Abstract

This entry explores various investment evaluation techniques with special attention to their application in energy investments. Key components of the techniques are described, including the concept of the time-value of money, discount rates, and the role of risk and its consideration in performing a financial assessment of a project. Financial evaluations from simple payback periods to internal rate of return (IRR) analysis are discussed with the entry concluding that net present-value analysis is, in almost all cases, the preferred evaluation technique.

INTRODUCTION

You have just been informed that your six-digit lottery ticket hit the $50 million Big Payout Mega Lottery. You now are entitled to $5 million per year for ten years or you can take a one-time payment of $30 million. What is the best decision? For the lucky winner, this decision hinges on what economists call the time preference of consumption. An individual could take all the money in a single payout and have the opportunity to immediately acquire goods and services or the individual could defer the opportunity to spend the money and receive larger, future annual payouts. With little knowledge of finance, the newly created millionaire could use a more formal analysis and identify which of the two payout options afford the largest financial return.

While few of us will face such a joyful exercise in our personal finances, everyone who makes financial decisions in their personal or business environment will either implicitly or explicitly have to make a decision like our lottery winner. Individuals who consider the rated miles per gallon expectations in purchasing a car or who consider the energy-efficiency rankings in purchasing a new appliance are in some fashion doing a financial analysis. Likewise, a corporation or business has a fiduciary responsibility to make investments that maximize the overall return to the firm. Many financial decisions involve multiple time periods and uneven cash flows, and without some analytical tools to simplify and compare options, individuals and companies would be stymied in their efforts to estimate the total net worth of investments or to select from competing opportunities that would maximize their overall monetary gain.

In the first part of this entry, two fundamental concepts used in performing financial analyses will be introduced: the time-value of money and the discount rate. The latter portion of the entry explores a variety of financial techniques that are commonly used in evaluating and ranking the value of investment opportunities when cash flows occur over time. These kinds of applications are commonplace in energy investments. Examples include investments in oil and gas drilling projects, power plants, transmission lines, natural gas pipelines, and energy-efficiency investments. In the energy industry in particular, many projects require substantial upfront capital and the associated revenue stream generally occurs over long time periods. However, the investment evaluation techniques discussed here are generic and are routinely used in most applications. Finally, the two most commonly used analytical techniques—present-value analysis and IRRs—are discussed and their relative advantages and disadvantages are examined.

FUNDAMENTALS OF INVESTMENT EVALUATION

It is critical to appreciate that the value of money is time dependent. Money received now has more value than money received in the future as long as there is a positive interest rate that an investor can earn. The proof of this statement is intuitive. If given some amount less than a dollar today, one could, with a positive interest rate, have a dollar in the future. Thus, a dollar today cannot be equal to a dollar in the future given a positive interest rate environment. Developing a comparable value for time disparate dollars is done using a variety of present-value techniques.

One of the most commonly employed investment metrics is the simple payback period. Its strength is in its computational simplicity. The payback period is the number of years (or months) until the revenue stream equals or exceeds the initial project outlay. This technique is frequently used in advertisement to convince potential customers how shrewd a purchase might be. For example, assume a consumer were to spend $500 for the installation of attic insulation to make his house more energy efficient. If this investment saves $100 a year in energy costs, then the simple payback period would be five years. Payback analysis does permit a relative ranking of project worthiness when multiple projects are being evaluated. In other words, projects with shorter paybacks would tend to be superior to longer-dated projects.

However, the simplicity of the technique is offset by two important omissions. The simple payback does not account for the time-value of money nor does it assign any value to the positive cash generated after the breakeven period is reached. In addition, if projects have cash flows that switch from negative to positive and back, even relative rankings are obscured when comparing projects.

Payback analyses can be improved upon by calculating a current value for the future cash flows up to the payback period. Doing this typically results in a longer payback than the simple payback. This approach more accurately reflects the value of the capital investment that has been “tied up” in the project. However, properly valuing the time dependency of the cash flows against the initial investment outlay does not remedy the other problem of correctly accounting for cash flows beyond the breakeven point.

The correct solution to this problem entails using present-value analysis for the life of the entire project. Present-value analysis offers a powerful analytical tool to compare cash flow streams of both inflows (revenue) and outflows (expenditures) and standardizes the magnitude and timing of the flows such that the values are represented in today’s currency values. The term “current dollars” refers to values that have been standardized to reflect values in today’s dollars and “nominal dollars” refers to the value in the future periods under consideration. When present-value analyses incorporate the value of any initial capital expenditure, and year-by-year inflows and outflows are netted out, the final valuation constitutes a “net present value” (NPV) of the overall project’s worth.

In the simple case, a one-year present-value term can be represented by:

PV = CFj /(1 + rx)

where CFj is the cash flow in time period 1 and r represents the rate of return that the investor is willing to accept for an alternative investment with comparable risks.

By extension, the present value of multiple years of cash flows can be represented by:

This equation can be collapsed into:

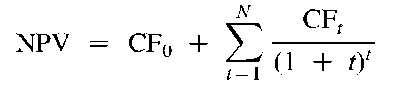

This basic formula can be extended to include capital outlays. With the addition of any initial capital outlay CF0, this present-value analysis becomes a NPV of the form:

The CFo term is only the initial outlay divided by (1 + r)°, which equals the outlay divided by one. However, multiyear outlays are likely to occur, especially on large construction projects. In this case, the outlays are likewise discounted and summed along with future cash inflows. Thus, the NPV formula can be further reduced to account for the initial and subsequent time periods, resulting in:

Each CFf represents the balance of cash flow for each time period. Positive flows are offset by any outflows such as maintenance, labor, accrued interest, or any other cost. Negative flows should be offset by projected revenues, impact of taxes, depreciation, and any terminal salvage value.

For most capital budgeting analyses, an annual end-of-year convention is used to simplify the timing of receipts or expenditures. However, projects involving large capital expenditures or large cash inflows frequently incorporate more discrete time periods for booking cash flows. This is especially true for multiyear, capital-intensive projects that incur substantial interest and construction costs prior to generating revenue. Examples in the utility industry include power plant and refinery construction schedules. Because hundreds of millions of dollars can be spent over the course of a year, accrued interest during construction can be substantial. Thus, when comparing multiple projects that have large intrayear cash flow differences, more fractional time periods provide greater accuracy of total project costs.

If one uses an end-of-year accounting convention, then the cost of funds during construction is assumed to be zero and interest begins to accrue at the beginning of the subsequent year. Conversely, if all cash flows are assumed to occur at the beginning of the year, then accrued interest is overstated. The analyst may elect to do mid-year expenditures to average these out. For projects that require greater scrutiny or for managing actual construction budgets, more discrete time periods such as months or quarters can be used as the unit of analysis. Of course, the discount rate should be adjusted to reflect the compounding impacts of the more discrete time periods.

Another complexity involved with cash inflows and outflows is ensuring that inflation is appropriately accounted for in the analysis. In performing net present-value analysis, there are two strategies that can be used to adjust the cash flow streams. As previously mentioned, dollars are accounted for in either nominal or real terms. Nominal dollars measure cash flow including the impact of inflation whereas real dollars adjust for inflationary expectations. One can convert the nominal inflows and outflows into real cash flows by dividing by an anticipated inflation factor. In this case, a real rate of return would be used as the discount factor in the NPV formula. Alternatively, the cash flows could be stated in nominal dollars, but the value of r would be adjusted higher to account for inflation-related risk.

Finally, it is important to note that any initial cash outlay represents incremental project costs. For example, if special equipment has been purchased or if buildings have been constructed to undertake a project but the project is later abandoned, then such costs are called “sunk costs” in economic jargon. If a subsequent project is undertaken, the initial capital outlays should not include any unrecoverable, sunk costs. However, any additional first-year outlays and all future cash flows should be included in the analysis. If these previously incurred costs have residual value and could be sold or leased to generate cash inflows, then these values would be reflected in the initial year’s outlay. If these costs have no recoverable value, regardless of what the initial costs were, then for purposes of evaluating project investments, their outlay value is zero when used in subsequent project evaluations.

DETERMINING THE APPROPRIATE DISCOUNT RATE

In business applications, the r term is referred to as the discount rate or cost of capital and is a rather complex concept. At its most basic, the discount rate embodies all known sources of risk and therefore reflects what investors must anticipate earning to assume those risks. Thus, as project risk increases, the discount rate used in evaluating any specific project must also go higher.

Examples of project risk abound. In inflationary investment periods, the investor must be compensated for the loss of purchasing power between time periods. Second, the discount rate must capture the relative risks associated with a particular investment decision. Examples include uncertainty of cash inflows, uncertainty related to completing the project, and uncertainty surrounding the political and legal climate in which the project will operate. Opposition to the construction of large infrastructure projects such as liquefied natural gas terminals or power plants is common. Prudent investors will require a greater return to lend capital to finance such projects if the possibility exists that the project will not be completed and thus incur uncompensated development costs, or on the other extreme, if the project is completed but a change in political regimes leads to the nationalization of the project by a foreign government. These types of risks are typically referred to as project-specific risks.

Moreover, the appropriate discount rate is almost unique in that it will vary depending on if the investor is an individual, a business, or a government agency. Within these subgroups, individual circumstances will further define the preferences to defer consumption and the willingness to assume other risks. For many individuals, the need or preference for immediate consumption results in very high discount rates. In the case of individual consumers investing in conservation and energy-efficiency technologies, discount rates vary inversely with income and for individuals with limited capital personal discount rates can be extraordinarily high.

Businesses include a number of components in assessing project risk. Projects are examined for intrinsic or project-specific risks, as discussed above. In addition, the project will be examined in the context of all the firm’s projects and in the context of other market opportunities. Thus, determining what is the appropriate discount rate to use is conceptually difficult, even if the arithmetic computation of the net present-value formula is straightforward.

One factor that goes into the development of the appropriate discount rate is a firm’s cost of capital. For businesses that use a combination of equity and debt to finance projects, the weighted average cost of these component sources of capital typically reflect the individual company’s discount rate. This assumes, however, that any individual business has a risk profile identical to that of the industry as a whole. In other words, if your “riskiness” is exactly the mean riskiness of comparable businesses in your industry sector, then a starting point for assessing individual projects would be the firm’s cost of capital. Any specific project would need additional scrutiny to account for any unique project risks and the appropriate discount rate that should be used in the analysis could be higher or lower than the firm’s cost of capital.

Finally, because debt is frequently a tax-deductible expense, the debt component should be adjusted for tax savings. The following formula would result in an approximate after-tax cost of capital:

Weighted after tax cost of capital

where r^ is the required interest on debt, T is the appropriate marginal tax rate, D is the amount of debt that is financed, rE is the expected return on equity, and E is the equity value. It is important to note that the marginal cost or last-source cost of capital is the correct factor to use as the discount rate for new investments. This discount rate would be the appropriate rate to use in any present-value analysis as long as the various projects under consideration possessed similar risk characteristics. As a convention throughout this entry, discount rate and cost of capital are used synonymously.

ALTERNATIVE INVESTMENT METRICS

Net present-value analysis provides a final value on a project-specific basis. Generally, a positive NPV should be undertaken and a negative project should not. However, given that capital is limited and not all investment opportunities afford the same return, alternative investment criteria can be useful in comparing projects. The discussion below should lead to caution when these alternative techniques are used without consideration of the net present-value results. Decision makers can end up with confused if not outright misleading results if these alternative techniques are used in isolation.

Many finance professionals, especially those in the public sector, rely on benefit-to-cost analyses as analytical tools. Most investment opportunities involve both cash outflows and inflows. When present-value analysis is applied and the annual outflows and inflows are not netted out but are instead simply discounted back as current dollars, then the ratio of the present-value benefits (inflows) divided by the present value of costs (outflows) gives a relative ranking against which multiple projects can be judged. In corporate finance, such rankings are referred to as profitability indexes.

Alternatively, the IRR is another commonly used investment metric. Most corporate finance texts define the IRR as that discount rate which equates the present value of a project’s expected cash inflows to the present value of the project’s cash outflows. The resultant percentage, when applied to the NPV equation, would result in a zero present value for the project.

In terms of the actual formula for IRR, the fundamental net present-value equation is set to zero and IRR notation replaces r for the discount rate.

Thus, IRR answers the question of what is the internally generated return on investment when assuming a project’s cash flows result in a breakeven project. In one sense, IRR is a measure of profitability based only on the timing and magnitude of internally generated cash flows of the project. It is not the same as the discount rate the company has determined is needed to initiate the project. Only when a project results in a zero NPV will those two terms be equal.

Frequently, corporate finance professionals prefer the IRR metric because the concept is familiar to shareholders, directors, senior managers, and external investors. However, the use of internal rates of return as investment criterion warrants some caution. Prior to the proliferation of handheld business calculators and spreadsheets, the value of IRR was largely calculated by iterative estimation techniques. Depending on the scope and duration of the cash flow streams, this exercise could be rather burdensome. Spreadsheets and handheld calculators have eliminated these practical difficulties. Interpreting and acting upon IRR results is still problematic, however. Internal rates of returns when considered in isolation can lead to some erroneous decisions on the profitability ranking of different investment opportunities.

It is important to understand how IRR analyses relate to present-value analyses. Present-value analysis specifies the discount rate or cost of capital a priori. This rate is based on external factors such as prevailing interest rates and the expected return on invested equity for projects with similar risk attributes. Thus, any positive present value would imply a positive return on invested capital and indicates the project should be undertaken. The calculation of an IRR asks a different question. Given the expected positive and negative cash flows resulting in a zero present value, what would be the implied return on invested capital?

There are two basic scenarios to consider. Investment capital is frequently, but not always, limited. With adequate funds, such that any two or more projects can be undertaken, an IRR greater than the cost of capital and a positive present-value analysis lead to the same conclusion—undertake the projects. Most firms and individuals do not have unlimited funds. In these cases, selecting one project eliminates the opportunity to undertake the second one. These are referred to as mutually exclusive projects. With mutually exclusive cases like these, the two metrics can result in, at best, ambiguous decision criteria and, at worst, conflicting investment-decision rules.

A NPV AND IRR COMPARISON

Let us explore how the NPV and IRR results can lead to potentially conflicting investment signals. Assume that two project opportunities are available. They have the following cash flows:

| Year | Project A ($) | Project B ($) |

| 0 | - 5000 | - 5000 |

| 1 | 2500 | 500 |

| 2 | 1500 | 1000 |

| 3 | 1000 | 1250 |

| 4 | 800 | 1800 |

| 5 | 500 | 2500 |

As the analyst assigned to evaluate the two projects, you are told that the company’s cost of capital is 5%. You are directed to prepare an NPV and IRR analysis and to make a recommendation to the board of directors. The handy spreadsheet functions indicate that at 5% cost of capital, the NPVs for Project A and B are $624.06 and $859.71, respectively. The IRR function on the spreadsheet produces an IRR of 11% for Project A and 10% for Project B. Because both projects have positive NPVs and the IRR is greater than the cost of capital, the recommendation should be to undertake both projects. In this example, project feasibility is independent. In other words, capital is available to complete both opportunities.

The ambiguity occurs if these are mutually exclusive projects. Typically, this implies capital is not available to do both. While Project B has the higher NPV, its IRR is lower than Project A’s. Which recommendation should be made to the board, and more importantly, how do you explain this anomaly as part of the PowerPoint presentation?

A graphic presentation of the relationship between discount rates and NPVs can help explain the apparent

conflict. The table below calculates the NPV for these two projects from a zero discount rate to 15% using increments of 5%.

| Cost of capital

(%) |

Project A NPV

($) |

Project B NPV

($) |

| 0 | 1300.00 | 2050.00 |

| 5 | 624.06 | 859.71 |

| 10 | 109.62 | 1.69 |

| 15 | - 285.53 | - 621.81 |

Next, the NPVs are plotted against the cost of capital and presented in Fig. 1 below.

A number of characteristics about the two investment projects can be gleaned from this chart. First, notice that at the lower range for the cost of capital, Project B has higher NPVs—simply because of the higher cash inflows and these inflows losing little time value due to the lower discount rates being applied. The two project NPV streams intersect and cross over when the discount rate is approximately 8.2%. At this rate, the NPVs for both projects are approximately $279. For any discount rate above this level, Project A has a higher NPV and would be the preferred project until it turns negative around 11.3%. Project B turns negative around 10% while Project A still has a positive $109 NPV.

The internal rates of return for Project A and Project B are 11 and 10%, respectively. Recall that the NPV calculation specifies the firm’s actual cost of capital for the project. If the NPVs are positive and the IRR is greater than the underlying cost of capital, then both projects yield positive returns and should be undertaken. If the actual cost of capital is 10%, then as previously noted, Project B is only marginally cost effective. If the actual cost of capital was 10.1%, Project B’s NPV turns to a -$12. At this point, the 10% IRR is lower than the cost of capital and Project B should not be undertaken. Again, Project A’s IRR of 11% exceeds the required cost of capital and remains a viable investment.

Fig. 1 The net present values of two projects.

Let’s return to the limited capital or mutually exclusive case. If only one of the projects can be undertaken, which one is the superior selection? If both IRRs exceed the required cost of capital, then the decisions should default to the project with the highest NPV. This option maximizes the return to the firm. The ambiguity occurs when the actual cost of capital is less than the crossover or intersection rate. The graph indicates that in all such cases, the NPVs for Project B are higher than for Project A. Yet, the IRR is higher for Project A. If one were explaining the selection before the board of directors, would Project A with the higher IRR not be the more defensible investment?

The answer is no. These mixed investment signals are being generated by the forced computation of the IRR and the assumed reinvestment rate of cash proceeds from the two projects. Because IRR analyses force a discount rate to result in a zero NPV, the formula results in a high rate that is necessary to discount the large, front-loaded cash flows from Project A back to zero to offset the initial capital outlay. Implicit in this process is the assumption that the earlier cash proceeds are reinvested at the IRR. The net present-value method assumes that the proceeds are reinvested at the firm’s cost of capital. Therefore, the back-end-loaded cash stream generated by Project B is being discounted at a lower and more realistic cost of capital rate that results in a higher NPV. As mentioned earlier in this exposition, the discounting of the magnitude and timing of the cash flows is causing these divergent results between IRR and NPV analyses.

Table 1 presents two cash flow patterns that dramatically indicate how the IRR can lead to the selection of an inferior project when exclusivity exists.

The NPV of Project A is $1715 when a 10% cost of capital figure is used. At 10%, Project B has an NPV of $1872. With no other information, Project B would be the preferred option. However, the IRRs lead to a different and erroneous conclusion. Project A has an IRR of 23% and Project B yields only a 15% IRR. Here again, the timing and magnitude of cash flows are distorting the two criteria because the mathematical solution of deriving the IRR forces a higher rate to be used to discount the early positive cash flows in Project A back to zero.

VARIABLE DISCOUNT RATES

Another confounding problem when calculating IRR is when the discount rates vary over the project horizon. This can occur when the cost of capital varies because of differences in the yield curve, or term structure, of debt. Because the IRR is derived as a single point value using iterative techniques, the calculated value must be the same for each year of the analysis. However, companies may have a different cost of debt for financing the early years of a project vs. the cost of capital for the later year financing requirements. For example, low cost, short-term commercial paper may be used for the early year’s financing on a project and higher cost bonds for the remainder of the project’s life. Internal rate of return techniques cannot easily handle this complexity. Other factors that might change the discount rate are phased in changes to the tax rates or depreciation schedules.

Another odd result can occur when projects have cash flows that switch between positive and negative values. Sometimes referred to as nonnormal cash flows, applying IRR techniques can result in more than one IRR being generated. This is likely to occur when a project generates a positive NPV for some portion of the project life and then the cash outflows generate a negative NPV value for several years and then reverse back to positive. The analyst can end up with two return rates and little confidence in which rate accurately captures the true IRR. Net present-value analyses can address issues like these by permitting time varying discount rates.

CONCLUSIONS

It should be evident from the discussion above that net present-value metrics have a variety of features that make them preferable to IRR analysis. They are computationally more reliable while providing a clearer indication of the value that a specific project generates for the bottom line.

Table 1 NPV and IRR comparison-example cash flows

| Project | CF0 | CFi | cf2 | cf3 | cf4 | CFS | cf6 | cf7 | cf8 | cf9 | CFm |

| A | - 9000 | 6000 | 1000 | 3000 | 150 | 150 | 150 | 150 | 150 | 150 | 150 |

| B | - 9000 | 1800 | 1800 | 1800 | 1800 | 1800 | 1800 | 1800 | 1800 | 1800 | 1800 |

The conventional decision rule states that a firm should undertake all projects with positive NPVs and IRRs that are greater than the discount rate. However, in situations where projects are mutually exclusive, IRR should be carefully evaluated before using it as the primary indication of a project’s profitability. Despite the widespread use of IRR, practitioners of investment analyses should employ this technique only as a secondary evaluation tool to net present-value strategies.

This entry has provided an overview of the mechanics of net present-value analyses and discussed several of the conceptual issues involved using these techniques. However, such a brief treatise does a disservice to novices using these evaluation techniques. The description and examples all have yielded a single NPV that belies major simplifications of assumptions and ignores the single most difficult factor to quantify—the project’s risk. For example, we assumed that the cash flows for any project were known with certainty; we assumed the cost of capital was constant over the project’s life; and we assumed any two projects had identical risk profiles. Such certainty allows a calculated, single-point NPV estimate to be confidently taken to lenders to seek financing for the project.

In real applications, such certainty rarely exists. As a consequence, a toolbox of additional analytical techniques can be incorporated into NPV analysis to give investors a more complete assessment of project parameters. Most of these tools are designed to better quantify and thus illuminate the risk associated with investments. For example, recent work in option theory allows option value to be incorporated into the project’s pro forma. This may be particularly important when early development work is being undertaken with uncertain cost factors such as volatile interest rates or wide ranging estimates in construction costs. The ability to proceed, terminate, or transfer a project prior to a substantial commitment of capital can increase project flexibility and thus can impart real value to the project’s overall worth.

Along these same lines, practitioners frequently will use sensitivity analyses to change the value of critical variables to assess the impact on the NPVs. Such efforts result in a series of NPVs under varying conditions such as high and low interest rate environments. Even more sophisticated Monte Carlo techniques run literally thousands of combinations of factors to develop a statistical distribution of NPVs for any given project. With Monte Carlo distributions, profitability is described in terms of probable payouts instead of single-point estimates. We mention these tools to remind readers that while NPV is the linchpin for investment analysis, it is only the starting point.