Abstract

One of the everyday jobs of the treasurer is to manage the cash, and flow of funds through the organization. If the amount or receipt and collection activities are out of control, the entire firm may face bankruptcy. There is an old saying, ”If you pay attention to the pennies, the dollars will take care of themselves.” In this spirit, this paper looks at taking care of the daily amounts of cash flowing through the firm in a systematic fashion. The purpose is to understand the importance of the interrelationships involved and to be able to measure the amount and speed of the cash flow. Once something can be measured, it can be managed.

Introduction

The management of cash flow is essential to the success of every enterprise, whether it be public or private. In fact, cash management is probably more critical to the success of an enterprise than making an individual sale or providing a service for a period of time. A business can lose a single customer or can suspend services for a short period without irreparable damage. However, let an imbalance in cash flow occur that forces a cash manager to miss a payroll, a debt payment, or a tax deadline and, quite possibly, the company is entirely out of business. This is a rather harsh penalty for one mistake or oversight on the part of the cash manager.

During the 1960s and 1970s, when we were experiencing high rates of inflation and attendant high-interest rates, the idea of cash management became well accepted, and integrated into the financial function of the firm. This was caused by the high costs of idle cash balances. With the recession and attendant drop in inflation and lower interest rates during the 1980s, the management of cash was still important, but for different reasons. During this period even though rates were low, credit standards were tightened and cash became scarce. Again idle cash balances were undesirable. During the economic boom of the 1990s with the advent of the New Economy (Information), the changing economy caused the focus to shift from manufacturing and production to service and information. As these changes took place, the silo approach to cash management as part of the traditional treasury function shifted to a totally integrated approach focusing on creation of shareholder value. Cash management became the development and implementation of integrated financial strategies for the entire organization. During the recession (2000-2003), the economy faced low-interest rates and at the same time credit standards are tightening in the context of the new information economy, thus giving reasons for paying close attention to cash balances. In October 2004, the Federal Regulations of the U.S. Banking System for the first time were allowing all check payments to be processed electronically. This change has sped up the flow of cash through the system, and made it more important for treasurers to keep track of cash balances.

The purpose of cash flow and working capital management has become an indispensable part of the entire organization. The objective is no longer to maximize cash flow or minimize idle cash but rather to ensure the availability of cash in the form and amount required for the continuing operation of the enterprise and to ensure an addition to shareholder value.

Standard texts on the subject include: Gallinger and Healey(1991) and Maness and Zietlow (1998).

Definitions

Working Capital

The following terms are those more commonly used in connection with working capital.

Working capital is the dollar amount or the total of a firm’s current assets. Current assets include cash, marketable securities, investments, accounts receivable, and inventories. These assets are considered liquid because they can be converted into cash within a year. The dollar amount of these assets varies from time to time because of seasonal variations in sales and cyclical variations in general business conditions. Hence, the level of working capital held by a company is not constant.

Working capital can be thought of consisting two parts - permanent and temporary. Permanent working capital is the dollar amount of working capital that remains fairly constant over time, regardless of fluctuations in sales. Temporary working capital is the additional assets required to meet the seasonal or cyclical variations in sales above the permanent level.

Working Capital Management

Working capital management is a much broader concept than working capital because it involves the management of current assets, current liabilities, and the interrelationship between them. In practice, we tend to make no distinction between the investment decisions regarding current assets and the financing decisions regarding current liabilities. In fact, quite often these two are so closely related that we talk about spontaneous financing of assets – for example, a firm buying some inventory on credit. In such a situation, both assets and liabilities are increased simultaneously thereby providing, at least in the short run, the financing for the investment.

Net Working Capital

Net working capital is the difference between current assets and current liabilities. It is a financial indicator that can be used in conjunction with ratios to gauge the liquidity of a company. In general, an abundance of net working capital is considered desirable because it suggests that the firm has ample liquidity to meet its short-term obligations. As we shall see, this may not always be the case. In fact, one of the objectives of cash management is to reduce excess or redundant net working capital to a minimum, and thereby reduce the cost of holding idle assets.

An Overview of Corporate Working Capital

Money

The subject of this paper is cash flow, or in other words, how money moves through a business enterprise. Everyone has a general understanding of what money is and how it can be used. A simple definition of money, one used by the Federal Reserve, is: Money is made up of the currency in circulation and checking account balances. The characteristics that must be present for something to serve as money are, first, a store of value; second, ready acceptance; and third, easy transferability.

Throughout history, we have seen various things serve as money – for example, the giant stone of the Yap Islanders, the tobacco currency of early American colonists, gold, silver, shells, and even paper. The key feature that these diverse things have in common is that the participants in the economy were willing to use them for transaction purposes, or to represent the accumulation of wealth. In the new age of the internet, money has taken the form of information. There is no physical representation of value, i.e. dollar bills, credit cards, etc, but rather information with respect to account numbers and the ability to transfer value from one account to another. Such things as digital cash, digital wallets, and virtual credit cards are being used as e-money. This new approach will have an impact on working capital with respect to time and costs. From this understanding of the function that money serves, we can move to a much more sophisticated concept – that of the flow of funds.

When financial managers talk of the flow of funds or working capital, they are referring to the fact that money as we know it – corporate cash checking account and e-money – is actually increasing or decreasing as a result of management actions or decisions. However, they are also referring to factors or accounts that are not really money, but which serve as close substitutes. Such things as inventory, accounts receivable, financial instruments, and other types of marketable securities are all affected by economic or corporate activity. As these accounts change, the ultimate effect is a change in the level of corporate cash. But before these so-called near monies are actually turned into money, we can keep track of them by observing the corporate flow of funds.

Cash Management

Maximum cash generation is usually the primary objective of the financial manager. This objective is based on the assumption that any business is only as sound as the management of its cash flow. However, cash flow management is not an isolated task in the normal operation of a business. Instead, managing cash flow means being deeply involved with every aspect of business operations. Consequently, any and all management effort must be directed to at least satisfying cash flow requirements while managers try to achieve the other objectives of the company. To be more specific, cash flow must be considered to achieve survival, profitability, growth, creation of shareholder value, and finally, the efficient use of corporate resources.

No one objective or goal predominates at all times. The goals are interrelated to such a degree that it is in the best interest of management to work toward attaining all the goals simultaneously. At any given time, priorities may vary as to which objective is most crucial, but all of them must ultimately be achieved to run a successful enterprise.

Keynes’ famous statement ”In the long run, we’re all dead” does not necessarily apply to the corporate form of business. Survival becomes one of the primary objectives for any business. Temporary illiquidity, or lack of money, or financial resources may lead to suspending payments of corporate obligations. As long as creditors accept deferred or rescheduled payments, the short-run problems may be worked out and the business may survive. The ultimate threat of creditors is to drive a business into bankruptcy, which is in effect the admission by management that the cash values from dissolving the business is worth more than trying to keep the business going.

From the cash flow manager’s perspective, the desire for survival demands that the firm be managed in such a way as to guarantee the maximum cash flow possible. Thus, management seeks to convert the company’s investment in inventories and receivables into cash as quickly as possible. Remember that this desire to speed up cash inflow must be balanced against growing revenues, increasing profits, and the creation of shareholder wealth. In the extreme case, a company could make every product on an order basis and demand cash payment. This would eliminate inventories and receivables. No doubt, the competitive structure of any industry would reduce this strategy to a very unprofitable one in short order.

Other things being equal, the higher the profits a company generates, the more successful it is in achieving its other goals. However, as a business seeks to maximize profits, it must take greater risks. As the risk increases, the need for careful cash management becomes much more important. As a business strives to become more profitable by becoming more competitive, there is a cost in terms of higher inventories, more efficient production equipment, and more liberal credit policies to encourage sales. Competitive strategies increase the firm’s need for cash flow by slowing down the rate at which working capital is converted into cash and by increasing the amount of resources tied up in each of the working capital components. Indeed, the cash manager will constantly be forced to balance profitability, growth, and survival as the manager tries to ensure that the company not only has sufficient funds but also uses those funds in an efficient fashion.

Rapid expansion in revenue and increase in market share make marketing management an exciting profession. Marketing-oriented individuals measure their success not by increased profits, but by the increase in the year’s market share or by the percentage of market share a given product line has achieved. In striving for these objectives, quite often the risks of rapid growth are overlooked. The major problems begin to surface when the cash management system has not kept up with the rapid growth and its attendant increase in risk.

The efficient use of leverage is of primary importance to sustaining rapid growth. The owners of a company do not have the liquid resources to provide all of the cash necessary to finance the growth, and so external funding must be sought. Usually this external funding is in the form of debt, which increases the overall risk for the company.

In and of itself, leverage is neither good nor bad. However, the misuse of leverage can place severe drains on the cash flow of a firm at a time when the company can least afford these drains.

An effective financial manager must balance the multiple objectives of the firm, and keep in mind that there are many ways to achieve these objectives ,and use the firm’s resources efficiently. Too much emphasis on any one of these goals can lead to very severe cash flow problems. The effective management of cash flow is necessary to achieve the multiple objectives simultaneously.

The Components of Working Capital

The components of working capital are the current assets listed on a firm’s balance sheet - cash, marketable securities, accounts receivable, and inventory. We can envision the flow of funds through a company as the process of continuously converting one asset into another. Cash is used to buy the necessary raw material that will be used in the production of goods and services. These goods are sold to customers. This increases accounts receivable. As customers pay their bills, accounts receivable are once again turned into cash. If there is a temporary surplus of cash, it may be used to purchase marketable securities. By holding marketable securities, a firm can earn interest on surplus funds, but can quickly convert these funds back into cash when needed. The company then repeats the cycle. The amount of funds and the speed at which the funds move from one account to another are the essential elements of cash flow management.

Flow of Funds

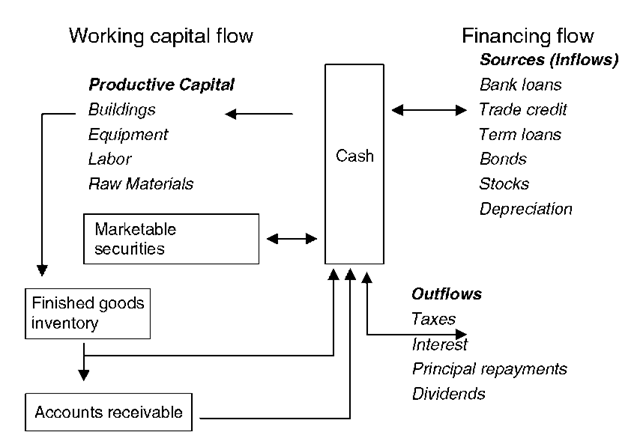

The flow of funds through an organization encompasses all segments of the corporation and is related to all decisions within the firm. This flow of cash, or flow of funds, is one of the main concerns of the cash manager. The flow of funds diagram below illustrates how funds flow through a company. Because the flow is circular and continuous, it is possible to start anywhere in the diagram.

Figure 11.1. Flow of funds

Cash

Cash is listed first on the balance sheet because it is the most liquid shortest term asset. In the flow of funds diagram, it is at the heart of the process. A company may keep a small amount of actual currency on hand as petty cash, but this quantity of cash is usually very small compared to the company’s demand deposits, checking account balances, or lines of credit. Demand deposits are the principal way in which a corporation pays its bills, both by issuing a check or electronic funds transfer.

The main problem that financial managers face is maintaining the cash account at an appropriate level. If they hold too little cash, they run the risk of not being able to pay the bills, or take advantage of opportunities that arise. On the other hand, holding too much cash is not good, because the interest that would have been earned if the funds had been properly invested is lost. The process of balancing too little versus too much cash demands most of a cash manager’s attention.

Marketable securities

Marketable securities are closely related to cash. In fact, they are often called cash equivalents and may be combined with cash on the company’s balance sheet. Investing in marketable securities involves purchasing money market instruments. These include treasury bills, commercial paper, certificates of deposit, and other short-term investments. A ready secondary market exists for such securities because most companies regularly buy and sell them before they mature. Because such a large market exists, any company can easily sell these instruments at a price close to their true value. This is why they are called marketable securities.

Most firms invest excess cash balances in marketable securities because they earn interest.

The financial manager is faced with two problems when managing the marketable securities account. First, how much money should he invest? And second, what is the appropriate maturity? When making this decision, other things being equal, the longer the maturity, the higher the yield on the investment.

Accounts Receivable

Accounts receivable consist of the money owed to the company by customers. Accounts receivable exist because most firms sell on credit. Customers buy now and pay later.

Accounts receivable usually constitute a very large component of a company’s working capital. Thousands, even millions, of dollars can be tied up in a firm’s accounts receivable. Why do companies make such a large commitment? The answer is, of course, that most companies extend credit to customers. This is primarily for marketing reasons. Customers are more willing to buy on credit, and very often competitors are willing to offer credit. In most businesses, credit terms are determined by traditional industry practice and competitive conditions. The automobile industry is a great example of using credit terms to sell cars.

Many financial managers work very closely with the marketing department to determine credit terms. This is because financial managers are responsible for obtaining the funds needed to finance accounts receivable. However, financial managers do have some control over the level of accounts receivable by ensuring prompt billing and collection.

Inventories

Inventories are the physical materials that company uses to make its products, or to sell directly to its customers. Companies maintain inventories for two main reasons: first, it is more efficient and less expensive to buy from suppliers in large quantities; and second, many customers demand a wide selection of products and fast delivery. If a company is not able to offer its customers wide choice and fast delivery, it will lose sales to competitors.

We have discussed the four components of working capital - cash, marketable securities, accounts receivable, and inventory. Associated with each of these components is too small or too large.

Too much cash has an opportunity cost of forgone interest, which will hurt profitability. Too little cash may lead to a situation in which the company is unable to meet its commitments and is forced into bankruptcy despite profitable operations. An excess of funds tied up in marketable securities can lead to slower company growth because the funds have not been efficiently used for expansion. Insufficient funds in marketable securities may lead to an inadequate safety margin when cash is needed in an emergency.

Too little cash tied up in accounts receivable may indicate a noncompetitive credit policy, a business downturn, or a dwindling market for the company’s products. Too large an amount in accounts receivable may indicate an overgenerous credit policy, which in turn, could lead to collection and bad-debt problems, and inefficient use of the firm’s resources.

Finally, too much inventory incurs the risk of obsolescence as well as additional costs of storage, insurance, and handling. On the other hand, too little inventory may place the firm in a noncompetitive position for failing to have the products to sell when the consumer wants them.

The Accounting Perspective Versus the Financial Perspective

A manufacturer or wholesaler seldom generates a sale directly in exchange for cash. Instead, the firm exchanges a product for the IOU of the customer according to predetermined selling terms. When a company purchases inventory, the cash payment typically follows the actual receipt of the inventory by 30 days.

From the accounting perspective, no distinction is made between an actual transaction and a cash transaction. Thus, on the seller’s side, a transaction requires a record of the sale on the day it occurs, even though no cash actually changes hands. The buyer’s side also records the purchase, and at the same time, records an increase in inventory and accounts payable. But the actual transaction has no immediate effect on the cash account of either company. This is known as accrual accounting. We can define accrual basis accounting as the recognition of revenue when it is earned and the recognition of expense in the period in which it is incurred, without regard to the time of receipt or payment of cash.

Financial accounting enables a manager to measure the financial performance of a firm by properly matching the firm’s revenues and expenses as they occur. At the same time, however, accrual accounting does not provide the proper picture of the cash flow through the company. Although it is well known that corporate managers seek to maximize profit and maintain corporate liquidity, accounting theory focuses almost exclusively on measuring and reporting profitability. Any use of an accrual accounting system to measure cash flow is just as foolhardy as the use of a cash budget to measure profitability. These diverse systems were designed to measure different types of activity.

One very important financial statement presented by firms is the cash flow statement. Basically it provides information about cash flows from three areas of firm activity: 1) cash flow from operating activity, 2) cash flow from investing activity, and 3) cash flow from financing activity. The cash flow from operations is merely the reported net income plus a minus the change in net working capital plus depreciation. The cash flow from investing activity is any purchase or sale of fixed assets needs a plant, equipment or land, and the cash flow from financing activities considers the issuance of equity or debt as well as the repayment of debt, the repurchase of equity, and the payment of preferred and common dividends. Using these classifications of cash flow, we can identify ”free cash flow.” The firm’s free cash flow is defined as cash provided by operating activities minus capital expenditures net of depositions minus preferred dividends. The amount of free cash flow available to management will allow for flexibility in making decisions about the firm’s future.

It must be noted that the accounting perspective (net income) and the financial perspective (free cash flow) are very different. Each serves a different function and uses different forms of analysis to give different perspectives on a given firm’s performance.

The Reasons for Holding Cash

As we have already said, cash is listed first on a company’s balance sheet and is considered a component of working capital. Cash is made up of demand deposits and currency. Now, let’s examine the reasons for holding cash.

There are three principal reasons for holding cash. First, a company needs cash for transactions. This cash is used to pay bills, wages, taxes, and meet other company obligations. We have already seen that having a positive net income does not guarantee that a company has enough cash on hand to meet all of its obligations.

The second reason for keeping a supply of cash is to have it available as a reserve. The old rule of saving for a rainy day is just as applicable for corporations as it is for individuals. Financial managers cannot predict exactly what future cash needs will be. Therefore, managers must have some cash in serve to meet unexpected needs. The exact amount of cash held in reserve depends on the degree of uncertainty about these needs. If there is a great deal of uncertainty about day-to-day cash needs, the company will have to maintain a large cash reserve. The necessity for maintaining a large cash reserve is lessened if the company has fast, dependable, and easy access to short-term credit. For example, if a bank extends a line of credit that can be used during times of cash shortages, lower cash reserves can be maintained.

Finally, holding cash is an essential part of many lending indentures. When a firm borrows money, the lender requires certain conditions (covenants) that must be adhered to, for example, a certain level of cash must be maintained in a bank account. In order to be in legal compliance with the lending agreement, the firm must maintain a minimum level of cash or working capital

Investing in Marketable Securities

Most cash held in demand deposits earns no interest. Therefore, once the basic corporate needs for cash are satisfied, the financial manager should invest extra cash in the most productive manner possible. Many cash managers invest at least a part of this surplus money in marketable securities. As mentioned earlier, marketable securities earn a reasonable rate of return and offer the advantage of being quickly convertible into cash.

There are four criteria that should be considered when evaluating marketable securities: safety, marketability or liquidity, yield, and taxability. Safety refers to the probability that the full principal will be returned without any loss. Financial managers require a very high degree of safety in marketable securities. Marketability refers to how quickly and easily a security can be converted into cash. This factor is especially important if the security is being held as a reserve for the cash account, because it may have to be sold on very short notice. Yield is the interest or the price appreciation received from holding the security. Some securities pay interest; some may have tax-free interest; other securities sell at a discount and pay full face value at maturity. The effect is the same as paying interest. Some securities may have tax-free interest; discount securities may be taxed at a different rate than interest paying securities; and so on. Therefore, a cash manager must be aware of the corporation’s tax situation in order to select the best type of marketable security.

There are three main reasons for investing in marketable securities. One is that they act as a reserve for the cash account. In other words, marketable securities are held to meet unexpected cash needs. Therefore, as noted earlier, their marketability is very important because they may have to be sold quickly.

Securities can also be used to meet known cash outflows. Frequently the need for certain cash outflows can be predicted. One example is taxes. Every company regularly withholds taxes from employees’ paychecks. This money is paid to the government on a monthly or quarterly basis. The cash manager knows the exact amount and the due dates of these payments in advance and can purchase securities that mature at the correct time.

A third reason for investing in marketable securities is that company profits benefit. Cash managers describe funds not needed for cash reserves or taxes as ”free” because such funds are not constrained by specific liquidity requirements. Therefore, cash managers can invest free cash for a higher yield after considering taxes, even though such investments are less liquid and may be a bit more risky.

Creating an Integrated Cash Management System

There are two main benefits to be derived from a cash management program – first, incremental profits that will augment net income, and second, freed-up resources (namely cash) that can be used for other corporate purposes. Both of these benefits are worthwhile, but the most important benefit is probably an effective cash management system. Such a system will not only pay for itself but should also have a positive effect on net income.

Reviewing the cash management cycle from beginning to end is the best approach to integrating cash management with overall company planning. The objective of the review is to find all the ways (that are consistent with the firm’s other objectives) to speed up inflows and slow down outflows. The emphasis should be on evaluating all corporate functions that, from a financial executive’s standpoint, can potentially affect cash flow.

An integrated cash management analysis involves reviewing the firm’s billing and collection procedures in light of industry practice and competition. The purpose of the review is to shorten the time it takes for payments to be put to some useful purpose.

Many banks offer cash management services to both corporate and individual clients. The relationship the company has with its bank and the form and amount of bank compensation must be reviewed carefully. In addition, an in-depth review of forecasting and planning procedures must be done to ensure that management has a good understanding of the company’s cash flow cycle. Both the timing and the amounts of flows must be taken into consideration so that the firm’s short-term investment performance will produce an acceptable rate of return.

A total review of a cash management system should also look beyond cash mobilization to information mobilization. This ensures that the decision maker receives information quickly so excess funds can be invested or short-term liabilities reduced. Clearly, it makes no sense to mobilize a company’s cash if productive uses for the additional funds are not exploited.

The next step in a cash management system is to integrate it with the financial management information system. This means setting up a planning and budgeting system that identifies projected financial needs, forecasts surpluses or deficits of funds, and then makes coordinated decisions to use those funds most effectively. Systematically coordinating short- and long-term activity allows a financial executive to know at all times what is happening at the bank, in the firm’s marketable security portfolio, to the firm’s capital budget plans, and to overall corporate liquidity needs.

The benefits of using cash more efficiently are readily apparent. But if all of the financial functions are combined, the overall cost of managing such a system is reduced. Thus, from both income-generating and cost-reduction perspectives, a cash management system can be self-sustaining.

To develop and implement broader integrated systems, cash managers must take more responsibility for coordinating and working with executives in other functional areas of the firm. It is also important to review corporate policies and procedures, to determine whether there is full interaction in the cash management function.

As a result of the wide-ranging impact of cash management on the entire firm, financial executives have a more complex job than ever before. Such executives must broaden their interests and interactions while at the same time performing the traditional financial functions. For example, they have to interact with the purchasing department and with the materials management staff. They also must play a much larger role in contract negotiations. Too often, contracts are left to the legal department, and some important financial considerations may be overlooked, especially as these considerations relate to the firm’s cash management policies. Costs, payments, disbursement schedules, progress payments, and other financial considerations are of concern to financial executives. They should be involved in negotiations before contracts are finalized.

The idea of taking a company-wide view rather than looking specifically at individual operations makes eminent sense. Cash managers should broaden their perspective and think of cash management as an activity that is affected by all components of the company’s operations. All decisions that are made and actions taken through the company affect cash flow, and hence cash management. This includes everything from production scheduling and inventory control to marketing and credit policy – from tax policy, negotiation, accounting, and control to personnel and payroll. The effects of cash management have an impact on all areas of a company.

The simple statement that cash management speeds up inflows and slows down outflows must be put into perspective for it to be effective and useful. Emphasis should be placed on evaluating how well the organization performs in all cash management areas, and how effectively the concepts as a whole.

Cash Flow Cycle

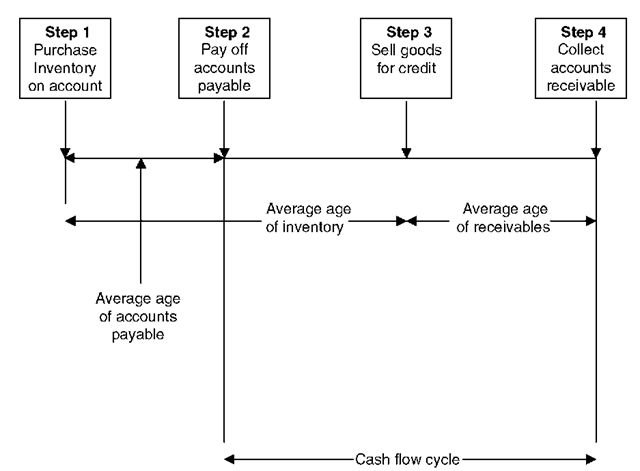

The flow of funds or cash flow refers to the movement of money through the business. The time it takes for these funds to complete a full-cycle reflects the average duration that a firm’s cash is invested in inventory and accounts receivable, both of which are non-earning assets. Therefore, it is in a company’s best interest to keep the cash cycle as short as possible.

To see the relationship between the various accounts and the cash cycle refer to the cash cycle chart below.

The table below shows how cash, accounts receivable, inventory, and accounts payable will be affected by each of the four steps in the cash cycle.

Figure 11.2. Cash cycle

Calculating the Cash Flow Cycle

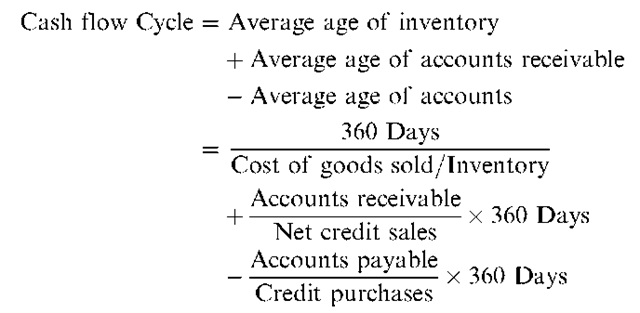

The cash flow cycle is defined as the average age of inventory plus the average accounts receivable less the average age of accounts payable. Or as the cash cycle chart indicates, the cash flow cycle is the average time it takes for a company to pay out cash, and receive a cash inflow that completes the transaction.

The cash flow cycle can be calculated using the following equation:

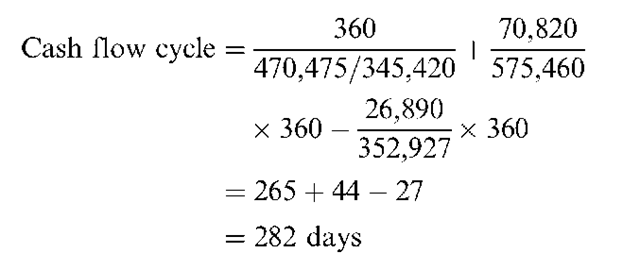

To illustrate how this equation can be put to use, let us look at a Company ABC, where:

Cost of goods sold = $470,570 Inventory = $345,420

Table 11.1. Changes in accounts

| Account | Step 1 Step 2 | Step 3 | Step 4 |

| Cash | 0 - | 0 | + |

| Accounts receivable | 0 0 | + | - |

| Inventory | + 0 | - | 0 |

| Accounts payable | + - | 0 | 0 |

| Accounts receivable | = $ 70,820 | ||

| Net credit sales | = $575,460 | ||

| Accounts payable Credit purchases | = $ 26,890 = $352,927 |

Substituting these figures in our equation, we calculate the cash flow cycle of ABC Company as:

In the above example, ABC’s cash cycle is 282 days. It is not possible to decide at this point if this amount of time is too long or too short because it represents a lot of factors that need to be considered. Calculating your company’s cash flow cycle is the starting point of any analysis that you will have to perform to answer the question: Is cash being effectively managed in my company?

The Matching Principle

One of the fundamental principles of finance is matching the cash inflows from assets with the cash outflows from their respective sources of financing. The technique of hedging can be used when trying to accomplish this objective.

Financing temporary current assets with short-term sources of funds and financing fixed assets and permanent current assets with long-term sources of funds illustrates how the matching principle is put to work. The basic strategy of the perfect hedge is to match the expected inflows and outflows of funds. This is fundamentally sound financing because the inflows of funds from the sale of assets are being used to repay the loans that financed these acquisitions. When the cash inflow is in excess of the required cash outflow, the situation is considered to be more conservative than the opposite case in which the cash outflow is greater than the cash inflow. This imbalance must be met by rolling over short-term financing or seeking other sources of funds. This is considered to be an aggressive approach.

The company, DEF, demonstrates the trade-off that exists between risk and return when using different approaches to the matching principle. The trade-off should be kept in mind when a company is considering a change in its sources of funds in response to changing conditions. The aggressive approach should be used when firms are expanding their working capital during the recovery and prosperity phases of the business cycle. Alternatively, during the recessionary phase, a more conservative approach may be more appropriate.

A Conservative Versus an Aggressive Approach to the Matching Concept

The figures below illustrate the results DEF Company would achieve by employing an aggressive approach or a conservative approach to matching its cash inflows with its cash outflows.

Summary

The purpose of this paper is to put working capital into the proper perspective for managers concerned with managing the cash flow of their firms. They must realize that planning and managing cash flow are more than just managing the cash account. Although the cash account is one of the major assets that affects cash flow, other current assets and current liabilities, and quite often long-term assets and financing, it also has an impact on the cash cycle of the firm.

Table 11.2. DEF Company (dollars in millions)

| Assets | ||||

| Current assets | $100 | |||

| Fixed assets | 100 | |||

| Total assets | $200 | |||

| Liabilities | ||||

| Conser- | Aggres- | |||

| vative | sive | |||

| Short-term | $25 | $100 | ||

| liabilities | ||||

| (at 7%) | ||||

| Long-term debt (at 12%) | 125 | 50 | ||

| Equity | 50 | 50 | ||

| Total liabilities plus equity | $200 | $200 | ||

| Income statement | |||

| Earnings before | $50.00 | $50.00 | |

| interest | |||

| and taxes | |||

| Less: | |||

| Interest | (16.75) | (13.00) | |

| Taxes (at 40%) | (13.30) | (14.80) | |

| Net income | $19.95 | $22.20 | |

| Current ratio | Current assets | 4.0 | 1.0 |

| ^Current liabilities J | |||

| Net working capital | { Current assets— \ Current liabilities | $75.00 | $0.00 |

| Rate of return on equity | Net income V Equity ) | 39.9% | 44.4% |

The concept of working capital and management’s philosophy of trying to maintain it at a particular level are also important. If management is aggressive, it may take one approach to the matching principle that will have direct impact on the cash flow planning process. If management tends to be more conservative, other options may be available. Above all, when we are dealing with the cash flow planning process, it must be remembered that we are involved with a very dynamic situation that is closely related to the character of the decision maker. Therefore, given the exact same situation, two different managers can reach satisfactory solutions that may be entirely different from one another.