Demometrics

The measurement of the relationship between socioeconomic variables and demographic variables, e.g. between income levels and interregional migration.

denationalized money

Money issued by a variety of private and foreign banks and not by a national government. This money is less likely to be debased. This diminution of the role of the state enables banks to benefit from SEIGNORAGE.

Denison residual

Advances in knowledge and associated causes of economic growth. Denison discovered this important growth determinant in his study of the USA and eight West European countries for the period 1950-62.

Denison’s law

This states that the private sector saving of companies and households is a constant proportion of national income. This relationship held for twenty-five years but it is now being disputed.

department

1 part of an economy or economic organization.

2 A branch of capitalist production, according to marx. He divided the economy into three departments: Department i, the means of production, i.e. energy, machines and tools, raw materials and buildings; Department ii, consumer goods which reconstitute both the labour force and capitalists, contributing to their well-being; Department iii, luxury goods, weapons, which renew neither constant nor variable capital.

dependency culture

A society, or major part of it, permanently dependent on transfer incomes because the extensive provision of welfare benefits has inhibited work and individual effort. several governments, including those of the USA and the UK, fear that benefits fix the poor in a perpetual state of relative deprivation. It is also argued that excessive international aid can have the same effect on whole countries.

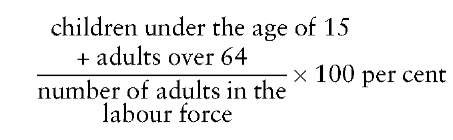

dependency ratio

The proportion of a population which has to be supported by recipients of factor incomes. It is commonly measured as

The value of this ratio is large when persistently high birth rates have increased the proportion of children in a population, or much international emigration has left an old population.

dependency theory

Exploitation theory applied to small countries. A small country exporting agricultural commodities finds that the control of its economy, especially its trade, shipping, insurance, banking and port facilities, passes to foreigners who are often associated with a local wealthy elite. The economy suffers from the repatriation of profits and imports, both of which are detrimental to domestic industries. The deterioration in local industry reduces industrial employment and pushes indigenous workers into the subsistence sector. In order to counteract the losses created by dependency, these theorists recommend fast independent growth and the granting of priority to basic needs. Critics argue that the theory at best is applicable only to some tropical colonies in the 1900-50 era, that it exaggerates the extent of profit repatriation and that it fails to establish a single optimal set of prices.

dependent economy

An economy closely linked with another, either through economic treaties (see comecon) or through dependence on a narrow range of exported goods. Many Third World countries are dependent on a single export, e.g. Mauritius on sugar and Zaire on copper.

depletable externality

An externality which by affecting one person affects others less, e.g. horse manure used in gardening.

deposit account

An interest-bearing bank account (UK) which cannot be withdrawn without due notice (in most cases, at least seven days). In the USA, such accounts are known as savings accounts or time deposits.

deposit insurance

Insurance used to protect deposits held in banks and other financial institutions. In the USA, the major scheme has been the FEDERAL DEPOSIT INSURANCE CORPORATION which from 1933 insured the deposits of the member banks of the federal reserve system and of non-member banks choosing to join. Instability in the banking system of the USA in the 1990s put deposit insurance under a great strain. critics argued that insurance made banks more reckless in their lending policies, causing the financial difficulties which insurance sought to avoid.

Depository Institutions Deregulation and Monetary Control Act 1980

US federal statute which increased fair competition in US banking by imposing universal reserve requirements of 3 per cent for the first $25 million of deposits and 12 per cent of further deposits on commercial banks, mutual savings banks, SAVINGS BANKS, SAVINGS AND LOAN ASSOCIATIONS and credit unions. The federal reserve system was empowered to demand supplementary reserves of 4 per cent of deposits for a maximum of ninety days and allowed to charge for its services. now accounts were legalized and many interest rate ceilings phased out.

deposit-taking business

A commercial bank, or other financial institution, licensed to conduct financial business according to the rules of a central bank, e.g. the Bank of England.

depreciation

1 The decline in value of an asset measured by various accounting rules of thumb. Under the straight-line method, the annual amount of depreciation is equal to a fraction of the capital expenditure (the value of an asset divided by its life). Other methods include the ‘declining balance’ approach which makes depreciation equal to a fraction of the written-down value of the asset, and the ‘sum of digits’ approach under which a fraction of the capital expenditure declines linearly over time. True economic depreciation, the replacement cost of physical wear and tear, is difficult to calculate as capital markets are often imperfect.

2 The fall in value of a currency under a FLOATING EXCHANGE RATE regime.

depression

A fall in national output continuing for a few years. Over the past 200 years, there have been several depressions, especially in the nineteenth century, in the economies of Western countries. The term is often used loosely to refer to a period of extensive unemployment and business failures. The start of the 1930s is usually cited as the major recent example of a depression in the strict sense.

deprival value

A measure of the value of an asset to its owner; the lower of the replacement cost or ECONOMIC VALUE.

deregulation

Abolition of governmental regulations, especially for prices and the operations of publicly owned organizations, with the aims of lowering prices through more competition, and of stimulating the growth of small businesses. Examples of deregulation include the securities markets of New York and London, US airlines and UK buses. Deregulation of stock markets occurred in the USA in 1975, in the UK in 1986 and in Japan gradually in the mid-1980s. In banking the USA amended its regulatory bank legislation in the depository INSTITUTIONS DEREGULATION AND MONETARY CONTROL ACT OF 1980 and the GARN-ST GERMAIN DEPOSITORY INSTITUTIONS ACT OF 1982, to remove ceilings on interest rates and to allow thrifts to diversify their financial activities, e.g. credit cards and commercial and industrial loans.

Critics of deregulation argue that safety suffers, industries are destabilized and there is less provision for underused services thought desirable for social reasons. some large bank failures in the 1980s were partly attributed to the removal of regulatory safeguards.

derivative

1 A sophisticated financial product, e.g. SWAP, WARRANT, OPTION or FUTURE available in security, commodity and currency markets. The product is derived from a simple transaction in a spot market.

2 A function fx) of x which shows the slope of a graph of the function x. For the function x to be at a maximum or a minimum, it is necessary that this derivative be zero. Major derivatives in economics include marginal cost, marginal REVENUE, the MARGINAL PROPENSITY TO CONSUME, the MARGINAL PROPENSITY TO import and the marginal product of labour.

derived demand

The demand for a factor of production derived from the demand for its product, e.g. there is a demand for labour in the construction industry because of a demand for houses. Demand for a product and the derived demand for a factor will change by the same proportion if the input-output ratio is constant, which is unlikely in a period of technological change.

deserving poor

Those with low incomes through no fault of their own, e.g. the victims of a trade depression. The distinction between the deserving and undeserving poor has been used to deprive the latter of welfare benefits.

designated competitive bidding

A restricted form of offer in which firms wishing to participate are screened for their expertise and location.

destructive competition

Fierce competition, often in the form of price wars, which drives many firms out of an industry and weakens those that remain.

devalorization

The process that reduces the value of capital through a fall in the price of intermediate or final goods, or as a result of bankruptcy.

development

1 The movement of an economy from agricultural activities using simple technology to the production of industrial products and a range of services using modern technology. (Even in the seventeenth century petty regarded development as the growth of service industries.)

2 The cumulative growth of per capita income, accompanied by structural and institutional changes. Although per capita income is a crude measure unless problems of measuring the gross domestic product and its distribution are taken into account, this is often the best proxy measure. Post-1945 development policies have often failed to help the poorest 40 per cent of the world’s population. Although many aid programmes have an urban bias, they have widely achieved lower rates of infant mortality, more hospital beds, an increased supply of piped water and the building of many all-season roads.

development bank

A bank specializing in the provision of finance for development projects in developing countries and depressed regions. Major international development banks use both capital subscribed by donor countries and capital borrowed from international capital markets to support particular projects and programmes, often over the medium term. The principal international development banks include the international BANK FOR RECONSTRUCTION AND DEVELOPMENT, the INTERNATIONAL FINANCE CORPORATION, the INTER-AMERICAN DEVELOPMENT BANK, the ASIAN DEVELOPMENT BANK, the AFRICAN DEVELOPMENT BANK, the CARIBBEAN DEVELOPMENT BANK, the EUROPEAN INVESTMENT BANK, the EUROPEAN BANK FOR RECONSTRUCTION AND DEVELOPMENT and the INTERNATIONAL INVESTMENT BANK.

development economics

Growth theory applied to the economic problems of developing countries. In a sense, it started with smith’s The Wealth of Nations which was concerned with an analysis of the causes of economic growth, but it boomed as a subject in the period of decolonialization of the 1950s. When development economists began devising growth policies for less developed countries, they were inspired by soviet economic management of the 1930s, wartime economic management and the Marshall plan for recovery in Western Europe. Criticism of the industrialization bias of early development plans, and their consequent environmental effects, made intermediate technology increasingly popular as a development strategy.

development planning

The use of central planning in Third World countries as a route to economic development. The earliest plans were carried out before and after the second World War in British, French, Belgian and Portuguese colonies. These plans included a crash investment programme, especially in the public sector, and a commitment to rapid industrialization.

diamond model

A theory of competitive advantage based on four different determinants within a domestic economy: factor conditions, domestic demand conditions, the presence of related and supporting industries, and strategy, structure and rivalry of firms within the industry.

difference equation

An equation relating a variable measured at one time to variables measured at previous times. This mathematical device is much used in dynamic economics, e.g. in the case of a cobweb the quantity supplied in year t + 1 is a function of the price in year 1. Difference equations can be linear or non-linear, homogeneous or non-homogeneous, of first or second order.

differential tax incidence

The burden of one tax compared with another.

differential theory of rent

The theory of Anderson, ricardo and others which asserted that the rent on land subject to diminishing returns arose from differences in fertility or location with no rent being paid on the least fertile or most distant land. As the margin of cultivation is extended, the total amount of rent paid increases.

differentiated good

A good appearing different from its market rivals by being sold under a brand name and packaged differently. Recognition of this marketing device made a great contribution to the formation of the theory of MONOPOLISTIC COMPETITION.

differentiated marketing

A marketing strategy with separate marketing programmes for each product of a firm.

differentiation

1 A major business strategy to acquire some monopoly power by the differentiation of products, or of their marketing and distribution to the consumer.

2 A mathematical method of calculating the derivative of a function; this is much used in neoclassical economics.

diffusion index

A measure used to identify business cycles. The standard diffusion index is calculated by giving a value to each component series. The value is 0 per cent for a decrease, 50 per cent if there is no change in the overall number rising or falling, or 100 per cent if there is an increase over a given time period. In the USA, Business Cycle Indicators, published from 1961, has measured diffusion for twenty-one economic indicators.

diffusion rate

The proportion of output of an industry using a particular technique by a stated date, e.g. the percentage of the steel industry using technique X by 2000. This is a major measure of technical progress and of innovation. High rates of diffusion are encouraged by the possibility of cost reduction and by energetic advisory and information services.

Dillon Round

The fifth round of tariff reductions, organized under the general agreement on tariffs and trade, of 1960-1. Under it, the USA agreed to a 20 per cent reduction in tariffs on 20 per cent of its dutiable imports. As the concessions were concentrated on manufactures, the round had little effect on the exports of less developed countries whose industrialization was at a low level. it was of far more importance for bilateral deals between the USA and industrialized countries.

diminishing marginal rate of substitution

This rule of consumer behaviour states that at the same level of utility a consumer will sacrifice decreasing amounts of good Y to obtain extra units of good X. This is usually expressed as an indifference curve.

diminishing marginal utility law

This states that the amount of satisfaction derived from the consumption of successive units of the same good or service will decline. The law is used to explain the downward-sloping nature of the normal demand curve, to resolve the so-called WATER AND DIAMONDS PARADOX and to justify redistribution from the rich to the poor. Although bentham, senior and jevons are noted for their clear exposition of this law, hints of it appeared in earlier economic writings.

diminishing returns law

The decline in output which occurs as successive units of a variable factor of production are applied to a fixed factor. The most familiar example was the application of increasing amounts of labour to a fixed amount of land with the consequence that the marginal product of labour declined. This view of agricultural production was central to much of classical economics, including ricardo’s model of the economy. The US economist Henry Charles Carey (1793-1879) was one of the few economic writers of the nineteenth century to argue that in a developing economy cultivation can proceed from the least to the most fertile land bringing about increasing returns.

Dinks

Double income, no kids: US professional couple with a high joint income and no dependants.

direct and indirect taxation

Two broad categories of taxation differentiated according to administrative arrangements, incidence, or the characteristics of taxpayers. Income taxes, for example, are paid directly to revenue authorities, can directly reduce taxpayers’ real incomes and be directly related to taxpayers’ characteristics. But an indirect tax, such as a sales tax, is indirectly paid by an individual through purchasing goods and services, is not directly related to the personal circum stances of a taxpayer and can have its incidence shifted to the producer. Direct taxation is regarded as more equitable but it is more difficult and expensive to collect.

direct cost

1 A production cost directly attributable to the cost of producing one unit of a particular output.

2 Variable cost.

direct factor content

The amounts of factors of production used only in the last stage of production.

direct foreign investment

1 Investment in productive facilities by a foreign company, e.g. the purchase or building of factories.

2 The purchase of stocks and shares which give a foreign company control over existing real assets.

direct-indirect taxes ratio

A measure of the tax structure which compares the yields from the various types of tax to see their relative importance as sources of revenue.

direct labour organization

A department of a UK local authority carrying out building, street cleansing or other activities itself rather than contracting them out to private sector firms. They were severely criticised for their low productivity. In the 1980s, the UK government began the replacement of direct labour organizations by private firms through competitive tendering in an attempt to reduce the cost of local government services.

directly unproductive profit-seeking activities

Activities yielding pecuniary returns but not producing goods or services. A major example is the evasion of tariffs.

direct product profitability

A measure of a retailer’s net profit after all labour, equipment and storage costs attributable to that product have been deducted. This is a more precise cost accounting technique than the previously popular method of calculating gross profit margins before deducting the average costs of handling and storage of each product. The knowledge gained from applying the direct product profitability method enables a retailer to have a more optimal product mix and a better use of shop space.

direct sale

A sale to a customer without the use of agents and the payment of their commission. This is a cheaper way of selling, especially for services such as insurance.

dirigisme

state intervention in society and direction of the economy as practised in France from the seventeenth century.

dirty float

An exchange rate regime which, for the most part, is dominated by market forces but occasionally has interference by governments and central banks to prevent an excessive fluctuation in the value of a currency.

disappointment aversion

Being willing to suffer more pain from a loss than receiving pleasure from gaining the same amount. This aversion causes many people to prefer the high probability of a small loss in a lottery to the low probability of a high loss through investing in equities.

discomfort index

okun defined this as the sum of the unemployment rate plus the rate of inflation.

disconnective taxation

Taxation unconnected to any spending. The opposite of a benefit tax.

discount bond

A bond valued at less than its nominal value because of its high risk or its low COUPON.

discounted cash flow

A method of investment appraisal which discounts the future benefits and costs of an investment to discover its present value. The method can be used to evaluate whether an investment project is worthwhile either by following the rule that the present value of benefits must exceed the present value of costs, or by considering whether the internal rate of return is acceptable compared with that on other investment projects.

discounted share price

A share price which takes into account expectations of future changes in earnings per share. As stock markets are constantly responding to information about particular companies’ prospects, the announcement of a fall or rise in company profits can often have little impact on a share price.

discount house

A financial institution of the City of London, which borrows money at call from banks and other institutions and invests it in treasury bills, high-quality COMMERCIAL BILLS and CERTIFICATES OF DEPOSIT. The twelve discount houses, forming the money market, act as a buffer between the commercial banks and the bank of England. Banks short of cash will recall money lent to the money market which then has to discount bills to balance its books. The Bank of England as lender of last resort is always prepared to lend to discount houses, by discounting bills, in order to preserve the liquidity of the banking system as a whole.

Curiously, many of these discount houses are now owned by clearing banks who could easily abolish them by abandoning an agreement not to compete in the money market which has existed since the 1930s: the banks prefer this unusual buffer between themselves and the Bank of England.

discounting

A method used to value at the same date economic flows or stocks which have originated at different dates. A typical use of discounting is to convert the expected future incomes from an asset to present values using a discount rate.

discount market

The money market specializing in transactions in short-term financial assets.

discount rate

1 The rate of interest charged by a central bank to lower level financial institutions (usually commercial banks) for discounting their bills, i.e. lending them money, often when acting as the LENDER OF LAST RESORT.

2 The rate used for discounting future values to the present. In cost-benefit analysis there is a distinction between a private and a social rate of discount. A private rate of discount reflects the time preference of private consumers; a so cial rate is based on the government’s view, which can be more long-sighted as it attempts, in most cases, to take into account the welfare offuture generations.

discount window

US term for lending to depository institutions by each of the twelve district federal reserve banks. From 1913 to 1916, this was the only lending a federal reserve bank could undertake. It is either adjustment credit to meet a temporary need for funds or extended credit to help banks subject to seasonal fluctuations, or accommodation to cope with special circumstances, e.g. the effects of a change in the financial system. Other lending is by discounting eligible paper, e.g. a commercial or agricultural loan made by the bank to a customer. Before 1980, such lending was only made to Federal Reserve member banks; now, under the depository institutions deregulation AND MONETARY CONTROL ACT 1980, it is open to all depository institutions except bankers’ banks which maintain transaction accounts or non-personal time deposits. Discount window loans are usually only a small proportion of bank reserves, e.g. less than 3 per cent in 1985. This lending can be used in monetary policy instead of open market operations.

discouraged workers hypothesis

The view that workers give up job search activity because high unemployment rates and a lack of hiring by businesses make it unlikely that they will succeed in gaining employment. Lack of search loses them the status of being unemployed and so they drop out of the labour force.

discrete variable

A variable which can take only some of the values between two given values, e.g. the number of countries in the world can be 50, 100 or 200 but not 1.8.

discriminating auction

A form of sale with discrimination based on price. The bids are ranked from the highest. Each bidder pays what has been bid until the good or service auctioned is sold out.

discrimination

1 Unfair and unfavourable treatment of a group of workers or other persons.

2 Setting different wages for workers with the same productivity but different personal characteristics, i.e. sex, age or race, or refusing to hire them.

Different schools of economics have chosen different approaches to the issue: neoclassical economists such as becker examined how a taste for discrimination affects the demand for each group, while others have placed discrimination in the context of wider concerns such as class conflict.

diseconomy of scale

A rise in average costs as a consequence of an increase in output. This is visible in the positively sloped part of the average cost curve. Early writers on the subject attributed such diseconomies to the managerial problem of co-ordinating the activities of large enterprises. Later writers noted other sources of diseconomies, including material fatigue, increases in the marginal cost of attracting more customers and rising factor prices – how many of these ’causes’ are valid depends on how strictly a diseconomy is defined.

disembedded economy

An economy in which economic relationships dominate the social relationships of kinship and polity. This phenomenon, observed by the german historical school, is followed today by an emphasis on markets.

disembodied technical progress

An increase in productivity which occurs without the installation of new capital goods. Examples include organizational changes or learning-by-doing.

disequilibrium

1 An economic system in a state of excess DEMAND or EXCESS SUPPLY.

2 The state of an economic system whose key variables continue to fluctuate around an equilibrium or an equilibrium growth path. Expectations of economic agents or lags in the system can cause this.

disequilibrium economics

The analysis of non-clearing markets or national economies with less than full employment. In macroeconomics, the dynamic multiplier shows how disequilibrium occurs in the economy as a whole; in the multiplier-accelerator model changes in the national income are studied. keynesian economics is believed to be essentially a theory of disequilibrium rather than a theory of general equilibrium as neo-keynesians would assert.