Profit and Loss Account

This scintillating and vitally important bit of information tells you how much money a company is making. City analysts have raptures or cold sweats poring over every little scrap of information that appears in this section of a company’s accounts. It tells you how much the company sold (sales, turnover, revenue all mean the same thing), how much it cost to make those sales, and the overall expenses to the company of things like tax and dividend payouts. Then, if they are really lucky, there might be some retained profits left over that can be ploughed back into the company.

Make sure you look at the numbers in the consolidated profit and loss account, not that of its parent. Consolidated just means that the numbers are adjusted to include the correct percentage of all the businesses part or wholly belonging to the company (see Accounts).

Prospectus

A glossy fat brochure full of a dazzling array of all the facts and figures that you will ever need to know about a company, if not more. Its purpose is to act as a reassuring, confidence-inspiring document that persuades investors to part with their hard-earned cash and invest in the company that is about to be brought to the stock market, usually in the form of a new issue or public offering. Naturally the prospectus will be upbeat and positive and designed to show the company in the best possible light. There’ll be a whole bunch of numbers that make positive projections for the company’s future profits and expansion, blah, blah, blah. From your point of view, one of the main things to watch for is sentiment (see Market Influences). Does the market await this new issue with baited breath, or will it be a dead duck? If you’re planning on going for a new issue, financial press comment and a reliable stockbroker will help you to gauge whether to do so or not. By the way, a prospectus is not the same as an offer document (see Offer Document).

Protectionism

Something Japan has been getting away with for years. Basically it’s when a country says it’s not going to buy foreign imported rubbish and makes it impossible for importers to infiltrate their economy. How? It does so by setting unreasonably high tariffs, restricting the amount of goods they’ll allow in, and coming up with specifications that are prohibitively expensive for the importers to meet; that sort of thing.

Provisions

A company has to make provisions for potential bad debts and depreciation; these are found in its annual report and accounts. A provision can be a warning to investors of a large looming bad thing that may well cost the company several million pounds. Alternatively, it could just be that it is being prudent and keeping money aside as a safety cushion for unexpected happenings.

Proxy

When you buy ordinary shares in a company, you are entitled to vote at its Annual General Meeting (AGM) and any Extraordinary General Meeting (EGM). Voting can be important if it involves the takeover of another company or a key issue regarding the company’s finances. If you cannot make it to the AGM or EGM, you can elect someone else, ie, a proxy, to vote on your behalf, according to your instructions (see Annual General Meeting, Extraordinary General Meeting).

Public Limited Company – PLC

All companies listed on the stock market have to be plcs. Not all plcs are quoted on the stock market by any means. Many more are privately owned. The point is that a plc has more stringent accounting requirements than a non-plc. You’ll see this written sometimes as PLC, other times plc.

Public Sector Borrowing Requirement – PSBR

A very grand-sounding phrase that basically means the government is strapped for cash, having spent too much (what’s new?), and now needs to borrow money on a big scale, to the tune of billions of pounds. Puts my paltry overdraft to shame. Anything I can do, the government can do better! (See Monetary Policy.)

Put Option

The right, but not the obligation, to sell a share (or any other financial instrument) within a defined period of time in the future, at a price that is fixed now (see Call Option, Derivatives – Options).

Quality of Earnings

Analysts like to emphasize that it’s not enough if a company’s earnings are growing; they have to be good quality, ie, consistent. An example: a company that has a fixed contract with a customer for 20 years will be judged by the City to have higher quality of earnings than those of a company that has short-term contracts that need to be renewed, say, every six months (see Analyst, Earnings per Share).

Quantitative Funds/Fund Management

Called ‘quant’ for short, it’s a method of investing money that originated in the United States (naturally). Investment experts feed a whole bunch of information and numbers about stock markets and individual companies into a computer program. They then set criteria that allow it to effectively decide where the money being managed would be best invested, in geographical and risk-reward terms. The computer program is invariably incredibly complicated and scientific, and something that neither you nor I (and I suspect sometimes even the fund manager him or herself!) could possibly make head or tail of. And hey, it very often works. But there are potentially large pitfalls with this sort of fund management. The judgements made by the computer about the future are all based on an objective analysis of the past. It ignores the human element; for example, the effect that a company’s management can have in turning things around in the future. It also lacks the ability to react quickly enough to bolt-from-the-blue scenarios, ie, when something completely unexpected happens that the computer couldn’t have possibly anticipated. So there is a danger that these funds can be too inflexible. On the occasions when things do go wrong, investors have been known to really lose their shirts. But it just reinforces the old, old motto, ‘Thou shalt not put all thy eggs into one basket!’

Quote

A share’s ‘quote’ is its current price. It is normally listed on the Stock Exchange, with its buy and sell price ‘quoted’ by market-makers (see Market-Maker).

Quoted Company

Means the company is listed on the Stock Exchange. Other expressions meaning the same thing are: publicly listed company, publicly quoted company (see Quote).

Ramp

Beware shares that are ramped by the City bods. It happens more frequently than you think and is not always very obvious. Basically when City dealers want to get rid of some slightly dodgy shares that some other wise guys originally suckered them into, a small select band of them ‘ramp’ the shares by stretching the truth enormously as to their merits, just enough so that the unsuspecting investor (imagine an innocent guppy fish being circled by a shark!) will swallow the story. Curiously, as soon as the inflated or ‘ramped’ shares are offloaded, they have a tendency to collapse in a heap on to the heads of the poor sods who bought them.

Random Walk Theory

I feel like a random walk today - should I try Hyde Park or Kensington Gardens, I wonder. Seriously, it is a theory. Yes, that’s right, a theory that has been devised by random walk theorists. Basically they reckon that, because share price movements are random, there’s absolutely no point in trying to second guess, or predict, their future price movements. This puts paid to the technical analyst’s theory that you can, indeed, second guess the future by looking at past share price movements (see Efficient Market Theory, Technical Analysis).

Ratios

Sums. Shriek in horror remembering all that eye-glazing algebra we had to learn at school. But it’s not that bad. A ratio is simply the division of one number into another. City analysts and investors often pluck the numbers for ratios from the balance sheet and profit and loss statement of a company’s accounts. These accounting ratios can give them lots of clues about the financial health or prospects for a company.

I say ‘can’ as opposed to ‘do’, because the numbers crunched by the City people are only as good as the information they glean from the management of the companies they follow. Some companies are more forthcoming than others. Anyway, serious investors set great store by these ratios, especially the analysts who make it their business to create and analyse these numbers ad infinitum (see Acid Test, Analyst, Price/Earnings Ratio).

Real Return

When financial whizzos talk about real returns on your money as opposed to unreal, what they actually mean is that they have stripped out inflation, which whilst unreal, feels bloody real to us when our pay packets don’t keep up with it, and buy us less and less as the years go by. So to take an easy example: if the building society or bank is paying you 5 per cent on money deposited, and inflation is 2 per cent, the real return on your money is a mere 3 per cent.

Real-Time

What, as opposed to fake-time? This describes financial information transmitted ‘live’ as you see it. An example is the FTSE 100 index, which is calculated and recalculated every few seconds, thus displaying ‘real-time’ prices.

Receiver

Oh dear, oh dear, let’s pray you never see one of these, because, as the word implies, it’s they who will be doing the receiving, not you! When a business goes bankrupt, or sometimes even before then, people called receivers are appointed to scoop up as many of the assets remaining in that business’s possession as possible, with a view to flogging them off to clear their debts (see Bankrupt, Liquidation, Shares).

Recession

Trust economists to come up with a confusing word for what is in fact very simple. The official definition of recession is ‘two successive quarters of negative economic expansion’. What they actually mean is six months when the economy just doesn’t grow. And how on earth can you have negative expansion, for goodness’ sake?

Recovery Stocks

Some companies can sink to their knees quite quickly if things go wrong for them such as losing an important customer, or if the management is lousy. Perhaps a business is doing well, but money isn’t coming in quickly enough, or it could be sensitive to changes in the general economic outlook for its products, ie, the business is cyclical (see Cyclical Shares). Regrettably, companies listed on the Stock Exchange are frequently subject to the short-termism of City analysts. As soon as they get a whiff that all is not well, they cheerfully (or not so cheerfully if they’re nursing a loss!) dump the shares en masse. But then a few months later, the outlook might have improved for the company: it may have formed an alliance with a major customer, or it is subject to a takeover bid, or quite simply the bad management has been replaced by good. Lo and behold, as soon as there is just the tiniest glimpse of recovery in the company’s fortunes, the same people who told you those shares were an unmitigated disaster and not to be touched with a bargepole, will be busily buying them up again and the company’s share price may well recover sharply. That’s why shares that fall and then rise rapidly are called recovery shares.

Redemption Value

This is the amount of money that issuers of bonds, loans, etc repay to lenders on the redemption date of the loans (see Maturity Date). This value is fixed when the loan is issued.

Redemption Yield

Other phrases meaning the same thing are: ‘total yield at redemption’ or ‘projected total yield’. Don’t panic. It is just the result of a maths calculation worked out by the City types who specialize in selling bonds to investors. ‘Redemption yield’ is useful because it gives the investor a guide to his total returns if he decides to hang on to a bond until its redemption date (see Maturity Date). This fairly complicated calculation adds up the yearly income stream that a bond is due to pay out over its lifetime, including any capital gains or losses that will be returned to the lender at the end of its life (see Bonds, Income Yield, Running Yield, Yield).

Registered Securities

These are shares or bonds with a centralized register in which all the names of the owners, as at any moment in time, are recorded. The type that do not have such a register are called bearer securities, hence are anonymous (see Bearer Securities, Securities).

Registrar

It’s the thrilling task of the registrar of a company to keep its share ownership list up to date. A registrar can be an individual, or an organization hired by a company to do this tedious, but necessary task. As millions of us buy and sell shares in various companies, there is a busy little registrar, adding and deleting our names from the share registers of those companies. They do all the other thankless tasks for which we should be grateful, like sending us our dividends, tax vouchers and notice of bonus (freebie share) issues.

Regular Savings Plan/Scheme

If you haven’t been lucky enough to win the lottery, marry a millionaire, or inherit a large wodge of cash, then you should definitely think about having one of these. It involves setting aside the increasingly paltry sum of, say, £50-100 per month, into a savings plan with a view to slowly and carefully investing it into stock market pooled investment funds of your choice over a period of years. For many people who don’t have huge wads of spare cash, it’s a convenient way of investing because it spreads risk and saves them worrying about the close-up, day-to-day participation needed for direct share market investment. The beauty of putting in small regular sums is that it irons out the highs and lows of stock market fluctuations (see Diversification, Drip Feeding, Investment Trust, Managed Funds, Unit Trust).

Reinsurance

Insurers who offer to insure really big, mega-expensive things like oil rigs, ships or aeroplanes, worry that things might go wrong. The Piper Alpha oil rig disaster springs to mind. So to hedge their bets, they take out insurance on the things that they have agreed to insure, to minimize the necessity of having to cough up if things should go horribly wrong. They offload the risk on to another insurer, who then offloads the risk on to some other poor punter. As this process continues and each insurer successively offloads the risk of say, another oilrig blowing up, there is a real danger that things go full circle and the first insurer has regained the risk they originally tried to offload.

Relative Strength

This is when you check out the performance of an individual share against the overall stock market’s performance. A popular measure in the United Kingdom is the FTSE 100. So if the FTSE 100 is up 10 per cent over a one-month period, and Gotcha plc is up 12 per cent in the same period, then Gotcha has outperformed the FTSE 100 by 2 per cent (see Outperform, Underperform).

Research

Research is the endless reams and reams of written analysis produced by City analysts on specific companies, sectors of commerce and industry, and on entire markets. The vast quantity of this stuff churned out by them rarely reaches the likes of you and me. It’s reserved for the big bods, ie, the institutions (see Institutional Investors). They, being heavy hitters who can move share markets with their sheer volume of business, get the de luxe treatment. Smaller investors have to rely on the financial press and private client stockbroker research. Bear in mind that not many private client stockbrokers provide comprehensive research coverage of the whole UK stock market. Many of them tend to specialize and be very good at certain sectors, but not so good in others. PS. The advent of the internet is making stock market research more and more accessible (see Financial Information).

Reserves

There are two meanings for this in a financial sense: 1) Economic-speak - just as you and I keep some spare cash in the kitty for emergencies, governments do, too. And they like to hold the reserves of their country in a suitably stable currency (if there are any left!) such as the US dollar, preferring to steer clear of the Indian rupee or Russian rouble. 2) Accounting-speak – reserves in a company’s accounts. In this context they are assets, like cash, and are shown in the balance sheet of the accounts (see Capital and Reserves).

Retail Price Index – RPI

This is one way in which our beloved UK government measures inflation. It’s compiled monthly by the government statistics department. It is supposed to measure the change in prices of consumer goods and services in retail shops: stuff like clothes, food, mortgages, cars, etc. The City watches the RPI like a hawk to spot changes in trends. Any signs of an increase and they are all of a panic, fretting that with a resurgence of inflation, interest rates will have to rise to dampen it down. And if the numbers are falling, jubilation and glee set in as they eagerly anticipate a fall in interest rates. But then doom and gloom come along, as worries about an excessive fall in inflation leading to deflation set in (see Deflation, Inflation, Lagging Indicator, Leading Indicator).

Retained Earnings

When a company makes profits, it doesn’t usually generously dish out all of these profits in one go to its shareholders in the form of dividends. Why not? you cry petulantly, we want more dividends. Well, the reason why not is because the company holds back some of its profits in order to have money in the kitty to grow and invest in the business, and what it holds back are called retained earnings or retained profit.

Return on Capital Employed -ROCE

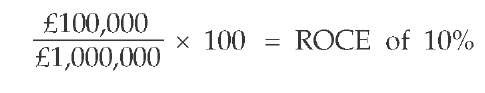

Return on capital employed, you’ll be thrilled to know, is one of the really useful City sums. It measures a company’s ability to generate profits on its assets. The idea behind it is to see how efficiently the money in the business is being used, ie, how much profit is being squeezed out compared with each pound employed (see Capital Employed). Let’s say a business is using capital of a million pounds and is generating profits of £100,000:

Return on Equity – ROE

It’s yet another ratio that the City analysts love to calculate and it tells the shareholders of the business how much profit is being generated by its total amount of funds:

It is a similar, but different calculation to return on capital employed, which measures how much profit is being generated from the assets at the company’s disposal (see Return on Capital Employed).

Revenue

This is accounting-speak for the amount of sales or turnover generated by a business. It pops up in a company’s profit and loss statement, as well as in its cash-flow statement (see Accounts, Cash-Flow Statement, Turnover).

Reverse Takeover

Confusingly, this actually means a little company swallowing up a big company. Imagine a goldfish gobbling up a river pike. It happens when a small company with very good management is able to borrow money to buy the bigger company and do better with it.