Graphics Reference

In-Depth Information

twoway (scatter rs id, text( -3 27 "Possible Outliers", size(vlarge)))

(scatteri -3 18 -4.8 10, recast(line))

(scatteri -3 18 -3 3, recast(line)), legend(off)

This graph is similar to the one above

but uses the

text()

option to add text

to the graph. Two

scatteri

commands

are used to draw a line from the text

Possible Outliers

to the markers for

those points. The

coordinates are

given for the starting and ending

positions, and

recast(line)

makes

scatteri

behave like a line plot,

connecting the points to the text.

Uses allstates.dta & scheme vg s2c

yx

Possible Outliers

0

10

20

30

40

50

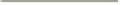

twoway (scatter rs l [aw=cd], msymbol(Oh))

(scatter rs l if cd > .1, msymbol(i) mlabel(stateab) mlabpos(0))

(scatter rs l if cd > .1, msymbol(i) mlabel(cd) mlabpos(6)), legend(off)

This graph shows the

leverage-versus-studentized residuals,

weighting the symbols by Cook's

CT

.1235647

D

(

cd

). We overlay it with a scatterplot

showing the marker labels if

cd

exceeds

.1, with the

cd

value placed underneath.

Uses allstates.dta & scheme vg s2c

AK

.1903994

DC

.6812371

0

.1

.2

.3

.4

Leverage

Imagine that we have a data file called

comp2001ts

that contains variables representing

the stock prices of four hypothetical companies:

pricealpha

,

pricebeta

,

pricemu

,and

pricesigma

, as well as a variable

date

. To compare the performance of these companies,

let's make a line plot for each company and stack them. We can do this using

twoway

tsline

with the

by(company)

option, but we first need to reshape the data into a

long

format. We do so with the following commands:

. vguse comp2001ts

. reshape long price, i(date) j(compname) string

We now have variables

price

and

company

and can graph the prices by company.

The electronic form of this topic is solely for direct use at UCLA and only by faculty, students, and staff of UCLA.