Graphics Reference

In-Depth Information

is the probability of such an event, which clearly reflects the volatility inherent in the

business. In addition, it can serve as a useful tool when planning how the insurer's

funds are to be used over the long term.

he ruin probability in a finite time T is given by

ψ

(

u, T

)=

P

inf

<

t

<

T

R

t

<

(

.

)

Most insurance managers will closely follow the development of the risk business

and increase the premium if the business behaves badly. he planning horizon may

be thought of as the sum of the following: the time until the risk business is found to

behave “badly,” the timeuntil the management reacts, andthe time until the decision

to increase the premium takes effect (Grandell,

).

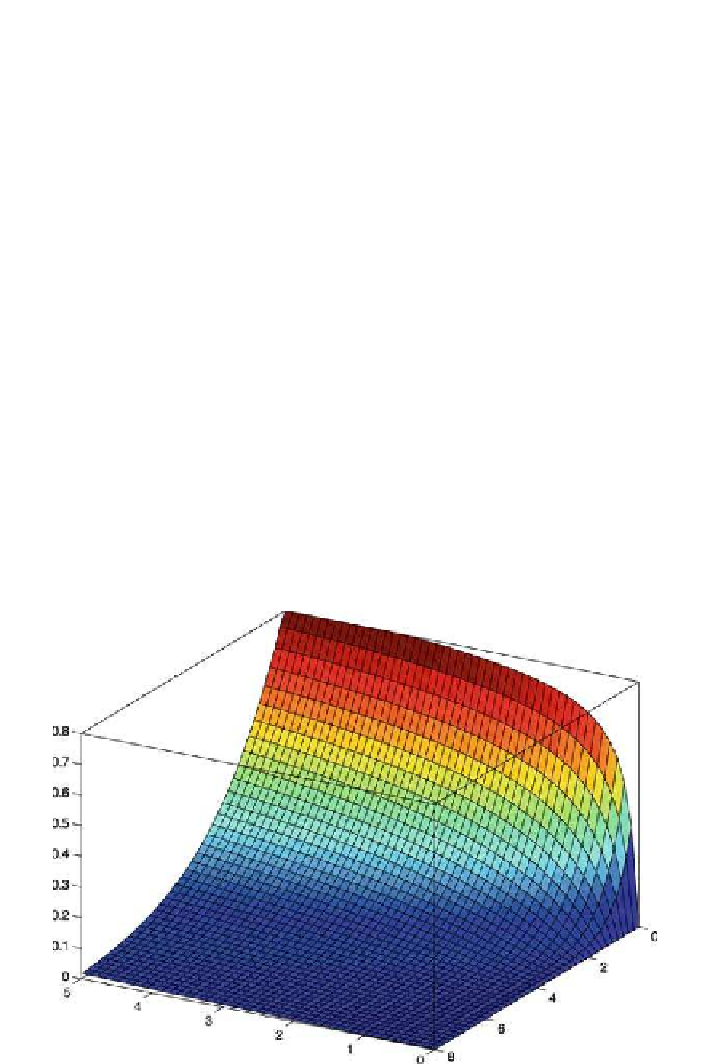

In Fig.

.

, a three-dimensional (

-D) visualization of the ruin probability with

respect to the initial capital u (varying from zero to eight million DKK) and the time

horizon T (ranging fromzero tofive months) isdepicted.he remaining parameters

of the risk process are the same as those used in Figs.

.

and

.

, except that the

relative safety loading was raised from θ

.

. We can see that the

ruin probability increases with the time horizon and decreases as the initial capital

grows.

he ruin probability in finite time can always be computed directly using Monte

Carlosimulations. Naturally, thechoiceofthe intensity function andthe distribution

=

.

to θ

=

Figure

.

.

Ruin probability plot with respect to the time horizon T (let axis,inmonths)andthe

initial capital u (right axis, in million DKK). he relative safety loading θ

.

; other parameters of

the risk process are the same as in Fig.

.

. From the Ruin Probabilities Toolbox

=