Information Technology Reference

In-Depth Information

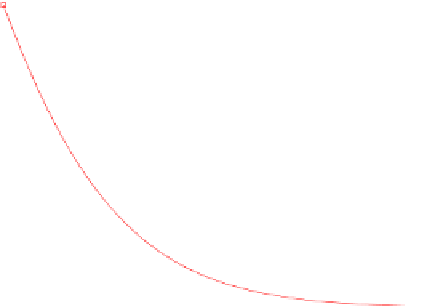

Fig. 6.1

Down-and-out,

down-and-in barrier put and

plain vanilla put option

Example 6.1.2

Consider a down-and-out and down-and-in put option. Set

K

=

100,

T

0

.

01. We plot the price of both options and the

corresponding plain vanilla put price in Fig.

6.1

. Here, we computed the down-

and-out barrier option using finite elements and applied formula (

6.1

) to obtain the

corresponding down-and-in contract.

=

1,

B

=

80,

σ

=

0

.

3 and

r

=

6.2 Asian Options

Asian options are path-dependent options where the payoff depends on the price

history of the underlying, in particular on the arithmetic average price at maturity,

T

1

S

T

:=

S(τ)

d

τ.

(6.3)

T

−

t

0

t

0

The term

T

−

t

0

denotes the length of the averaging period. Applying Itô's formula

we

set

t

0

=

0. There are different types of o

pt

ions. The

fixed strike

call has payoff

(S

T

−

K)

+

and the

floating strike

call

(S

−

S

T

)

+

. To derive the partial differential

equation, we introduce the

new variable

t

=

Y(t)

S(τ)

d

τ.

0

Since this history of the asset price is independent of the current price

S(t)

,

we

may treat S

,

Y and t as independent variables

. The value of an Asian can then be

obtained in the form

V(t,S,Y)

. We need a stochastic differential equation for the

vector process

(S, Y )

. Applying Itô formula, we obtain that

(S, Y )

is a diffusion

process,

Search WWH ::

Custom Search