Information Technology Reference

In-Depth Information

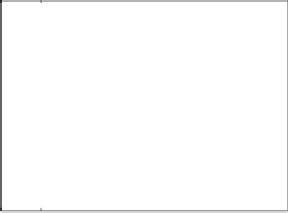

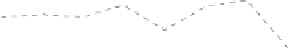

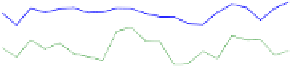

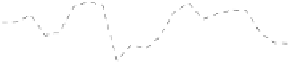

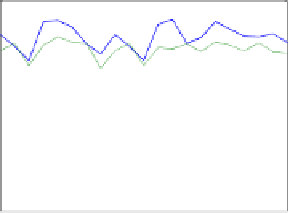

Revenue of Agents in Experiment A

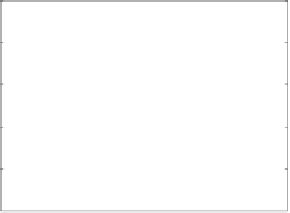

Revenue of Agents in Experiment B

60

60

SouthamptonSCM

HP−Agent

SouthamptonSCM

40

40

HP−Agent

20

HV−Agent

20

0

HV−Agent

−20

0

Dummy Agent

Dummy Agent

−40

−20

−60

−40

−80

1

2

3

4

5

6

7

8

1

4

7

10

13

16

19

21

Game

Game

(a)

(b)

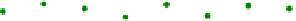

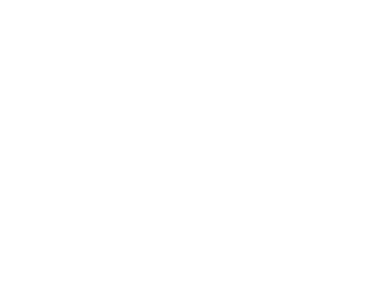

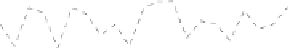

Revenue of Agents in Experiment C

60

SouthamptonSCM

HP−Agent

20

HV−Agent

−20

−60

−100

Dummy Agent

−140

−180

1

4

7

10

13

16

19

21

Game

(c)

Fig. 3.

Revenue of each kind of agent

We now start to analyse the performance of the different agents as shown in Fig-

ure 3.

10

In experiment A, it can be seen that SouthamtptonSCM performs significantly

better than the other two agents and that the HP-agent is better than the HVs. In exper-

iment B, SouthamptonSCM is significantly better than both HP-agents and HV-agents

and the HP-agents are better than the RAs. In experiment C, SouthamptonSCM is sig-

nificantly better than the other two, however we cannot differentiate statistically which

agent is better between HP and HV agents. Now, in all cases, we can attribute this suc-

cess of SouthamptonSCM solely to the adaptivity aspect of its pricing (because this is

the only difference between the agents). Moreover, we found that the average revenue

SouthamptonSCM obtained is 49

.

7% higher than HP-agents in experiment A, 129

.

7%

higher in experiment B, and 58% higher in experiment C. This means, relatively speak-

ing, SouthamptonSCM does best in experiment B. It is interesting that there are more

HP-agents in experiment B than in A (

i.e.

, our agent performs better in a more uncertain

environment). This further shows that the adaptivity of prices are effective in this case.

However, in experiment C, more agents use the Day-0 bidding strategy and this affects

all the agents greatly (see the discussion below).

10

Statistical significance is computed by a Student's t-test and this shows all results are signifi-

cant (

p<

0

.

05).