Environmental Engineering Reference

In-Depth Information

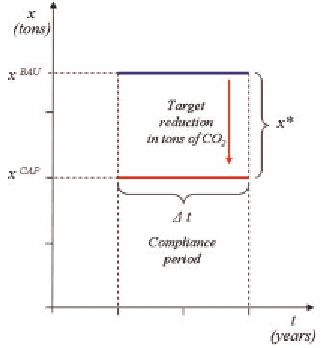

Figure 1. Derive target reduction for compliance

period

Figure 2. Derive price point for emission allow-

ances

in comparison to business as usual emissions. The

demand curve and slope depends on how costly it

is to reduce emissions to avoid having to purchase

allowances in the market.

In the following we illustrate the cap and trade

market mechanism as a transmission channel in

an emissions constraint economy. The reason to

focus on the impacts in the electricity sector is

twofold. First, for most economies the coal, gas

and oil fired power generation plants are the largest

commercial emitters and, hence, are most affected

by emissions constraints. Secondly, electricity is

a regional product where producers do compete

with other regional producers subject to the same

cap and trade regime but not with outside produc-

ers. Hence, electricity producers in a liberalized

electricity market should be able to pass on emis-

sions related costs to the wholesale and retail

consumer. This differs in other industry sectors,

where firms covered by the regime would have

to compete with others outside the regime.

14

We

make the assumption that the electricity market is

liberalized as it is more or less the case for most of

the large electricity markets in the EU. It follows

from this assumption that electricity prices should

reflect the short run marginal cost of generation

which will include the cost of consuming emis-

sion allowances.

15

Figures 1 to 3 illustrate the transmission chan-

nel in an emissions constraint economy from set-

ting a certain cap on overall emissions

x*

(Figure

1) to deriving a market based price point

p*

where

marginal revenues and marginal abatement cost

per ton of CO2 are balanced (Figure 2) to finally

arrive at an electricity price

p

E

where the carbon

uptick of

p*

times the specific efficiency factors

is added to each generation technology of an

economy's electricity generation fleet.

Figure 1 illustrates the equivalent of cumula-

tive emissions in a business as usual scenario

without emissions constraints denoted with

x

BAU

.

The cap

x

CAP

, i.e. the maximum amount of emis-

sion allowances allocated, is defined for a certain

compliance period

Δ t

. The target reduction

x*

results from the difference of

x

BAU

and

x

CAP

. The

target reduction

x*

determines the scarcity in the

emissions trading market and, hence, defines the

price point

p*

in Figure 2.

Since the aggregate marginal cost of abate-

ment in the economy is not observable as such,

the price point

p*

is the result of the individual

firms calculus to balance the marginal cost of