Graphics Reference

In-Depth Information

the score, the farther the company is from the class of bankrupt companies, and so

(we can assume) the lower its PDis. his means that the dependence between scores

and PDs is assumed to be monotonous. his is the only kind of dependence that was

assumed in all rating models mentioned in this chapter, and the only one we use for

the PD calibration.

he conversion procedure consists of the estimation of PDs for the observations

in the training set with a subsequent monotonisation (steps one and two) and then

the computation of the PD for a new company (step three).

Step one is the estimation of PDs for the companies in the training set. We used

kernel techniques to perform a preliminary evaluation of the PD for observation i

from the training set, i

=

,

,...,n:

n

j

=

K

h

(

x

i

, x

j

)

I

y

j

=

)=

PD

(

x

i

.

(

.

)

n

j

=

K

h

(

x

i

, x

j

)

A k nearest neighbor Gaussian kernel was used here. h is the kernel bandwidth.

he preliminary PDs evaluated in this way are not necessarily a monotonic func-

tion of the score. he monotonisation of

,

,...,n is achieved at step two

using the pool adjacent violators (PAV) algorithm (Barlow et al. (

) and Mam-

PD

i

, i

=

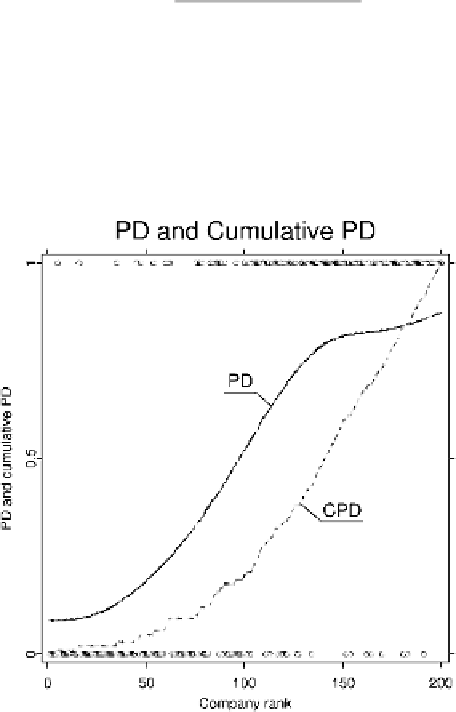

Figure

.

.

PD and cumulative PD estimated with the SVM for a subsample of

observations from

the Bundesbank data. he variables included in the model were those for which the higher AR

achieved: K

, K

, K

, K

, K

, K

, K

and K

. he higher the score, the higher the rank of the

company