The cost of capital is the rate of return that investors in the market require in order to participate in the financing of an investment. The cost of capital is the rate used by managers of value-maximizing firms to discount the expected cash flows in capital budgeting. The investment projects which offer expected returns greater than the cost of capital are accepted because they generate positive net present values (NPV) while projects with expected returns lower than the cost of capital should be rejected. Thus, the cost of capital is the hurdle rate used to evaluate proposed investment projects.

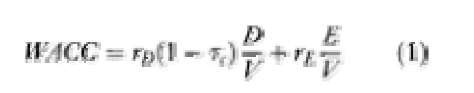

When the project is marginal and does not significantly shift the risk profile of the firm, the cost of capital can be computed as the weighted average costs of the various sources of finance. In the case where the firm is financed by debt and equity, the weighted average cost of capital (WACC) is computed as follows:

where rD is the cost of debt finance, t is the marginal corporation tax rate, rE is the cost of equity finance, D is the market value of debt, E is the market value of equity and V is the market value of the firm, i.e. E + D. In principle each project should be valued at its own cost of capital to reflect its level of risk. However, in practice, it is difficult to estimate project-by-project cost of capital. Instead, the firm’s overall weighted average cost of capital is used as a benchmark and then adjusted for the degree of the specific risk of the project.

The cost of capital can also be regarded as the rate of return that a business could earn if it chooses another investment with equivalent risk. The cost of capital is, in this case, the opportunity cost of the funds employed as the result of an investment decision. For value-maximizing firms, the cost of capital is the opportunity cost borne by various investors who choose to invest in the proposed project and not in other securities and, thus, it is estimated as the expected rates of return in the securities market. For regulated companies the cost of capital can be used as a target fair rate of return.

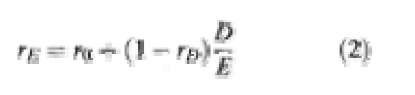

Modigliani and Miller (1958) show that, in a world of perfect capital markets and no taxes (i.e. Tc in equation (1) is zero), the cost of capital of a firm is independent of the type of securities used to finance the project or the capital structure of the firm. The main argument advocated is that as debt is substituted for equity, the cost of the remaining equity increases but the overall cost of capital, r>, is kept constant:

When taxes are introduced, Modigliani and Mi ller (1963) show that firms will prefer debt to equity finance because of the tax shields associated with the company’s borrowing plans. However, Miller (1977) demonstrated that the value of corporate interest tax shields can be completely offset by the favorable treatment of equity income to investors and, as result, the firm’s cost of capital is independent of its financing method.

The current main problems associated with the cost of capital relate to the estimation of the components of the WACC. While rD can be proxied by the average interest rate paid by the firm on its loans, t should be the marginal not the standard corporation tax rate. Lasfer (1995) showed that in the UK the effective corporation tax rates vary significantly from one firm to another and that a large number of companies are tax exhausted and do have lower debt in their capital structure compared to tax-paying firms. Thus the net tax advantages to corporate borrowing are unknown unless one computes the effective tax rate for each individual company.

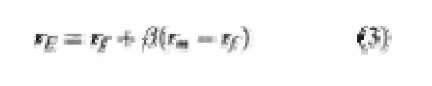

The cost of equity, rE can be based on the capital asset pricing model (CAPM) and computed as:

where J is the risk measure and (rm – rf) is the risk premium on the overall stock market, rm, relative to the risk-free rate of return, rf. However, the validity of this formulation has, recently, been the subject of severe empirical criticisms (Fama and French, 1992). Stulz (1995a) argues that the cost of equity capital should be estimated using the global rather than the local CAPM because capital markets are integrated. This method involves an estimation of a global market portfolio and for countries that are only partially integrated in international capital markets, the computation of the cost of capital may not be possible.

The traditional formulation of the WACC assumes that managers are value maximizers. Recent evidence provides a challenge to this assumption and argues that managers do not act to maximize shareholder wealth but, instead, maximize their own utility. In this case the WACC should be modified to account for the agency costs of managerial discretion. Stulz (1995b) defined the agency cost adjusted cost of capital by incorporating into the discount rate the impact of agency costs in the same way that the WACC approach incorporates in the cost of capital the tax shield of debt. However, it is not clear whether, in investment decisions, managers should adjust the discount rate or the expected cash flows. Moreover, the agency costs of managerial discretion depend on a firm’s capital structure, dividend policy, and other firm-specific factors which might be difficult to value. Furthermore, the above measurements can be difficult because they involve measuring expectations by market participants which are not directly measurable. In practice, the “true” cost of capital is likely to be unobservable.