budgetary policy

The principles underlying the revenue and expenditure accounts of a governmental or other organization. The accounts used in a budget will reflect the responsibilities of that organization and its relationships with others, e.g. a state budget will show its financial relationship with the federal government of that country. in those accounts will be stated the sources of revenue and objects of expenditure, a reflection of the taxing and other fund raising carried out and the spending programmes chosen by that government or firm. it is usual to divide budgets into current and capital budgets. An overall budgetary policy can be summarized by whether it is balanced, in surplus or in deficit. Until Keynesian policy ideas influenced governments, government budget deficits were regarded as a sign of financial recklessness; now budget deficits are regarded as a fiscal policy option available to most governments.

budget constraint

A line showing the maximum amount of goods, in different combinations, which a consumer can obtain from his or her income. It is drawn in combination with indifference curves to indicate the maximum utility which can be obtained from a particular level of real income. In the figure, if AB is the budget line and I1, I2 and i3 are indifference curves, then M is the combination of quantities of goods x and Y at which this consumer maximizes utility. The slope of this budget line shows the relative prices of the two goods; a shift of the line away from the origin indicates an increase in real income.

budget cutting

proposals to reduce planned public expenditure. In the USA, this has been a prominent feature of recent supply-side economics and has taken the form of attempts to reduce federal outlays for civil purposes. A major cut proposed has been in social transfer payments, on the grounds that such payments discourage the supply of labour.

budget incidence

The total effect on a household of the taxation and expenditure policies of a government.

Budget Resolution

The statement passed by the US Senate and House of Representatives which details spending outlays and authorizes the future expenditure of moneys for specific purposes.

budget year

The fiscal year chosen by national finance ministries and treasuries. In the UK the year runs from 5 April to 4 April of the next year; in the USA from 1 October to 30 September of the following year.

buffer stock

1 An accumulation of a commodity for the purpose of stabilizing its world price. The stock built up provides a means of intervention, particularly in the markets for metals, oil and agricultural produce. Buffer stock managers buy in the commodity in times of falling prices and sell when prices are rising. But there are limits to the efficacy of buffer stocks – for example, the major price fall of tin in 1985 was so cataclysmic that the managers were unable to prevent it. Governments have financed many of these stocks to maintain the incomes and employment of primary producers.

2 A cash balance which can absorb unexpected variations in expenditure and income.

building and loan association

US co-operative association whose stock holders offer mortgage loans for the purchase or building of houses.

Building Societies Act 1986 (G2, K2) UK statute which liberalized the operating rules for building societies and aligned them with other financial institutions. The societies were allowed to lend to non-members, hold and develop land as a commercial asset and invest in companies and other corporate bodies. Also diversification into banking, insurance, investment, trusteeship and executorship, and land management services was allowed. Liquid assets were limited to a third of a society’s assets. Instead of being required to have 90 per cent of their loans secured by property, building societies were permitted to reduce that proportion to 75 per cent by 1992, enabling them to have broader investment portfolios. A new Building Societies Commission regulates the building societies.

Building Societies Association

UK association of building societies which jointly represents their interests. When it fixed common mortgage interest rates, it was a powerful cartel.

building society

A UK financial institution primarily concerned with raising, through members’ deposits, a stock or fund for making advances to them secured on land and buildings for residential use, according to the building societies act 1986. As they stand between those who save and those who ultimately borrow money, they act as financial intermediaries. All of them were founded as local non-profit-making institutions, the earliest dating from the 1840s. Through mergers some societies acquired a power rivalling that of the major banks and, like the latter, offering a wide range of financial services. In 1900, there were 2,286 building societies; in 1990, 105; in 2000, 67. The recent decline in their numbers occurred through mergers with banks or insurance companies. The 1986 Act freed them from many restrictions, changing their character from organizations with social aims to competitive firms with a commercial orientation.

bulge-bracket firm

A top investment bank of the USA, one of the leading oligopolists of the US securities industry. The separation of commercial from investment banking under the glass-steagall act protects their privileged position.

bull

A speculator who, expecting prices of shares, commodities or currencies to rise, will buy now and sell after prices have risen, thereby making a capital gain. The opposite is a bear.

bulldog bond

A bond denominated in sterling by a company whose accounts are in another currency.

bulldog issue

A long-term sterling bond issue, mostly purchased by UK institutional investors.

bullet strategy

An investment rule to concentrate the securities in a portfolio at one point of the YIELD CURVE.

bullion

Gold or silver ingots or bars used as bank reserves and as private stores of wealth.

Bullionist controversy

A major debate in classical monetary theory from 1797 to 1825 which was occasioned by the suspension of cash payments, i.e. the inconvertibility of the pound sterling, during the Napoleonic Wars. The Bullionists, named after the supporters of the Bullion committee’s report of 1810 to the House of Commons, included ricardo: they recommended a restoration of convertibility as soon as practicable. During the period of suspension, the Bank of England was accused of over-issuing banknotes and creating much of the wartime inflation. However, Henry thornton, a commercial banker, in his brilliant Paper Credit, took a broader view of money and the banking system.

Bullock Committee

UK governmental committee on workers’ participation in the management of companies which reported in 1977. The committee, headed by the historian Lord Bullock and consisting of trade unionists, employers and industrial relations experts, was asked to devise a scheme based on the assumption that there is a need for a radical expansion of industrial democracy through trade union representation. The trade unionists and academic experts in the majority recommended that UK companies with more than 2,000 employees should reconstitute their boards of directors according to a ’2x + y’ principle of equal numbers of employee and shareholder representatives (2x) and co-opted directors (y). This was intended to be an extension of collective bargaining into the boardroom. The minority report recommended two-tier (supervisory and executive) boards following the European example of West Germany. The report’s recommendations were not embodied in legislation.

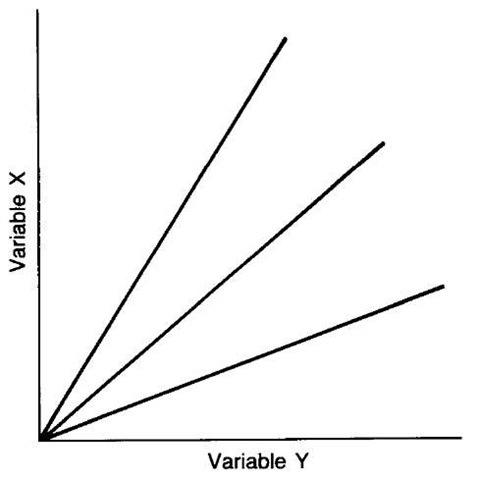

bunch map

A set of lines from the origin of a graph with each line measuring a coefficient between two variables. These maps have been used to check for the presence of multicollinearities in data.

Bundesbank

Germany’s central bank which replaced the Reichsbank in 1957. Its principal duty has been to safeguard the value of the currency by regulating the quantities of money in circulation and of credit in the economy. Although expected to support the government’s general economic policy, it is independent of instructions from the government. The bank’s president chairs fortnightly meetings of the Bank council on which bank directors and presidents from the federal states sit; the council fixes interest rates and credit policy. Also, the Bundesbank decides on the size of the note issue, is custodian of the nation’s gold and foreign currency reserves and is in charge of official dealings in foreign exchange markets. The Bundesbank’s contribution to low German inflation in the past has been praised, but critics have accused the bank of setting money market interest rates which were too high on several occasions, risking recession in the economy.

bundling

The sale of two or more goods or services in a package deal. A seller is able to increase sales of less popular items by combining them with those in great demand.

bunny bond

A fixed interest security entitling the holder to an interest payment in cash or to more units of the asset.

buoyant tax

A tax with a rising yield because of increases in the extent of the tax base, e.g. through rises in income or property values.

Bureau of Economic Analysis

The branch of the US Department of Commerce responsible for assembling and publishing US national income accounts.

Bureau of the Budget

A US federal bureau created within the US Treasury by the Accounting Act 1921 to provide operational control over expenditure programmes. In 1939 it was transferred to the President’s Office, at which time it changed its function increasingly to ensuring managerial efficiency.

Burns, Arthur Frank, 1904-87

An Austro-Hungarian who emigrated to the USA in 1914; educated at Columbia University and professor at Rutgers University from 1927 to 1958. Principally renowned for his business cycle research at the NATIONAL BUREAU OF ECONOMIC RESEARCH, Washington, DC, in 1930-44 and chairman of the Board of Governors of the US FEDERAL RESERVE SYSTEM from 1970 to 1978, where he practised his conservative monetary beliefs. As US Ambassador to West Germany in 1981-5 he negotiated the German Treaty of 1982 to obtain more German logistic support for US troops. His final years were spent in research at the American Enterprise Institute. In his important exposition of business cycle theory (with Wesley Mitchell) he compiled a list of economic indicators which became the basis of business cycle forecasting in the USA after 1945. He calculated ‘reference cycles’ as the single indicator of turning points in cycles. A noted anti-Keynesian in economic policy matters.

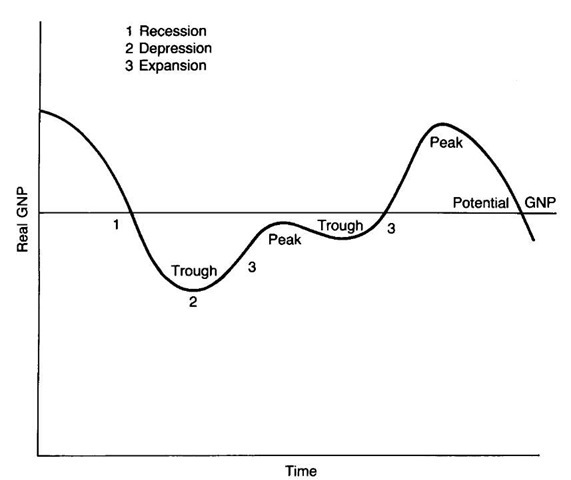

business cycle

‘A type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions, and revivals which merge into the expansion phase of the next cycle; this sequence of changes is recurrent but not periodic; in duration business cycles vary from more than one year to ten or twelve years’ (Mitchell).

Previously these were known as periodic ‘commercial crises’. The national bureau of economic research has studied these cycles since 1920. haberler, in an extensive survey of business cycle research, noted the many possible causes of cycles, including credit changes, overinvestment, costs of production, underconsumption, mass psychology, variations in harvests -the interaction of the multiplier and the accelerator and international influences. More recently, the cycle of elections in democratic countries has been associated with fluctuations in national economies.

business studies

The multidisciplinary analysis of the problems of business, using economic, accounting, psychological, legal and statistical methods. It blossomed as a subject as a consequence of the establishment of business schools, especially the Wharton School of Finance and Commerce in Philadelphia in 1881 and the Henley Administrative Staff College (UK) in 1947. These postgraduate schools, the chief practitioners of business studies, have reduced many managerial inefficiencies which used to be regarded as the principal cause of diseconomies of scale. The distinctive discipline developed by the subject has been ORGANIZATION THEORY.

Butskellism

The similar economic policies pursued by Hugh Gaitskell and R.A. Butler as Chancellors of the Exchequer in the early 1950s.

The techniques of demand management that they employed were based on a mixture of planning and market freedom. This form of macroeconomic policy was criticised for entailing too many monetary and fiscal changes.

butterfly effect

The large differences in the values of dependent economic variables as a consequence of minuscule differences in inputted economic variables. This type of effect makes it difficult for policy-makers to be sure of the effects of their decisions. Foreign exchange markets often display butterfly effects.

buyers’ market

A market in which buyers have a dominant influence on price because of excess supply. Contrast with sellers’ market.