gains from trade

The increase in output or welfare received by a country, or the world as a whole, through international trade making possible specialization of production. The theory of comparative advantage demonstrates how this is possible.

Galbraith, John Kenneth, 1908

A Canadian-American liberal economist who has achieved astounding publishing success in his topics on capitalism, the Great Depression, the affluent society and the industrial state. With a training in agriculture in ontario and in agricultural economics at Berkeley, California, he has taught at Harvard University since 1949. His early work on industrial price rigidities and on price controls made use of his wartime experience as head of the price Section of the US Office of Price Administration. In 1952, American Capitalism launched his career as a best-selling economic guru. His works contain strikingly novel analyses, e.g. of consumers’ countervailing power to large oligopolists, of the contrast between private affluence and public squalor and of the managerial nature of modern capitalism. outside the university, he was a leading adviser to President John F. Kennedy and his ambassador to India. Much of his writing has the broad sweep of an eighteenth-century economist who has espoused the mixed economy: this approach is not without its critics as modem economists are often irritated by his avoidance of the empirical testing of his theories. But it is greatly to his credit that one of his most thorough topics is his late survey of economic thought in 1987.

game theory

The study of the ‘behaviour of independent decision makers whose fortunes are linked in an interplay of collusion, conflict and compromise’ (Shubik). The theory is central to much formulation and testing of models in economics as it studies multilateral decision making. The earliest exponents of the art were cournot, EDGEWORTH, BoHM-BAWERK and ZEUTHEN.

Much of the theory recognizes uncertainty; recently it has taken into account ignorance of rules, incomplete information and indefinite time horizons. Important solution concepts utilized are the nash equilibrium, the core, the Neumann-Mor-genstern stable set and the shapley value. Major applications include bilateral monopoly, duopoly, planning processes, welfare economics and the study of markets and monetary institutions.

gamma stock

The least active stock or share quoted on the STOCK EXCHANGE AUTOMATED QUOTATION SYSTEM.

Gandhian economics

A spiritual approach to economics involving self-reliance in a local environment, honesty, equality, surrender of private property for the sake of all, and a distinction between ‘stranger-defined work’ and ‘self-defined work’. This type of economics tries to increase the level of minimum consumption, lower the prices of necessaries and raise the prices of luxuries. The goal is to replace riches in material goods with the wealth of being surrounded by caring people.

Gang of Four

The Republic of Korea, Taiwan, Hong Kong and Singapore.

gang system economy

A slave economy practising the subdivision of labour. This was a principal characteristic of the sugar colonies of the Caribbean.

gap analysis

The amount of assets with variable rates financed by fixed rate liabilities. This is used in the analysis of the relationship between the interest rates and maturities of assets and liabilities.

Garn St Germain Depository Institutions Act 1982 (G2, K2) The sequel to the depository institutions DEREGULATION AND MONETARY CONTROL ACT 1980 which continued the deregulation of the US banking industry, particularly through the removal of interest rate ceilings.

Gastarbeiter

German word for guestworker.

gazumping

Breaking an agreement to sell a house because another prospective buyer has offered a higher price in the period between an oral promise to sell and the exchange of contracts. A sharp practice prevalent in England in the 1970s and 1980s.

GDP deflator

The ratio of the gross domestic product at current prices to gross domestic product at constant prices multiplied by 100. It is the weighted average of the detailed price indices used to deflate the gross domestic product: the weights used reflect the importance of each category of output in the gross domestic product.

gearing

The ratio of a bank or other company’s total borrowings of a fixed term or perpetual nature to its shareholders’ funds and minority interests.

gender division of labour

The traditional assignment of particular occupations or tasks with men continuing to have a wide range of job opportunities, and women restricted to a narrow range.

General Accounting Office

An independent US agency, outside the Executive office, directly responsible to the us congress for seeing that the funds voted by congress are spent as enacted in legislation.

General Agreement on Tariffs and Trade

A multilateral trade agreement signed in 1947. it covers all major trading countries with the exceptions of the soviet republics and china. it was originally intended to be part of the International Trade Organization, a body intended to police international transactions, and, together with the INTERNATIONAL MONETARY FUND and the world bank, constituted a new international economic system. As the international trade organization was never established, the General Agreement on Tariffs and Trade remains as a treaty. Under Article 1, each contracting party to the agreement pledged to offer most favoured nation treatment to the others; Article 3 challenged trade discrimination by requiring contracting parties to charge only domestic taxation on imports from treaty partners; Articles 11 to 15 stated that quantitative restrictions on imports were permitted, after consultation, for balance of payments reasons. Trade has gradually been liberalized in a number of rounds of negotiations.

Most disputes between members have been solved, with the exception of the problem of the subsidization of agricultural products. But it can be argued that the continued existence of voluntary export restraints and deals such as market sharing have retained protection in a modern guise.

General Agreement to Borrow

The credit line set up by the group of ten for the INTERNATIONAL MONETARY FUND in 1962 to provide loans to the group’s members. The facility was enlarged in January 1983 when other IMF members were permitted to contribute to it and make use of it in emergencies.

general competitive bidding

A method of selecting a contractor for a large investment. Typically an outline of a construction project is announced. Anyone can participate in the bidding and the bidder offering the lowest price wins the contract. Also known as the ‘open bidding system’.

general equilibrium

The state of an economy in which all its markets for consumer goods, capital goods, labour services, financial assets and money are in equilibrium and the economy is in overall balance. The leading marginalist walras was the first economist to set out the conditions for general equilibrium. Today, the basic questions about a general equilibrium always include whether the solution proposed exists, whether it is unique and whether it is stable. General equilibrium analysis has the advantage of being flexible enough to be able to incorporate many goals and resources in a model. It is contrasted with Marshall’s partial equilibrium analysis and is a half-way house between microeconomics and macroeconomics.

general fund

part of a budget providing finance for a variety of purposes.

general government net worth

The fixed capital stock of central or local government less its net financial liabilities. This balance sheet approach to the study of government finance has been suggested as a framework for assessing a government’s ability to sustain its economic policies. It also has the useful function of making governments distinguish productive investments from debt servicing.

General Household Survey

A sample survey used in the UK to collect data on the labour force and on household expenditure.

generalized least squares

An improved method of estimating relationships between economic variables. Each observation is weighted by the reciprocal of the STANDARD DEVIATION of the disturbance concerned before applying the LEAST SQUARES METHOD.

generalized medium

Something generally acceptable for the purpose of making many transactions. money performs this in modern economies as it can be used to effect exchanges in numerous markets and measure the value of millions of different types of goods and services.

generalized system of preferences

A proposal made at the 1964 meeting of UNITED NATIONS CONFERENCE ON TRADE AND development, and accepted in 1968, that developed countries grant preferential tariff treatment for imports of manufactures and semi-manufactured products from developing countries. Those granting preferential treatment include the USA, the european community, Canada, Australia and Japan.

general market equilibrium

The equilibrium of a market with several interdependent commodities traded with, for each commodity, the quantity demanded being equal to the quantity supplied.

general sales tax

An indirect tax levied on the sales of most consumer goods and services, usually expressed as a percentage of the value of the purchases.

general strike

Simultaneous strikes in most major industries of a country: famous examples include that in the UK in 1926 and several in Poland and Sweden in the 1980s. These strikes often start in a major sector and become general through sympathetic action.

general training

Training of members of a labour force in skills of use to many employers, e.g. word processing. There is a case for education of this kind to be provided by an educational institution, or financed by an industry as a whole, to avoid an employer gaining no return to the investment made in a worker’s training because the worker moves to another job.

general union

A trade (labor) union which organizes workers from different occupations and industries, e.g. the Teamsters (USA), the Transport and General Workers’ Union (UK). General unions are often so large as to dominate a national trade union movement.

generational accounting

The construction of accounts showing the taxes paid less transfer payments received over a person’s lifetime in order to execute long-term fiscal planning and analysis. Lifetime net fiscal burdens are calculated by summing the net taxation of all generations living at a point in time. in most major oEcD countries, often in central banks or treasuries, these accounts are produced. This analysis examines the fiscal burden on future generations created by current policies to see if they are sustainable and achieving a balance in the fiscal burden between generations. At the end of the 1990s the USA, Germany and Japan had serious generational imbalances.

generative city

A city whose existence and growth are a major cause of the growth of a region. The best example in most countries is the capital city.

gentrification

improvement of older working-class inner city housing by rich professionals, e.g. in San Francisco and south London.

geographical trade structure

Analysis of a nation’s international trade showing the countries of origin of its imports and the countries of destination for its exports. This structure reflects international trading agreements and the extent of economic interdependence among countries. In the UK, for example, membership of the european community from 1972 has brought about a switch from trade with the commonwealth to trade with major European economies, especially Germany.

geometric mean

The nth root of a set of numbers which have been multiplied together, e.g. the geometric mean of 2, 4, 8 is the third root of 64, i.e. 4.

geometric progression

A series of numbers which increases by a constant, or common, ratio, e.g. 2, 4, 8, 16, where 2 is the common ratio. malthus asserted that population grows according to this progression.

George, Henry, 1839-97

us economist and politician famous for advocating that all taxation should be raised from a single tax on land, an idea which had its origins in the writings of the physiocrats and the classical differential theory of rent. He regarded increases in land values in the nineteenth century as a major cause of inequality and injustice in society. His famous work, Progress and Poverty (1879), which was very popular in the USA in the 1880s and 1890s, is still closely studied in the many Henry George Schools of Economics which provide expositions of the master’s ideas throughout the world. The Henry George Foundation of America, founded in 1926 and based at Columbia, Maryland, still researches into land value taxation and site value taxation.

German capitalism

An economic system noted for high wages, high international competitiveness and a promotion of social cohesion through strong trade unions, labour-management co-operation and high levels of spending on health care and welfare.

German Historical School

Successive generations of German economists in the nineteenth and early twentieth centuries who took a holistic approach to economics, attempting to examine all economic phenomena, using material from social history. Their researches included fiscal policy, administration, industrial organization, cities, bank credit, government and private enterprise. The earliest writers of this school were Bruno hildebrand (1812-78), Wilhelm roscher (1817-94) and Karl knies (1821-98), the leader was Gustav von schmoller (1838-1917) and the later writers were Arthur Spiethoff (1873-1957), Werner sombart (1863-1941) and Max Weber (1864-1920).

Gerschenkron effect

The effect of the choice of a particular base year on an index of industrial output.

In a largely agrarian society, the base year chosen will determine the rate of growth exhibited by that index. This was originally applied to the Soviet economy by the Austro-American economic historian Alexander Gerschenkron (1904-78).

gestation period

The time it takes for production or a capital project to be completed. classical economists, e.g. ricardo, asserted that the average period was twelve months, as in agriculture where there is only one harvest per year.

Gibrat’s law

The relationship between size and rate of growth of an entity such as a firm or a city.

Giffen good

A good increasingly demanded as its price rises. giffen noted this exception to the normal demand curve inverse relationship between price and quantity demanded of a good in the case of an essential foodstuff.

Giffen paradox

An exception to the normal inverse relationship between price and quantity demanded made famous by giffen. He noticed in the case of bread consumption that the quantity demanded rose when the price did, an exception to the general law of demand. If a poor family spends its income on bread and meat, a rise in the price of bread would make it impossible for it to afford a discrete amount of meat, with the consequence that there would be an excess of income after maintaining the same level of bread consumption which would be used to purchase more bread -hence an increased consumption of bread despite a rise in its price. income and substitution effects analysis is used to explain this paradox: the income effect outweighs the substitution effect and there is a change in the sign of the income effect from positive to negative.

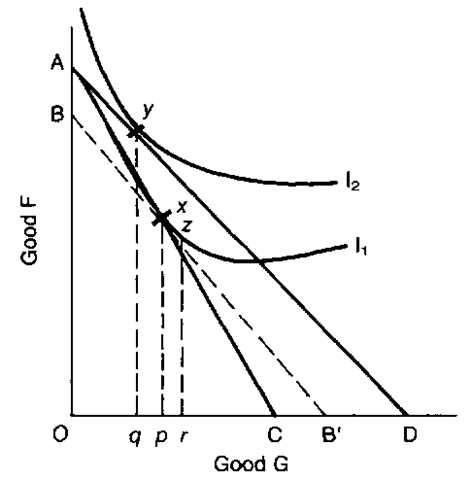

In the figure, i1 and i2 are the indifference curves of a particular consumer faced with the choice between goods F and G. There is a fall in the price of good G (more of it can be obtained for a fixed amount of F) expressed by a shift in the budget line from AC to AD, but there is also a fall in the quantity demanded of it from or to oq as the income effect yz is more than the substitution effect xz.

Giffen, Sir Robert, 1837-1910

Born in Strathaven, Scotland. After careers in law and journalism (he was assistant editor of The Economist from 1868 to 1876 and city editor of the Daily News from 1873 to 1876), he became a civil servant working at the Board of Trade as Chief of the Statistical Department and then Assistant Secretary until he retired in 1897. A founder of the Royal Economic Society and famous for the giffen PARADOX.

gifts tax

A tax on the transfer of personal capital to someone else, often a close relative. The tax is imposed to prevent persons from avoiding inheritance taxes by transferring ownership before death; small gifts of a single year are usually exempted.

gilts

UK government security with a guarantee that interest will be paid and capital repaid on its redemption day (if any). The term arose because of the high value of these bonds.

Gini coefficient

A measure of income distribution, devised by the italian demographer and statistician Corrado Gini (1884-1965). It is the ratio of the area between a lorenz curve and the line of absolute equality (shaded in the figure) to the area of the entire triangle below that line (ABc). it has also been applied to the measurement of industrial CONCENTRATION.

giro

A system for transferring bank deposits long used in most European countries and offered as a service by the UK Post Office from 1968 and by UK clearing banks shortly afterwards. Instead of a transfer being effected by a cheque, the holder of a giro account instructs the bank concerned to make a change in its ledgers to pay another giro account-holder a particular amount of money.

GLAM

Grey, leisured, affluent, married: the key socioeconomic group of the late twentieth century, aged between 45 and 59 years.

Glass-Steagall Act 1933

Banking Act 1933 (USA) which separated investment banking from deposit-taking banking with the aim of discouraging speculation and conflicts of interest, e.g. between underwriting new share issues and normal commercial bank lending. It banned the payment of interest on demand deposits and allowed the Federal Reserve System to set reserve requirements. Since 1980, there have been US calls for the repeal of the Act so that US banks can have as wide a range of financial products as European banks. Japan’s version of Glass-Steagall (Article 65 of its Securities and Exchange Law) was also much criticized.

global depository receipt

A bank certificate referring to domestic shares sold internationally through the foreign branches of a bank.

global deregulation

The abolition of exchange controls, tax barriers, fixed dealing commissions and limitations on overseas investment together with the creation of new financial instruments which foreigners can use. More and more countries are heading down the path of deregulation. Since 1979, the UK, Japan, Germany and many other countries have abolished their exchange controls. Japan, long reluctant to allow foreigners to invest in the country, has allowed more foreign access to its financial markets. Also, the New York and London Stock Exchanges have undertaken massive deregulation.

globalization

The expansion of domestic markets and activities into a world-wide system. As long ago as the Roman Empire trade was encouraged internationally. In the seventeenth century companies trading to the East Indies from Western Europe not only exported and imported but established factories in distant countries. From the late nineteenth century major industrial and banking companies set up foreign subsidiaries. Today globalization does mean that increasingly economic activity takes place within world-wide markets, often electronically. branding has produced more homogenization of tastes and reduced the scope for local production. With globalization national governments become less important: large corporations and world markets dictate the distribution of production and of incomes. Critics point out the threat to democracy posed by the establishment of institutions not subject to national governments.

global monetarism

A proposed regime of fixed exchange rates with a collective monetary policy for participant countries. The aim of this form of monetarism is to stabilize the average price of traded goods.

glut

Excess supply of all or most goods and services. classical economists regarded a glut as a general economic depression, characterized by failing output, employment and prices – it was only temporary as price changes were expected to restore the economy to a full-employment equilibrium.

gnomes of Zurich

A description of the Swiss bankers alleged to be speculating against sterling in the 1960s used by Harold Wilson, then prime minister of the UK.

goal equilibrium

An equilibrium that attempts to achieve a particular aim, e.g. the maximization of consumers’ utility.

goal system

A method of raising tax revenue which requires each tax office to achieve a quota of tax revenue.

goal variable

A policy objective forming part of the objective utility function of a policy-maker, e.g. price stability, a balance of payments equilibrium.

going concern

A commercial organization, usually a firm, expected to continue to operate for the foreseeable future because of its stable financial condition.

going rate

A wage rate regarded as the acceptable pay at a particular time for an occupational group. often it is the pay set by a major employer or bargaining group.

goldbug

Someone in favour of a return to the gold STANDARD.

gold bullion standard

A fixed exchange rate system which existed in its purest form from 1880 to 1914. National currencies were valued in terms of weight units of gold, and exchange rates were fixed through the medium of gold. if international transactions were not in balance then internal adjustment was needed in the debtor country. currencies on the gold standard were convertible into each other merely with the cost of shipping gold from one country to another. The key player of the system was the central bank of each country as it had the tasks of contracting the internal money supply – in the case of a balance of payments deficit to produce a credit contraction, and the reverse in the case of a balance of payments surplus. Both domestically and internationally, gold was ideal because of its unique qualities as a standard of value and as a medium of exchange. It applied the one-price law throughout the world, permitting gold to flow according to the price specie-flow mechanism. But too little co-operation between the central banks (many of whom were reluctant to follow the harsh rules of the system) weakened the automatic effects of the gold standard. The gold standard was in force in the UK from 1717 to 1931 (apart from the Napoleonic Wars and the First World War). Before the First World War the bank of England, as the central bank of the creditor country of the world, operated according to the rules, but the USA did not do so when it had a similar task after 1918: it had a great inflow of gold, but it did not allow domestic prices to rise. When debtor countries introduced exchange controls and entered into trade wars, the gold standard was at an end.

gold coinage

Coins now used chiefly for investment or collecting purposes. Leading examples include the britannia, the krugerrand and the MAPLE LEAF.

gold demonetization

Ceasing to use gold as the basis for valuing a currency. The major example of this was when the US dollar replaced gold after the collapse of the bretton woods system as the peg for many currencies.

golden age

A period of steady growth with continuous full employment. In this age, the warranted rate of growth is equal to the

NATURAL RATE OF GROWTH.