disequilibrium growth theory

A dynamic theory with keynesian foundations accounting for the course of change of a national economy. This growth process can be initiated by disequilibrium in a factor or product market or through the non-equality of aggregate demand and aggregate supply.

disequilibrium money

The mismatch between the demand for and supply of money brought about by lags that prevent supply-side shocks from affecting the demand for money. These shocks in money and credit markets lead to asset prices overshooting their equilibrium level.

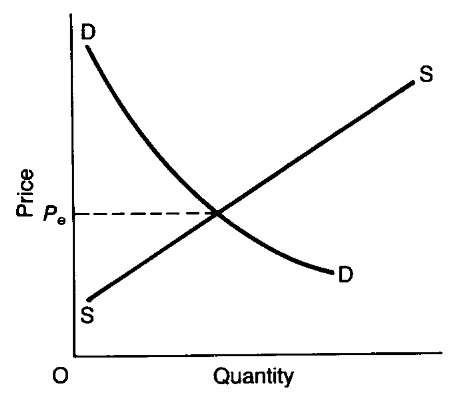

disequilibrium price

A price that fails to equate demand with supply. In the figure, Pe is the equilibrium price. Above Pe prices will be determined by the demand curve; below it, by the supply curve.

disguised unemployment

That part of the labour force consisting of employed workers with a low productivity making little contribution to the GROSS DOMESTIC PRODUCT. A low level of investment per worker, or the reluctance of labour to move to more productive and higher paid work in the more modern sectors of an economy, can cause this unemployment. Countries or regions with large agricultural sectors, e.g. less developed countries and southern regions of the european union, often have a great deal of this sort of unemployment.

disincentive effect

The discouraging effect of a tax on the supply of effort or the number of persons available for work. The best example is an income tax with a high marginal rate. This can result in a backward-bending labour SUPPLY CURVE.

disinflation

The reduction of inflation to a very low level. A major way of attempting to reach this goal is to lower aggregate demand by the use of monetary and fiscal policies.

disinflation cost

The loss of output resulting from a monetary policy seeking to reduce inflation by a reduction in aggregate demand, often through increasing interest rates.

disintermediation

Bypassing the banking system by direct borrowing and lending between companies/ corporations or other users and suppliers of finance. When the bank of England introduced the ‘corset’ as a means of reducing bank lending, disintermediation enabled companies to continue to borrow short term when refused credit by their bankers.

‘dismal science’

The summary dismissal of economics made by Thomas Carlyle (1795-1881). He argued that as utilitarianism had been mechanically applied and as humans were increasingly connected only by cash payments, fundamental spiritual values were being neglected.

disposable income

1 PERSONAL INCOME plus TRANSFER INCOME net of all taxes levied on incomes.

2 The amounts of money a person can spend or save in a given time period.

dissaving

1 The spending of accumulated savings.

2 A net increase in borrowing.

distortion

The failure to reach a welfare optimum because the social marginal cost of producing goods is less or more than the social marginal benefit of consuming that good. welfare economics is much concerned with distortions when analysing taxation and monopoly.

distortionary tax

A biased tax causing inefficiencies. Many specific taxes, e.g. those levied on the products of one industry but not on those of another, can change the post-tax allocation of demand.

distribution

1 The division of the national income among the factors of production in the form of wages, profits, interest and rent. turgot, in his Reflections sur la formation et la distribution des richesses (1766), was probably the first economic writer to examine the distribution as a separate issue. Despite John Stuart mill’s attempt to separate the laws of production from the laws of distribution, there has always been an intimate relationship between distribution and other economic theories. Socialist economists have made the study of distribution a major concern.

2 The distribution of one type of income between persons or between groups.

3 The last stage of production in which goods or services reach final consumers.

distributional/social weights

The increased weighting of one social or income group in cost-benefit analysis. This gives a group more significance: for example, if the lower quartile of an income distribution is given a weight of 4 but the upper quartile only 1 then costs and benefits affecting the lowest income group will be regarded as four times as important as those of the top group.

disturbance term

A variable, positive or negative in value, or error term which indicates the extent to which the dependent variable of a regression equation falls short of the central value of the independent variables. In the equation I = a(Y — Yi) + u, I is net investment, Y is this year’s income, Y1 is last year’s income and u is the disturbance term showing the extent to which I is more or less than the central value of a( Y — Y1). This term reflects the random element in economic relationships.

disutility

A negative satisfaction, e.g. pain, tiredness, unhappiness. Study and work supposedly create disutility, justifying higher earnings to better educated and more productive workers. Consumption of a good or service, according to the law of diminishing marginal utility, can continue to the point where utility turns into disutility, e.g. a few glasses of claret can give a person utility, a few litres severe disutility. A bad produces disutility.

divergence indicator

The margin by which a currency in the exchange rate mechanism can diverge from its central or par value. This is ±2.25 percent except for the later entrants to the mechanism, e.g. Italy and the UK, which can diverge by 6 per cent in either direction to make adjustment to a fixed exchange rate easier.

divergence threshold

The crucial value of the divergence indicator for a currency of the exchange rate mechanism. At this value, either a change in the domestic economic policies of the country concerned or a change in the par value of its currency is required.

diversification

1 The production of a range of products by a firm.

2 The establishment of several industries in a region or a country.

3 The spreading of investments over a range of assets with different degrees of risk.

Ultimately diversification is always concerned with minimizing the risk of a loss of income.

diversification cone

Combinations of factor endowments which produce the same set of goods at the same factor prices in the heckscher- OHLIN TRADE THEOREM.

diversification discount

The discount arising from a firm having several divisions each with the authority to make investments. The discount occurs owing to the lack of co-operation between divisions.

divestment

The disposal of part of the assets of a firm; the opposite of a merger. An appraisal of the activities of a diversified firm often results in divestment as a means of rationalizing its interests.

dividend

The variable return to equity shares, decided by the board of directors of a company or corporation according to its policy on net profit distribution. For preference shares, the dividend is at a fixed rate determined when they were issued, unless there is a right to participate in residual profits.

dividend discount model

The fair pricing of an asset measured as the present value of expected cash flows from it. In the case of a common stock or equity it is the expected dividend payments and the expected price of the stock at a future date.

dividend net

The rate of dividend paid in the last year, less income tax paid at the standard rate.

dividend yield

The yearly return on each £100 or $100 invested:

Divisia money index

A combination of different measures of money weighted by the amount of interest paid on each. The higher the interest rate, the less the monetary instrument is ‘money’ in the narrow sense of being cash. The growth of interest-bearing current accounts has rendered the index less useful.

division of labour

specialization of productive activity either by persons in different occupational groups undertaking particular tasks or by dividing a task into its component operations. Although writers as early as xeno-phon had mentioned the principle, smith, with his famous example of pin making, made it a central explanation of the growth process, He noted that such specialization would save time as there would not have to be frequent changes from one activity to another, that workers would become more dextrous and that the analysis of jobs would make possible the introduction of machinery. However, he was aware that workers would become dull through repetitive tasks – a Smithian point often misinterpreted by Marxists: division of labour in itself can produce alienation amongst workers, whether or not they own the capital they use.

division of thought

Specialization in the processing of information and acting upon that data. Such specialists will undertake either strategic planning or executive operations.

do-able

A development strategy emphasizing projects and methods wanted by local populations as they are more likely to be maintained in the long term.

Dobb, Maurice Herbert, 1900-76

UK Marxist economist, educated at Cambridge and the London School of Economics, and a fellow of Trinity College, Cambridge, from 1924 to 1967 and Reader in Economics from 1959. Throughout his academic career his Communist Party ideological stance informed his views and his writings. As a defender of Soviet-style economic planning, he participated in major debates with mises and hayek. His analysis of capitalism defended the Marxian interpretation of economic history, provoking a long-running controversy amongst Marxists. He had a deep interest in the history of economic thought, collaborating with sraffa in the editing of ri-cardo’s works and suggesting that economic theory descended from quesnay through ricardo and marx to leontief and sraffa. Current policy issues also concerned him: he was able to make use of a Ricardo-Marx two-sector model to make policy recommendations for less developed economies.

dogs of the Dow

An approach to investment based on using dividend data. At the beginning of the year, US stocks listed by Dow are ranked by dividend yield from the highest to the lowest and then an equal amount is invested in each of the top ten stocks. The following year the procedure is repeated and the stocks whose rank has fallen below the top ten are sold.

dole bludger

An Australian unemployed person who does not seek work but enjoys a life of leisure financed by social security benefits. Abolition of unemployment benefit was intended to force such persons into retraining or job search.

dollar

The name of the USA’s currency since 1785. Other countries, including Hong Kong, Canada and Australia, have followed the US lead. The term is derived from the Bohemian thaler introduced in 1517. ‘Yen’ (Japanese) and ‘yuan’ (Chinese) both mean dollar.

dollarization

1 The use of the US dollar for domestic monetary transactions outside the USA because the local currency is depreciating rapidly through high inflation. In 1904 Panama abandoned its own currency for the dollar, as did Ecuador in 2000 and El Salvador in 2001.

2 The abandonment of a national currency in favour of the US dollar. In countries such as Ecuador a rapid decline in the value of its currency, the sucre, required this drastic economic reform.

dollar overhang

US dollars held outside the USA in the 1960s in excess of the gold backing for them. dollar standard (F3) The basis of value for international monetary fund currencies, the US dollar, under the bretton woods system (1968-73), a successor to the gold standard. Unlike linking currencies to gold, this standard did not require dollar holdings as a backing for other currencies, thus making it a less potent system of international money.

domain

The set of values a variable can take.

Domar, Evsey David, 1914

A founder of modern economic growth theory. Educated at the Universities of California (Los Angeles), Michigan and Harvard. Early in his career he was an economist with the federal reserve Board of Governors and then at the cowles commission, and professor at the Massachusetts Institute of Technology from 1958 to 1972. He is best known for reviving economic growth theory in the harrod-domar model; his other works include studies of taxation and comparative economic systems.

Domei

Japanese Federation of Labour. This labour union national federation merged with Churitsuroren to form Rengo in 1987. Domei had 2.09 million members in 1987.

domestic absorption

A nation’s total use of its own output of goods and services in consumption and investment.

domestic banking system

The interconnected banking institutions of a particular country. These receive deposits from the public, lend at home and abroad and effect the transfer of funds. As the ultimate guarantor of the liquidity of a banking system, a national central bank operates and, to a large extent, attempts to control all wholesale and retail BANKS.

The greater sophistication attributed to the banking systems of Western countries is a product of their long period of relative freedom to develop a variety of financial instruments, unlike the mono-banks of soviet-type economies whose role was limited through subservience to a system of central planning.

The Second World War created an excessive volume of public sector debt which made possible a post-war expansion in bank advances to meet the demands of private sector borrowers. other changes have been a widening of the range and activities of commercial banks, including new techniques and financial products, particularly in the UK and the USA. In the USA in the 1960s, for example, there was a switch from asset management to liability management and later a shift from fixed rates to variable rates for lending. To assess a domestic banking system a commonly used indicator is the trend in the prices of the stocks and shares of issued bank securities as these reflect investors’ confidence.

domestic credit expansion

Growth of the money supply, adjusted by the deficit or surplus on the balance of payments current and capital accounts. It consists of the public sector borrowing requirement less net sales of public sector debt to the non-bank private sector and bank lending to the private and overseas sectors. The reasoning behind this measure is that a balance of payments deficit leads to a reduction in the expansion of the domestic money stock through excess spending overseas. Conversely, a money supply expands with a balance of payments surplus, increasing foreign currency reserves. This measure was intended to produce a monetary aggregate suitable for open economies. It was first used in the UK in 1968 when it was monetary target popular with the international monetary FUND.

domestic labour

1 Unpaid work within households often undertaken by women.

2 Hired servants engaged in cleaning, cooking and other household tasks.

domestic resource cost

The opportunity cost of using a factor of production to produce one unit of output, divided by the international value added by producing that unit. This is used as an alternative measure to the effective rate OF PROTECTION.

domestic system

A primitive form of production in which merchant capitalists advance capital to self-employed craftworkers and artisans who, using their own simple tools, make a product. Before the Industrial Revolution in Great Britain, the textile industry was organized in this way.

dominant firm

A firm making most of the sales of an industry and often a price leader. There are many firms of this type in oligopolistic industries.

dominant strategy

The pursuit of objectives by a firm which ignores the possible actions or reactions of its rivals.

Donovan Commission

The Royal Commission on Trade Unions and Employers’ Associations of 1965-68 chaired by Lord Donovan. It concluded that the UK had two systems of industrial relations: a formal system with industrywide collective agreements on pay, hours of work and other employment conditions; and an informal system at the factory level setting earnings supplements to national wage rates and causing wage drift and unofficial strikes to enforce workers’ demands. This dual system was partly the consequence of full employment in the UK in the 1950s and 1960s. To remedy these faults in the industrial relations system, the Donovan Commission recommended the limitation of industry-wide agreements to matters which could be regulated effectively at the industry level and the introduction of factory agreements to replace informal understandings.

dose-response function

The relationship between a dose of pollution and the physical consequences, including mortality, morbidity, crop yields and material deterioration.

dot com company

A firm which markets its goods and services from its website on the Internet.

double counting

Recording something twice with the consequence that the total resulting from aggregating individual items is incorrectly too large. In national income accounting, double counting is a crucial problem to be avoided. It is essential, for example, to ensure that transfer incomes are not added to factor incomes as transfer incomes are derived from factor incomes.

double discounting

A calculation which twice takes into account inflation thus producing too small a net present value. Double discounting is only approved when it is used to correct for both inflation and time preference.

double factorial terms of trade

net barter terms of trade multiplied by the ratio of the productivity change index for one country’s export industries and the productivity change index for a foreign country’s export industries. This measure of the terms of trade indicates the exchange rate between domestic and foreign factor services.

double taxation of savings

Taxing both the income out of which savings are made and the income from the savings when they are invested. Many income tax systems have this feature.

double-taxation relief

A tax credit allowed against the tax payable by a resident of a country on account of income already having been taxed abroad, e.g. if a US citizen has already been taxed in France, then that will be taken into account when calculating that person’s liability for paying US taxation.

This relief is only possible if there is a tax treaty between the two countries concerned or between states in a country, such as the USA, with a federal constitution. In the USA where the rate of individual income tax can vary from state to state, a person who resides in one state and works in another can gain relief by being given tax credits by one state.

Douglas Amendment 1965

An amendment to the bank holding company act (USA) prohibiting bank holding companies from acquiring banks in other states.

Douglas, Paul Howard, 1892-1976

A US economist who was taught, and much influenced, by John Bates clark at Columbia University. For most of his academic career, i.e. 1920-4 and 1927-48, he was a professor at Chicago. As US senator for illinois in 1948-66, he fought for family allowances, old-age pensions and pro-union legislation.

In 1928, he used marginal productivity theory as the foundations of the cobb-dou-glas production function, the leading approach on the subject until 1961. His early work on wages included a seminal study of labour force participation relating wages to participation within major US cities and attempting to vindicate marginal productivity THEORY.

Dow Jones Industrial Average

The leading US index of stock market prices, which is an unweighted arithmetic average of the thirty industrial shares most widely quoted in the USA. Averages are also published every trading day for transportation and utilities stocks, as well as a composite index combining the movements in the three indices.

downsizing

Reducing the size of a labour force by making workers redundant. A term particularly applied to the staff reductions made by securities houses after 1987.

downstream dumping

Exporting goods with artificially low prices because intermediate goods have been purchased below cost.

downstream firm

A firm engaged in a later stage of production or retailing.

droit de suite

A directive approved by the European Parliament and European Commission in June 2001 that the authors of works of art should benefit from the resale of their artistic work; not to be fully implemented until 2010. The fees charged will be according to five bands of selling prices with the lowest band giving the artist 4 per cent of the value of the sale and the highest 0.4 per cent.

drug economy

The part of a national economy financed by the proceeds from the sale of illegal drugs. It is so large in some economies, including the USA, that it is sufficient to keep consumer spending buoyant whatever macroeconomic policy is being followed. In the USA, examination of large and suspicious cash deposits at banks, possible evidence of drug dealing, are required under the Money Laundering Act 1986 and the Anti-Drug Abuse Act 1988. In the UK, a court can order the confiscation of the assets of drug-traffickers.

dual-decision hypothesis

Clower’s reinterpretation of keynes’s unemployment equilibrium by distinguishing ‘notional’ demand, the demand of households at prices reflecting a full- employment equilibrium from ‘effective’ demand, the demand of households whose actual incomes have fallen through unemployment. Adjustment to unemployment equilibrium takes place through incomes and not through relative prices. This hypothesis recognizes that in a market system a household cannot buy and sell what it pleases if there is excess supply in the economy, and attempts to reconcile wal-ras’s law with keynes’s General Theory.

dual economy

A national economy consisting of a rich modern sector and a poor traditional sector. Originally this term was used to describe many colonial economies after the Second World War.

dual exchange rate

The two values of a currency determined separately for different sets of monetary transactions. A fixed exchange rate can be used for normal commercial transactions and a floating rate for capital account transactions. Mexico has followed this system.

dual federalism

A loose form of federalism in which the federal and state levels act separately but in parallel. This traditional view of the US Constitution implies that federal government is mainly concerned with interstate commerce with production being the concern of the states.

dual labour market

A labour market divided into a primary sector with better jobs and a secondary sector with inferior jobs. The primary sector consists of large firms offering training and high remuneration but the secondary sector has many small marginal firms offering small rewards and prospects to their workers. The primary sector firms use internal labour markets but in the secondary sector there is heavy reliance on the external labour market. Students of sexual and racial discrimination frequently use this concept, pointing out that women and blacks are often trapped in the secondary market.

dual pricing

The practice of quoting prices in two currencies. This occurs as part of the transition to a new currency or because of lack of confidence in the national currency. This occurred in many eastern European countries and in european union countries after the introduction of the euro.

dummy variable

A variable in an econometric equation only taking the values 0 or 1. it is used to refer to being in one state or another, e.g. married or not married, living in one century or another. A shift dummy reflects an exogenous shift; a slope dummy, a change in the slope of a function.

dumping

The sale of goods by a firm or government at a price below their cost of production with the aim of increasing a market share or avoiding the costs of storing unsold goods. Although in some countries the practice is encouraged, and made possible by means of government subsidization, there is much opposition to dumping, e.g. the GENERAL AGREEMENT ON TARIFFS AND trade has an International Dumping Code and the USA passed the Anti-Dumping Act in 1921. In some cases, dumping can only be prevented by retaliatory acts such as the imposition of duties or the severing of trading relationships.

Dunlop, John Thomas, 1914

A leading US expositor of labour economics educated at the University of California at Berkeley. Apart from governmental posts, including being US Secretary of Labor from 1975 to 1976, he has held a succession of academic posts at Harvard University from 1936. His chief research interests have been wage determination and labour management relations in many national economies, including those of the USA, Eastern Europe and the Third World. His detailed work on the relationship between market structures and wage setting contributed to the analytical linking of industrial organization and labour economics.

duopoly

An industry with two firms. Each duopo-list’s output and prices will depend on the market actions of the other. cournot’s analysis of 1838 considered two firms making an identical product, each aiming to maximize its profits on the assumption that the other firm kept its output constant. He proved that equilibrium would be reached with equal division of the market and the charging of the same price, a price lower than a monopolist’s price but higher than under perfect competition.

Du Pont formula

An analysis of the determinants of the difference between an actual rate of return on investment and the budgeted return where return on investment = return on sales x asset turnover.

Dupuit, Arsene Jules Etienne Juvenal, 1804-66

French engineer educated at l’Ecole poly-technique des Ponts et Chaussees. In his work on public utilities, especially the construction of bridges and public works, he pioneered the use of cost-benefit analysis. He was one of the earliest marginal-ists, introducing a demand curve related to marginal utility and suggesting the notion of consumer’s surplus. His contributions to economics are chiefly contained in two articles, ‘De la mesure de l’utilite des travaux publics’ (1884) and ‘De l’influence des peages sur l’utilite des voies de communication’ (1849) in the Annales desponts et chaussees. jevons and Marshall recognized him as their forerunner.

Durbin-Watson statistic

A test for the presence of autocorrelated disturbances. This statistic (DW) is calculated as the ratio of the sum of the squares of the differences between regression residuals in the present period and in the previous time period to the sum of the squares of the residuals in the present period. These disturbances are usually absent if the DW statistic has a value of about 2.

Dutch auction

A method of selling which consists of an auctioneer inviting a bid much higher than what is regarded as likely to be acceptable to the buyers. The starting price is gradually reduced until a buyer shouts ‘mine’ and accepts the item at that price. In Holland, an automated method is used for such auctions: the buyers face a ‘clock’ with prices on its face and a pointer moves gradually counterclockwise from the higher to the lower prices.

Dutch book

A principle for dynamic decision-making situations that leads to a sequence of bets finishing in an inescapable loss, as in the case of a bookmaker always gaining from gambling on the outcome of horse races.

Dutch disease

The harmful consequences for a national economy of discovering natural resources, especially the decline in traditional industries brought about by the rapid growth and prosperity of a new industry. New dominant industries can afford to pay wages far in excess of other industries, so the latter raise their wage levels to un-affordable levels causing unemployment. The successful new industry has high exports, creating a foreign exchange surplus and raising the country’s exchange rate, with the consequence that other industries of the economy become internationally uncompetitive. This was noticeable in the Netherlands after the discovery of North Sea gas. There rising prosperity brought about higher levels of welfare benefits which persisted after the downturn in the economy, causing immense difficulties for the financing of public expenditure. Many other economies have experienced this phenomenon, e.g. Jamaica with its bauxite industry, Venezuela with its petroleum industry.

dynamically inconsistent policy

A policy based on decisions which later cease to be optimal.

dynamic economics

The study of the movement of an economy from a particular state at a particular date to another state later usually using lagged variables. Although classical economists such as Adam smith and John Stuart mill were concerned to study the nature of economic progress, it was particularly roBERTSON, HARROD, HICKS and the STOCKHOLM school in the 1930s who began the creation of formal dynamic models of economic growth and change. The inclusion of time in the study distinguishes this approach from static models of economic systems. In dynamic models, at least one variable is measured at a different time from the others; subscripts are attached to each variable to indicate the date(s) to which they refer.

dynamic gains from trade

The effects of a trade policy on economic growth. Important determinants of these gains are the accumulation of physical capital, the transmission of technology and improvements in the quality of macro-economic policy.

dystopia

A disagreeable state, the opposite of a utopia. It is likely to have low incomes, high crime and other social problems, and few economic prospects.