Civil Engineering Reference

In-Depth Information

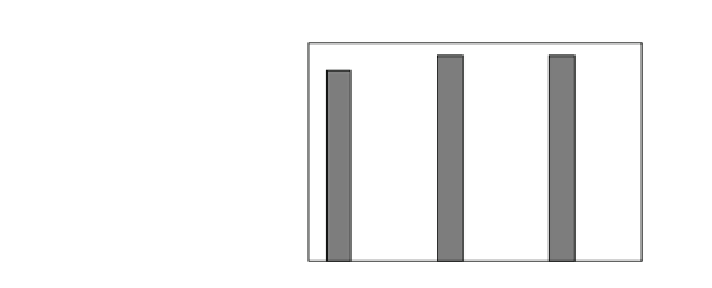

Fig. 4 Two-stage

investment with option to

abandon V

min

to implement

stage 1 (Menassa

2011

)

σv

=

0.1

σv

=

0.2

σ

v

=

0.5

$14

$12

$10

$8

$6

$4

$2

[I

1

-

I

2

]

(Million)

$0

[$1 - $9]

[$5 - $5]

[$9 - $1]

6.3.3 Multistage Investment with Option to Stage

In this scenario, all stages of the investment need to be implemented before the

building can be operated and occupied again. However, because of budgeting,

financing, and technical constraints, the decision-maker wishes to stage the

investment over a period of time. This might be the case where the building

requires major refurbishment that forces all the existing tenants of the building to

move to an alternative accommodation during the refurbishment process. The total

investment expenditure is still I; however, the expenditures at any specific stage

cannot exceed a preset rate i. Thus, if the NZER is to be implemented in n stages,

then I

P

k

¼

1

i

k

and i

k

i. This type of the investment allows the decision-maker

to stage the investment and stop or abandon the investment at any given stage

(Majd and Pindyck

1987

) and (Espinoza and Luccioni

2007

). However, if the

project is abandoned after several stages of investing, then the building owners

will not be able to operate the building because not all the refurbishment measures

are in place. This is a major difference between this scenario and that presented in

the previous section. Majd and Pindyck (

1987

) developed the partial differential

equations along with the boundary conditions for this type of investments

assuming a perpetual American option with time to build. A discussion of the

numerical solution can be found in both (Dixit and Pindyck

1994

) and (Majd and

Pindyck

1987

). For the purpose of this problem, the approximate solution pro-

posed by Espinoza and Luccioni (

2007

) is adopted to determine the value of this

investment at each stage NPV

m

. The assumptions underlying this approximate

solution are as follows:

1. I

0

is the present value of investment cost assuming that investment is contin-

uously made over a period of time T = I/i at a rate that does not exceed i. The

value of this investment cost at time k = 0 and k = m is given in Eqs. (

4

) and

(

5

), respectively: