1. Introduction

The concept of economic regulation originally found its way into the public choice literature in Stigler’s (1971) paper in the Bell Journal of Economics. The paper was a restatement of the time-honored capture theory of regulation, though unlike his precursors, Stigler formulated the capture theory as a testable economic model. He also showed several innovative ways to test the theory. Posner (1973) offered an assessment of how well the theory of economic regulation stacked up against competing theories.

The most important subsequent contribution to this subject is Peltzman (1976), and this is where I pick up the topic for purposes of exposition.

2. Peltzman’s Generalization

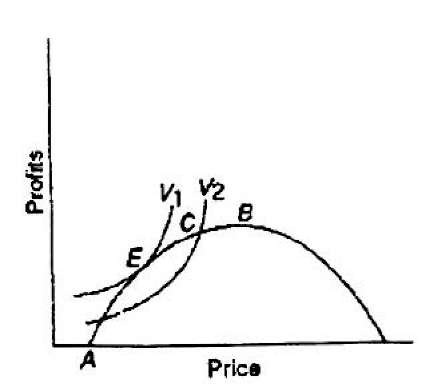

In his basic paper, Stigler made the following observation: "These various political boons are not obtained by the industry in a pure profit-maximizing form" (1971, p. 6). This comment contained the seed that later led to Peltzman’s (1976) generalization of Stigler’s theory. Figure 1 illustrates.

Profits are measured along the vertical axis, and price along the horizontal axis. A vote-maximizing regulator/ politician seeks to trade off wealth between consumers represented by the price variable and producers represented by the profit variable. Higher indifference curves for the regulator are read in a northwestern direction. Point A on the horizontal axis corresponds to a competitive industry making zero economic profits. Point B corresponds to profit-maximization by a pure monopolist or a perfect cartel. Note that the shape of the regulator’s indifference curves show the nature of Stigler’s conjecture. Point B is not a political equilibrium unless consumer interests are ignored totally by the regulator. (This would imply a V curve parallel to the profit axis tangent to point B.) A normal political equilibrium is given by point E, where the regulator equates his marginal rate of political substitution (of consumer for producer votes) to the slope of the transfer locus as defined by the profit hill.

Peltzman’s model contains many useful implications. For example, why are certain types of industries regulated and others not? In Figure 1, it is easy to see that the improvement in regulator utility (votes) is greater when industries that are either purely competitive or pure monopolies are regulated. Movements from point such as A (pure competition) or B (pure monopoly) to point E create more political wealth for the regulator than movements from intermediate positions such as C (oligopoly?). Thus, there is a vote-maximizing rationale for why one observes the extensive regulation of natural monopolies (utilities) and purely competitive industries (agriculture) and little or no regulation of the steel and automobile industries.

Figure 1: A regulatory equilibrium.

In a private setting, it is well known that fixed costs have no influence on short-run price and output. However, fixed costs matter to the political equilibrium level of price and profit in Figure 1. Imagine that the profit hill (which is a function of price and costs) shrank by a constant amount throughout its range, reflecting an increase in fixed costs in the industry. Obviously, the optimal political price would change. In general, the vote-maximizing regulator will make trade-offs in such a fashion that increases in industry profit are shared with consumers through a regulatory price reduction and decreases in industry profit are buffered by regulatory price increases. Hirshleifer (1976, 243) called this the principle of "share the gain and share the pain."

There are numerous other interesting applications of Peltzman’s model, which is without doubt the single most important theoretical development in the post-Stigler literature on economic regulation. A few of these are summarized below.

3. The Origins of Regulation

Economists have typically taken a cross-sectional approach to the study of regulation. Given that regulation exists in some jurisdictions and not in others, differences in such variables as price and output can be compared in the two cases. Much less attention has been devoted to the question of why regulation comes into existence in the first place. In other words, what explains the timing of major regulatory events such as the passage of a new law mandating a regulatory program?

Stigler (1971) laid out a method for addressing this issue in his original paper on the subject. He attempted, with mixed results, to explain the onset (the date) of occupational regulation across U.S. states. The subsequent literature has not risen very much to Stigler’s challenge on this issue, but there are some developments worth reporting.

Stigler and Friedland (1962) reported cross-sectional regression results for electricity prices across U.S. states for 1922. Their results suggested that state regulation of electricity prices had no detectable effect on the level of these prices; prices in regulated states were statistically the same as prices in unregulated states. Jarrell (1978) unraveled this conundrum by examining the timing of municipal and state regulation of electric utilities over the period prior to 1922. He found that both municipal and state regulation occurred first where the demand for regulation was the greatest, that is, where electric utility markets were the most competitive. The predicted effects of economic regulation are borne out in Jarrell’s results as prices and profits rose substantially in the states that were regulated early.

Shughart and Tollison (1981) applied the timing method to explain the evolution of more liberal corporate chartering laws across U.S. states from 1837 to 1913. The older system of corporate chartering was excessively bureaucratic and cumbersome, requiring legislative enactment of a firm’s charter in some cases. The new system was a great deal less costly in that obtaining a charter required going to the appropriate state office, filing the appropriate forms, and paying a fee. Shughart and Tollison sought to explain the year in which states adopted more liberal chartering laws with a model that incorporated proximate measures of the costs and benefits of such laws to local (state) manufacturing interests. Greater costs suggest later passage; greater benefits suggest earlier passage. Such a theory leads to a robust explanation of the timing of this significant episode of legal change and deregulation in U.S. history.

Explaining the timing of specific government regulations provides a challenge to economists and other students of government regulation. The progress made thus far is not really impressive, and there are many regulatory histories waiting to be written (or, one should say, rewritten).

4. Heterogeneous Firms

In the simple version of the capture theory, a unified industry captures a regulatory process at the expense of consumers. However, much economic regulation is driven by a different set of combatants. Much regulation is fueled by competitor versus competitor interests. The most obvious example of this type of regulation is where the producers of butter obtain a regulation raising the price of margarine. But this is not what is meant here; what is meant is competitor versus competitor in the same industry, that is, some butter producers against others.

Buchanan and Tullock (1975) were the first to articulate such a theory of regulation in the context of pollution controls. Since their paper, other applications of the basic concept have appeared (see, e.g., Maloney and McCormick, 1982). The basic idea is straightforward. Firms in an industry are heterogeneous with respect to costs; the industry supply curve is upward sloping to the right. This opens the door to possible regulations that impose relatively greater costs on higher-cost, marginal firms, causing some of them to leave the industry. All firms face higher costs as a result of direct regulation, but the exit of higher-cost firms raises market price in the industry. Depending upon relevant elasticities of demand and supply, the increase in price can outweigh the increase in costs for the lower-cost producers. If so, the regulation increases their wealth at the expense of both consumers and the higher-cost firms in the industry.

This approach to the explanation of regulation has been used extensively in the areas of social and environmental regulation. Fundamentally, it offers a better understanding of why direct administrative controls over production are preferred to less intrusive regulation such as environmental user fees or property rights.

In an innovative spirit, Marvel (1977) used this theory to explain the origin of the British factory acts in the 1830s. Contrary to the conventional wisdom that such laws were in the public interest because they limited the working hours of women and children, Marvel argues that the regulation of hours favored steam mill over water mill owners. The latter could only operate when the water flow was sufficient, and hence ran long hours when stream conditions were good. The hours restrictions curtailed the ability of the water-driven mills to make up for lost output when streams were low. According to Marvel’s estimates, the resulting rise in textile prices transferred a significant amount of wealth to steam mill owners, who could operate on a regular basis. This is only part of the interest-group story of the factory acts, but Marvel laid out an innovative and plausible private-interest explanation of this legislation based on the idea of heterogeneous firms.

5. Social versus Economic Regulation

Stigler (1971) called his article "The Theory of Economic Regulation." This has come to be a somewhat misleading title. As the previous discussion indicated, much, if not all, of the regulation that goes under the heading of social and safety regulation has been successfully analyzed with the tools that Stigler initially deployed. In short, the best way to understand any regulatory scheme is to answer the twin questions, who wins and who loses. As Becker (1976) emphasized, it is best to think in terms of an economic theory of regulation rather than a theory of economic regulation.

Indeed, even the most innocuous sounding regulatory programs have been analyzed with the interest-group model. These include environmental, health, and safety programs (Bartel and Thomas, 1987), the British factory acts (Anderson and Tollison, 1984), various antitrust policies and practices (Mackay et al., 1987), the banning of the importation of slaves into the United States (Anderson et al., 1988), immigration restrictions (Shugart et al., 1986), apostolic decrees by the Roman Catholic Church (Ault et al., 1987), Luddism (Anderson and Tollison, 1984, 1986), population growth (Kimenyi et al., 1988), farmer opposition to futures markets (Pashigian, 1988), and still others.

6. Modern Deregulation

Deregulation is obviously an important issue for the theory of economic regulation. Not only must the theory be able to explain the onset of regulation, but it must also be able to explain the exit of regulation from the political marketplace.

Peltzman (1989) has addressed this challenge to the theory, specifically focusing on the deregulation of selected U.S. industries in the late 1970s and early 1980s. This episode of deregulation was quantitatively important, and Peltzman wanted to see if the theory of economic regulation could explain it.

He framed the issue in a general way by emphasizing that the theory of economic regulation, as presently constituted, is mostly an architecture for describing positions of political equilibrium, and it has not been expanded sufficiently to account for the process of entry into and exit from the political market for regulation. With the issue thus framed, Peltzman argued that the Chicago theory can explain episodes of deregulation, primarily as a function of regulatory-induced cost increases that increase the potential gains to the benefactors (consumers) of deregulation. In essence, he proposed a cyclical theory of regulation. Regulation (or entry) occurs and a rent-transfer process is begun; over time, the rents are eroded because the regulator cannot enforce a perfect cartel; and, finally, deregulation (or exit) becomes politically profitable. It is the present value of the regulatory transfer at the onset of regulation that drives behavior in Peltzman’s dynamic model of economic regulation.

This is certainly an intriguing idea. Although it is not clear why cost increases and rent dissipation cannot be controlled by the regulator, the answer is probably traceable to Stigler’s (1971, p. 6) conjecture quoted earlier. Peltzman goes on to apply this type of analysis to the various industries that have been deregulated and finds that it fits some cases but not all. Perhaps the most prominent of the latter cases is the role of rents accruing to organized labor in industries like trucking, where such rents were relatively large and the recipient group was politically powerful (apparently to no avail).

All that one can do at this stage is agree with Peltzman, who argues for further research on this issue. Peltzman, however, has pointed in a useful direction. Namely, if wealth transfers are the basis of regulation, they are surely also the basis of its decline.

7. Concluding Remarks

A lot of ground has been covered since Stigler (1971) and Posner (1974). In fact, one might say that opposing theories of regulation have been pretty thoroughly driven from the scene. Mathematical economists still spin out complex considerations of optimal regulation and so on, but the workers who toil in the empirical study of regulation and governmental behavior know better. The impact of interest groups on the economy is a fascinating problem, as scholars such as Becker (1983) and Olson (1982) have shown. A whole new type of political economy has emerged from this work which has become a dominant paradigm in political economy because it is grounded in positive economic methodology.