Exotic options are possibly defined as all options that are not “vanilla” options, with a predefined (or constant) exercise price and time to expiration, and where there is one underlying asset. Thus exotic options may have uncertain exercise prices, expiration times, and several underlying assets, which may not follow lognormal or normal diffusion processes.

Characteristic exotic options include Asian options, where the exercise price and/or the underlying asset is an average of prices defined over some time period; barrier options, where the option is initiated or extinguished if the asset price hits a specific, predetermined level; chooser options, where the holder has the choice after a number of days whether to hold a call or a put on the underlying asset; compound options which are options on options; and look back options, where the call option holder has the right to buy/sell at the minimum/maximum price recorded over the option lifetime. Perhaps the primary identifying characteristic of exotic options is that the field is particularly fertile for combinations and permutations of the generic exotic types, and options involving innovative characteristics, ideal for creative artists.

The valuation of exotic options is sometimes imply through building blocks of vanilla-type options, perhaps with the asset-price volatility modified (as in Margrabe, 1978), or averaged, as in Asian options. Some illustrations are provided below for such building-block approaches, involving closed-form solutions for barriers, choosers, and look backs. Otherwise, the path-dependent options such as barriers and look backs, the multivariate spread and correlation products, and the nested options, such as complex choosers and compounded options, are valued through numerical methods, including Monte Carlo simulations, lattice methods, and explicit and implicit finite differences.

Brief History of Theory and Practice

Being first in exotic-option theory is alleged of many authors, including Merton (1973), who values a “down and out” barrier option. Earlier Cox and Miller (1965) provided solutions for homogeneous diffusion processes with absorbing barriers, and there were many predecessors. Margrabe (1978) provided a simple valuation for an option to exchange one asset for another, now used for spread options. Geske (1979) valued compound options, while Goldman et al. (1979) provided the valuation methodology for look back options, without regret, buying at the low and selling at the high.

The Rubinstein (1991) working paper has been widelly circulated, and parts published in RISK over the last three years, along with many other authors. Thus exotic options are no longer so “strikingly unusual or colourful in appearance or effect,” as finance text topics such as Gemmill (1993) provide solutions and illustrations.

The use of exotic options is largely anecdotal, since only a few exotics have been exchange traded. No doubt there were many imbedded options in contracts and bonds, such as the publicly traded Petro-Lewis 9 percent guaranteed oil-indexed notes issued in April 1981 which had contingent interest based on look-back Asian barrier features, prior to the academic and investment banking “discoveries” of exotics in the late 1980s.

Perhaps a distinguishing feature of exotics is that options are designed to suit almost any conceivable or desired payoff structure for an investor, or for a producer/consumer who seeks a complex, customized hedge for commodity, interest rate, equity, currency, or other asset/ liability exposure.

Barrier Options

An extinguish (or absorbing) barrier option is a vanilla option from the contract date until (or if) the underlying asset hits a predetermined level, and the option is “knocked out.” Thus the potential time of the option is uncertain and is no greater than a vanilla option with the same original time to expiration. An exercisable (or knock in) option is activated only when the barrier has been hit. In both cases, when the barrier is hit, either the option expires or is exercised or the then time to expiration is specified.

There are a wide variety of barrier options including the simple knockouts, such as down and out call, down and out put, up and out call, and up and out put; the knock ups, down and in call, down and in put, up and in call, and up and in put; and other combinations, such as the knockout must be both up and down or either up and down (double barriers); or there are a specified number of partial sufficient, or necessary, barriers for knockout or knockin.

A simple valuation of down and in call barriers (without any rebates) is:

where

and S is the underlying asset, T is the time to expiration (if barrier not hit), r is the riskless rate, X is the exercise price, H is the barrier, 8 is the underlying asset payout rate, a is the volatility of underlying asset, and N is the cumulative normal distribution; then

With these building blocks, plus a few additions, Rich (1994) shows how to construct a long menu of barriers.

Chooser Options

A curious convention is that choosers are options for the undecided, or “as you like it” options. For payment today, the holder has the right (and requirement) to choose, after t days, whether to hold a call or put on the underlying asset. This enables the investor to establish a long position in volatility, but unlike a vanilla straddle or strangle, the investor is forced to abandon one option at the decision or choice date.

If the call and put have a common exercise price and (initially) remaining time to expiration, the chooser payoff is:

where C(X, T-1) is the value of a call option and P(X, T-1) is the value of a put option.

If t1 is the time of required choice, and S1 is the asset price at t1, the European put-call parity theorem implies:

This package has the same value as:

where

Lookback Options

The lookback option is termed an option for investing without any regrets, or always buying at the low and/or selling at the high, or for investors without any market-timing ability. While the option holder is guaranteed the “best” price over a specified period, the disadvantage is the high cost, compared to a plain vanilla option.

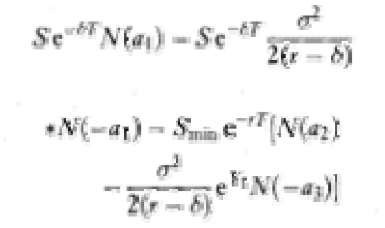

The payoff from a lookback call is: MAX (0, ST- Smta) and the initial value is:

where Smin is the minimum value achieved to date (Gemmill, 1993) and

Research and Practical Issues

Exotic options may be adapted to suit a wide variety of investment objectives and exposures, often derived directly from the solutions provided for certain types of partial differential equations. However, with complexity, both the assumed usage and conceivable dynamic hedging processes may become problematical. Since exotics are by definition innovative, new exotic formations and combinations should be a growing industry. Plausible exotics may cover all sorts of distribution functions, chapters of texts on probability and measure, and stochastic processes, including fat tails, and extremes, incorporating stochastic volatility, correlation, and discontinuities.