Information Technology Reference

In-Depth Information

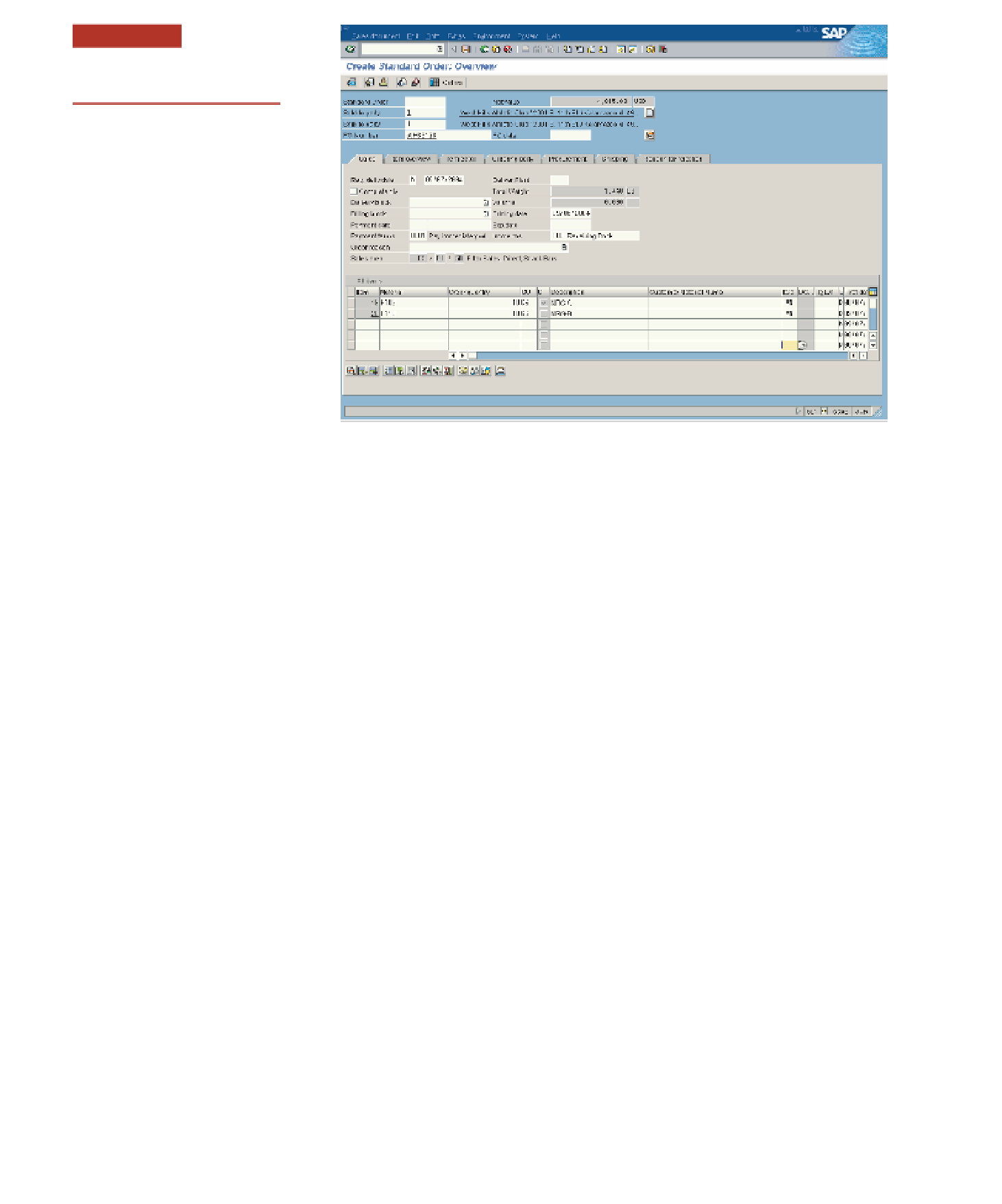

Figure 9.9

Sales Order Entry Window

(Source: Copyright © by SAP AG.)

•

An order clerk records a sale and the ERP system automatically creates an accounts

receivable entry indicating that a customer owes money for goods received.

•

A buyer enters a purchase order and the ERP system automatically creates an accounts

payable entry in the general ledger registering that the company has an obligation to pay

for goods that will be received at some time in the future.

•

A dock worker enters a receipt of purchased materials from a supplier, and the ERP system

automatically creates a general ledger entry to increase the value of inventory on hand.

•

A production worker withdraws raw materials from inventory to support production,

and the ERP system generates a record to reduce the value of inventory on hand.

Thus, the ERP system captures transactions entered by workers in all functional areas of the

business. The ERP system then creates the associated general ledger record to track the

financial impact of the transaction. This set of records is an extremely valuable resource that

companies can use to support financial accounting and managerial accounting.

Financial accounting consists of capturing and recording all the transactions that affect

a company's financial state and then using these documented transactions to prepare financial

statements to external decision makers, such as stockholders, suppliers, banks, and govern-

ment agencies. These financial statements include the profit and loss statement, balance sheet,

and cash flow statement. They must be prepared in strict accordance to rules and guidelines

of agencies such as the Securities and Exchange Commission, the Internal Revenue Service,

and the Financial Accounting Standards Board. Data gathered for financial accounting can

also form the basis for tax accounting because this involves external reporting of a firm's

activities to the local, state, and federal tax agencies.

Managerial accounting involves using “both historical and estimated data in providing

information that management uses in conducting daily operations, in planning future oper-

to enable the firm's managers to assess the profitability of a given product line or specific

product, identify underperforming sales regions, establish budgets, make profit forecasts, and

measure the effectiveness of marketing campaigns.

All transactions that affect the financial state of the firm are captured and recorded in

the database of the ERP system. This data is used in the financial accounting module of the

ERP system to prepare the statements required by various constituencies. The data can also

be used in the managerial accounting module of the ERP system along with various assump-

tions and forecasts to perform various analyses such as generating a forecasted profit and loss

statement to assess the firm's future profitability.