countervailing power

The power of an opposing group, e.g. of a trade union facing a large firm, or of a consumer facing a monopolist or oligopolist. The best examples of it occur under BILATERAL MONOPOLY. GALBRAITH regarded such power as a means of stabilizing and making fairer the capitalist system.

country fund

A fund of stocks and shares invested in the securities of only one country. These funds provide a means of investing in countries whose stock exchanges allow only limited access by foreigners. As such funds are less liquid than open-ended funds which can invest globally, they often sell at a discount to their net asset value.

coupon

1 originally the warrant which had to be presented to obtain interest on a bond.

2 The nominal rate of interest, e.g. £5 per £100 of nominal stock. it is to be distinguished from the bond’s yield, which will be higher than the coupon if the market price of the bond is lower than its nominal price, and vice versa.

Cournot, Antoine Augustin, 1801-77

French mathematician and philosopher who was a major founder of mathematical economics. His important work, which was to inspire Marshall considerably, formulated the law of demand (with demand curves constructed for the first time in economics), rigorously expounded theories of DUOPOLY, BILATERAL MONOPOLY and OLIGOPOLY, and examined the incidence of indirect taxes and costs. As a French civil servant and academic he also wrote on probability and epistemology. His principal work on economics was Recherches sur les Principes Mathematiques de la Theorie des Richesses (1838), republished in English as Researches into the Mathematical Principles of the Theory of Wealth (New York, 1960).

Cournot’s duopoly model

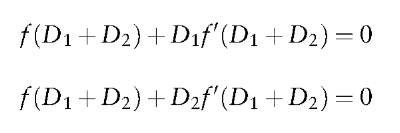

A market model of two springs and two proprietors, each of whom independently seeks to maximize their income. As proprietor A has no direct influence on the sales of water from proprietor B’s spring, A can only adjust the price but B is forced to accept A’s price. If A’s sales are Di, and B’s sales are D2, the final and stable equilibrium occurs where

cover

Earnings available to shareholders divided by the total amount of dividend paid. Thus, if cover is 3.2, the dividend is covered more than three times so it is unlikely that the dividend will have to be cut in the next year and the company has sufficient retained earnings to be able to expand. However, a company with a high cover for a number of years appears to be cautious and neglecting growth opportunities.

cowboy

A small-scale business, often in the construction industry, which dishonestly performs a contract and then rides away before non-performance of the contract is discovered.

cowboy economy

An economy, like the US economy, which behaves as if natural resources are infinite in supply and that Nature can absorb any amount of refuse. boulding coined this term to describe the ‘Wild West’ philosophy still prevalent in modern USA.

Cowles Commission

US econometric research centre founded in Colorado Springs in 1932 and then moving to Chicago University in 1939 to avoid the Colorado state income tax which affected its benefactor. It was noted in its early days for the distinctive econometric methodology of haavelmo and his followers which concentrated on the problems of simultaneity, identification and estimation.

CPI-U

A version of the US consumer price index for all urban consumers covering about 80 per cent of the US population.

CPI-W

A version of the US consumer price index for all urban wage earners and clerical workers covering about 32 per cent of the US population.

craft union

A trade (labor) union drawing all of its membership from a ‘trade’, i.e. a few closely related occupations, e.g. in engineering or printing. Many of the first unions in the UK and the USA were of this nature. Craft unionism has been blamed for much demarcation, a practice which raises labour costs by insisting on a rigid subdivision of labour. Unskilled workers, before forming general unions, resented the craft unions for maintaining a labour elite.

crashometrics

The quantitative analysis of crashes in security or currency markets. This exercise provides a means of estimating the exposure of a portfolio to a market crash.

crawling peg

An exchange rate adjustment method which gradually changes the par value of an exchange rate by small amounts. This is less disruptive than devaluation or revaluation as it does not encourage speculation.

creative accounting

The manipulation of the accounts of a firm or other enterprise to produce a more favourable picture of its financial state. profits are made to appear higher to induce a rise in the company’s share price; costs are inflated to justify product price increases. A variety of methods can be used, e.g. changing the method of allocating expenses, changing the valuation of assets and using more convenient exchange rates than those ruling at the time of the transaction. Some of these practices are within the rules of company law; others are so questionable as to amount to deception. UK local authorities in the 1980s used many devices to increase their spending, including selling their principal buildings and leasing them back, barter (e.g. exchanging council land for a new building), rescheduling debts and capitalizing current expenditure (e.g. including house repairs in their capital programme).

creative destruction

Schumpeter’s description of the evolutionary process inherent in capitalism consisting of entrepreneurs employing new products and new processes to supplant the old.

creative federalism

A co-operative partnership between the federal, state and local governments of the USA which led to many new programmes. President Lyndon B. Johnson used this term to describe US federalism in the 1960s.

credit

1 A loan, or an agreement to lend money, to be repaid at a later date.

2 Bank lending (in macroeconomics) as credit is chiefly analysed within the context of the money supply.

3 All the sources of finance available to firms (including trade credit) and to households.

In the past two decades there has been a great increase in the amount of credit given to households on the basis either of collateral (a house in the case of a building society mortgage) or of credit scoring for hire purchase expenditure on consumer durables. The creation of new credit instruments, e.g. the credit card, has resulted in an expansion in the total volume of credit.

credit card

A means of purchasing consumer goods and services by presenting a card issued by a bank, financial institution or retailer permitting the buyer to settle in part or in full the amount payable. Major examples of these include visa and Mastercard. such cards, in use in the USA since 1950 and in the UK since 1966, have contributed to the large increase in consumer debt. As the banks financing these cards advance the amount due to retailers and collect from the cardholders later, they bring about a short-term increase in the money supply. Like the development of other modern financial arrangements, credit cards have made it more difficult for central banks to control the money supply.

credit crunch

A shortage of bank loans and other forms of credit which brings about the curtailment of a business’s activities or even its collapse. credit can be limited by its price, by the type of borrower or by the state of the lender’s balance sheet relative to the criteria used by a regulatory body (this often happened in the USA under regulation q). The crunch comes under regulation because the lenders cannot use their own funds.

credit enhancement

A technique for improving the credit-worthiness of a security or asset-backed debt. The collateral can be larger than the debt, or losses can be underwritten.

credit money

Banknotes and bank deposits which have been created by banks. This medium of exchange has gradually displaced coinage made of precious metals.

credit rating

Measuring the creditworthiness of a government or corporation. For a government, a scale from the lowest (0) to the best (100) using the information supplied by leading international banks is used; for corporations, the most famous rating is conducted by standard & poor.

credit rationing

Restricting the total amount which can be borrowed or excluding types of borrower so that a central bank can control the total volume of bank deposits. The aim of this rationing is to reduce the risk of borrowers defaulting or to prevent increases in interest rates. In the UK this was traditionally done by the bank rate, which provided the basis for all other interest rates. However, in the UK as elsewhere a greater variety of controls have been employed. The recent growth of new money markets, where interest rates are largely determined separately within each market, has weakened the power of central banks to exercise complete control.

credit reserves

Gold and foreign currency reserves of central banks which are used to settle intercountry indebtedness. increasingly, major currencies, such as those of the USA, Germany, Japan, Switzerland and the UK, have been held in preference to gold.

credit scoring

Assessments of applicants for credit using a points system. A score is awarded for each of the applicant’s characteristics, e.g. home ownership, employment and payment record for previous credit. credit is granted if the total score is above the acceptance level.

credit spread

That part of the yield to maturity attributable to credit risk. Treasury bonds have no credit risk but financial instruments with less liquidity do.

credit tranche facility

An INTERNATIONAL MONETARY FUND lending facility to help a member country deal with a short-term balance of payments problem, similar to a compensatory financial facility. The loan has to be repaid over a three- to five-year period.

credit union

A friendly society whose members save to provide small loans to other members in need of financial assistance at an interest rate lower than the market rate. The group forming a credit union usually resides in the same area, or works for the same employer or belongs to another association, e.g. a church. In the depressed areas of the UK in the 1980s credit unions became popular alternatives to the main financial institutions. By 1990, 310 were formed in the UK with over 40,000 members; the USA has more than 60 million persons in credit unions; in Germany they appeared as early as the 1860s.

crisis

In Marxian economics, a phase of the trade cycle which is the upper turning point where an economy turns down from a boom to a recession. Marx believed that such crises were inevitable under capitalism and would occur every ten years. A crisis could occur for two reasons. The preceding increase in employment pushes up wages and reduces the rate of profit below the normal level, cutting back capital accumulation. Also, producers who are slow to innovate have higher costs and may go bankrupt and cause a collapse of firms throughout the economy. Crises, according to Marxists, are inevitable under capitalism because of its continual capital accumulation without the co-ordination of investment decision making which planning would achieve.

crisis management

Working out strategies to deal with possible disasters, e.g. floods, interference with the quality of a product or an act of war. The police, fire and ambulance services have to consider worst case scenarios but firms also need contingency planning. They can maintain excess capacity and keep large inventories, e.g. to guard against a disruption in the supply of crucial components, as well as contracting to retain the services of other firms as back-up.

critical economy

An atypical economy subject to disruptions and shocks.

critical value

The lower or upper value of a confidence INTERVAL.

cross price elasticity of demand

The responsiveness of the quantity demanded of one good to a change in the price of another good. It can be measured, for example, as the ratio of the percentage change in quantity demanded of good A to the percentage change in the price of good B. If A and B are substitutes the cross price elasticity is positive; it is negative if A and B are complements. The concept has been used extensively by analysts of market concentration and antitrust lawyers as it indicates whether the dissimilar output from different firms is supplied to one or several markets.

cross-section data

Data referring to different groups at the same point in time, e.g. wages of workers in different countries at a particular date. Economic analysis based on time series data faces the problem of the effects of the passage of time on exogenous variables; cross-sectional analysis eliminates this difficulty.

cross-subsidization

The financing of an unprofitable part of an enterprise by a more profitable part. A public enterprise, instead of following the rule of attributing costs properly to each division to make each part of that enterprise individually financially accountable, could allow the profitable divisions to finance loss-making divisions. In the private sector, cross-subsidization occurs within firms if some of their products are sold at less than incremental cost. To ensure maximum efficiency, firms should avoid this practice as far as possible.

cross-trading

A method of disposing of all the goods a seller offers in a market by selling the same good at different prices throughout a trading day, with prices falling towards the end of the day.

crowding hypothesis

The view that discrimination occurs because some workers are crowded into the few occupations lacking barriers to entry. Women’s wages, for example, have been depressed by an excess supply to the few jobs traditionally available for women. Both John Stuart mill and edgeworth used this model of discrimination.

crowding in

Public expenditure which stimulates private sector investment.

crowding out

An alleged effect on private sector demand of an increase in public expenditure. it was argued, especially by monetarists, that KEYNEsiAN–style budget deficits will raise borrowing with the effect of increasing interest rates which will lead to a reduction in private sector investment and expenditure on consumer durables. The stimulative effect of increased government expenditure will be cancelled out by expenditure reductions in the private sector. The reduction in business investment, in the long term, will further reduce the ability of the private sector to spend. The size of this effect depends strongly on the elasticity of is-lm curves. In the figure, although an increase in government expenditure raises the is curve from is1 to IS2, because of the inelasticity of the LM curve the rate of interest rises from r1 to r2, without an increase in national income. crowding out may also occur because increased government spending changes private sector expectations about the future of the economy, thereby reducing the amount of investment carried out.

crude population rate

The ratio of births, deaths, or other demographic events, to the average total population of a country at the midpoint of a specified period, usually a year. These rates are called ‘crude’ because the population used in the denominator is not adjusted to give the measure theoretical significance, e.g. a crude birth rate per total population is less useful in a demographic model than a birth rate per women of child-bearing age.

C share

A Chinese stock market share owned only by state-owned enterprises. It is denominated and payable in either Chinese or foreign currency.

cultivated capital

A hybrid form of capital combining human-made and natural capital, e.g. food, wood and natural fibres.

cultural economics

The analysis of the demand for and production of literature, music, opera, drama, painting and sculpture. The peculiarities of the labour market for these performers and producers are analysed and the role of public subsidies considered.

Cultural Revolution

A change in the organization of the Chinese society and economy in the late 1960s and 1970s. This revolution challenged the division of labour previously practised, especially by breaking down the division between the town and countryside. Revolutionary factory committees were set up to implement changes. These included using five-year plans only as general guidelines, requiring administrators to work two or three days per week in manual work and setting up of work teams involved in matters as diverse as production planning, assigning production tasks, establishing safety regulations and managing welfare funds. Mass action was used to unify the working class.

York and London: Monthly Review Press.

cum dividend

A stock exchange security with the entitlement to receive an imminent dividend.

cumulative multistage cascade system

A sales tax on the gross value of a commodity at each stage of production. It does not allow a rebate of taxes paid at earlier stages of production. This tax was in force in West Germany until the end of 1967, in Luxemburg until the end of 1969 and in the Netherlands until the end of 1968.

cumulative security

A stock exchange security which accumulates unpaid interest or preference dividends so that the holder does not suffer from a year of poor profitability. In return for this greater security of income, many cumulative preference shares are without voting rights.

currency

The official money currently circulating in a country and available for immediate use as a medium of exchange. It can take the form of coins, banknotes and, in a broader sense, bank deposits. Currencies are called by various names, the most popular being dollar, franc and kroner. The value of a currency is regarded as an overall indicator of world opinion about that country’s economy. Apart from the use of prudent fiscal and monetary policies to boost confidence in a currency, there are other ways of making a currency attractive. A central bank can produce beautiful banknotes, offer convertibility into another currency or raise its interest rates to encourage foreign holdings of that currency. A few small countries – Luxemburg,

Panama and Liechtenstein – do not have their own currencies.

currency appreciation

A rise in the international value of a currency. If, for example, more French francs are exchanged than previously for the same amount of US dollars, the dollar has appreciated.

currency basket

A combination of currencies to produce a common unit, e.g. the ecu. The values of these currencies are weighted, e.g. by shares in world trade or the gross national products of the countries participating.

currency cocktail

A mixture of contributing currencies, e.g. the ecu or SDR.

currency depreciation

A fall in the international value of a currency as less of another currency is exchanged for one unit of one’s own. Residents of one country using the currency in other countries will have their purchasing power per unit of the currency reduced. Depreciation can occur very rapidly in foreign exchange markets in reaction to bad news about the state of the economy issuing the currency.

currency devaluation

A fall in a fixed exchange rate which reduces the value of a currency in terms of other currencies. The pound, for example, was devalued in 1949 from US$4.03 to US$2.80 and in 1967 from US$2.80 to US$2.40. The aim of devaluation is to improve the balance of payments current account. The change in the exchange rate by raising import prices and lowering export prices will reduce imports and increase exports, if there is a price-elastic demand for both and the possibility of diverting production to exports and substitutes for imports by reducing domestic expenditure.

currency reform

Replacing an existing currency which has lost its value with a new currency. Germany after the First and second World Wars provides good examples of this. on an appointed day, holdings of the old currency are replaced by the new at a particular exchange rate. The intention of such reform is to restore confidence in the money used by a state. in some extreme cases where a currency has been severely devalued, it has changed its name, e.g. in Peru the sol de oro became the inti.

currency revaluation

A deliberate increase in the price of a currency with a fixed exchange rate. This is undertaken to reduce a balance of payments surplus. Revaluation is often urged by countries in deficit to enable them to compete more easily in international markets. As a consequence of a revaluation, a central bank suffers losses from the fall in value of its foreign exchange holdings: taxpayers ultimately bear these losses as central banks are usually owned by governments.

currency risk

The possibility of suffering a financial loss through holding a currency which falls in value. Supporters of the euro argue that one of the principal arguments for monetary union is the reduction in this type of risk.

currency run

A great increase in the public’s demand for cash because of the belief that other forms of finance, including credit cards, will be ineffective. At the time of the beginning of the new millennium, 1 January 2000, many believed that only coins and banknotes were reliable at a time when widespread computer failures were possible.

Currency School

A group of UK economists who, following ricardo, believed that the note issue should be convertible and strictly determined by the amount of gold possessed by the Bank of England. The leaders of the school, Robert torrens and Samuel loyd (later Lord Overstone), convinced Prime Minister Sir Robert Peel of their theory -hence the bank charter act 1844 which was to provide the framework for many of the operations of UK banking until 1980.

currency stabilization scheme

An international arrangement by which a group of states agrees to link the exchange rate values of their currencies to gold, a leading currency (e.g. the US dollar) or an artificial currency. The first scheme in the post-1945 period was bretton woods; the major one in force at the beginning of the twenty-first century is the european monetary system.

currency swap

A capital market exchange of a loan in one currency for a loan in another, e.g. a fixed interest dollar loan for a floating interest loan in Swiss francs.

current account

1 A bank account of a UK clearing bank immediately available for making payments. In the past, bank accounts of this type never earned interest; some now do. In the USA they are known as CHECKING ACCOUNTS or SIGHT DEPOSITS.

2 A sub-account of a nation’s balance of payments accounts consisting of visible and invisible trade plus private and official current transfers; capital flows are in the separate capital account.

current assets

The assets of a firm convertible into cash within a period of twelve months. They consist of stock in trade, work in progress, debts owed to the firm, readily realizable investments, bills receivable, prepayments, cash at the bank and in hand.

current cost accounting

A form of accounting which includes adjustments for the effects of inflation. The UK’s Statement of Standard Accounting Practice 1980 required several adjustments to be made: to depreciation for fixed assets which had risen in price, to sales figures for the higher cost of replacing stocks and to monetary working capital.

current deposit

A bank deposit of a UK bank which is payable on demand, now termed a sight deposit.

current liabilities

The debts of a firm payable within the current accounting period, usually twelve months, which include sums owed by creditors and bills payable. These are liquid if payable within a month; otherwise, ‘deferred’.

current operating profit

The current value of output sold over a period, less the current cost of related inputs.

current population survey

A survey of US households undertaken by the US Census Bureau. Its monthly surveys are used to provide data on employment, unemployment, wages and hours statistics. Also it provides annual figures on school enrolments, living arrangements, annual incomes, poverty status and other important socioeconomic variables.

current prices

A measurement of an income variable at the prices of the period for which data were collected; for example, consumption at current prices would show for years X, Y and Z the actual cost of purchasing such goods and services at the prices ruling in years X, Y and Z respectively.

current purchasing power

The historic value of an asset adjusted by changes in a retail price index.

current ratio

The ratio of current assets to current liabilities of a firm. Also known as a working capital ratio or 2:1 ratio following the rule of thumb that assets should be twice liabilities, unless the seasonal or speculative nature of the firm requires more working capital. This is the principal measure of the liquidity of a firm.

customize

To modify the standard design of a consumer durable by minor changes in its appearance or functions to allow its owner to express his or her personality, e.g. replacing small car/automobile wheels by larger ones.

customs union

A group of countries with a common external tariff but with free trade amongst themselves and free movement of labour and capital. The european community is a major example of such an arrangement. Many theories about customs unions are based not only on how free trade based on comparative advantage is beneficial but also on location theory to understand the changes within the customs union, e.g. the movement of capital and population towards growth poles creating a dynamic effect of a union.

cycles

Regular fluctuations in a national economy from a peak through a downswing to a trough and then an upswing back to the peak. Few national economies are without this instability.

cyclical trade

A type of intra-industry trade, particularly in agricultural products which are traded north to south between the two hemispheres in one harvest and south to north in the other part of the year.

cyclical unemployment

Recurrent unemployment occurring at particular phases of the business cycle, starting with the downturn from a boom. This unemployment is caused by a deficiency of AGGREGATE DEMAND and is associated with a fall in the number of job vacancies.

cyclical variations

Movements in a time series brought about by the business or trade cycle. These components of changes in the values of a variable can be removed from raw data by first removing seasonal variations by making a seasonal adjustment and then dividing the adjusted data by corresponding trend values.