Information Technology Reference

In-Depth Information

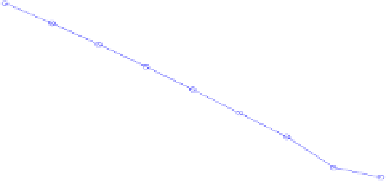

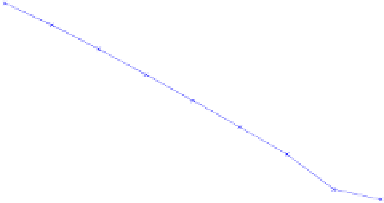

0.9

m=9, n=20

m=9, n=19

m=9, n=18

0.85

0.8

0.75

0.7

0.65

0.6

0.55

0.5

1

2

3

4

5

6

7

8

9

Auction

Fig. 5.

The winner's expected profit for a varying competition

for different

n

. As seen in the figure, for all the three values of

n

, the winner's expected

profit also decreases from one auction to the next.

5

Related Work

Existing work has studied the dynamics of the revenue of objects for sequential auc-

tions [15,19,14,3]. However, a key limitation of this work is that it focuses on objects

that are either exclusively private value or exclusively common value. For instance,

Ortega-Reichert [15] determined the equilibrium for sequential auctions for two private

value objects using the first price rules. Weber [19] showed that in sequential auctions

of identical objects with risk neutral bidders who hold independent private values, the

expected revenue is the same for each auction. On the other hand, Milgrom and Weber

[14] studied sequential auctions in an interdependent values model with affiliated

5

sig-

nals. They showed that expected revenues have a tendency to drift upward. This may

be because earlier auctions release information about the values of objects and thereby

reduce the winner's curse problem.

In contrast to the above theoretical results, there has been some evidence in real-

world sequential auctions for identical objects - for art and wine auctions in particular -

that the prices tend to drift downward [1,13]. Because the theoretical models mentioned

above predict either a stochastically constant or increasing price, this fact has been

called the

declining price anomaly

. Mc Afee and Vincent [13] consider two identical

private value objects and using the second price sealed bid rules, they show that the

declining price anomaly cannot be explained even if the bidders are considered to be

risk averse. Bernhardt and Scoones [3] show a decline in the sale price by considering

two private value objects. Here, we generalise this model to

n>

2 objects with both

common and private values

6

. Although the objects we consider have both common and

5

Affiliation is a form of positive correlation. Let

X

1

,

X

2

, ...,

X

n

be a set of positively corre-

lated random variables. Positive correlation roughly means that if a subset of

X

i

sarelarge,

then this makes it more likely that the remaining

X

j

s are also large.

6

Multi-object auctions for common and private value objects have been studeied in [8]. This

work focusses on the efficiency of these auctions, while our present work focusses on the

variation in the revenue of such auctions.