The notion of “convenience yields” was first introduced by Kaldor (1939) as the value of physical goods, held in inventories resulting from their inherent consumption use, which accrues only to the owner of the physical commodity and must be deducted from carrying costs. Similarly, Brennan and Schwartz (1985) define the convenience yield as the flow of services that accrues to an owner of the physical commodity but not to an owner of a contract for future delivery of the commodity. These benefits of holding physical stocks often stem from local shortages, and the ability to keep the production process running (Cho and McDougall, 1990). Working (1949) showed that the convenience yield can assume various levels over time, especially for seasonal commodities like wheat. He argued that when inventory levels are high the convenience de rived from holding an additional unit of the physical good is small and can be zero or even negative. On the other hand when inventory levels are low, the convenience yield can be significant.

The notion of convenience yields has become an integral part in explaining the term structure of commodity futures prices. The risk premium theory as advanced by Keynes (1923), Hicks (1938) and Cootner (1960) relates futures price s to anticipated future spot prices, arguing that speculators bear risks and must be compensate d for their risk-bearing services in the form of a discount (“normal backwardation”). The theory of storage as proposed by Kaldor (1939), Working (1948, 1949), Telser (1958), and

Brennan (1958) postulates that the return from purchasing a commodity at time t and selling it forward for delivery at time T, should be equal to the cost of storage (interest forgone, warehousing costs, insurance) minus a conveni ence yield. In absolute values this relationship can formally be expressed as:

where Ser(T t) is the current spot compounded at the risk free rate, w— is storage costs, and Sis the convenience yield.

An alternative expression for the futures price can be obtained by stating the storage costs and convenience yield as a constant proportion per unit of the underlying commodity:

In contrast to Keynes’s risk-premium theory, the theory of storage postulates an intertemporal relationship between spot and futures prices which could be referred to as “normal contango.” Abstracting from the convenience yield, the futures price would be an upwardly biased estimator of the spot price. In this case sto rers would be compensated for holding the commodity in their elevators. However, the theory of storage predicts that the higher the possibility of shortages in the respective commodity, the higher the convenience yield will be, and positive amounts of the commodity will stored even if the commodity could be sold for higher spot prices. This observation is referred to as “inverse-carrying charge” (Working, 1948).

Both theories have been subject to empirical studies. Empirical studies of Keynes’s risk-premium theory have been ambiguous. Evidence supporting the risk-premium theory has been found by Houthakker (1961, 1968, 1982), Cootner (1960), and Bodie and Rosansky (1980). However, Telser (1958) and Dusak (1 973) could not find evidence of a systematic risk premium in commodity markets. Early attempts to test the theory of storage were conducted by Telser (1958) and Brennan (1958) relating inventory data to convenience yields for several commodities. These “direct tests” suffer from the difficulty of obtaining, defining, and measuring inventory data. Fama and French (1987) propose “indirect test” strategies, building on the variation of differences in spot and futures prices (the basis). The logic of the indirect testing methodology is based on the proposition that when inventories are low (i.e. the convenience yield is high, negative basis) demand shocks for the commodity produce small changes in inventories, but large changes in the convenience yield and the interest adjusted basis. In this case, following Samuelson’s (1965) proposition, the spot prices should change more than futures prices and the basis should exhibit more variability than when inventory levels are high. Hence, negative carry is associated with low inventory levels. Alternatively, if the variation of spot and futures prices is nearly equal when the basis is positive, it can be concluded that positive carrying costs are associated with high inventory levels. This reasoning should hold in particular for commodities with significant per unit storage costs. Fama and French (1987) find significantly differing basis standard deviations across the twenty-one commodity groups studied. Basis variability is highest for commodities with significant per unit storage costs and lowest for precious metals. This finding is consistent with the theory of storage.

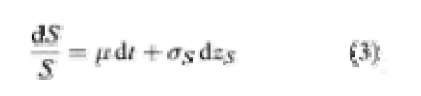

More recent studies of the intertemporal relationship of futures prices incorporating convenience yields have been carried out in the context of pricing contingent claims by arbitrage. The most prominent authors to apply continuous time stochastic models to the pricing of commodity contingent claims are Brennan and Schwartz (1985), Gibson and Schwartz (1990a and b, 1991), Brennan (1991), Gabillon (1991), and Garbade (1993). Typically the analysis starts off by assuming an exogenously given geometric Brownian motion process for the spot price relative chang es of the commodity:

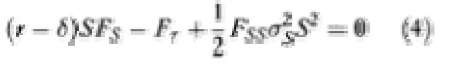

where as is the instantaneous standard deviation of the spot price, n is the expected drift of the spot price over time, and dzs is the increment of a Wiener process with zero mean and unit variance. Further assuming a constant deterministic relationship between the spot price and the convenience yield (net of cost-of-carry) <S(S) = SS, Brennan and Schwartz (1985) employ a simple arbitrage argument in order to derive a partial differential equation which must be satisfied by the futures price:

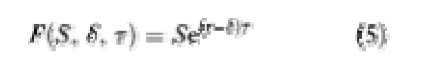

where subscripts denote partial derivatives and with the futures price at maturity satisfying the boundary condition F(S,0) = S. One possible solution to this partial differential equation is the well known relationship between the futures and spot price as mentioned above:

where t denotes the time to maturity of the futures contract and S denotes the convenience yield net of storage costs. Note that equation (5) is independent of the stochastic process of the spot price. From a theoretical point of view the derivation of the futures price under the constant and deterministic convenience yield assumption is associated with the problem that only parallel shifts in the term structure can be modeled, since both spot and futures prices in equation (5) have equal variance. This is inconsistent with Samuelson’s (1965) proposition of decreasing volatility of futures prices over time to delivery or settlement.

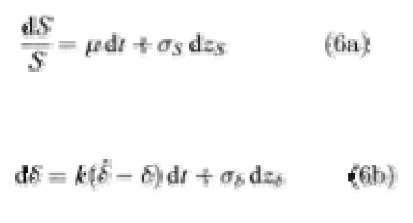

Brennan (1991) estimates and tests alternative functions and stochastic processes for convenience yield and its dependence on price and time. Both Brennan (1991) and Gibson and Schwartz (1990a, 1991) present stochastic two-factor models of the term structure of commodity and oil futures prices respectively, incorporating an “autonomous” stochastic process for the convenience yield. The process governing the convenience yield changes is modeled as an Ornstein-Uhlenbeck process with Gaussian variance. An analysis of the time series properties of the convenience yields is presented in Gibson and Schwartz (1991) who find support for a mean-reverting pattern in the convenience yield series. The system of stochastic processes can then be represented by the following equations:

with dzsdzs = pel/, where p denotes the correlation coefficient between the increments of the two stochastic processes, k is the speed of adjustment, and ^denotes the long-run mean of the convenience yield process.

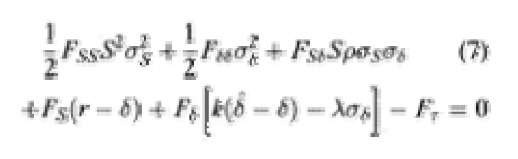

Abstracting from interest rate uncertainty and applying Ito’s lemma, it can be shown that under the same arbitrage assumptions made in the one-factor model the futures price must satisfy the following partial differential equation:

subject to the boundary condition F(S,S,0) = S, where X denotes the market price per unit of convenience yield risk. Gibson and Schwartz (1990a and b) solve this partial differential equation numerically and obtain values for crude oil futures and futures options under the appropriate boundary conditions. Both Brennan (1991) and Gibson and Schwartz (1990) report that the accuracy of commodity futures pricing relative to the simple continuous compounding model can be enhanced by add ing a mean-reverting convenience yield as a second stochastic variable. Although the Brennan and Gibson and Schwartz models are consistent with Samuelson’s decreasing volatility pattern, the convenience yield is specified independently of the spot price of oil, which implies that although the spot price of oil is stable, the convenience yield tends to a long-run mean level. Based on this critical remark Gabillon (1991) proposes an alternative two-state variable stochastic model, where the system of stochastic processes consists of the current spot price of oil and the long term price of oil. Gabillon uses the ratio of current spot p rice to long-term price and time to maturity in order to determine the convenience yield level. According to this model the current term structure of futures prices depends on the relative level of the spot price. Garbade (1993) presents an alternative two-factor arbitrage free model of the term structure of crude oil futures prices, with the term structure fluctuating around some “normal shape” in a mean-reverting manner, abstracting from the convenience yield.

More empirical and theoretical work is necessary in order to shed light on the relative pricing efficiency of alternative models of the term structure of commodity futures prices. In particular, shortcomings in the appropriate modeling of the convenience yield process and its distributional properties as well as its relation to the spot price of oil are still unresolved. Moreover, current research has not addressed problems associated with the assumption of constant spot price volatilities and interest rates. The assumption of constant interest rates might not be warranted, especially in the long run. Potential corporate finance applications have been discussed by Gibson and Schwartz (1991) in the case of long-term oil linked bonds. Other useful applications might concern the valuation of long-term delivery contracts and the hedging of such commitments with respect to both price and convenience yield risk.