Abstract

This paper analytically determines the conditions under which four commonly utilized portfolio measures (the Sharpe index, the Treynor index, the Jensen alpha, and the Adjusted Jensen’s alpha) will be similar and different. If the single index CAPM model is appropriate, we prove theoretically that well-diversified portfolios must have similar rankings for the Treynor, Sharpe indices, and Adjusted Jensen’s alpha ranking. The Jensen alpha rankings will coincide if and only if the portfolios have similar betas. For multi-index CAPM models, however, the Jensen alpha will not give the same ranking as the Treynor index even for portfolios of large size and similar betas. Furthermore, the adjusted Jensen’s alpharank-ing will not be identical to the Treynor index ranking.

Keywords: Sharpe index; Treynor index; Jensen alpha; Adjusted Jensen alpha; CAPM; multi-index CAPM; performance measures; rank correlation; ranking; rank transformation

Introduction

Measurement of a portfolio’s performance is of extreme importance to investment managers.

That is, if a portfolio’s risk-adjusted rate of return exceeds (or is below) that of a randomly chosen portfolio, it may be said that it outperforms (or underperforms) the market. The risk-return relation can be dated back to Tobin (1958), Markowitz (1959), Sharpe (1964), Lintner (1965), and Mossin (1966). Evaluation measures are attributed to Treynor (1965), Sharpe (1966), and Jensen (1968, 1969). Empirical studies of these indices can be found in the work by Friend and Blume (1970), Black et al. (1972), Klemkosky (1973), Fama and MacBeth (1974), and Kim (1978). For instance, the rank correlation between the Sharpe and Treynor indices was found by Sharpe (1966) to be 0.94. Reilly (1986) found the rank correlation to be 1 between the Treynor and Sharpe indices; 0.975 between the Treynor index and Jensen alpha; and 0.975 between the Sharpe index and Jensen alpha.

In addition, the sampling properties and other statistical issues of these indices have been carefully studied by Levy (1972), Johnson and Burgess (1975), Burgess and Johnson (1976),Levhari and Levy (1977), and Jen (1978), and Chen (1981, 1984, 1986). For example, Chen (1981,1986) found that the statistical relationship between performance measures and their risk proxies would, in general, be affected by the sample size, investment horizon, and market conditions associated with the sample period. Notwithstanding these empirical findings, an analytical study of the relationship among these measures is missing in the literature. These performance measures may well be considered very “similar” owing to the unusually high rank correlation coefficients in the empirical studies. However, the empirical findings do not prove the true relationship. These measures can theoretically yield rather divergent rankings especially for the portfolios whose sizes are substantially less than the market. A portfolio size about 15 or more in which further decreases in risk is in general not possible (Evans and Archer, 1968; Wagner and Lau, 1971; Johnson and Shannon, 1974) can generate rather different rankings. In the case of an augmented CAPM, a majority of these performance measures, contrary to the conventional wisdom, can be rather different regardless of the portfolio sizes!

In this note, it is our intention to (1) investigate such relationship, (2) clarify some confusing issues, and (3) provide some explanations as to the empirically observed high rank correlations among performance measures. The analysis is free from the statistical assumptions (e.g. normality) and may provide some guidance to portfolio managers.

The Relationship between Treynor, Sharpe, and Jensen’s Measures in the Simple CAPM

Given the conventional assumptions, a typical CAPM formulation can be shown as1

where y = pp — Pf, which is the estimated excess rate of return of portfolio i over the risk-free rate, x = pm — Pf, which is the excess rate of return of the market over the risk-free rate.

The Treynor index is a performance measure which is expressed as the ratio of the average excess rate of return of a portfolio over the estimated beta or

Similarly, the Sharpe index is the ratio of the average excess rate of return of a portfolio over its corresponding standard deviation or Similarly, the Sharpe index is the ratio of the average excess rate of return of a portfolio over its corresponding standard deviation or

A standard deviation, which is significantly larger than the beta, may be consistent with the lack of complete diversification. While the Sharpe index uses the total risk as denominator, the Trey-nor index uses only the systematic risk or estimated beta. Note that these two indices are relative performance measures, i.e. relative rankings of various portfolios. Hence, they are suitable for a nonparametric statistical analysis such as rank correlation.

In contrast to these two indices, the Jensen alpha (or a) can be tested parametrically by the conventional t-statistic for a given significance level. However, the absolute Jensen alpha may not reflect the proper risk adjustment level for a given performance level (Francis, 1980). For instance, two portfolios with the identical Jensen’s alpha may well have different betas. In this case, the portfolio with lower beta is preferred to the one with higher beta. Hence, the adjusted Jensen alpha can be formulated as the ratio of the Jensen alpha divided by its corresponding beta (see Francis, 1980) or

The close correlation between the Treynor and Sharpe indices is often cited in the empirical work of mutual fund performances. Despite its popular acceptance, it is appropriate to examine them analytically by increasing the portfolio size (n) to the number of securities of the market (N), i.e. the portfolio risk premium x approaches the market risk premium y. Rewriting the Treynor index, we have

since Cov(x • yi) = Var(y) = Var(x) forx = y2.

Equation (21.5) indicates that the Treynor index, in general, will not equal the Sharpe index even in the case of a complete diversification, i.e. n = N. It is evident from (21.5) that these two indices are identical only for sx = 1, a highly unlikely scenario. Since neither the Treynor nor Sharpe index is likely to be normally distributed, a rank correlation is typically computed to reflect their association. Taking rank on both sides of Equation (21.5) yields

since sx in a given period and for a given market is constant. As a result, the Treynor and the Sharpe indices (which must be different values) give identical ranking as the portfolio size approaches the market size as stated in the following propositions:

Proposition #1: In a given period and for a given market characterized by the simple CAPM, the Treynor and Sharpe indices give exactly the same ranking on portfolios as the portfolio size (n) approaches the market size (N).

This proposition explains high rank correlation coefficients observed in empirical studies between these indices. Similarly, Equation (21.5) also indicates that parametric (or Pearson Product) correlation between the Treynor and Sharpe indices approaches 1 as n approaches N for a constant sx, i.e. Ti is a nonnegative linear transformation of Si from the origin. In general, these two indices give similar rankings but may not be identical.

The Jensen alpha can be derived from the CAPM for portfolio i:

It can be seen from Equation (21.7) that as n ! N, yi ! x, and bi ! 1. Hence ai approaches zero. The relationship of the rankings between the Jensen alpha and the Treynor index ranking are equal can be proved as bi approaches 1 because:

Since x is a constant; yi=bi ! yi and fix ! x. We state this relationship in the following proposition.

Proposition #2: In a given period and for a given market characterized by the simple CAPM, as the portfolio size n approaches the market size N, the Jensen alpha ranking approaches the Treynor index ranking.

However, the Jensen alpha will in general be dependent on the average risk premium for a given beta value for all portfolios since

for a constant bi (for all i). In this case the Jensen alpha will give similar rank to the Treynor index for a set of portfolios with similar beta values since

for a fairly constant set of bi’ ‘s. Hence, we state the following proposition.

Proposition #3: In a given period and for a given market characterized by the simple CAPM, the ranking of the Jensen alpha and that of the Treynor index give very close rankings for a set of fairly similar portfolio betas regardless of the portfolio size.

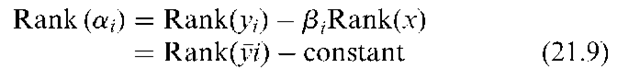

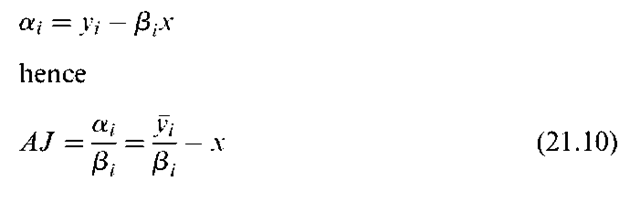

Next, we examine the relationship between the adjusted Jensen alpha and the Treynor index in the form of the adjusted Jensen alpha (AJ). Since

It follows immediately from Equation (21.10) that

Rank(AJ) = Rank(T) – Rank(x) (21.11)

The result is stated in the following proposition.

Proposition #4: In a given period and for a given market characterized by the simple CAPM, the adjusted Jensen alpha gives precisely identical rankings as does its corresponding Treynor index regardless of the portfolio size.

Clearly, it is the adjusted Jensen alpha that is identical to the Treynor index in evaluating portfolio performances in the framework of the simple CAPM. The confusion of these measures can lead to erroneous conclusions. For example, Radcliffe (1990, p. 209) stated that ”the Jensen and Treynor measures can be shown to be virtually identical.” Since he used only the Jensen alpha in his text, the statement is not correct without further qualifications such as Proposition #3. The ranking of the Jensen alpha must equal that of the adjusted Jensen alpha for a set of similar betas, i.e. Rand(a/bi) = Rank(a) for a constant beta across all i. All other relationships can be derived by the transitivity property as shown in Table 21.1. In the next section, we expand our analysis to the augu-mented CAPM with more than one independent variable.

The Relationship Between the Treynor, Sharpe, and Jensen Measures in the Augmented CAPM

An augumented CAPM can be formulated without loss of generality, as

where zij is another independent variable and cij is the corresponding estimated coefficient. For instance, zij could be a dividend yield variable (see Litzenberger and Ramaswami, 1979, 1980, 1982). In this case again, the Treynor and Sharpe indices have the same numerators as in the case of a simple CAPM, i.e. the Treynor index still measures risk premium per systematic risk (or b) and the Sharpe index measures the risk premium per total risk or (sy). However, if the portfolio beta is sensitive to the additional data on zij due to some statistical problem (e.g. multi-collinearity), the Treynor index may be very sensitive due to the instability of the beta even for large portfolios. In this case, the standard deviations of the portfolio returns and portfolio betas may not have consistent rankings. Barring this situation, these two measures will in general give similar rankings for well-diversified portfolios.

Table 21.1. Analytical rank correlation between performance measures: Simple CAPM

| Sharpe Index (Si) | Treynor Index (Ti) | Jensen Alpha (Ji) | Adjusted Jensen Alpha AJi | |

| Sharpe Index (Si) Treynor Index (Ti)

Jenson Alpha (Ji) Adjusted Jenson Alpha (AJi) |

1

Rank(Ti) = Rank(Si) • Si-Identical ranking as n ! N As n ! N Rank(J) ! Rank ($•) As n ! N Rank(AJ) ! Rank (£•) |

1

Rank(J) ! Rank(T) as n ! N or b ! 1 or Rank(J) ! Rank(T) for similar bi s Rank (AJ) = Rank(T) regardless of the portfolio size |

1

Rank(«i/bi) = Rank(ai) for similar bi‘s |

1 |

However, in the augmented CAPM framework, the Jensen alpha may very well differ from the Treynor index even for a set of similar portfolio betas.

This can be seen from reranking (ai) as:

It is evident from Equation (21.13) that the Jensen alpha does not give same rank as the Trey-nor index, i.e. Rank (ai) ^ Rank y/bi = Rank (yi) for a set of constant portfolio beta bn’s. This is because CjZj is no longer constant; they differ for each portfolio selected even for a set of constant bi’s (hence b^Rank(x)) for each portfolio i as stated in the following proposition.

Proposition #5: In a given period and for a given market characterized by the augmented CAPM, the Jensen alpha in general will not give the same rankings as will the Treynor index, even for a set ofsimilar portfolio betas regardless of the portfolio size.

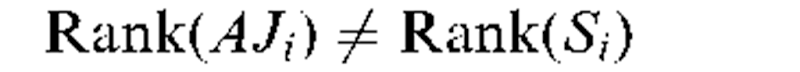

Last, we demonstrate that the adjusted Jensen alpha is no longer identical to the Treynor index as shown in the following proposition.

Proposition #6: In a given period and for a given market characterized by the augmented CAPM, the adjusted Jensen alpha is not identical to the Treynor index regardless of the portfolio size.

We furnish the proof by rewriting Equation (21.12) for each portfolio i as:

We have

It follows immediately that Rank (AJ) ^ Rank (T) in general since the last term of Equation (21.14) is not likely to be constant for each estimated CAPM regression. It is to be noted that contrary to the case of the simple CAPM, the adjusted Jensen alpha and the Treynor index do not produce identical rankings. Likewise, for a similar set of bi’s for all i, the rankings of the Jensen and adjusted Jensen alpha are closely related. Note that the property of transitivity, however, does not apply in the augmented CAPM since the pairwise rankings of Ti and J or AJi do not converge consistently (Table 21.2) even for large porfolios.

Table 21.2. Analytical rank correlation between performance measures: Augmented CAPM

Conclusion

In this note, we first assume the validity of the single index CAPM. The CAPM remains the foundation of modern portfolio theory despite the challenge from fractal market hypothesis (Peters, 1991) and long memory (Lo, 1991). However, empirical results have revalidated the efficient market hypothesis and refute others (Coggins, 1998). Within this domain, we have examined analytically the relationship among the four performance indices without explicit statistical assumptions (e.g. normality). The Treynor and Sharpe indices produce similar rankings only for well-diversified portfolios. In its limiting case, as the portfolio size approaches the market size, the ranking of the Sharpe index becomes identical to the ranking of the Trey-nor index. The Jensen alpha generates very similar rankings as does the Treynor index only for a set of comparable portfolio betas. In general, the Jensen alpha produces different ranking than does the Treynor index. Furthermore, we have shown that the adjusted Jensen alpha has rankings identical to the Treynor index in the simple CAPM. However, in the case of an augmented CAPM with more than one independent variable, we found that (1) the Treynor index may be sensitive to the estimated value of the beta; (2) the Jensen alpha may not give similar rankings as the Treynor index even with a comparable set of portfolio betas; and (3) the adjusted Jensen alpha does not produce same rankings as that of the Treynor index. The potential difference in rankings in the augmented CAPM suggests that portfolio managers must exercise caution in evaluating these performance indices. Given the relationship among these four indices, it may be necessary in general to employ each of them (except the adjusted Jensen alpha and the Treynor index are identical in ranking in the simple CAPM) since they represent different measures to evaluate the performance of portfolio investments.