Chemistry Reference

In-Depth Information

The results given in this proposition show that for a large set of values of the

cost externality and the adjustment speed a, multiple stable Nash equilibria are

obtained (see the shaded area in Fig. 3.11). Additionally, for sufficiently high values

of the adjustment coefficient a in this area, namely for a>a

p

./, a stable 2-cycle

C

2

coexists with the two stable equilibria E

1

and E

2

. This latter point seems to be

important for the following reason. If the adjustment process converges to the equi-

libria only if initial conditions are chosen from a certain subset of

and otherwise

it cannot be observed, it becomes crucial to obtain information on the relative size

of the set of initial conditions from which players can eventually coordinate their

actions (see Mailath (1998), Fudenberg and Levine (1998)).

We will now turn to the analysis of the global dynamics of the model. Since we

are not able to discriminate among the equilibria E

1

and E

2

on the basis of the

local stability properties, to obtain further information on the stability properties of

the Nash equilibria we will study their basins of attraction. Figure 3.12 depicts the

basins of the locally stable equilibria E

1

and E

2

for two quite distinct situations.

In Fig. 3.12a, obtained with

D

3:4 and a

D

0:2<1=.1

C

/

D

0:2273, the basins

have a quite simple structure. For initial production quantities in

S

with x

1

.0/ >

x

2

.0/ the adjustment process (3.23) converges to the equilibrium E

1

. On the other

hand, if the reverse inequality holds, then the process converges to the equilibrium

E

2

. Therefore, if firm 1 (firm 2) initially dominates the market in terms of market

share, this property prevails throughout and the equilibrium E

1

(equilibrium E

2

)

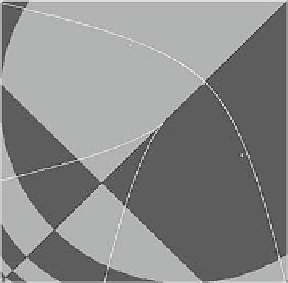

is eventually selected. In contrast to this, the situation shown in Fig. 3.12b, is quite

different. It is obtained with the same value of the cost externality , but with higher

values of the adjustment coefficients, namely a

D

0:5 > 1=.1

C

/

D

0:2273.In

S

1

1

x

2

E

2

x

2

E

2

Δ

Δ

E

S

E

S

Δ

−1

K

Z

0

E

E

1

LC

(

b

)

LC

(

a

)

Δ

−1

Z

2

Z

4

x

1

x

1

0

1

0

1

(a)

(b)

Fig. 3.12

Oligopolies with linear inverse demand function and cost externalities. The case of

duopoly with identical speeds of adjustment. Basins of attraction of the multiple Nash equilibria

(

a

) Simple structure for

0:2. Convergence to either E

1

or E

2

depending on which

firm dominates initially. (

b

) Non-connected basins for

D

3:4 and a

D

0:5, now convergence to

E or E

2

cannot be determined on the basis of which firm dominates initially

D

3:4 and a

D

Search WWH ::

Custom Search