One of the simplest stock valuation models is the dividend growth model, often attributed to Gordon (1962). For instance, suppose that a firm pays dividends once a year and that after one year, when that dividend is paid, the stockholder plans to sell the investment. The value of the stock, P0, at the beginning of the year will be

where E(P1) is the estimate of the value of the stock at the end of the year and E(d) is the estimate of the dividend per stock paid then and k is the discount rate for that firm based upon its level of risk. This model may be extended to take into account the permanent nature of the firm and the fact that the stock owner is uncertain as to when he intends to sell the stock. Thus

where E(d„) is the dividend expected at the end of year n. Now, if it is assumed that the dividend per stock is constant

If equation (3) is multiplied by (1 + k) and this is subtracted from equation (3) then

As n approaches infinity then the last term on the right-hand side of equation (4) approaches zero. Therefore

It should not be thought that this model assumes that the investor holds the stock for an infinite period of time! After whatever period the stock is held for, it will be purchased by another whose valuation is based upon holding it for another finite period who in turn will sell it on to another who will similarly hold it, and so on. The effect of this is that the stock is held by a series of owners for a period approaching infinity and the price at which it passes between them reflects the infinite time horizon of that dividend stream. Thus this model is not sensitive to how long the present stockholder intends to hold the stock.

The main problems with this simple dividend model are the assumption of constant d and k over an infinite time horizon, and their estimation. An assumption of a constant growth in dividends may easily be incorporated into the model. Let the annual growth in dividends grow at a compound rate, g. Thus

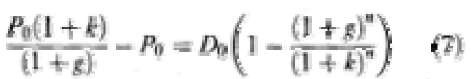

Multiplying equation (6) by (1 + k)/(l + g) and subtracting equation (6) from it gives

If k > g and as A = A(1 + g) the right-hand side of equation (7) simplifies to A. Thus

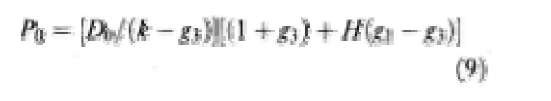

Models have been developed to vary some of the above assumptions. For example, Fuller and Hsia (1984) have developed a three-step dividend growth rate model which assumes that the “middle step” growth rate g2 is exactly half way between the other two. This is

where A is the current dividend per share, g1 is the growth rate in phase 1, g2 is the growth rate in phase 2, g3 is the long-run growth rate in the final phase, and H = (A + B)/2 where A is the number of years in phase 1 and B is the end of phase 2.

Say the present dividend is 1.00, and that its growth is 12 percent but declining in a linear fashion until it reaches 8 percent at the end of ten years. Because the total above-normal growth is ten years, H is five years. Thus

A surprising variable to be included in these models is the dividend per share. This may be adjusted to include the firm’s reported earnings per share. Consider the firm’s sources and application of funds statement:

where yt is the firm’s reported earnings, et is the firm’s new external funds received during the period, rt is the depreciation charged for the period, dt is the dividend paid during the period, and it is the amount of new investment made during the period. It will be seen that the firm’s economic (or Hicksian) income also equals its dividend, that is

It should not be thought that the results of these models will necessarily coincide with market values. The user may have quite different expectations. They may be useful, therefore, to quantify the effect of different forecasts. They may also be used to compute forecasts and expectations built into existing stock prices.