INTRODUCTION

During the last few years, the growing interest in the banking industry on the Internet has led to the development from simple banking Web sites into comprehensive online banking portals (OBP). These portals offer a great variety of services in addition to traditional bank products and thereby enable customers to obtain financial advice from a single source.

Very few contributions in the academic and business literature concerned OBP compared to other topics dealing with banking in general such as adoption factors and customer acceptance studies. This chapter could be a major contribution in this field by bridging the gap in the literature. It gives a comprehensive definition of OBP and analyses the diversity of competitive, technical and strategic challenges faced by banks on the Internet.

Background: Defining Online Banking Portals

Web portals are defined and analyzed differently in the literature. In their study on media concentration in Internet, Dewan, Freimer, Seidmann, and Zhang (2004) recognize portals by the highest number of their visitors comparatively to other Web sites. For example, Yahoo and Google are the two major Internet portals visited by 58% and 39% of all users, but also this disparity is increasing over time. These portals are gateways, providing value-added services continuously scanning the World Wide Web (WWW) to offer sorted and updated links to other more specific Web sites.

Smith (2004) recognizes the heterogeneous nature of Web portal definitions. He identifies 17 definitions of portals and classes of portals published between 1999 and 2000. This confusion is due to the fact that:

Many definitions focused on the application being provided or the intended markets, while several listed specific kind of applications a portal would be likely to provide. However, it is impractical to compare portal products on the basis of application suite or market, since a given market may support many configurations of features. (Smith, 2004)

The conclusion here is that the definition of a Web portal must be tailored on the activity sector, as well as on the relative business model and the technical architecture used.

This perspective was analyzed by Saatcioglu, Stallaert, and Whinston (2001) in the case of financial portals. They propose a business model resembling an “AOL of the financial services industry” to interpose between customers (individuals, institutions, businesses and governments) and specialized financial partners (news, information, advisory services, index tracking, stock pricing, etc.). This model corresponds to an exclusively trading profile of customers. However, authors added banking services, insurance, mortgage and tax services to the global financial offer given to their customers (Saatcioglu et al., 2001). I do not agree with this classification because it does not take into account the difference between trading services and banking services, and that between individual and corporate customers’ needs of online services. Figure 1 presents a general review of classic services offered by OBP.

OBPs are different from simple electronic banking Web sites. They offer a unique access point for a great variety of product and services. Bauer et al. (2005) define OBP in accordance with three major dimensions:

1. Integration Dimension: OBP includes all the stages of the financial transaction cycle (information provision, initiation, negotiation, execution, settlement, after sales support, etc.).

2. Aggregation Dimension: OBP gives the widest offer of product and services among settlement of strategic alliances. Acceding to a broader range of offerings at one single site, increases transaction efficiency and reduces opportunity costs.

3. Personalization Dimension: OBP gives to differentiated segments of customers the possibility to customize displayed commercial offers and Internet communication campaigns to their specific needs and profiles. This dimension enables the customer to the reduce time and cost of finding an adapted product or service.

Although the undeniable advantage presented by this recent definition, Bauer et al., (2005) does not take into account the technical, organizational, and risk management dimensions of OBP. White (2000) tried to underline these aspects in his analysis of enterprise information portals (EIP). He concentrates on back-office systems, heterogeneous databases management, structured access, customized interfaces, multi-level security, future-proof, etc., as factors of failure or success of EIP. This analysis reinforces the idea that the value of Internet business models is linked to technology deployment levels and conditions.

Figure 1. Classic services offered by an OBP

CHALLENGES OF ONLINE BANKING PORTALS

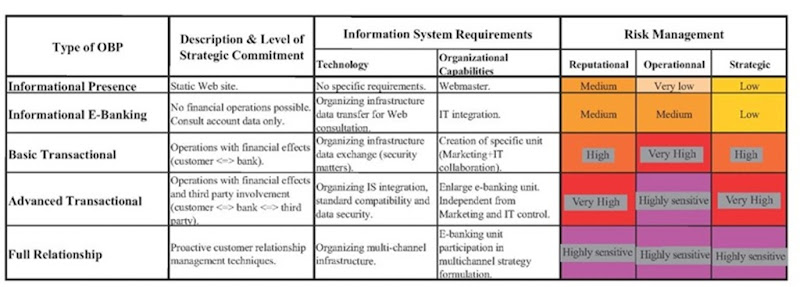

The range of services offered by OBP is determined by many factors. These factors show the type of the bank’s commitment in an Internet strategy and every type of OBP corresponds to a particular strategy, IS organization and risk levels (see Table 1). Naturally, the risk level increases in the case of a high commitment strategy (full relationship OBP) and decreases significantly in case of low commitment strategy (informational presence OBP). In addition, IS requirements in terms of technology and organizational capabilities vary considerably with the chosen type of OBP.

“Informational e-banking” is the first type of OBP for which a specific link must be established between the Web and the IS of the bank. In order to give the customer a minimum amount of information about his current transactions, core banking infrastructure has to be organized to fit in with data transfer. In many cases, IT integration is carried out to ensure compatibility and transferability of data between different systems (central banking and Web server). The difference in risk levels comparatively to “informational presence” is due to the risks of transferring data especially in an “open” area like Internet. Operational risk increases very quickly from “very low” to “medium” because the gap between these two types of OBP is the highest commitment in organizing and managing technology change. However, strategic risk do not increase given that account consultation is not considered as a competitive advantage or a high valuable service: it is a strategic necessity in almost all markets in developed and emerging countries.

Technology management becomes more and more important for the following types of OBP because internal organization decisions have to be made. For example, a “basic transactional” type is the first step of close collaboration between marketing and IT departments. From here, OBP implementation is considered more than an IT operation, it is also an important tool to increase brand image value and to establish customer loyalty. However, the competitive advantage of OBP is much more dependent on the organizational capability of the bank to call up organization synergies than the quality of technical infrastructure. This capability ensures flexibility and reactivity of OBP back-office management to changes in market competition or customer needs.

Table 1. Connecting type of OBP to IS requirements and risk management level

FUTURE TRENDS

Implementing OBP is not independent from other functions of the bank and must be integrated into its whole strategy. The rise of customer relationship management as one of the key techniques to harmonize customer knowledge among distribution channels should affect the way OBPs are implemented. In fact, the Internet is no more than a channel of distribution that could create more value if associated with coming information from other channels. To obtain a full relationship via the Internet, a bank must define a progressive multi-channel strategy and support the highest level of risk management. In addition, successive mergers and acquisitions waves in the financial industry will have a deep impact on the nature and the structure of OBPs offered products and services.

CONCLUSION

My recent research on online banking citations in multiple academic and professional databases show some confusing uses of many synonyms: electronic banking, Internet banking, e-banking, and PC banking.

In the academic literature, electronic banking is an umbrella concept that could be considered as the container of all other concepts. However, online banking is more often used by non peer-reviewed journals, magazines and newspapers as an umbrella concept.

In addition, e-banking is progressively disappearing from the literature and Internet banking is more often preferred because of its precision to speak about customer access to their accounts via Internet. PC banking is used generally to describe a direct connection between a customers PC and an internal server within the bank by means of electronic data interchange (EDI) or any other private network. In this case, special software is provided by the bank to the customer in order to establish the connection.

Every one of these concepts corresponds to a specific level of OBP development. The period preceding the Internet’s rise is dominated by PC banking, especially for corporate customers. Before the Internet became popular, banks oriented their offer to the retail market with a special focus on browser-based technologies.

KEY TERMS

E-Banking: Is linked to e-business literature but, is progressively abandoned by the literature to use more precise concepts like “Internet banking.”

Electronic Banking: Is the umbrella concept defining the distant access to a bank account by a customer. Some scholars created confusion by using this concept as a synonym of PC banking, e-banking, and Internet banking.

Internet Banking: Is the distant access to a bank account by an Internet-based browser.

Online Banking: Is the umbrella concept defining the distant access to a bank account by a customer especially for Internet-based access. In the academic literature, this concept is considered a synonym of Internet banking.

PC Banking: Define a direct connection between a customers PC and an internal server within the bank by means of electronic data interchange (EDI) or any other private network. In this case, special software is provided by the bank to the customer in order to establish the connection.