Chemistry Reference

In-Depth Information

1

x

2

x

2

c

2

E

S

NE

E

S

c

2

NE

c

1

E

2

E

1

c

1

x

1

x

1

0

1

0

1

(a)

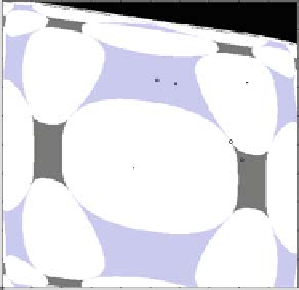

(b)

Fig. 5.2

The duopoly game with logistic reaction functions. Firm 2 has full information but firm

1 has misspecified demand. (

a

) The misspecification parameter of firm 1 is "

1

D

1:12, E

S

is

the unique stable steady state (

light grey

basin of attraction) coexisting with a stable cycle of

period 2 (

white basin

). Other parameters are

1

D

2:8;

2

D

2:9;"

1

D

1:12;"

2

D

1.(

b

)The

misspecification parameter of firm 1 increases to "

1

D

1:18. Two new subjective equilibria E

1

;E

2

emerge, of which E

1

is stable (

dark grey

basin of attraction) and E

2

is unstable. Other parameters

are

1

D

2:8;

2

D

2:9;"

1

D

1:18;"

2

D

1

with "

1

D

1:12 and "

2

D

1. In this case the strategy space consists of the basins

of two coexisting attractors, namely the subjective equilibrium E

S

and a 2-cycle

C

2

D

.c

1

;c

2

/ (as well as a small portion of the basin of infinity). If the misspecifi-

cation parameter "

1

is further increased, two new steady states are created, denoted

by E

1

and E

2

in Fig. 5.2b (obtained for "

1

D

1:18). These new subjective equilibria

are created via a saddle-node bifurcation (through a mechanism similar to the one

shown in Fig. 5.1) and, as a result, they appear far away from E

S

. The subjective

equilibrium E

1

is stable (a stable node) and E

2

is unstable. Furthermore, a stable

cycle C

2

coexists.

Observe that the Nash equilibrium NE of the true game is located in the basin

of E

S

and is quite near to E

S

. If the initial quantities of the firms are located in

the basin of E

S

, then the adjustment process leads to a situation where the long run

outcome is close to the Nash equilibrium of the true game. On the other hand, if

the trajectories converge to E

1

, then the adjustment process based on misspecified

demand relationships leads the firms to an equilibrium which is quite different from

the true Nash equilibrium. It is interesting to notice that Fig. 5.1b shows that in

E

1

firm 1 has a higher market share, and it turns out that it also has a higher profit

than firm 2 ('

1

D

0:465;'

2

D

0:2). Despite the fact that firm 2 knows the true

demand, firm 1 (although unwittingly) achieves not only market dominance, but -

with regard to the full information case - gains a higher profit, whereas firm 2's

profit is reduced by more than 50%.

Search WWH ::

Custom Search