IMPORT AND EXPORT PRICE INDEXES

The import and export price indexes measure price changes in agricultural, mineral, and manufactured products for goods bought from and sold to foreigners. They represent increases and decreases in prices of internationally traded goods due to changes in the value of the dollar and changes in the markets for the items. Import and export price indexes are provided monthly by the Bureau of Labor Statistics in the U.S. Department of Labor. The data are published in a press release and in the BLS monthly journal, Monthly Labor Review. The import and export price indexes cover most foreign traded goods. The broad product categories of the indexes are food, beverages and tobacco, crude materials, fuels, intermediate manufactured products, machinery and transportation equipment, and miscellaneous manufactured products. The monthly figures cover approximately 10,000 products. Additional product detail is provided quarterly. Military equipment, works of art, commercial aircraft, and ships are excluded. Prices represent the actual transaction value including premiums and discounts from list prices and changes in credit terms and packaging. Prices usually are based on the time the item is delivered, not the time the order is placed. The indexes reflect movements for the same or similar items exclusive of enhancement or reduction in the quality or quantity of the item. The import and export price indexes are not seasonally adjusted.

INDIRECT QUOTE

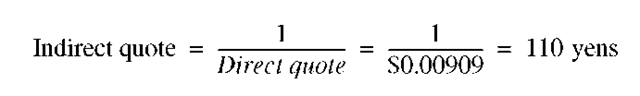

The price of a unit of home currency, expressed in terms of a foreign currency. For example, in the Unites States, a quotation of 110 yens per dollar is an indirect quote for the Japanese yen. Indirect and direct quotations are reciprocals.

An indirect quote is the general method used in the over-the-counter market. Exceptions to this rule include British pounds, Irish punts, Australian dollars, and New Zealand dollars, which are quoted via direct quote for historical reasons. (e.g., 1 pound sterling = $1.68). In their foreign exchange activities, U.S. banks follow the European method of direct quote.

INFLATION

Inflation is the general rise in prices of consumer goods and services. The federal government measures inflation with four key indices: Consumer Price Index (CPI), Producer Price Index (PPI), Gross Domestic Product (GDP) Deflator, and Employment Cost Index (ECI). Price indexes are designed to measure the rate of inflation of the economy. Various price indexes are used to measure living costs, price level changes, and inflation.

• Consumer Price Index: The Consumer Price Index, the most well-known inflation gauge, is used as the cost-of-living index, to which labor contracts and social security are tied. The CPI measures the cost of buying a fixed bundle of goods (some 400 consumer goods and services), representative of the purchase of a typical working-class urban family. The fixed basket is divided into the following categories: food and beverages, housing, apparel, transportation, medical care, entertainment, and other. Generally referred to as a cost-of-living index, it is published by the Bureau of Labor Statistics of the U.S. Department of Labor. The CPI is widely used for escalation clauses. The base year for the CPI index was 1982-84 at which time it was assigned 100.

• Producer Price Index: Like the CPI, the PPI is a measure of the cost of a given basket of goods priced in wholesale markets, including raw materials, semifinished goods, and finished goods at the early stage of the distribution system. The PPI is published monthly by the Bureau of Labor Statistics of the Department of Commerce. The PPI signals changes in the general price level, or the CPI, some time before they actually materialize. (Because the PPI does not include services, caution should be exercised when the principal cause of inflation is service prices.) For this reason, the PPI and especially some of its subindexes, such as the index of sensitive materials, serve as one of the leading indicators that are closely watched by policy makers.

• GDP Deflator: This index of inflation is used to separate price changes in GDP calculations from real changes in economic activity. The Deflator is a weighted average of the price indexes used to deflate GDP so true economic growth can be separated from inflationary growth. Thus, it reflects price changes for goods and services bought by consumers, businesses, and governments. Because it covers a broader group of goods and services than the CPI and PPI, the GDP Deflator is a very widely used price index that is frequently used to measure inflation. The GDP deflator, unlike the CPI and PPI, is available only quar-terly—not monthly. It is also published by the U.S. Department of Commerce.

• Employment Cost Index: This index is the most comprehensive and refined measure of underlying trends in employee compensation as a cost of production. It measures the cost of labor and includes changes in wages, salaries, and employer costs for employee benefits. ECI tracks wages and bonuses, sick and vacation pay plus benefits such as insurance, pension and Social Security, and unemployment taxes from a survey of 18,300 occupations at 4,500 sample establishments in private industry and 4,200 occupations within about 800 state and local governments.

• CRB Bridge Spot Price Index and the CRB Bridge Futures Price Index: These are two widely watched benchmarks for commodity prices by Bridge/CRB, formerly Commodity Research Bureau. The CRB Spot Price Index is based on prices of 23 different commodities, representing livestock and products, fats and oils, metals, and textiles and fibers, and it serves as an indicator of inflation. Higher commodity prices, for example, can signal inflation, which in turn can lead to higher interest rates and yields. The CRB Bridge Futures Price Index is the composite index of futures prices that tracks the volatile behavior of commodity prices. As the best known commodity index, the CRB Futures Index, produced by Bridge Information Systems, was designed to monitor broad changes in the commodity markets. The CRB Futures Index consists of 21 commodities. In addition to the CRB Futures Index, nine subindexes are maintained for baskets of commodities representing currencies, energy, interest rates, imported commodities, industrial commodities, grains, oil, seeds, livestock and meats, and precious metals. All indexes have a base level of 100 as of 1967, except the currencies, energy, and interest rates indexes, which were set at 100 in 1977.

• The Economist Commodities Index: This is the gauge of commodity spot prices and their movements. The index is a geometric weighted-average based on the significance in international trade of spot prices of major commodities. The index is design to measure inflation pressure in the world’s industrial powers. It includes only commodities that freely trade in open markets, excluding items such as iron and rice. Also, this index does not track precious metal or oil prices. The commodities tracked are weighted by their export volume to developed economies. The index information may be obtained from Reuters News Services or in The Economist magazine. The index may be used as a reflection of worldwide commodities prices, enabling the investor to determine the attractiveness of specific commodities. The MNC may enter into futures contracts. The indicators also may serve as barometers of global inflation and global interest rates.

Price indexes get major coverage, appearing in daily newspapers and business dailies, on business TV cable networks such CNNfn and CNBC and on Internet financial news services. Government Internet Web sites www.stats.bls.gov and www.census.gov/econ/ also provide this data.

A Word of Caution: Inflation results in an increase in all prices, but relative price changes indicate that not all prices move together. Some prices increase more rapidly than others, and some go up while others go down. Inflation is like an elevator carrying a load of tennis balls, which represent the prices of individual goods. As the inflation continues, the balls are carried higher by the elevator, which means that all prices are increasing. But as the inflation continues and the elevator rises, the balls, or individual prices, are bouncing up and down. So while the elevator lifts all the balls inside, the balls do not bounce up and down together. The balls bouncing up have their prices rising relative to the balls going down.

INITIAL MARGIN

The minimum amount of money (or equity) that must be provided by a margin investor at the time of purchase. It is used to prevent overtrading and excessive speculation. Margin requirements for stock have been 50% for some time. Margin requirements for foreign currency futures are determined and periodically revised by the International Money Market (IMM), a division of the Chicago Mercantile Exchange, in line with changing currency volatilities using a computerized risk management program called SPAN (Standard Portfolio Analysis of Risk). See also MAINTENANCE MARGIN; MARGIN TRADING.

INTERBANK MARKET

The interbank market is the market for exchange of financial instruments—especially, foreign exchange—between commercial banks. Although the foreign exchange dealings of most managers involve a company buying from or selling to a bank, the vast majority of large-scale foreign exchange transactions are interbank. These transactions tend to determine exchange rates—with which occasional market participants such as companies must deal. Local and regional commercial banks may offer clients a foreign exchange service, which such banks provide on request by dealing through a larger bank, typically in a large city (such as New York, San Francisco, Chicago, Miami, and perhaps half a dozen more U.S. cities). Another surface of large-scale foreign exchange dealing in the United States is the brokers’ market.

INTERBANK OFFERED RATE

Interbank Offered Rate (IBOR) is the rate of interest at which banks lend to other major banks. Terms are established for the length of loan and individual foreign currencies. A number of financial centers offer an IBOR, including: Abu Dhabi (DIBOR), Bahrain (BIBOR), Brussels (BRIBOR), Hong Kong (HKIBOR), London (LIBOR), Luxembourg (LUXIBOR), Madrid (MIBOR), Paris (PIBOR), Saudi Arabia (SAIBOR), Singapore (SIBOR), and Zurich (ZIBOR).

INTEREST ARBITRAGE

Also called intertemporal arbitrage, interest arbitrage is an exchange arbitrage across maturities. It involves buying foreign exchange in the spot market, investing in a foreign currency asset, and converting back to the initial currency through a forward contract. It is similar to two- or three-way (triangular) arbitrage, in that it requires starting and ending with the same currency and incurring no exchange rate risk. In this case, profits are made by exploiting interest rate differentials as well as exchange rate differentials. In other words, this works when the interest parity theory is not valid. Also, an interest arbitrageur must use funds for the time period between contract maturities, while the two- and three-way arbitrageurs need funds only on the delivery date.

INTEREST RATE DIFFERENTIAL

Also called interest agio, the interest rate differential is the difference in interest rates between two nations. The International Fisher effect proposes that the spot exchange rate should change by the same amount as the interest rate differential between two countries.

INTEREST RATE PARITY

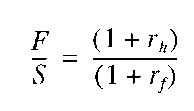

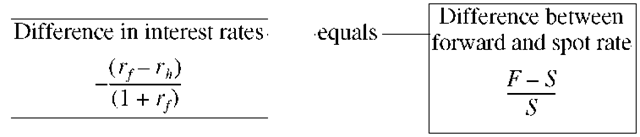

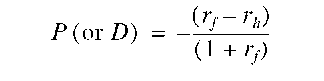

Interest rate parity (IRP) holds that investors should expect to earn the same return in all countries after adjusting for risk. It recognizes that when you invest in a country other than your home country, you are affected by two forces—returns on the investment itself and changes in the exchange rate. It follows that your overall return will be higher than the investment’s stated return if the currency your investment is denominated in appreciates relative to your home currency. By the same token, your overall return will be lower if the overseas currency you are holding declines in value. The IRP is expressed as follows:

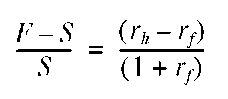

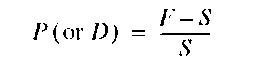

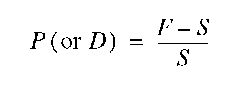

where F = forward rate, S = spot rate, and rh and rf = home (domestic) and foreign interest rates, respectively. Subtracting 1 from both sides yields:

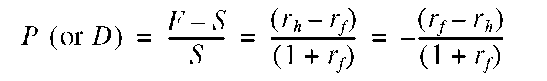

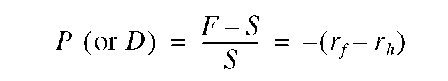

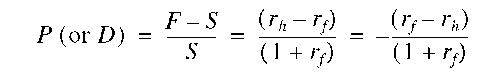

This implies that the differences between national interest rates for securities of similar risk and maturity should be equal to (but opposite in sign) the forward exchange rate differential between two currencies, except transaction costs. Specifically, the premium or discount (in direct quotes) should be:

When interest rates are relatively low, this equation can be approximated by

If this relationship, which is defined as interest rate parity, does not hold, then currency traders will buy and sell currencies—that is, engage in arbitrage—until it does hold. Note: The theory is applicable only to securities with maturities of one year or less.

EXAMPLE 65

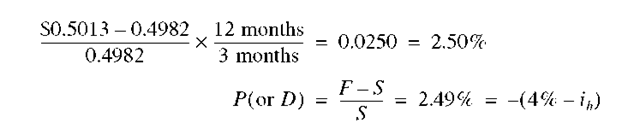

To illustrate interest rate parity, suppose that you, as an investor, can buy default-free 90-day German bonds that promise a 4% nominal return and are denominated in German marks. The 90-day rate, r, equals 1% per 90 days (4% x 90/360). Assume also that the spot exchange rate is S = $0.4982/DM, which means that you can exchange 0.4982 dollar for one mark, or DM 2.0074 per dollar. Finally, assume that the 90-day forward exchange rate, F, is $0.5013, which means that you can exchange one mark for 0.5013 dollar, or receive DM 1.9949 per dollar exchanged, 90 days from now. You can receive a 4% annualized return denominated in marks, but if you want a dollar return, those marks must be converted to dollars. The dollar return of the investment depends, therefore, on what happens to exchange rates over the next three months.

However, you can lock in the dollar return by selling the foreign currency in the forward market. For example, you could

• Convert $1,000 to 2,007.40 marks in the spot market.

• Invest the 2,007.40 marks in 90-day German bonds that have a 4% annualized return or a 1% quarterly return, hence paying (2,007.40) (1.01) = 2,027.47 marks in 90 days.

• Agree today to exchange these 2,027.47 marks 90 days from now at the 90-day forward exchange rate of 1.9949 marks per dollar, for a total of $1,016.33.

This investment, therefore, has an expected 90-day return of [($1,016.33/$1,000) - 1] = 1.63%, which translates into a nominal return of 4(1.63%) = 6.52%. In this case, 4% of the expected 6.52% return is coming from the bond itself, and 2.52% arises because the market believes the mark will strengthen relative to the dollar.

Note: (1) By locking in the forward rate today, the investor has eliminated any exchange rate risk. And, since the German bond is assumed to be default-free, the investor is assured of earning a 6.52% dollar return. (2) The IRP implies that an investment in the United States with the same risk as a German bond should have a return of 6.52%. Solving for rh in the preceding equation would yield the predicted interest rate in the United States of 6.52%.

Solving for rh yields 6.50% (due to rounding errors).

(3) The IRP shows why a particular currency might be at a forward premium or discount. Notice that a currency (in direct quotes) is at a forward premium (F > S) whenever domestic interest rates are higher than foreign interest rates (rh > rf). Discounts prevail if domestic interest rates are lower than foreign interest rates. If these conditions do not hold, then arbitrage will soon power interest rates back to parity.

EXAMPLE 66

The 180-day U.S. T-bill interest rate in the U.S. is about 8%; the rate on 180-day United Kingdom instruments is 16%, annualized; and the 180-day forward premium for the pound is -5.86%, expressed as an annual rate. Given these data, does a riskless profit (or arbitrage) opportunity exist? The IRP says:

Step 1: Compute the forward premium P (or D).

This is given in this example as P = -5.86%. Step 2: Compute the interest rate differential using

The premiums obtained by the use of the two equations are not identical. The IRP is violated. Profit opportunity exists. An arbitrage profit can be made by doing the following:

1. Borrow U.S. dollars at 8%.

2. Exchange the U.S. dollars for British pounds, at the spot rate.

3. Invest the pounds at 16% for 180 days in the British money market.

4. Sell the pounds at the 180-day forward rate.

5. Accept U.S. dollars in 180 days by delivering the pounds invested in the U.K. market.

6. Repay loan of U.S. dollars, pocketing the profit.

This set of transactions is called covered-risk arbitrage since risk is covered by the forward market.

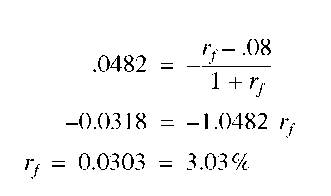

EXAMPLE 67

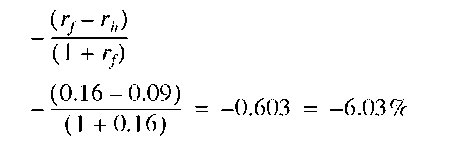

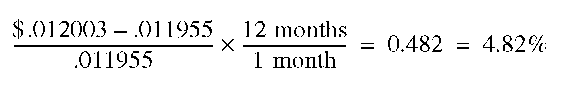

On May 3, 20×1, a 30-day forward contract in Japanese yens (in direct quotes) was selling at a 4.82% premium using the equation

to annualize yields would give:

The 30-day U.S. T-bill rate is 8% annualized. Then, the 30-day Japanese rate, using the equation:

would be:

The 30-day Japanese rate should be 3.03%.

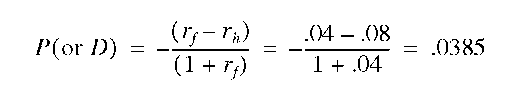

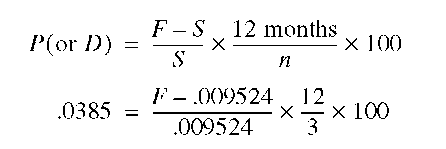

EXAMPLE 68

| U.S. Dollar | ||

| Country | Contract | Equivalent |

| Japan (Yen) | Spot | $.009524 |

| 90-day forward | ? |

The interest rate in Japan on 90-day government securities is 4%; it is 8% in the U.S. If the interest rate parity theory holds, then the implied 90-day forward exchange rate in yen per dollar would be calculated as follows:

Step 1: Compute the premium (discount) on the forward rate using:

Step 2: Compute the forward rate using the equation:

Solving this equation for F yields $.009616.

EXAMPLE 69

Almond Shoe, Inc. sells to a wholesaler in Germany. The purchase price of a shipment is 50,000 DMs with terms of 90 days. Upon payment, Almond will convert the DM to dollars.

| U.S. Dollar | Currency | ||

| Country | Contract | Equivalent | per U.S. $ |

| Germany (Mark) | Spot | .730 | 1.37 |

| 90-day future | .735 | 1.36 |

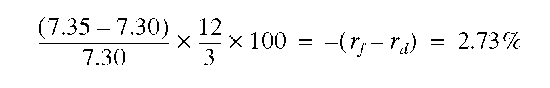

Note that the DM is at a premium because the 90-day forward rate of DM per dollar is less than the current spot rate. The DM is expected to strengthen (fewer DM to buy a dollar). The differential in interest rates is -2.73%, as shown below.

This means that if the interest parity theory holds, interest rates in the U.S. should be 2.73% higher than those in Germany.

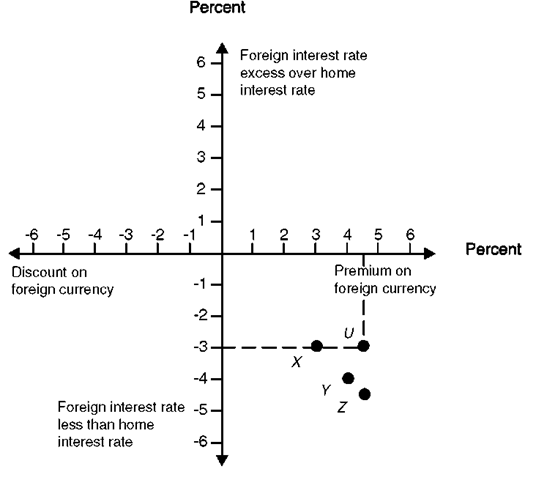

Exhibit 68 illustrates the conditions necessary for equilibrium. The vertical axis shows the difference in interest rates in favor of the foreign currency, and the horizontal axis shows the forward premium or discount on that currency. The interest rate parity line shows the equilibrium state, but transaction costs cause the line to be a band rather than a thin line. Point X shows one possible equilibrium position, where a 3% lower rate of interest on yen securities would be offset by a 3% premium on the forward yen. The disequilibrium situation is illustrated by point U. It is located off the interest rate parity line because the lower interest on the yen is 3% (annual basis), whereas the premium on the forward yen is slightly over 4.5% (annual basis). The situation depicted by point U is unstable because all investors have an incentive to execute a covered interest arbitrage whose gain is virtually risk free.

EXHIBIT 68

Interest Rate Parity and Equilibrium

INTEREST RATE RISK

The variability in the value of a security as the interest rates and conditions of the money and capital markets change, interest rate risk relates to fixed-income securities such as bonds. For example, if interest rates rise (fall), bond prices fall (rise). Price changes induced by interest-rate changes are greater for long-term than for short-term bonds. There are different types of interest rate risk: (1) basis risk in which the interest rate base is mismatched and (2) gap risk in which the timing of maturities is mismatched.

INTEREST RATE SWAPS

An interest rate swap is an exchange by two parties of interest rates on borrowings made in the two markets—fixed for floating and floating for fixed. Consequently, each party obtains the type of liability it prefers and at a more attractive rate. The advantages to interest rate swaps are the following: (1) The swap contract is simple and straightforward. (2) Swaps provide alternative sources of financing. (3) Swaps give the corporation the flexibility to convert floating-rate debt to fixed-rate, and vice versa. (4) There are potential interest rate savings. (5) Swaps may be based on outstanding debt and may thus avoid increasing liabilities. (6) Swaps are private transactions. (7) Rating agencies, such as Moody’s and S&P, take a neutral to positive position on corporate swaps. (8) Tax treatment on swaps is uncomplicated, as there are no withholding taxes levied on interest payments to overseas swap partners, and the interest expense of the fixed-rate payer is treated as though it were on a fixed-rate obligation. One major drawback to swaps is the risk that one swap partner may fail to make the agreed payments to the other swap partner. It is a growing trend that MNCs will use swaps to match assets to liabilities and to protect investments in capital assets, such as plant and equipment, from floating-rate interest fluctuations. Financial institutions also see swaps as a way to match receivables (loans made) to liabilities (investors deposits). See also SWAPS.

INTEREST RATES

Interest rates take many different forms. They are as follows:

A. Discount, Fed Funds, and Prime Rates

These are three key interest rates closely tied to the banking system. The discount rate is the rate the Federal Reserve Board charges on loans to banks that belong to the Fed system. The fed or federal funds rate is the rate that bankers charge one another for very short-term loans, although the Fed heavily manages this rate as well. The prime rate is the much discussed benchmark rate that bankers charge customers. The three rates, at times, work in tandem. The Fed Funds rate is the major tool that the nation’s central bank, the Federal Reserve, has to manage interest rates. Changing the target for the Fed Funds rate is done when the Fed wants to use monetary policy to alter economic patterns. The discount rate was once the Fed’s key tool. Now it takes a backseat, as a largely ceremonial nudge to markets made often after Fed Funds changes are implemented. The prime rate is a heavily tracked rate although it is not as widely used as a corporate loan benchmark as it has been in the past. The prime is set by bankers to vary loan rates to smaller businesses and on consumers’ home equity loans and credit cards.

B. 30-Year Treasury Bonds

The most widely watched interest rate in the world, the security known as the T-bond is seen as the daily barometer of how the bond market is performing. The 30-year Treasury bond is a fixed-rate direct obligation of the U.S. government. There are no call provisions on Treasury bonds. Traders watch the price of the U.S. Treasury’s most recently issued 30-year bond, often called the bellwether. The price is decided by a series of dealers who own the exclusive right to make markets in the bonds in U.S. markets. (The bond trades around the clock in foreign markets.) Bond yields are derived from the current trading price and its fixed coupon rate.

Because of its long-term nature, the T-bond is extra sensitive to inflation that could ravage the buying power of its fixed-rate payouts. Thus, the T-bond market also is watched as an indicator of where inflation may be headed. Also, T-bond rates somewhat impact fixed-rate mortgages. (These loans are more often tied to 10-year Treasury rate.) Still, the T-bond yield is also seen as a barometer for the housing industry, a key leading indicator for the economy.

C. Three-Month Treasury Bills

The Treasury bill rate is a widely watched rate for secure cash investments. In turbulent times the rate can be volatile and can be viewed as a signal of the economy’s health. T-bills, both three-month and six-month issues, are auctioned every Monday by the U.S. Treasury through the Federal Reserve. The T-bill rate shows what can be expected to be earned on no-risk investments. Historically, T-bills have returned little more than the inflation rate. Many conservative investors buy T-bills directly from the government. T-bill rates approximate rates on money-market mutual funds or statement savings accounts, also popular savings tools for the small investor.

INTERNAL FINANCIAL TRANSFER SYSTEM

The internal financial transfer system of the MNC covers various mechanisms for transferring funds internally. It includes transfer prices on goods and services traded internally, dividend payments, leading and lagging intercompany payments, payments for fees and royalty charges, intercompany loans, and equity investments.

INTERNAL RATE OF RETURN

Internal rate of return (IRR) is defined as the rate of interest that equates initial capital outlay

(I) with the present value (PV) of future cash inflows. Or at IRR, I = PV.

Decision rule: Accept the project if the IRR exceeds the cost of capital. Otherwise, reject it.

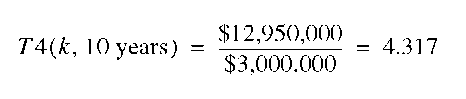

EXAMPLE 70

Consider the following foreign investment project:

| Initial investment (I) | $12,950,000 |

| Estimated life | 10 years |

| Annual cash inflows (CF) | $3,000,000 |

| Cost of capital | 12% |

We set the following equality (I = PV):

$12,950,000 = $3,000,000 x T4(k, 10 years) where T4 is a present value of an annuity factor.

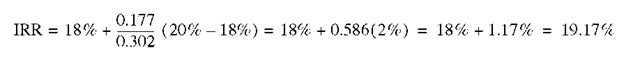

which stands somewhere between 18% and 20% in the 10-year line of Exhibit 4 in the topic. The interpolation follows:

| PV of | an Annuity of $1 Factor | |

| J4(fc,10 years) | ||

| 18% | 4.494 | 4.494 |

| IRR | 4.317 | |

| 20% | 4.192 | |

| Difference 0.177 | 0.302 | |

Therefore,

Since the IRR of the investment is greater than the cost of capital (12%), accept the project. The advantage of using the IRR method is that it considers the time value of money. The shortcomings of this method are that (1) it fails to recognize the varying sizes of investment in competing project, and (2) it is time-consuming to compute, especially when the cash inflows are not even. However, spreadsheet software and financial calculators can be used in making IRR calculations. For example, MSExcel has a function IRR(values, guess). Excel considers negative numbers such as the initial investment as cash outflows and positive numbers as cash inflows. Many financial calculators have similar features. As in the example, suppose you want to calculate the IRR of a $12,950,000 investment (the value -12950000 entered in year 0 that is followed by 10 year cash inflows of $3,000,000. Using a guess of 12% (0.12), which is in effect the cost of capital, your formula would be @IRR(values, 0.12) and Excel would return 19.15%, as shown below.

| Year 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 9 | 10 |

| -12,950,000 | 3,000,000 | 3,000,000 | 3,000,000 | 3,000,000 | 3,000,000 | 3,000,000 | 3,000,000 | 3,000,000 3,000,000 | 3,000,000 |

| IRR = | 19.15% |

INTERNATIONAL ACCOUNTING STANDARDS COMMITTEE

The International Accounting Standards Committee (IASC), founded in 1973, aims at the development of international accounting standards. It also works toward the improvement and harmonization of accounting standards and procedures relating to the presentation and comparability of financial statements (or at least through enhanced disclosure, if differences are present). To date, it has developed a conceptual framework and issued a total of 32 International Accounting Standards (IAS) covering a wide range of accounting issues. It is currently working on a project concerned with the core standards in consultation with other international groups, especially the International Organization of Securities Commissions (IOSCO), to develop worldwide standards for all corporations to facilitate multilisting of foreign corporations on various stock exchanges. At the inception, its members consisted of the accountancy bodies of Australia, Canada, France, Japan, Mexico, the Netherlands, the United Kingdom, Ireland, the United States, and Germany. Since its founding, membership has grown to around 116 accountancy bodies from approximately 85 countries.

INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT (IBRD)

The International Bank for Reconstruction and Development, also called the World Bank (http://www.worldbank.org), was established in December 1945 to help countries reconstruct their economies after World War II. IBRD assists developing member countries by lending to government agencies and by guaranteeing private loans for such projects as agricultural modernization or infrastructural development. It attempts to promote economic and social progress through the creation of modern economic and social infrastructures. It makes loans to countries or firms for such purposes as roads, irrigation projects, and electric generating plants. Bank headquarters are in Washington, D.C. See also WORLD BANK.

INTERNATIONAL BANKING FACILITY (IBF)

An international Banking Facility (IBF), authorized in December 1981, is a separate banking operation within a domestic U.S. bank, created to allow that bank to accept Eurocurrency deposits from foreign residents without the need for domestic reserve requirements, interest rate regulations, or deposit insurance premiums applicable to normal U.S. banking. IBFs simply require a different set of books to receive deposit from, and make loans to, nonresidents of the U.S. or other IBFs. IBFs are not institutions in the organizational sense, but accounting entities that represent a separate set of asset and liability accounts of their establishing offices. They are actually a set of asset and liability accounts segregated on the books of the establishing institutions. IBFs are allowed to conduct international banking operations that, for the most part, are exempt from U.S. regulation. Deposits, which can be accepted only from non-U.S. residents or other IBFs and must be at least $100,000, are exempt from reserve requirements and interest rate ceilings. The deposits obtained cannot be used domestically; they must be used for making foreign loans. In fact, to ensure that U.S.-based firms and individuals comply with this requirement, borrowers must sign a statement agreeing to this stipulation, when taking out the loan.

INTERNATIONAL CAPITAL ASSET PRICING MODEL

The international capital asset pricing model (ICAPM) is an international version of the Capital Asset Pricing Model (CAPM). It differs from a domestic CAPM in two respects. First, the relevant market risk is world market risk, not domestic market risk. Second, additional risk premium is linked to an asset’s sensitivity to currency movements. The ICAPM can be used to estimate the required return on foreign projects, taking into account the world market risk.

INTERNATIONAL DEVELOPMENT ASSOCIATION

The International Development Association (IDA), a part of the World Bank Group, was created in 1959 (and began operations in November 1990) to lend money to developing countries at no interest and for a long repayment period. IDA provides development assistance through soft loans to meet the needs of many developing countries that cannot afford development loans at ordinary rates of interest and in the time span of conventional loans. The Association’s headquarters are in Washington, D.C. See also WORLD BANK.

INTERNATIONAL DIVERSIFICATION

International diversification is an attempt to reduce the multinational company’s risk by operating facilities in more than one country, thus lowering the country risk. It is also an effort to reduce risk by investing in more than one nation. By diversifying across nations whose business cycles do not move in tandem, investors can typically reduce the variability of their returns. Adding international investments to a portfolio of U.S. securities diversifies and reduces your risk. This reduction of risk will be enhanced because international investments are much less influenced by the U.S. economy, and the correlation to U.S. investments is much less. Foreign markets sometimes follow different cycles from the U.S. market and from each other. Although foreign stocks can be riskier than domestic issues, supplementing a domestic portfolio with a foreign component can actually reduce your portfolio’s overall volatility. The reason is that by being diversified across many different economies which are at different points in the economic cycle, downturns in some markets may be offset by superior performance in others.

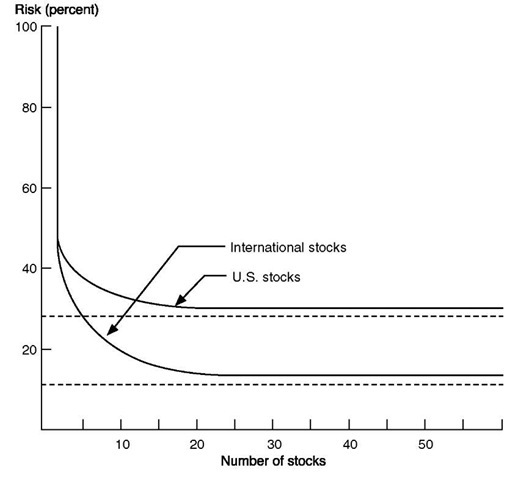

There is considerable evidence that global diversification reduces systematic risk (beta) because of the relatively low correlation between returns on U.S. and foreign securities. Exhibit 69 illustrates this, comparing the risk reduction through diversification within the United States to that obtainable through global diversification. A fully diversified U.S. portfolio is only 27% as risky as a typical individual stock, while a globally diversified portfolio appears to be about 12% as risky as a typical individual stock. This represents about 44% less than the U.S. figure.

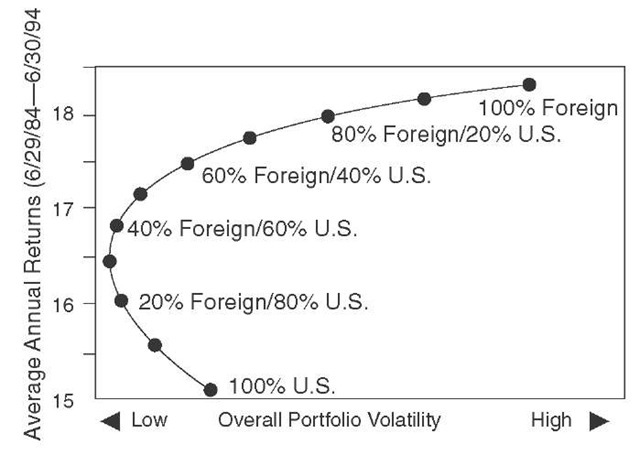

Exhibit 70 demonstrates the effect over the past ten years. Notice how adding a small percentage of foreign stocks to a domestic portfolio actually decreased its overall risk while increasing the overall return. The lowest level of volatility came from a portfolio with about 30% foreign stocks and 70% U.S. stocks. And, in fact, a portfolio with 60% foreign holdings and only 40% U.S. holdings actually approximated the risk of a 100% domestic portfolio, yet the average annual return was over two percentage points greater.

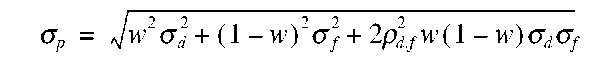

The benefits of international diversification can be estimated by considering the portfolio risk and portfolio return in which a fraction, w, is invested in domestic assets (such as stocks, bonds, investment projects) and the remaining fraction, 1 – w, is invested in foreign assets:

EXHIBIT 69

Risk Reduction from International Diversification

EXHIBIT 70

How Foreign Stocks Have Benefitted a Domestic Portfolio

The expected portfolio return is calculated as follows:

where rd = return on domestic assets and rf = return on foreign assets. The expected portfolio standard deviation is calculated as follows:

where od and of = standard deviation on domestic and foreign assets, respectively, and pdf = correlation coefficient between domestic and foreign assets.

The risk of an internationally diversified portfolio is less than the risk of a fully diversified domestic portfolio.

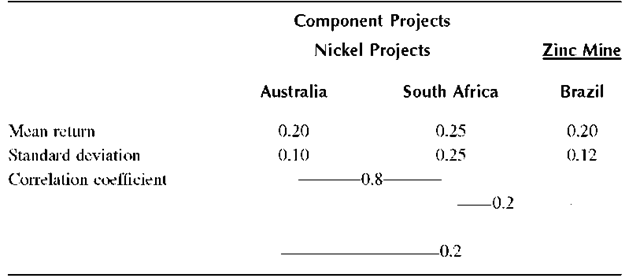

EXAMPLE 71

Suppose that three projects are being considered by U.S. Minerals Corporation: Nickel projects in Australia and South Africa and a zinc mine project in Brazil. The firm wishes to invest in two plants, but it is unsure of which two are preferred. The relevant data are given below.

Suppose that three projects are being considered by U.S. Minerals Corporation: Nickel projects in Australia and South Africa and a zinc mine project in Brazil. The firm wishes to invest in two plants, but it is unsure of which two are preferred. The relevant data are given below.

Possible portfolios and their portfolio returns and risks are the following:

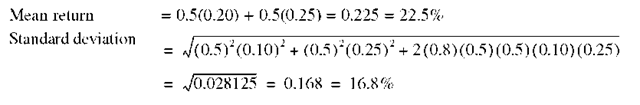

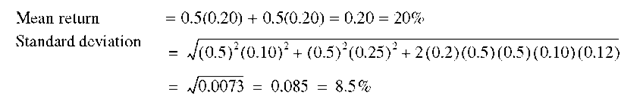

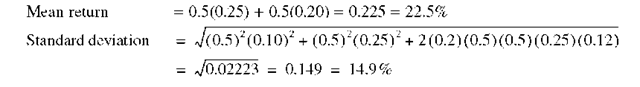

A. Australian and South African Nickel Operations:

B. Australian Nickel Operation and Brazil Zinc Mine:

C. South African Nickel Operation and Brazil Zinc Mine:

To summarize:

| Portfolio | Mean Return | Standard Deviation |

| B. Australian Nickel Operation and Brazil Zinc Mine | 20.0% | 8.5% |

| C. South African Nickel Operation and Brazil Zinc Mine | 22.5% | 14.9% |

| A. Australian and South African Nickel Operations | 22.5% | 16.8% |

The efficient portfolios, in increasing order of returns, are portfolios B, C , and A. Portfolio A can be eliminated as being inferior to portfolio C—both portfolios yield a mean return of 22.5%, but portfolio A has a higher risk than portfolio C. Management has to select between portfolios B and C, based on their risk-return trade-off.

The efficient portfolios, in increasing order of returns, are portfolios B, C , and A. Portfolio A can be eliminated as being inferior to portfolio C—both portfolios yield a mean return of 22.5%, but portfolio A has a higher risk than portfolio C. Management has to select between portfolios B and C, based on their risk-return trade-off.

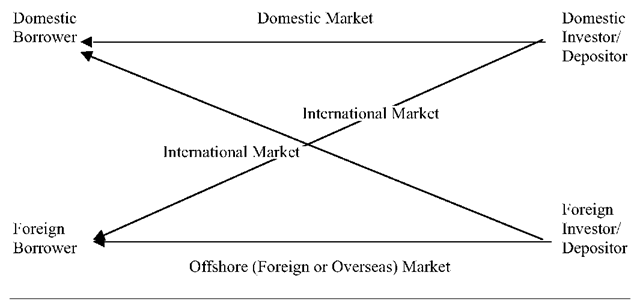

INTERNATIONAL FINANCIAL CENTERS

International banking is heavily concentrated on cities in which international money center banks are located, such as New York, London, and Tokyo. Four major types of financial transactions transpire in an international financial center that is in effect an important domestic financial center. Exhibit 71 displays major transactions that occur in this arena.

EXHIBIT 71

Major Types of Financial Transactions in an International Financial Market Arena

INTERNATIONAL FINANCING

1. Also called foreign financing, overseas financing, or offshore financing, raising capital in the Eurocurrency or Eurobond markets.

2. A strategy used by MNCs for financing foreign direct investment, international banking activities, and foreign business operations.

INTERNATIONAL FISHER EFFECT

Often, called Fisher-open, the theory states that the spot exchange rate should change by the same amount as the interest differential between two countries. The International Fisher effect is derived by combining the purchasing power parity (PPP) and the Fisher effect.

where rh and rf = the respective national interest rates and S = the spot exchange rate (using direct quotes) at the beginning of the period (Sj) and the end of the period (S2).

According to Equation 1, the expected return from investing at home, (1 + rv), should equal the expected home currency (HC) return form investing abroad, (1 + rf) S2/S1.

EXAMPLE 72

In March, the one-year interest rate is 4% on Swiss francs and 13% on U.S. dollars.

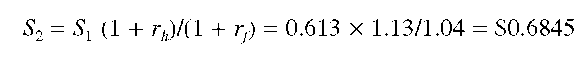

(a) If the current exchange rate is SFr 1 = $0.63, the expected future exchange rate in one year would be $0.6845:

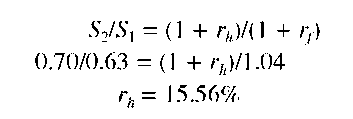

(b) Assume that the Swiss interest rate stays at 4% (because there has been no change in expectations of Swiss inflation). If a change in expectations regarding future U.S. inflation causes the expected future spot rate to rise to $0.70, according to the international Fisher effect, the U.S. interest rate would rise to 15.56%:

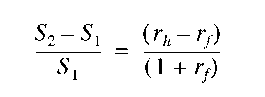

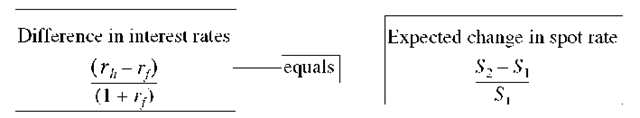

A simplified version states that, for any two countries, the spot exchange rate should change in an equal amount but in the opposite direction to the difference in the nominal interest rates between the two countries. It can be stated more formally:

Subtracting 1 from both sides of Equation 1 yields:

Equation 2 follows if rf is relatively small.

The rationale behind this theory is that investors must be rewarded or penalized to offset the change in exchange rates. Thus, the currency with the lower interest rate is expected to appreciate relative to the currency with the higher interest rate.

EXAMPLE 73

If a U.S. dollar-based investor buys a one-year yen deposit earning 4% interest, compared with 10% interest in dollars, the investor must be expecting the yen to appreciate vis-avis the dollar by about 6% (10% – 4% = 6%) during the year. Otherwise, the dollar-based investor would be better off staying in dollars.

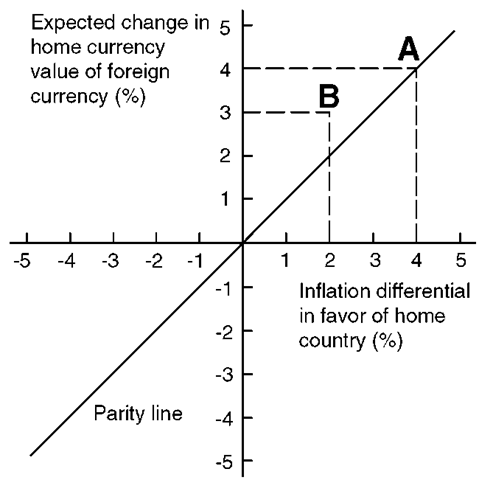

A graph of Equation 2 in Example 72 is presented in Exhibit 72. The vertical axis shows the expected change in the home currency value of the foreign currency, and the horizontal axis shows the interest differential between the two countries for the same time period. The parity line shows all points for which rh – rf = (S2 – 5j)/5j. Point A is a position of equilibrium because it lies on the parity line, with the 4% interest differential in favor of the home country just offset by the anticipated 4% appreciation in the home currency value of the foreign currency. Point B, however, illustrates a case of disequilibrium. If the foreign currency is expected to appreciate by 3% in terms of the home currency but the interest differential in favor of the foreign country is only 2%, then funds flow from the home to the foreign country to take advantage of the higher exchange-adjusted returns there. This capital flow will continue until exchange-adjusted returns are equal in the two nations.

EXHIBIT 72

International Fisher Effect

INTERNATIONAL FUND

Also called a foreign fund, an international fund is a mutual fund that invests only in foreign stocks. Because these funds focus only on foreign markets, they allow investors to control what portion of their personal portfolio they want to allocate to non-U.S. stocks. There exists currency risk associated with international fund investing. Note: General Electric Financial Network (www.gefn.com), for example, has a tool “How do exchange rates affect my foreign fund?” (www.calcbuilder.com/cgi-bin/calcs/MUT12.cgi/gefa).

INTERNATIONAL LENDING

International lending involves some risks: (1) Commercial risk (business risk) as in domestic lending, and (2) the added risk comes from cultural differences and lack of information (especially due to differing accounting standards and disclosure practices)—Country risk including political risk and currency risk. Further, the central role played by the enforcement problem and the absence of collateral make international lending fundamentally different from domestic lending.

INTERNATIONAL MONETARY FUND (IMF)

International Monetary Fund (IMF) (www.imf.org) is an international financial institution that was created in 1946 after the 1944 Bretton Woods Conference. It aims at promoting international monetary harmony, monitoring the exchange rate and monetary policies of member nations, and providing credit for member countries which experience temporary balance of payments deficits. Each member has a quota, expressed in Special Drawing Rights, which reflects both the relative size of the member’s economy and that member’s voting power in the Fund. Quotas also determine members’ access to the financial resources of, and their shares in the allocation of Special Drawing Rights by, the Fund. The IMF, funded through members’ quotas, may supplement resources through borrowing.

INTERNATIONAL MONETARY MARKET

International Monetary Market (IMM) is a division of the Chicago Mercantile Exchange where currency futures contracts, patterned after grain and commodity contracts, are traded. Futures contracts are currently traded in the British pound, Canadian dollar, German mark, Swiss franc, French franc, Japanese yen, Australian dollar, and U.S. dollar. Most recently, the IMM has introduced a cross-current futures contract (e.g., DM/¥).

INTERNATIONAL MONETARY SYSTEM

1. The financial market for transactions between countries that belong to the International Monetary Fund (IMF), or between one of these countries and the IMF itself. A market among the central banks of these countries, functioning as a kind of central banking system for the national governments of its 137 members. Each member country deposits funds at the IMF, and in return each may borrow funds in the currency of any other member nation. This system is not open to private sector participants, so it is not directly useful to company managers. However, agreements made between member countries and the IMF often lead to major changes in government policies toward companies and banks (such as exchange rate changes and controls and trade controls), so an understanding of the international monetary system may be quite important to managers. Regulation in this system comes through rules passed by the IMF’s members. The major financial instruments used in the international monetary system are national currencies, gold, and a currency issued by the IMF itself, called the SDR (special drawing right).

2. The sum of all of the devices by which nations organize their international economic relations.

3. The set of policies, arrangements, mechanisms, legal aspects, customs, and institutions dealing with money (investments, obligations, and payments) that determine the rate at which one currency is exchanged for another.

INTERNATIONAL MONEY MANAGEMENT

Also called international working capital management or narrowly international cash management, international money management (IMM) is concerned with financial policies used by MNCs aiming at optimizing profitability from currency and interest rate fluctuation while controlling risk exposure. It can be considered as comprising a series of interrelated subsystems that perform the following functions: (1) positing of funds—choice of location and currency of denomination for all liquid funds, (2) pooling funds internationally, (3) keeping costs of intercompany funds transferred at a minimum, (4) increasing the speed with which funds are transferred internationally between corporate units, and (5) improving returns on liquid funds.

INTERNATIONAL MONEY MARKET

The international money market is the Eurocurrency market and its linkages with other segments of national markets for credit. One unique feature of the international money market is the diversity of its participants, the wide range of borrowers and lenders that compete with one another on the same basis. It is simultaneously an interbank market, a market where governments raise funds, and a lending and deposit market for corporations. The market is extremely homogeneous in its treatment of borrowers and lenders. While in national markets there is invariably credit rationing during periods of tight credit, often mandated by government, in the Euromarkets the funds are always available for those willing and able to pay the price. Equally important, the market’s size assures that the marginal cost of funds is less. Another advantage to borrowers is that funds raised in the international money market have no restrictions attached as where they can be deployed. And also, the Euromarkets provide corporate borrowers with flexibility as to terms, conditions, covenants, and even currencies. The international money market parallels the foreign exchange market. It is located in the same centers as its foreign exchange counterparts. The market operates only in those currencies for which forward exchange market exists and that are easily convertible and available in sufficient quantity.

INTERNATIONAL RETURNS

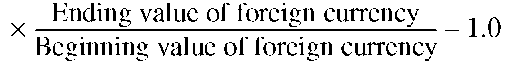

When investors buy and sell assets in other countries, they must consider exchange rate risk. This risk can convert a gain from an investment into a loss or a loss from an investment into a gain. An investment denominated in an appreciating currency relative to the investor’s domestic currency will experience a gain from the currency movement, while an investment denominated in a depreciating currency relative to the investor’s domestic currency will experience a decrease in the return because of the currency movement. To calculate the return from an investment in a foreign country, we use the following formula:

Total return (TR) in domestic terms = Return relative (RR)

The foreign currency is stated direct terms; that is, the amount of domestic currency necessary to purchase one unit of the foreign currency.

EXAMPLE 74

Consider a U.S. investor who invests in UniMex at 175.86 pesos when the value of the peso stated in dollars is $0.29. One year later UniMex is at 195.24 pesos, and the stock did not pay a dividend. The peso is now at $0.27, which means that the dollar appreciated against the peso. Return relative for UniMex = 195.24/175.86 = 1.11

Total return to the U.S. investor after currency adjustment is

In this example, the U.S. investor earned an 11% total return denominated in Mexican currency, but only 3.34% denominated in dollars because the peso declined in value against the U.S. dollar. With the strengthening of the dollar, the pesos from the investment in UniMex buy fewer U.S. dollars when the investment is converted back from pesos, pushing down the 11% return a Mexican investor would earn to only 3.34% for a U.S. investor.

INTERNATIONAL SOURCES OF FINANCING

An MNC may finance its activities abroad, especially in countries in which it is operating. A successful company in domestic markets is more likely to be able to attract financing for international expansion. The most important international sources of funds are the Eurocurrency market and the Eurobond market. Also, MNCs often have access to national capital markets in which their subsidiaries are located. Exhibit 73 represents an overview of international financial markets.

EXHIBIT 73

International Financial Markets

| Market | Instruments | Participants | Regulator |

| International monetary | Special drawing rights; | Central banks; | International Monetary |

| system | gold; foreign exchange | International Monetary | Fund |

| Fund | |||

| Foreign exchange markets | Bank deposits; currency; | Commercial and central | Central banks in each |

| futures and forward | banks; firms; | country | |

| contracts | individuals | ||

| National money markets | Bank deposits and loans; | Banks; firms; | Central bank; other |

| (short term) | short-term government | individuals; | government agencies |

| securities; commercial | government agencies | ||

| paper | |||

| National capital markets | Bonds; long-term bank | Banks; firms; | Central bank; other |

| deposits and loans; | individuals; | government agencies | |

| stocks; long-term | government agencies | ||

| government securities |

| Eurocurrency markets | Bank deposits; bank | Commercial banks; | Substantially |

| (short term) | loans; short-term and | firms; government | unregulated |

| rolled-over credit lines; | agencies | ||

| revolving commitment | |||

| Euro-commercial paper | Commercial paper issues | Commercial banks; | Substantially |

| markets (short term) | and programs; note- | firms; government | unregulated |

| issuing facility; | agencies | ||

| revolving underwritten | |||

| facilities | |||

| Eurobond market | Fixed coupon bonds; | Banks; firms; | Substantially |

| (medium and long term) | floating-rate notes; | individuals; | unregulated |

| higher-bound bonds; | government agencies | ||

| lower-bound bonds | |||

| Euroloan market (medium | Fixed-rate loans; | Banks; firms; | Substantially |

| and long term) | revolving loans; | individuals; | unregulated |

| revolving loans with cap; | government agencies | ||

| revolving loans with | |||

| floor |

The Eurocurrency market is a largely short-term (usually less than one year of maturity) market for bank deposits and loans denominated in any currency except the currency of the country where the market is located. For example, in London, the Eurocurrency market is a market for bank deposits and loans denominated in dollars, yen, franc, marks, and any other currency except British pounds. The main instruments used in this market are CDs and time deposits, and bank loans. Note: The term market in this context is not a physical market place, but a set of bank deposits and loans. The Eurobond market is a long-term market for bonds denominated in any currency except the currency of the country where the market is located. Eurobonds may be of different types such as straight, convertible, and with warrants. While most Eurobonds are fixed rate, variable rate bonds also exist. Maturities vary but 10 to 12 years are typical. Although Eurobonds are issued in many currencies, you wish to select a stable, fully convertible, and actively traded currency.

In some cases, if a Eurobond is denominated in a weak currency the holder has the option of requesting payment in another currency. Sometimes, large MNCs establish wholly owned offshore finance subsidiaries. These subsidiaries issue Eurobond debt and the proceeds are given to the parent or to overseas operating subsidiaries. Debt service goes back to bondholders through the finance subsidiaries. If the parent issued the Eurobond directly, the U.S. would require a withholding tax on interest. There may also be an estate tax when the bondholder dies. These tax problems do not arise when a bond is issued by a finance subsidiary incorporated in a tax haven. Hence, the subsidiary may borrow at less cost than the parent. In summary, the Euromarkets offer borrowers and investors in one country the opportunity to deal with borrowers and investors from many other countries, buying and selling bank deposits, bonds, and loans denominated in many currencies. Exhibit 74 provides a list of credit sources available to a foreign affiliate of an MNC.

EXHIBIT 74

International Sources of Credit

| Domestic | Domestic | Foreign Inside | Foreign | ||

| Borrowing | Inside the Firm | Market | the Firm | Market | Euromarket |

| Direct, short- | Intrafirm loans, | Commercial | International | Euro- | |

| term | transfer | paper | intrafirm loans, | commercial | |

| pricing, | international | paper | |||

| royalties, fees, | transfer | ||||

| service charges | pricing, | ||||

| dividends, | |||||

| royalties, fees | |||||

| Intermediated | Short-term | Internal back- | Short-term | Euro short- | |

| short-term | bank loans, | to-back loans | bank loans, | term loans | |

| discounted | discounted | ||||

| receivables | receivables | ||||

| Direct, long- | Intrafirm loans, | Stock issue, | International | Stock issue, | Eurobonds |

| term | invested in | bond issue | intrafirm long- | bond issue | |

| affiliates | term loans, | ||||

| foreign direct | |||||

| investment | |||||

| Intermediated | Long-term | Internal back-to- | Long-term | Euro long- | |

| long-term | bank loans | back loans | bank loans | term loans |

INTERNATIONAL STANDARD (ISO) CODE

Internationally agreed standard codes for foreign currencies are created by the International Standards Organization (ISO; www.xe.net/currency/iso_4217.htm). The following lists the commonly used symbols for several international currencies and their international standard (ISO) code.

| Country | Currency | Symbol | ISO Code |

| Austrlia | Dollar | A$ | AUD |

| Austria | Schilling | Sch | ATS |

| Belgium | Franc | BFr | BEF |

| Canada | Dollar | C$ | CAD |

| Denmark | Krone | DKr | DKK |

| Finland | Markka | FM | FIM |

| France | Franc | FF | FRF |

| Germany | Deutsche mark | DM | DEM |

| Greece | Drachma | Dr | GRD |

| India | Rupee | Rs | INR |

| Iran | Rial | RI | IRR |

| Italy | Lira | Lit | ITL |

| Japan | Yen | ¥ | JPY |

| Kuwait | Dinar | KD | KWD |

| Mexico | Peso | Ps | MXP |

| Netherlands | Guilder | FL | NLG |

| Norway | Krone | NKr | NOK |

| Saudi Arabia | Riyal | SR | SAR |

| Singapore | Dollar | S$ | SGD |

| South Africa | Rand | R | ZAR |

| Spain | Peseta | Pta | ESP |

| Sweden | Kronar | SKr | SEK |

| Switzerland | Franc | SF | CHF |

| United Kingdom | Pound | £ | GBP |

| United States | Dollar | $ | USD |

INTERNATIONAL TRANSFER PRICING

A transfer price is defined as the price charged by a selling department, division, or subsidiary of a multinational national company (MNC) for a product or service supplied to a buying department, division, or subsidiary of the same MNC (in different countries). A major goal of transfer pricing is to enable divisions that exchange goods or services to act as independent businesses. It also encompasses the determination of interest rates for loans, charges for rentals, fees for services, and the methods of payments. International transfer pricing is an important issue for several reasons. First, raw materials not available or in short supply for an MNC unit in one country can be imported for sale or further processing by another unit of the MNC located in a different country. Second, some stages of an MNC’s production process can be conducted more efficiently in countries other than where the MNC has its headquarters. Third, many MNCs operate sales offices in some countries but do no manufacturing there. To sell their products, the sales offices or subsidiaries must import products from manufacturing affiliates in other countries. Fourth, many services for MNC units are rendered by MNC headquarters or other affiliates of an MNC. Finally, there are many international financial flows between units of an MNC. Some are payments related to goods or services provided by other units; some are loans or loan repayment; some are dividends; and some are designed to lessen taxes or financial risks. Since the transfer price for a product has an important effect on performance of individual foreign subsidiary managers, their motivation, divisional profitability, and global profits, top management of MNCs should devote special attention to designing international transfer pricing policies.

A. Factors Influencing Transfer Price Determination

MNCs typically have a variety of objectives. Maximizing global after-tax profits is a major goal. Other goals often include increasing market share, maintaining employment stability and harmony, and being considered the “best” firm in the industry. However, not all of these goals are mutually compatible or collectively achievable. In addition, all MNCs face governmental and other constraints which influence their ability to achieve their objectives in the manner they would prefer. In determining international inter-corporate transfers and their prices, an MNC must consider both its objectives and the constraints it faces.

An MNC can also achieve further tax savings by manipulating its transfer prices to and from its subsidiaries. In effect, it can transfer taxable income out of a high-tax country into a lower-tax country. This tax scheme can be particularly profitable for MNCs based in a country that taxes only income earned in that country but does not tax income earned outside the country. But even if a country taxes the global income of its corporations, often income earned abroad is not taxable by the country of the corporate parent until it is remitted to the parent. If penetrating a foreign market is a company’s goal, the company can underprice goods sold to foreign affiliates, and the affiliates can then sell them at prices which their local competitors cannot match. And if antidumping laws exist on final products, a company can underprice components and semi-finished products to its affiliates. The affiliates can then assemble or finish the final products at prices that would have been classified as dumping prices had they been imported directly into the country rather than produced inside. Transfer prices can be used in a similar manner to reduce the impact of tariffs.

Although no company can do much to change a tariff, the effect of tariffs can be lessened if the selling company underprices the goods it exports to the buying company. The under-pricing of inter-corporate transfers can also be used to get more products into a country that is rationing its currency or otherwise limiting the value of goods that can be imported. A subsidiary can import twice as many products if they can be bought at half price. Artificially high transfer prices can be used to circumvent or lessen significantly the impact of national controls. A government prohibition on dividend remittances to foreign owners can restrict the ability of a firm to transfer income out of a country. However, overpricing the goods shipped to a subsidiary in such a country makes it possible for funds to be taken out. High transfer prices can also be considerable when a parent wishes to lower the profitability of its subsidiary. This may be caused by demands by the subsidiary’s workers for higher wages or participation in company profits, political pressures to expropriate high-profit foreign-owned operations, or the possibility that new competitors will be lured into the industry by high profits. High transfer prices may be desired when increases from existing price controls in the subsidiary’s country are based on production costs. Transfer pricing can also be used to minimize losses from foreign currency fluctuations, or shift losses to particular affiliates. By dictating the specific currency used for payment, the parent determines whether the buying or the selling unit has the exchange risk. Altering the terms and timing of payments and the volume of shipments causes transfer pricing to affect the net foreign exchange exposure of the firm.

International transfer pricing has grown in importance with international business expansion. It remains a powerful tool with which multinational companies can achieve a wide variety of corporate objectives. At the same time, international transfer pricing can cause relations to deteriorate between multinationals and governments because some of the objectives achievable through transfer price manipulation are at odds with government objectives. Complex manipulated transfer pricing systems can also make the evaluation of subsidiary performance difficult and can take up substantial amounts of costly, high-level management time. In spite of these problems, the advantages of transfer price manipulation remain considerable. These advantages keep international transfer pricing high on the list of important decision areas for multinational firms. Usually, multinational companies should be more considerate than domestic companies to set transfer prices, as they have to cope with different sets of laws, different competitive markets, and different cultures. Thus, it is not surprising that determining price for international sales is very difficult, especially for internal transactions among the segments.

When planning an internal sales price (transfer pricing) strategy, a corporation should be concerned about subsidiaries’ contributions and competitive positions as well as the whole corporation’s profitability, because subsidiaries’ contributions do not always increase overall company profit. High income means more tax. Perhaps, for instance, the parent company wants to show losses and pass income to its segments in low tax rate areas also, transfer pricing should benefit both sides, seller and buyer. Otherwise, inappropriate transfer pricing may cause company conflicts and may even lower profits. For example, if the transfer price of the parent company is too high, the subsidiaries may buy from outside parties even though buying from the parent company may be better for the organization as a whole. On the contrary, if the subsidiaries want to buy at very low prices, the parent company may not make deals with them at such a low price because it could get more money elsewhere. Thus, how to set appropriate transfer prices is not easy. Multinational companies should know transfer price methods very well. They should focus on transfer price considerations, such as tax rates, competition, custom duties, currencies, and government legislation.

B. Transfer Price Structure

The four types of transfer prices used for management accounting purposes are: cost-based transfer price, market-based transfer price, negotiated transfer price, dictated transfer price.

• Cost-based transfer price is based on full or variable cost. It is simple for companies to apply, and it is a useful method to strengthen compatibility. The major disadvantages of cost-based transfer price are that it lacks incentives to control costs by selling divisions, and it is unable to provide information for companies to evaluate performance by the Return on Investment (ROI) formula. In order to increase the efficiency of cost control, companies should use standard costs rather than actual costs. Also, because many tax agencies require international firms to present transfer prices fairly, the use of the cost-based method may be deemed an unfair transfer price.

• Market-based transfer price is the one charged for products or services based on market value. It is the best approach to solve the transfer pricing problem. It connects costs with profits for managers to make the best decisions and provides an excellent basis for evaluating management performance. However, setting market-based transfer prices should meet the following two conditions: (1) the competitive market condition must exist, and (2) divisions should be autonomous from each other for decision making.

• Negotiated transfer price is set by the managers of the buying and selling divisions with an agreement. A major advantage of this transfer pricing is that both sides are satisfied. But, it has some disadvantages. The division in which the manager is a good negotiator may get more profits than those in which the manager is a poor negotiator. Also, managers may spend a lot of time and costs in the negotiations. Usually, companies use negotiated transfer prices in those situations where no intermediate market prices are available.

• Dictated transfer price is determined by top managers. They set the price in order to optimize profit for the organization as a whole. The disadvantage is that the dictated transfer price may conflict with the decisions that division managers make.

C. Transfer Price Considerations

In order to be successful in business, companies must consider any policy very carefully, and transfer pricing is no exception. Income taxes and the various degrees of competition are very important considerations. Custom duties, exchange controls, inflation, and currency exchange rates are usually considered. Moreover, multinational companies should think over the whole companies’ profits when they set transfer prices. On the other hand, transfer pricing strategies by parent companies should not injure subsidiaries’ interests. For example, an American firm has a subsidiary in a country with high tax rates. In order to minimize the subsidiary’s tax liability and draw more money out of the host country, the parent company sets high transfer prices on products shipped to the subsidiary and sets low transfer prices on those imported from the subsidiary. However, this procedure may cause the subsidiary to have high duties, or it may increase its product cost and reduce its competitive position. Therefore, multinational companies should weigh the importance of each factor when planning transfer pricing strategies.

In the 1990s, many firms tend to hold the overall profit concept as the basic idea for transfer pricing strategies. Also, a lot of companies think of other considerations, such as differentials in income tax rates and income tax legislation among countries and the competitive position of foreign subsidiaries.

D. Tax Purposes

The basic idea of transfer pricing for tax purposes is to maneuver profit out of high tax rate countries into lower ones. The foreign subsidiaries can sell at or below cost to other family members in lower tax rate areas, thereby showing a loss in its local market, while contributing to the profit of buying members.

However, inappropriate transfer prices may cause companies to be exposed to tax penalties. For example, a parent company in the U.S. thinks that the U.S. tax rates are lower than its segment in a foreign country. The parent firm does not want to comply with the tax law of that foreign country. The company sets a high transfer price for its subsidiary so that profit of the subsidiary can be shifted to the parent company. But if the transfer price does not comply with the foreign country’s tax law, the profit shifted may be lost due to a tax penalty.

In addition, revenue flights become significant as the countries grow to compete for international tax income. This evidence stimulated national treasuries to take actions to strengthen the power of controlling transfer pricing practices. During the past ten years, the United States and its major trading partners have revised or introduced new transfer pricing regulations.

E. IRS Transfer Pricing Regulations

Section 482 of the Internal Revenue Code of 1986 authorizes the IRS to allocate gross income, deductions, credits, or allowances among controlled taxpayers if such allocation is necessary to prevent evasion of taxes.

Another provision in this section defines intangibles to include (1) patents, (2) copyrights, (3) know-how, (4) trademarks and brand names, (5) franchises, and (6) customer lists. Guided by this rule, the IRS can collect royalties commensurate with the economic values of intangibles and can prevent many U.S. parent companies from transferring intangibles to related foreign subsidiaries at less than their value.

At the end of 1990, the IRS issued the proposed regulations. Under the proposed regulations, the U.S. subsidiaries owned by a foreign multinational company were required to submit the detailed records that reflect the profit or loss of each material industry segment. Noncom-pliance with the regulations may cause financial penalties.

In addition, other countries, such as Canada and Japan enforced new transfer pricing regulations. In June 1990, the European community countries reached agreements for the harmonization of direct taxes in Europe. They made a draft on transfer pricing arbitration to resolve transfer pricing disputes between member countries.

F. The Tax Implementation Problems Faced by MNCs

All of the changes above bring high pressure on managers and high cost to firms to maintain appropriate income allocation. First, traditional management transfer pricing methods are based on marginal revenue and marginal cost. These techniques do not satisfy the documentation and verification rules for tax purposes. Thus, managers must find appropriate transfer pricing methods to comply with tax complication requirements. Second, tax rules require that the transfer price methods should meet comparability and unrelated party standards. Following these tax codes will increase a global company’s information costs. For example, multinational companies should submit various data and documents for different tax compliance requirements. They may even hire tax consultants to prepare all the necessary documents. Third, a manager must carefully analyze all the potential economic considerations of transfer pricing; otherwise, failure in following tax compliance requirements may cause heavy penalties.

G. Transfer Pricing Methods for Tax Purposes

When the transfer price does not satisfy tax requirements, the firm can reset its transfer pricing systems. However, this approach requires companies to apply multiple transfer pricing methods fluently. Usually, there are six transfer pricing methods for tax purposes. Exhibit 75 summarizes these six transfer pricing methods and an Other category.

EXHIBIT 75

Transfer Pricing Methods for Tax Purposes: Tangible Property

| Comparable | ||||||

| Method | Uncontrolled | Resale | Comparable | Profits | ||

| Description | Price | Price | Cost Plus | Profits | Split | Other |

| Comparable | Comparable | Price to | Production | Priced to yield | Split of | Gross profit |

| factors | sales between | unrelated | costs plus | gross profits | combined | reasonable for |

| unrelated | party less | gross profit | comparable to | operating | facts and | |

| parties | related gross | on | those for other | profits of | circumstances | |

| profit; | unrelated | firms | controlled | |||

| nonmanu- | sales | parties | ||||

| facturing | ||||||

| Comparability | Similarity of | Comparable | Gross profit | Gross profit | Allocation of | As appropriate |

| and | property; | gross profit | from same | within range | combined | |

| Reliability | underlying | relative to | type of | of profits for | profits of | |

| Standards | circumstance | comparable | goods in | broadly | controlled | |

| unrelated | unrelated | similar | parties | |||

| transfer | resale | product line | ||||

| Measures of | Functional | Functional | Functional | Business | Profits split | Fair allocation |

| Comparability | diversity; pro- | diversity; | diversity; | segment; | by unrelated | of profits |

| duct category; | product | accounting | functional | parties or | relative to | |

| terms in | category; | principles; | diversity; | splits from | unrelated | |

| financing and | terms in | direct vs. | different | transfers to | party sales | |

| sales; | financing | indirect | product | unrelated | ||

| discounts; and | and sales; | costing; | categories | parties | ||

| the like | intangibles; | and the like | acceptable if | |||

| and the like | in the same | |||||

| industry | ||||||

| Same | Required | Required | Required | Required | Required, but | Required, but |

| Geographic | some | some | ||||

| Market | flexibility | flexibility | ||||

| Comments | Deemed the best | The best | Internal | Not if seller has | Controlled | Least reliable; |

| method for all | method for | gross profit | unique | transaction | uncertainty | |

| firms; minor | distribution | ratio is | technologies | allocations | and costs of | |

| accounting | operations; | acceptable | or intangibles | compared to | being wrong | |

| adjustments | only used | if there are | because resale | profits split | are severe | |

| allowed to | where little | both | price is fixed; | in | ||

| qualify as | or no value | purchases | adjust the | uncontrolled | ||

| “substantially | added and | from and | transfer price | transactions | ||

| the same” | no | sales to | from seller | |||

| significant | unrelated | |||||

| processing | parties |

G.1. Comparable Uncontrolled Price

This price is based on comparable prices through transactions with unrelated parties. The company that focuses on a market-based organization uses this method. In a market-based structure, the company’s segments are autonomic and independent from each other. The managers can decide to make transactions with unrelated parties if the prices offered by other members in the company are not reasonable.

To illustrate the use a comparable uncontrolled method, a parent company sells fiber to its foreign segment and to other parties in its domestic market. On the other hand, its foreign segment buys fiber from the parent company as well as from other manufacturers in the local market. Thus, under a comparable uncontrolled method, the parent company can set a transfer price according to both selling and buying comparable prices resulting from transactions with unrelated parties.

However, comparable uncontrolled prices are only acceptable for those global companies who make internal transactions among their segments, and they do not compete with each other in their backyards.

G.2. Resale Price Method

This method is the best for intermediate distributions, such as wholesalers and retailers. It also applies to market-based organizations. Usually these companies add little or no value to goods and do not have a significant manufacturing process. The formula for this method is:

Computing the gross profit ratio is based on information on the profit ratios in the same product categories used by unrelated parties. However, the information on profit ratios set by competitors is not readily obtainable and may be costly for global companies.

G.3. The Cost-Plus Method

This method is adaptable to manufacturing companies. Under this method the amount of company product cost is adjusted for gross profit ratios. The ratio can be internal gross profit ratio if both sides in the company purchase from and sell to unrelated parties and have comparable price standards, or the ratio can be based on comparable company’s profit ratios for the same broad product category. The formula of the cost-plus method is:

G.4. Comparable Profit Method

This is a profit markup method. The gross profit part of the transfer price should be compared to others within a range of profits for broadly similar product lines. The profit ratio should be based on some internal profit indicator, such as rate of return. However, if the product or process involved is unique in the market, setting transfer prices under this method is unacceptable.

G.5. Profits-Split Method

Under this method, MNCs allocate the combined profits of subsidiaries that are involved in internal transactions. Parent companies compute the combined profits after these goods to customers are sold outside of the group. Also, the profit for each member involved in intercompany transactions is comparable to unit profits where unrelated parties participate in similar activities with comparable products. The profits-split method requires companies to obtain reliable detailed data for comparable products. Usually, it is not difficult for the company to get aggregate profit data for the whole product line, but there is not enough detailed data for analysis and comparison. Thus, appropriate profits-split pricing relies on whether the information on profits is reliable.

G.6. Other Methods

One of the five transfer pricing methods cannot be adopted all the time. For example, an MNC trades products only among its members. Each member does not purchase from or sell to unrelated parties because those products are unique and no company outside uses them. Under this situation, when the parent company sets transfer prices, there are no reliability and comparability standards to match because comparable products in the markets do not exist. Therefore, the company cannot use any of the transfer pricing method mentioned above. When none of the five specific methods can be applied reasonably, the company may choose another method. The method should be reasonable under the facts and circumstances, and should fairly allocate profits relative to unrelated party sales. However, there are no objective guidelines under this approach. The company may face challenges by tax agencies that could result in high costs for noncompliance. To minimize the risk of penalties, companies should have the documents to prove why a method was chosen.

H. Competitive Position