Environmental Engineering Reference

In-Depth Information

Table 2

Correlations without drift

q

Crude oil

Gasoline

Diesel

Crude Oil

1.0000

0.5895

0.7744

Gasoline

0.5895

1.0000

0.6789

Diesel

0.7744

0.6789

1.0000

Table 3

Correlations with drift

q

Crude Oil

Gasoline

Diesel

Crude oil

1.0000

0.5872

0.7722

Gasoline

0.5872

1.0000

0.6786

Diesel

0.7722

0.6786

1.0000

Similar approaches can be taken to calculate correlations. If the calculations are

based on

R

t

gures shown in Table

2

are obtained. If the residues are used, those

shown in Table

3

are obtained.

As can be seen, the differences between the results given by the two methods are

minimal here too.

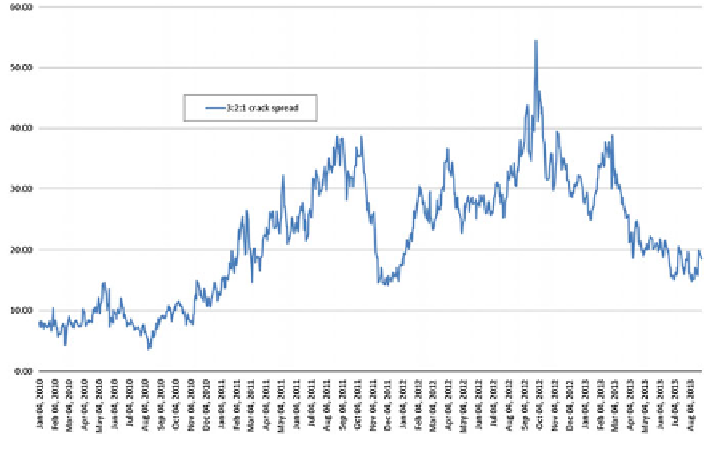

With the market data the historical values of a 3:2:1 crack spread can be cal-

culated. The result is shown in Fig.

2

.

Volatility can be estimated for an IGBM model, resulting in

r

IGBM

¼

the

1

7155.

:

Observe that in this case

r

IGBM

S

t

;

appears in the stochastic component of the dif-

ferential equation, which prevents negative values from being obtained. In the case

studied here, an analysis of Fig.

2

shows that there have been no negative values for

Fig. 2

Historical spot prices for 3:2:1 crack spread

Search WWH ::

Custom Search