In This Chapter

Finding the payment method that suits your needs

Discovering the ins and outs of payment services

Exploring merchant accounts

The hours you spend selecting your items, photographing them, touching up the pictures, and writing brilliant auction copy all come down to one thing: getting paid. Initially, you may be happy to take any form of payment, but as you become more experienced and collect for more auctions, you can decide which payment methods you prefer and which are more heartache than they’re worth.

Receiving and processing payments takes time and patience. The more payment methods that you accept, the more information you have to keep track of. Throughout this chapter, we detail the various payment options (including how to handle payment from international buyers) and how each affects your business.

Big Deals Only: Banker’s Draft

Banker’s drafts commonly come into play with big transactions – like when you put down a deposit on a house – so they may not be the most convenient way to pay, but they are secure and give peace of mind.

A banker’s draft is an ‘instant cheque’ that the payee’s bank makes out – so you know he or she has the funds available to pay for the item, unlike a normal cheque that has to clear.

A bank charges for drawing up a banker’s draft, as does PayPal. Unlike PayPal, however, the bank charges the buyer, not the seller. The bank fees are very steep, so give people more than just this option to pay.

Sign on the Line: Cheque and Postal Order

Another useful addition to your payment offering, cheques give both parties in the transaction peace of mind. Cheques can be cancelled and traced to an address if things go wrong on either side of the arrangement – although the payee may incur a fee for cancelling payment.

For the buyer, cheques also give proof of payment and are covered by eBay.co.uk’s Buyer Protection Programme. Cheques are particularly good for big payments and can be offered alongside Paypal or debit card options to give your customers some flexibility.

Like cheques, postal orders are traceable to an address, but they can also be easily bought and sold at your local post office and are available regardless of whether you have a bank account.

Accepting cash payments

We’re sure you’ve received cash from some of your winners. We don’t like cash. If the buyer doesn’t send the exact amount due, you have to call the buyer, who may claim that the correct amount should be there. Post can be stolen. All of a sudden, you must have lost the difference -and you have no recourse with cash.

Postal inspectors are constantly battling this problem, but you won’t know your post is being stolen until you’ve missed enough letters -usually bills and outgoing cheques. Explaining to a buyer that the money never arrived is difficult. The thief has the cash while your reputation may be shot. You can e-mail, phone, and talk and discuss, but the bottom line is that you haven’t received your money and the buyer insists you have it.

Hold This for Me: Escrow Service

Escrow.com (eBay’s official escrow service, which works for both US and UK customers) can make a buyer feel more comfortable proceeding with transactions of higher value purchases. By using escrow, buyers gain peace of mind because they know the transaction will be completed securely and easily.

You or your buyer must register to use the Escrow.com service. When you want to offer escrow as a payment option in one of your auctions, be sure to indicate as much on the Sell Your Item form so that it appears on the auction page. After the auction, the seller should initiate the escrow by going to www.escrow.com. To proceed with escrow, the buyer must send payment to Escrow.com (see Figure 13-1). Escrow.com accepts all credit cards, banker’s drafts, wire transfers, and personal or business cheques. A cheque is subject to a 10-day delay.

Figure 13-1:

Starting an escrow with Escrow. com.

After the buyer makes the payment, Escrow.com asks the seller to ship the item to the buyer. When the buyer receives the merchandise, the inspection period begins promptly at 12:01 a.m. the next weekday and continues for a time previously set by the buyer and seller.

The buyer notifies Escrow.com that the merchandise is approved, and then Escrow.com releases payment to the seller. If the buyer doesn’t feel that the merchandise is what he or she ordered, the buyer must return the item to the seller in its original condition, adhering to the Escrow.com shipping requirements. The buyer must also log on to the Web site to input return shipping information.

Helping your buyers buy safely

To give your customers a bit more confidence when they buy from you, why not apply for an accreditation from SafeBuy? The SafeBuy Assurance Scheme is operated by the Software Research Ltd, and is endorsed by TrustUK, the people that set up Which? Displaying the seal gives customers assurance that you are genuine and safe to deal with.

To be eligible for the SafeBuy seal, you must pass a rigorous test to ensure that you’re a solid

seller: You adhere to the Sale of Goods Act and the Data Protection Act, you won’t use spam for marketing purposes, you don’t exploit people, and so on.

An annual subscription to the SafeBuy Assurance Scheme costs £69, which seems like a lot, but it may make a big difference if you’re selling lots of stock on eBay.co.uk.

In the event of a return, the seller has the same inspection period to ensure that the item was returned in its original condition. After condition is confirmed, Escrow.com will refund the buyer (less the escrow fee and, if agreed on ahead of time, the shipping fee). Either the buyer or the seller can pay the escrow fee; the two can even split the cost. But you need to decide who will pay the fee up front and indicate this in your auction listing. The buyer is responsible for paying the escrow fee for all returns, no matter who had initially agreed to pay the fees.

Table 13-1 includes a listing of the escrow fees. (Credit cards are not accepted for payments of more than $7,500.00.) The fees are listed in dollars because Escrow.com is a US service, but you can find the cost in pounds by doing an online currency conversion – www.xe.com has a good conversion tool.

| Table 13-1 | Escrow.com Escrow Fees | ||

| Transaction Amount | Cheque or Money Order | Credit Card | Wire Transfer |

| Up to $1500.00 | $22.00 + 0.5% | $22.00 + 3.0% | $37.00 + 0.5% |

| $1500.01 – $7,500.00 | 2% | 4.5% | $15.00 + 2.0% |

| $7,500.01 – $20,000.00 | 1.75% | n/a | $15.00 + 1.75% |

| Over $20,0000.01 | 1.5% | n/a | $15.00 + 1.5% |

Sadly, scams involving escrow services are beginning to crop up on the Internet. Unscrupulous sellers set up fake escrow sites, sell a load of high value items on eBay to unsuspecting buyers, and then direct the buyers to the faux escrow Web site to set up their escrow. The buyers send their money (thinking the transaction is safe). After the fraudulent seller collects a stack of money, they shut down the Web site and abscond with it! Some buyers are reluctant to use escrow to pay for expensive items. Check out this link to the eBay.co.uk help page for more information

![]()

I Take Plastic: Credit Cards

As people become more comfortable with using credit cards on the Internet, so they become more popular for eBay.co.uk payments. Plus, major credit card payment services insure eBay payments to registered users, making credit cards safe for the buyer and easy for you. Credit card transactions are instantaneous; you don’t have to wait for a piece of paper to travel crosscountry.

For all this instantaneous money transfer, however, you pay a price. Whether you have your own merchant account (a credit card acceptance account in the name of your business) or take credit cards through a payment service (more on this just below), you pay a fee. Your fees can range from 2 per cent to 7 per cent, depending on how you plan to accept cards and which ones you accept.

A downside of accepting credit cards for your online sales exists. To protect yourself, please be sure to check the feedback – both feedback they’ve received and feedback they’ve left – of all bidders before accepting any form of credit card payment for a big-ticket item. Some buyers are chronic com-plainers and are rarely pleased with their purchases. A buyer may not be satisfied with your item after it ships and can simply call their credit card company and get credit for the payment; you’ll be charged back (your account will be debited) the amount of the sale. (See the ‘Forget the buyer: Seller beware!’ sidebar in this chapter.)

Credit card payment services

Person-to-person payment systems, such as eBay.co.uk’s PayPal, allow buyers to authorise payments from their credit card or current accounts directly to the seller. These services make money by charging percentages and fees for each transaction. The transaction occurs electronically through an automated clearinghouse. The payment service releases to the seller only the buyer’s shipping information; all personal credit card information is kept

private. A person-to-person payment service transaction speeds up the time it takes the buyer to get merchandise because sellers are free to ship as soon as the service lets them know that the buyer has made payment and the payment has been processed.

From the seller’s point of view, person-to-person payment service transaction fees are lower than the 2.5 to 3.5 per cent (per transaction) that traditional credit card companies charge for merchant accounts (get the details in the ‘Your very own merchant account’ section, later in this chapter). Even traditional retailers may switch their online business to these services to save money. In this section, we discuss the top payment services and how each works.

Forget the buyer: Seller beware!

When buyers dispute a sale, they can simply call PayPal or their credit card company and refuse to pay for the item. You lose the sale and possibly won’t be able to retrieve your merchandise. A payment service or merchant account will then chargeback your account without contacting you and without negotiating. Technically, the buyer has made the purchase from the payment service – not from you – and the payment service won’t defend you. We’ve heard of chargebacks occurring as long as six months after the transaction, although eBay.co.uk says they can occur no later than 60 days after they sent you the first bill on which the transaction or error appeared. No one is forcing the buyer to ship the merchandise back to you. Just like eBay Fraud Protection (see Chapter 3), the credit card companies skew the rules to defend the consumer. As the seller, you have to fend for yourself. See Chapter 4 on how to report fraudulent buyers. You usually have no way to verify that the shipping address is the one the credit card bills to. So, to add to your problems, the card may actually be stolen.

PayPal confirms through AVS (Address Verification Service) that the buyer’s credit card billing address matches the shipping address and gives you the option to not accept payments from buyers whose addresses don’t match. PayPal offers seller protection against spurious chargebacks under the following circumstances:

Fraudulent card use

False claims of non-delivery

See the section on PayPal for more details on how to be covered by seller protection.

If the issuing bank resolves a chargeback in the buyer’s favour, PayPal charges you a fee if you’re found to be at fault, but will waive the fee if you meet all the requirements of the PayPal Seller Protection policy.

Major credit card companies are now trying to curb online fraud for their merchant accounts. Visa has the new Verified by Visa acceptance, which takes buyers to a Visa screen (through software installed on the merchant’s server) and verifies their identity through a Visa-only password. MasterCard uses SET (Secure Electronic Transactions), a similar encrypted transaction verification scheme. These systems are expected to substantially reduce fraud and chargebacks.

Before you decide which credit card payment service to use, get out your calculator and check their Web sites for current rates. Calculate your own estimates; don’t rely on a site’s advertised samples. We’ve found that the charts on the Web tend to leave out certain minor fees. We’ve also found that comparison charts quoting the competition’s prices tend to include optional fees. Beware — and do your own maths.

When you pay the fee to your payment service, realise that the total amount of your transaction – including shipping fees and handling charges – incurs a fee. The payment service charges a percentage based on the total amount running through its system.

An Easy Way to Pay: PayPal

According to eBay.co.uk, nine in ten sellers offer PayPal as a payment option for customers, and you can see why – it provides a secure, tried, and tested way of sending and receiving money for items. eBay also own the company that runs this service – a fair endorsement, we think you’ll agree.

Using PayPal is quicker than a cheque or postal order, the system is integrated into eBay, no set up or monthly fees exist, and you can get help round the clock by calling 08707 307 191. On the minus side, PayPal creams off a small amount of money from your auction when you receive payment.

Other PayPal benefits that eBay.co.uk cites include:

Sellers don’t see buyers’ credit card details (they’re encrypted through PayPal’s system), which limits the risk of unauthorised use.

PayPal’s Buyer Protection Programme covers items up to £500 if they are lost, stolen or damaged.

PayPal can track payments and knows to whom they are sent. Payment is deposited directly into the seller’s account.

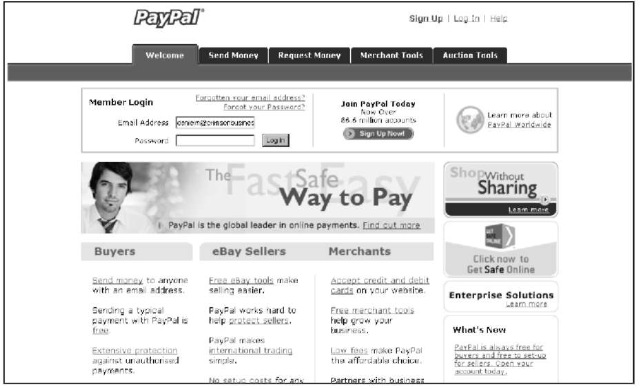

PayPal (see Figure 13-2) allows buyers to safely click and pay with a credit card or e-cheque directly from eBay after they win an auction or make a purchase. PayPal is conveniently integrated into all eBay transactions. If your auction uses the Buy It Now feature or is a fixed-price listing, buyers can pay for their purchases immediately with PayPal payments.

Figure 13-2:

The PayPal.com home page.

To accept credit card payments, you must have a premier or business level account. Buyers may join when they win their first auction and want to pay with PayPal, or they can go to www.PayPal.com and sign up. The situation is slightly different for the seller. You need to set up your PayPal account before you choose to accept it in your auctions or sales.

Here are more than a few particulars about PayPal accounts:

Auction payments are deposited into your PayPal account. Choose one of several ways to get your money:

• Have the money transferred directly into your registered current account.

• Keep the money in your PayPal account for making payments to other sellers.

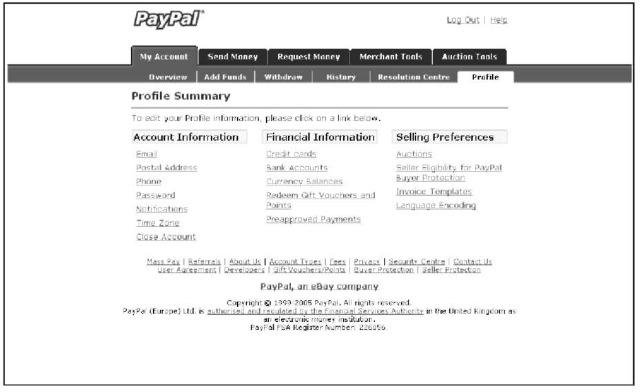

You get your own profile page when you sign up to PayPal (see Figure 13-3) – you can edit account details and general information about what cards you use, view eBay.co.uk auction accounts, and even check your time zone.

As a seller with a premier or business account, you can choose to accept or deny a payment without a confirmed address. A confirmed address means that the ship to address indicated by the buyer is the same as the billing address on the credit card the buyer chose to register with PayPal. On the accept or deny page, information about the buyer is shown, including verification status, account creation date, and participation number.

Figure 13-3:

The PayPal Member profile page.

PayPal sometimes fines sellers for chargebacks – the fine is calculated in euros but is about £7.50, – or it can retain the value of the chargeback from your PayPal account.

Look at Table 13-2 for more information about PayPal fees.

A brilliant feature of PayPal is the ability to download your sales and deposit history to your computer. Although PayPal also offers files that integrate with QuickBooks (more on QuickBooks in Chapter 16), the standard downloads are feature-rich. Rather than importing just sales figures, you see each and every detail of your transaction – dates, names, addresses, phone numbers, amounts, and more. Even fees and taxes are broken down separately, making Bookkeeping a breeze. The download imports into Microsoft Works and Excel. Downloading your history can help you calculate income taxes and VAT, reconcile your accounts, predict sales trends, calculate total revenues, and perform other financial reporting tasks. Downloaded sales and deposit histories also give you an excellent customer database.

The deposits download gives you detailed information for all the deposits that you receive: payments, PayPal transaction and deposit fees, refunds, rebates, and any adjustments made to your account.

Follow these steps to download your sales and deposit histories:

1. On your PayPal Main Overview page, click the History tab.

2. Click the Download My History link, on the right side of the page.

3. Enter the time span and the file format for the information that you want to view.

4. Click the Download History button.

The information appears on the screen. Or, if the servers are busy, you’ll receive an e-mail (usually in a minute or two) when the reports are ready.

5. Save the file in a directory that you can conveniently access for Bookkeeping.

You can just double-click the file to open it in Excel or Works. You now have all the information you could possibly need to apply to your Bookkeeping program.

Registering with PayPal

If you aren’t registered with PayPal yet, use the convenient Selling link on the All Selling page, which you reach from your My eBay page. To get more information, just click the PayPal related link to arrive at the PayPal Seller Overview page (see Figure 13-4), and then click the Sign Up button to begin registration. The registration form in Figure 13-5 appears. Type in what country you’re from, fill in the basic required information, and you’re in.

Figure 13-4:

The PayPal Seller Overview page.

Figure 13-5:

The new seller registration page.

The convenience of PayPal integration into the eBay site shines when your item is purchased. Winners just click a Pay Now button that pops up on your auction page immediately after the listing closes. When you list auctions, you pre-set the shipping and handling charges that appear in the shipping box at the bottom of the page. When winners click the Pay Now button, they’re taken directly to a payment page set up with your information. The process is as easy as purchasing something through Buy It Now.

When a purchase is made and the payment is deposited in your PayPal account, the system holds the money until you choose how you want to withdraw it.

PayPal accepts payments from 42 countries. For a current list of countries from which PayPal accepts payments, sign on to your PayPal account and go to

Because credit card and identity theft is so prevalent on the Internet, PayPal uses the extra security measure provided by Visa and MasterCard called CVV2. Most credit cards have three additional numbers listed on the back, immediately following the regular 16-digit number. Merchants use these numbers for security or verification but aren’t allowed to store them, so they’re presumably protected from hackers.

Withdraw your funds from the PayPal account on a regular basis; you need that money to operate your business. Don’t let this account become a temporary savings account – unless you choose the PayPal interest-bearing account (check out www.PayPal.com for more details).

Your very own merchant account

If your eBay.co.uk business is bringing in more than £10,000 a month, a credit card merchant account may be for you. At that level of sales, discounts kick in and your credit card processing becomes a savings to your business rather than an expense. Before setting up a merchant account, however, look at the costs carefully. Charges buried in the small print make fees hard to calculate and even harder to compare. Even those credit card companies who advertise low fees often don’t deliver. Look at the entire picture before you sign a contract.

Your own bank may be the best place to begin looking for a merchant account: They know you, your credit history, and your business reputation and have a stake in the success of your business. Build good credit before pursuing a merchant account because your credit rating is your feedback to the offline world.

If your bank doesn’t offer merchant accounts for Internet-based businesses, find a broker to evaluate your credit history and hook you up with a bank that fits your needs and business style. These brokers make their money from your application fee, from a finder’s fee from the bank that you finally choose, or both.

After you get a bank, you are connected to a processor, or transaction clearinghouse. Your bank merely handles the banking; the clearinghouse is on the other end of your Internet connection when you’re processing transactions, checking whether the credit card you’re taking is valid and not stolen or already up to the limit.

Table 13-3 highlights various possible costs associated with setting up and maintaining a merchant account.

| Table 13-3 Possible Internet Merchant Account Fees | |

| Fee | Average Amount |

| Set-up fee | £10 – £150 |

| Monthly processing fee to bank | 2.5% (1.5% – 5%) |

| Fee per transaction | 10p – 30p |

| Processor’s fee per transaction | 20p – 40p |

| Internet discount rate | 2% – 4% |

| Monthly statement fees | £5 – £10 |

| Monthly minimum processing fee | £10 – £20 |

| Gateway processing monthly fee | £10 – £20 |

| Application fees | £25 – £300 |

| Software purchase | £200 – £500 |

| Software lease | £20 per month |

| Chargeback fee | £10.00 |

Remember that some merchant accounts will charge you some of these fees and others may have a load of little snipes at your wallet. In the following list, we define some of the fees in Table 13-3:

Set-up fee: A one-time cost that you pay to either your bank or to your broker.

Discount rate: A percentage of the transaction amount (a discount from your earnings), taken off the top along with the transaction fee before the money is deposited into your account.

Transaction fee: A fee per transaction paid to the bank or to your gateway for the network.

Gateway or processing fee: Your fee for processing credit cards in real time paid to the Internet gateway.

Application fee: A one-time fee that goes to the broker or perhaps to the bank.

Monthly minimum processing fee: If your bank’s cut of your purchases doesn’t add up to this amount, the bank takes it anyway. For example, if your bank charges a minimum monthly fee of £20 and you don’t hit £20 in fees because your sales aren’t high enough, the bank charges you the difference.

If you’re comfortable with all the information in the preceding list and in Table 13-3, and you’re looking for a broker, heed our advice and read everything a broker offers carefully. Don’t miss any hidden costs.

The VeriSign Payment Services

If you have less than 1000 transactions a month through eBay.co.uk and your Web site, you may want to check out some of the services from VeriSign, a publicly-traded company and the world’s largest Internet trust service. A respected world-class company and the leader in its field, VeriSign offers gateway services at a reasonable price.

To participate in VeriSign’s gateway services, you must first sign up for a merchant account from your bank, PayPal, or by applying through preferred Merchant Account providers. The VeriSign service picks it up from there. You can integrate the service directly into your Web site. When you send out your winner’s congratulatory letter, include a link to the page on your site that links to VeriSign. When your orders are submitted to VeriSign for processing, both you and your customer receive a transaction receipt acknowledgement through e-mail when the transaction has been processed. VeriSign processes your transactions while you’re online.

Visit www.verisign.co.uk/index.html for more details.