Chemistry Reference

In-Depth Information

2

x

0

10

S

0

β

1

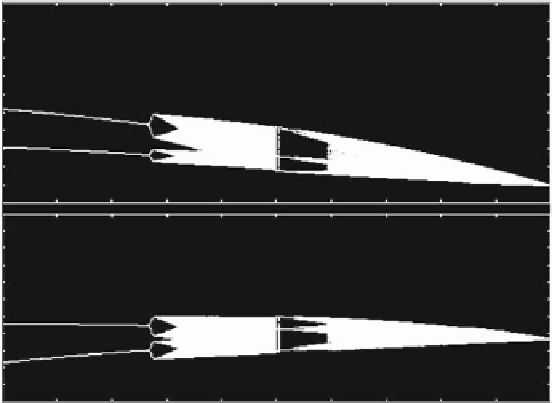

Fig. 4.18

The oligopoly model with intertemporal demand interaction and adaptive adjustment

in the discrete time case. The N-firm symmetric model with iso-elastic price function and linear

cost functions. Bifurcation diagrams with respect to ˇ

S

when the number of firms is increased

to N D 10 and the speed of adjustment is decreased to a D 0:5. Other parameter values are

as in Fig. 4.17. Note that the amplitude of the fluctuating attractors is much reduced compared to

Fig. 4.16 and 4.17

with N

D

4 instead of N

D

3. Now we see that the stable 2-cycles are born at ˇ

S

D

0

and period-doubling followed by period halving occurs at intermediate values of ˇ

S

.

As is commonly observed in adaptive models, the amplitude of the oscillations is

reduced with decreasing values of the speed of adjustment a. This effect is shown

in Fig. 4.18, obtained with the number of firms being increased to N

D

10 and the

speed of adjustment being decreased to a

D

0:5. The other parameters remain as in

Fig. 4.17.

When the asymptotic dynamics is chaotic, it is important to study the size and

the shape of the chaotic attractors inside which the long-run dynamics are ulti-

mately bounded. As already shown in the examples of the previous chapters (see

also Appendix C), the boundaries of the chaotic sets can be obtained by taking the

images of the folding curves, that may be critical curves (loci of vanishing Jacobian)

or the lines of non-differentiability (the borders that separate the different regions

D

.i /

). In our case, the candidates for the “folding curves” are:

The curves of non-differentiability, which are the lines .N

1/x

C

ˇ

S

S

D

A=c

when L>A=.4c/and the lines .N

1/x

C

ˇ

S

S

D

z

1

and .N

1/x

C

ˇ

S

S

D

z

2

when L<A=.4c/;

The curves of vanishing Jacobian, given by

det

J

.1/

.x;S/

D

0.

In Fig. 4.19 two chaotic attractors are shown. Figure 4.19a is obtained with the

parameters N

D

8, A

D

1, c

D

0:15, L

D

2, a

D

0:8, ˇ

S

D

0:55,for

Search WWH ::

Custom Search