing energy savings obligations on certain types of market players coupled with tradable certificates for energy savings (Tradable Certificates for

Energy Savings [TCES], or white certificates). Such schemes have been introduced in different forms in Italy, Great Britain, and France, and are being considered in other European countries.

This entry describes the concept and main elements of a TCES scheme and compares and analyses how these have been put into practice in Italy, Great Britain, and France. The entry builds on a sequence of publications by the authors, giving specific details on the still fairly short implementation track record of TCES schemes, as well as qualitative comparison of the TCES scheme with other policy tools promoting energy efficiency and the possibilities and dangers associated with attempts to integrate existing MBIs into the energy sector.[2-5]

SCHEMES WITH TRADABLE CERTIFICATES FOR ENERGY SAVINGS

Energy efficiency is a well-established option to decouple economic growth from the increase in energy consumption and thus reduce greenhouse gas (GHG) emissions by cutting the amount of energy required for a particular amount of end-use energy service. Apart from being a sound part of the environmental and climate change agenda, increased energy efficiency can contribute to meeting widely accepted goals of energy policy such as improved security of supply, economic efficiency, and increased business competitiveness coupled with job creation and improved consumer welfare. Alongside environmental and economic sustainability, the other main driver of energy policy in the European Union (EU) is to restructure electricity and gas markets. Many energy-efficiency advocates and policy-makers have called for legislation introducing energy efficiency and energy services as natural complements to the electricity and gas market liberalization. Otherwise, market failures in the energy sector would lead to lower levels of investment in energy efficiency than is socially optimal, with the final outcome being additional cost to the economy due to an imbalance between the supply side and demand side in the energy sector.

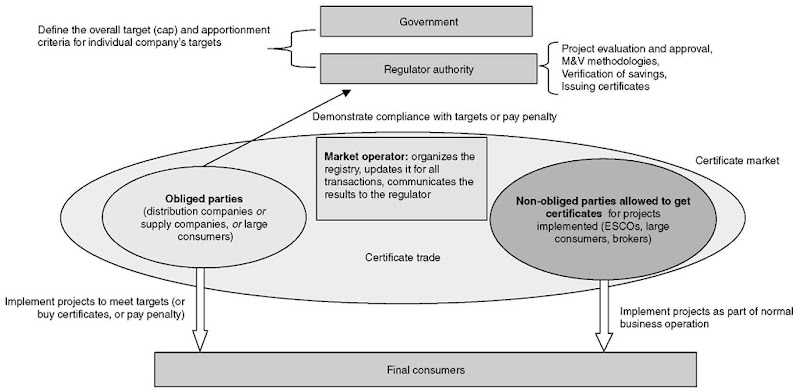

Fig. 1 A policy portfolio with mandatory savings targets and white certificates, and a summary of roles of actors and relationships among them.

A possible market-based policy portfolio could comprise energy-savings quotas for some category of energy operators (distributors, suppliers, consumers, etc.) coupled with a trading system for energy-efficiency measures resulting in energy savings. The savings would be verified by the regulator and certified by means of the so-called white certificates (tradable certificates for energy savings). In Italy certificates are called Energy Efficiency Titles, while in France they are referred to as Certificates of Energy Savings.

A TCES portfolio involves the following basic elements1-2’3’5’7’12’13-1:

• The creation and framing of the demand. Tradable certificates represent a meaningful option only if there is interest in buying/selling them.

• The tradable instrument (certificate), representing the savings, conferring property rights to the holder, and providing the rules for trading.

• Institutional infrastructure and processes to support the scheme and creation of the market. An aspect that is often overlooked is that markets do not function in a vacuum. These activities include, for instance, measurement and verification (M&V), evaluation methods and rules for issuing certificates, a data management and certificate tracking system, and a registry.

• Cost-recovery mechanisms, in some cases.

Fig. 1 illustrates the roles and summarizes the responsibilities of different categories of actors involved in the design and operation of a TCES policy portfolio.

GENERAL CHARACTERISTICS OF ENERGY-SAVING OBLIGATIONS AND TRADING SYSTEMS IN EUROPE

Variations of the policy mix described above have been introduced in Italy, Great Britain, and (since July 2006) France. In the Flemish region of Belgium, savings obligations are imposed on electricity distributors without any trading option (certificate or, as in Great Britain, obligation trading). The first operational scheme in the world with a white-certificate trading element has been introduced in New South Wales (NSW), Australia. It is, however, a GHG trading system that has an end-use energy efficiency element and is left out of the present discussion.

Box 1. Tradable certificate for energy savings (white certificate)

A White certificate is an instrument issued by an authority or an authorized body providing a guarantee that a certain amount of energy savings has been achieved. Each certificate is a unique and traceable commodity that carries a property right over a certain amount of additional savings and guarantees that the benefit of these savings has not been accounted for elsewhere.

In Italy, command-and-control measures (energy savings targets in primary energy consumption for electricity and gas grid distribution companies with more than 100,000 customers as of the end of 2001) are combined with market instruments (tradable certificates for energy savings issued to distributors and energy service companies) as well as with elements of tariff regulation (a cost-recovery mechanism via electricity and gas tariffs and multiple-driver tariff (MDT) schemes (MDTs essentially constitute tariff regulation schemes linking the evolution over time of allowed revenue with cost drivers such as the number of customers, grid lengths, and energy sales.[17]) to reduce the disincentives for regulated electricity and natural gas companies to promote end-use energy efficiency among their customers) or dedicated funds in some circumstances. Over the 5 years of the current phase of the scheme, 3 million tons of oil-equivalent (Mtoe) cumulative primary energy savings are projected to be realized, of which 1.6 Mtoe is by electricity distributors and 1.3 Mtoe is by natural gas distributors. At least half of the target set for each single year is to be achieved via a reduction of electricity and gas end-use consumption (referred to as the 50% constraint, to which each distributor is subject). The remaining share can be achieved via primary energy savings in all the other end-use sectors. Energy-saving projects contribute to the achievement of targets for up to 5 years (with only some exceptions). Only savings that are additional to spontaneous market trends and legislative requirements are considered. After a long process of designing and elaborating elements, the Italian scheme finally became operational in January 2005.[12'14-16]

In Great Britain, the Energy Efficiency Commitment (EEC) runs in 3-year cycles from 2002 to 2011. It replaced the Energy Efficiency Standards of Performance (EESOP), running from 1994 until 2002, which established the principle of pooled spending on energy efficiency for domestic consumers. The EEC-1 program required that all gas and electricity suppliers with 15,000 or more domestic customers deliver a certain quantity of fuel standardized energy benefits by encouraging or assisting customers to take energy-efficiency measures in their homes. The overall savings target was 62 fuel standardized TWh (Energy savings are discounted over the lifetime of the measure and then standardized according to the carbon content of the fuel saved.) (lifetime discounted), and the total delivered savings reached 86.8 TWh.[10] In EEC-2 (2005-2008), the threshold for obligation was increased to 50,000 domestic customers. The target has been increased to 130 TWh; however, due to the carrying over of savings from EEC-1, in 2005 more than a quarter of this target has already been achieved. Suppliers must achieve at least half of their energy savings in households on income-related benefits and tax credits. Projects can be related to electricity, gas, coal, oil, and Liquefied Petroleum Gas (LPG). Suppliers are not limited to assisting their own customers only and can achieve improvements in relation to any domestic consumers in the Great Britain. Carbon-benefits estimations take into account the rebound effect— the likely proportion of the investment to be taken up by improved comfort—by adjusting the benefits to comfort factors. In addition, dead-weight factors are considered to account for the effect of investments that would be made anyway. At present, certificate trading is not a feature of the scheme in Great Britain.

The French system, introduced in 2006, envisages that all electricity, gas, LPG, (Domestic fuel excludes transport usages.) oil, cooling, and heating fuel for stationary applications suppliers that supply over 0.4 TWh/year will have to meet a target of energy savings. It excludes plants under the EU Emission Trading System and fuel substitution between fossil fuels, as well as energy savings resulting only from measures implemented just to comply with current legislation. Apart from these, no additional restrictions on compliance are foreseen. To meet the obligation, savings can be made in any sector and with any energy source or carrier. The following details related to the obligation parameters are known at the time of finalizing this entry: the total target for the first 3 years (2006-2008) will be 54 TWh (in final energy), cumulated over the life of the energy-efficiency actions with a 4% discount rate. The target apportionment is a two-step procedure: first, the total obligation is divided among different energies; then the obligation for a particular energy is apportioned among respective energy suppliers included in the system. The expected cost of action is below 20 Euro/MWh.[1]

Energy-efficiency obligations without certificate trading are also in place in the Flemish region of Belgium. Regional utility obligations were introduced in 2003 and are imposed on the electricity distributors. Currently, 16 electricity distributors are covered by the obligation. The annual target is 0.58 TWh; eligible actions refer to residential and nonenergy-intensive industry and service, and can involve saving fuel from any sources. Separate targets are set for low-voltage clients (< 1 kV, mainly residential) and high-voltage clients (> 1 kV). For the low-voltage clients, the target is 10.5% of electricity supplied over the 6 years from 2003 to 2008, and for high-voltage users (> 1 kV), the target is 1% per annum for each over the same period. The reason for the higher than 1% per annum target for the low-voltage users is because of the Flemish Parliament’s decision to provide free vouchers for the head of every family in 2004 and 2005, which can be exchanged via the electricity distributor for either an energy-saving Compact Fluorescent Lamps (CFL), a low-flow shower head, or an energy meter. In 2006 and 2007, it is planned that the other family members will receive a voucher for an energy-efficient light bulb.[9] There is a discussion going on in the Netherlands about the introduction of a white-certificate scheme.

ENERGY-SAVING OBLIGATIONS AND TRADING SYSTEMS: EUROPEAN EXPERIENCES TO DATE

Below, details on and first experiences with the following parameters of the existing European schemes with energy-saving obligations and energy-saving trading elements are reviewed: (a) eligible projects allowed; (b) institutional infrastructure and processes to support the scheme; and (c) certificate delineation, trading rules, and tools to stabilize the market. A comprehensive discussion of these and other design and operational features is available in Bertoldi and Rezessy.[3]

Eligible Projects

In Italy, projects in all end-use sectors are eligible. At least half of the target set for each single year should be achieved by reduction of the supplied energy vector—i.e., electricity and gas uses, a.k.a. the 50% constraint.[12] The remaining share can be achieved via primary energy savings in all of the other end-use sectors. There is an illustrative list of eligible projects. Energy savings projects contribute to the achievement of targets for up to 5 years (with only some exceptions). Early experience in Italy shows that a significant share of savings certified in autumn 2005 is coming from cogeneration, district heating, and public lighting projects. There are numerous submissions for certification of projects following the deemed savings verification method, which has very minor data requirements (see more details later in this entry). A surplus of certificates and banking of certificates are expected in Italy because the regulator has to evaluate and certify the savings from eligible projects starting from 2001, when the decrees were passed.

In Great Britain, only activities concerning domestic users are eligible. At least 50% of the energy savings must be targeted to customers who receive income-related benefits or tax credits (a.k.a. the priority group). Projects can be related to electricity, gas, coal, oil, and LPG. Suppliers can achieve improvements in relation to any domestic consumers in the United Kingdom. A nonexclusive list of measures is included within the illustrative mix for EEC 2005-2008. Measures that are related to the reduction of energy vectors other than the one supplied by the obliged party are allowed. Experience from EEC-1 in Great Britain shows that a significant share (56%) of the 86.8 TWh of savings delivered in the period 2002-2005 came from building insulation (wall and loft). CFLs accounted for a quarter of the savings achieved, followed by appliances (11%) and heating measures (9%).[10] CFLs accounted for the largest number of projects undertaken (almost 40 million measures related to CFL installation in EEC-1), followed by wet and cold appliances.[8] All but two suppliers—which went into administration and administrative receivership—achieved their targets; six suppliers exceeded their targets in EEC-1 and carried out their additional savings to EEC-2. Suppliers can receive a 50% uplift on the savings of energy-efficiency measures that are promoted through energy service activities. This uplift is limited to 10% of the overall activity. Of the six major suppliers with an EEC target, three submitted schemes that would take them over the 10% threshold if take up had been as forecasted. In reality, the energy services uplift was only 3.6% of all insulation activity. There is uplift on innovative technologies as well.

Apart from plants under the EU Emission Trading System (ETS) directive, fuel substitution between fossil fuels, and projects resulting just from measures implemented only to conform to current legislation, no other restrictions on compliance are foreseen in the French scheme. Any economic actor can implement projects and get savings certified as long as savings are above 3 GWh over the lifetime of a project. Actions must be additional relative to their usual activity, and there is a possibility to pool savings from similar actions to reach the threshold. All energies (including fuel) and all of the sectors (including transports and excluding installations covered by ETS) are eligible. Certification of projects implemented by bodies, which do not have savings obligation, is allowed, but only after considering the impact of a project on business turnover. If impact on business turnover is identified, certification of savings is allowed only for innovative products and services. “Innovative” product in this discourse means that efficiency is at least 20% higher compared with standard equipment and market share is below 5%.

Institutional Infrastructure and Processes to Support the Scheme

A sound institutional structure is needed for a white-certificate system to function, including administrative bodies to manage the system, as well as processes such as verification, certification and market operation, transaction registry, and detection and penalization of noncompliance.

Under the EEC in Great Britain, the regulator Office of Gas and Electricity Markets (OFGEM) manages project evaluation and approval, verifies savings, and manages the data. In Italy, the regulator Authorita per l’energia elettrica e il gas (AEEG) implements the scheme; the marketplace is organized and managed by the electricity market operator Gestore del Mercato Elettrico (GME) according to rules and criteria approved by AEEG. GME issues and registers certificates upon specific request by AEEG, organizes market sessions, and registers bilateral over-the-counter contracts according to rules set by AEEG.[12] In France, certificates are issued by the Ministry of Industry, and the French Agency for Environment and Energy Management and Association Technique pour l’Envir-onnement et l’Energie (ATEE) are in charge of the definition of standardized actions.

To determine the energy savings resulting from an energy-efficiency activity, the eventual energy consumption has to be compared with a baseline (reference situation) without additional saving efforts. The choice of the reference scenario—in terms of reference consumption and conditions—raises some challenges, such as determining the relevant system boundary, minimizing the risk of producing leakage, establishing the practicality and cost effectiveness of a baseline methodology, and treating no-regret measures in the baseline determination (We are indebted to Ole Langniss for these comments). Additionally refers to certification of genuine and durable increases in the level of energy efficiency beyond what would have occurred in the absence of the energy-efficiency intervention—for instance, due only to technical and market development trends and policies in place. While in practice, projects tend to have a mix of public and private benefits, costs of disaggregating these benefits and precisely accounting for the exact share of no-regret measures in a larger action may be prohibitively high.

One way of overcoming this problem would be to place an objectively defined discount factor on investments, which accounts for these private benefits. One possibility is to use minimum efficiency requirements or current sale-weighted average efficiency levels. Furthermore, the electricity price and the effects of the EU ETS and other policies in place (such as taxation or standards) may also be accounted for in the baseline to ensure genuine additional savings. In Great Britain, a discount factor of 3.5% over the lifetime of the measure is applied, while in France, the discount factor is 4%. However, in both the British and French schemes, the savings are cumulated over the lifetime of equipment, and the discount factor refers to actualizing the annual savings for different measures with different life spans.

In Great Britain, saving estimations take into account the likely proportion of the investment to be taken up by improved comfort (comfort factors adjustment of carbon benefits; see earlier discussion) as well as dead-weight factors to account for the effect of investments that would be made anyway.

In Great Britain, the Department for Environment, Food, and Rural Affairs (DEFRA) requires suppliers to demonstrate additionality. Concerns have been raised that energy suppliers can claim toward their EEC target the total energy savings that flow from a partnership project regardless of the actual financial contribution made by the supplier.

In Italy, savings have to go over and above spontaneous market trends or legislative requirements [14'16]; the business-as-usual trend will be adjusted with time. The nature of the additionality check differs for project types (e.g., installation of efficient equipment may be evaluated on the basis of difference with the national average installed or with what is offered in shops). For projects that are based on the deemed savings and engineering verification approach (see details below), a case-by-case additionality check is performed by the regulator.

The Italian scheme uses three valuation (M&V) approaches: (a) a deemed savings approach with default factors for free riding, delivery mechanism, and persistence; (b) an engineering approach; and (c) a third approach based on monitoring plans whereby energy savings are inferred through the measurement of energy use. In the latter case, all monitoring plans must be submitted for preapproval to the regulatory authority AEEG, and they must conform to predetermined criteria (e.g., sample size, criteria to choose the measurement technology).1-14’16-1 In practice, most of the projects submitted to date have been of the deemed saving variety. There is ex-post verification and certification of actual energy savings achieved on a yearly basis (e.g., in the case of Combined Heat and Power [CHP], the plant operator has to prove that the plant has run a certain number of hours, etc).[11] In principle, the metering approach is a more accurate guarantee of energy saved than the standard factors approach (the latter cannot verify details such as location and operating hours of installed CFLs), but in practice it can be difficult to identify the actual savings (e.g., in households, there is only one meter for all electricity usage, which increases each year due to growth in appliances and can fluctuate with changing household numbers, lifestyle, weather, etc). It may be reasonable for large installations or projects, but it may result in high monitoring costs for smaller projects.[14,16]

In Great Britain, the savings of a project are calculated and set when a project is submitted based on a standardized estimate taking into consideration the technology used, weighted for fuel type and discounted over the lifetime of the measure. There is limited ex-post verification of the energy savings carried out by the government, although this work would not affect the way energy savings are accredited in the current scheme; the monitoring work affects the energy savings accredited in future schemes.

Energy savings can be determined by metering or estimating energy consumption ahead of time and comparing this with consumption after the implementation of one or more energy-efficiency improvement measures, adjusting for external factors such as occupancy levels and level of production. Certificates, therefore, can be issued either ex-post (representing the energy saved over a certain period) or ex-ante (representing the estimation of the energy to be saved over a certain period). With regard to ex-post certification, there are different options: the saved energy resulting from an energy-efficiency measure could be measured at the end of a predetermined period (e.g., after 1 year) or over the lifetime of the project (which has to be assessed accurately). The latter option will make the system more comparable to a green certificate. The certificate has a unique time of issue attached to it; it indicates the period over which energy has been saved, the location where energy has been saved, and who is saving the energy (initial owner of the certificate). Ex-post certification, however, will probably increase validation efforts and verification costs. Alternatively, for projects that can be monitored through a standard savings approach, certificates can be granted in advance (ex-ante) of the actual energy savings delivery. This will mitigate liquidity constraints of project implementers and allow them to finance new projects. If underperformance is detected at the end of the lifetime of the measure, the underperforming project owner should be asked to cover the shortage with certificates purchased on the spot market.

Depending on the design of the scheme, the role of the regulator may or may not include the issues of certificates and the verification of savings. For instance, third parties may be licensed to evaluate and approve projects, verify savings, and issue certificates. Then the role of the regulator would be to accredit third parties and audit their performance. With the cost of compliance being one of the major issues raised about the implementation of white-certificate schemes, this potentially reduces the overall cost. It is not as crucial which body issues the certificates, provided that these are based on verified data, which can come from the energy regulator (as is the case in Italy) or from a certified verifier.

Certificate Delineation, Trading Rules, and Tools to Stabilize the Market

The certificate is an instrument that provides a guarantee that savings have been achieved. Each certificate should be unique, traceable, and at any time have a single owner. A certificate needs to be a well-defined commodity that carries a property right over a certain amount of additional savings and guarantees that the benefit of these savings has not been accounted for elsewhere. Property rights must be clear and legally secured, as it is unlikely that trades will occur if either party is unsure of ownership.1-6-1

Minimum project size may be applied for certification of savings to reduce transaction costs and encourage pooling of projects.[12] The size of a certificate also has important implication on the number of parties that can offer certificates for sale (unless other restrictions apply). In Italy, certificates are expressed in primary energy saved, and the unit is 1 ton of oil equivalent (toe). In France, certification is allowed only above a threshold of 3 GWh of savings over the lifetime of a project.[1]

The validity and any associated intertemporal flexibility embodied by banking and borrowing rules, the rules for ownership transfer, the length of the compliance period, and the expectations of market actors about policy stability and continuity will all influence the market for white certificates. A long certificate lifetime and banking increase the elasticity and flexibility of demand in the long term. To mitigate the uncertainties about the achievement of the quantified policy target within the prespecified time frame, banking for obliged parties may be allowed only after they achieve their own targets. In Italy, certificates are valid for up to 5 years, with a few exceptions.1-12-1 In Great Britain, suppliers can carry over to EEC-2 all of their excess savings from measures implemented under EEC (this refers to measures rather than savings). In France, it has been proposed that the certificates’ validity be at least 10 years. Borrowing is discouraged, because it makes the attainment of a target uncertain and is against the ex-post logic of the white-certificate scheme as applied in Italy, for instance.

Rules defining trading parties are also important for market liquidity. Provided that administrative and monitoring costs are not disproportionate, as many parties should be allowed in the scheme as possible, because this enhances the prospects of diversity in marginal abatement costs and lowers the risks of excessive market power.[13] Parties that may be allowed to receive and sell certificates include obliged actors, exempt actors, Energy Service Companies (ESCOs), consumers, market intermediaries, Non Governmental Organizations (NGOs), and even manufacturers of appliances. A key benefit of allowing many parties into the scheme is that new entrants may have the incentive to innovate and deliver energy-efficiency solutions that have a lower marginal cost.

In Italy, certificates are issued by the electricity market operator upon request of the regulator AEEG to all distributors and their controlled companies and to ESCOs. Certificates are tradable via bilateral contracts or on a spot market organized and administered according to rules set out jointly by AEEG and the electricity market operator. There are three types of certificates—for electricity savings, for gas savings, and for primary energy savings—and they are fully fungible.

In France, any economic actor can make savings actions and get certificates as long as the savings are at least 3 GWh over the lifetime of a measure. Certificates are delivered after the programs are carried out but before the realization of energy savings.[1]

In Great Britain, there are no certificates in the strict sense of the word. The scheme covers obliged parties, and no other party can receive verified savings that can be used to demonstrate compliance with the savings target. Suppliers may trade among themselves either energy savings from approved measures or obligations with written agreement from the regulator. There has been little interest in trading to date because energy savings can be traded only after the supplier’s own energy-saving target has been achieved. Suppliers are also allowed to trade excess energy savings into the national emission trading scheme as carbon savings. However, the linking of carbon savings to the national emission trading scheme was never formalized. Suppliers have been allowed to carry savings over from EEC-1 to EEC-2, and this is what all suppliers that exceeded their target have chosen to do.

CONCLUSION

This entry discussed the general concept and the key elements of a system with energy-saving targets and tradable certificates for energy savings. It provided an up-to-date review of white-certificate schemes as implemented in three European countries, discussing some key design and operational features such as projects, implementer, and technology eligibility, and it pointed out key issues such as additionality, baseline setting, and M&V. This entry also explored the implications of different certificate trading rules and how these can affect the actual structure of the certificate market. Because the implementation track record of white-certificate schemes is very limited, it remains to be seen whether this policy portfolio will perform as expected, at what cost this will be achieved, and whether it can co-exist with and complement other MBIs in the energy sector to pave the road to a sustainable energy future.