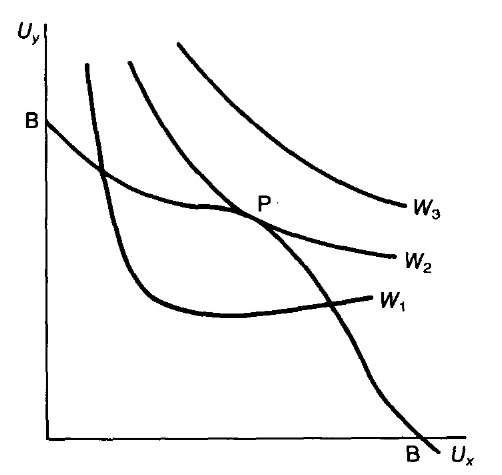

bliss point

An optimal combination of private and public goods. This combination is derived from a social welfare function. In the figure W1, W2 and W3 are different social welfare functions, BB is a grand utility maximization frontier, P is the bliss point, Ux and Uy are ordinal preference functions and W = W(Ux, Uy) is a social welfare function. At the bliss point P, social welfare is at a maximum because BB touches the highest welfare function contour.

bloc grant

The revenue transferred by the US federal government to a state or local government so that the lower level government has sufficient revenues to provide a service, e.g. education, at the standard desired by central government.

blocked development

Economic development deliberately impeded by other more developed countries. It has been asserted that dominant countries of the world have blocked the development of Third World countries, permitting them only ‘peripheral capitalism’.

block of shares

Any block of more than 10,000 shares, according to the New York Stock Exchange Rule 390. With few exceptions, this rule requires that listed stocks must be traded on the floor of the exchange, even if sold in ‘blocks’.

Blue Book

1 The annually published national income and expenditure accounts of the UK.

2 The document setting out the terms and conditions of a firm agreed through collective bargaining or unilaterally imposed by an employer, e.g. the Ford Agreement.

blue chip

A stock issue by a company or corporation with a high standing because of its earnings record. Such shares are chosen as a basis for the Financial Times, Dow Jones and other share indices. The term is taken from the game of poker as the highest value chips used are blue.

blue-collar worker

US expression for a person engaged in manual employment; usually contrasted with a white-collar worker. de-industrialization and the increasing education of the labour force has reduced the number of these workers and, also, labour union membership.

blue economy

The official economy, known to and recorded by government. The term is derived in the UK from the term blue book, the annual summary of the national income accounts.

blue return

A self-assessment business income tax system, recommended by the shoup mission to Japan of 1949, for collecting taxes from small and medium-sized firms. This system was intended to encourage smaller businesses to maintain minimal accounting systems.

blue-sky laws

US Securities Act 1933 and other US statutes which regulate and supervise the us securities industry so that financiers do not attempt to sell something which they do not possess, e.g. part of the sky, to another person, or to devise other fraudulent investment schemes.

bogey

The return to or income from an investment which is used as the benchmark to judge the performance of a fund manager. Movements in a stock market index are often used as a bogey.

Bohm-Bawerk, Eugen von, 1851-1914

Leading economist of the austrian school and disciple of Carl menger. He read law at Vienna University and then economics at Heidelberg, Leipzig and Jena Universities; his student contemporary was wieser. From 1889 to 1893 he was a civil servant working on income tax and currency reform. On three occasions (1893, 1896-7 and 1900-4) he was the Minister of Finance of Austria; in 1902 University of Vienna appointed him to a chair. In his economic writings, he began with a theory of value based on marginal utility and then proceeded to a theory of interest and capital. His lengthy exposition of the

ROUNDABOUT METHOD OF PRODUCTION, possible through the use of capital, is central to his work. Production more capitalistic in nature has on average a longer period of production. He refused to relate the payment of interest to either productivity or exploitation, asserting that interest is paid because present goods have a higher subjective value than future goods.

Boisguilbert, Pierre Le Pesant de, 1646-1714

Born at Sainte-Croix Saint Ouen de Rouen, studied law at Paris and later became a lieutenant of police. He is credited with introducing the principle of laissez-faire. His main work was Dissertation de la nature des richesses, de l’argent et des tributes, oil l’on decouvre la fausse idee qui regne dans le monde a l’egard de ces trois articles (1707).

bond

1 A promise under seal to pay money.

2 A fixed interest security issued by a government, corporation or company.

bond fund

A fund established to receive the proceeds of a bond issue and to make subsequent disbursements. such funds are often set up by local authorities.

bonding cost

The cost to an agent of putting up a bond as a guarantee to meet losses. Bonding is common amongst travel agents and insurance underwriters.

bond market

A market which raises long-term capital for governments and firms through bonds bearing a fixed rate of interest, as well as arranging the trading of issued bonds.

bond rating agency

A financial markets specialist which rates the creditworthiness of the principal issuers of bonds – governments, municipalities and corporations. Standard & Poor and Moody’s are the leading US agencies of this kind.

bonus issue

An issue to present shareholders of extra shares in proportion to existing holdings. If issued without charge, known as a scrip ISSUE.

book value

The value of an asset as recorded in the books or accounts of a firm or other organization. Often this valuation is made at the time that assets are originally purchased with the consequence that changes in value caused by inflation are ignored.

A peak in economic activity, the upper turning point in the business cycle. Booms are characterized by high output, low unemployment, speculative investment and many short strikes.

boom and bust

The characteristic of a cyclical economy. Despite the overall stability of the UK economy, for example, in the late 1990s there were fluctuations in some sectors, especially agriculture and manufacturing.

boomernomics

us investment practice of investing in equities related to the expenditure carried out by the people born in the late 1940s after the ending of the war with Japan brought men home to marry in the USA.

bootblack economy

A derogatory term for a national economy dominated by labour-intensive service industries. Bootblacking is manual and non-exportable, unlike the products of modern, technologically advanced and internationally oriented service industries, e.g. banking and accounting.

bootstrap

A self-fulfilling expectation: for example, the belief that investment is pointless because the economy is slowing down with the consequence that the economy does go into recession.

border trade

Importing and exporting across a border which is often intra-industry trade. If the border is long, the products exported over one part of a border will also be imported over another. This happens, for example, with building materials over the USA-Canada border.

borrower’s curse

Having excessive optimism about a project that is loan financed.

borrower’s risk

The hazard of not knowing whether the expected returns to a project will materialize.

bottleneck

A shortage in the supply of a factor of production which, if not remedied, can add to inflationary pressures; hence an economy with full employment suffers many bottlenecks. Also, lack of an appropriate infrastructure has often been a major bottleneck impeding the development of less developed countries.

bottom fisher

An investor who buys stock market securities whose prices have recently slumped in the belief the market has reached its lower turning point.

bottom-line accounting

Accounting which is especially concerned with the net profit or earnings that appears at the bottom of a profit and loss account.

bottom-up linkage model

An interregional model of a national economy which aggregates the values of regional variables. The quality of these models in many countries is affected by shortages of regional data.

bought deal

The purchase of a stock issue or a portfolio of investments by one or more financial institutions for resale in whole or part. Offloading parts of an acquired portfolio has become easier as there are now so many types of financial instrument. As these deals cut dealing costs, they provide a popular method for investment trusts to acquire securities.

Boulding, Kenneth Ewart, 1910-92

A polymath economist born in the UK who made diverse contributions to many areas of US economics. He was educated at Oxford, Chicago and Harvard Universities. His career, which began as an assistant lecturer at Edinburgh University, was spent chiefly at Michigan from 1949 to 1977 and subsequently at Colorado. His writing began with an article in the Economic Journal in 1932 on displacement cost and resulted in the production of over 300 articles and twelve topics. His major text topic, Economic Analysis, blended together KEYNESIANISM and NEOCLASSICAL ECONOMICS. In 1950, in A Reconstruction of Economics, he urged a theoretical switch from flows to stocks, from incomes to assets, and from the prices of labour and capital to their national income shares. His close examination of equilibrium linked price and ecological equilibria. His study of social organization contrasted the exchange system and its threat system of war with the integrative system of a grants economy.

Boulwareism

A substitute for collective bargaining, named after Lemuel Boulware, the Vice-President for Industrial Relations at General Electric. It consisted of a company making a unilateral offer based on research into a union’s demands. It was held by the US Supreme Court in 1969 that this was not US collective bargaining in ‘good faith’ as intended by the taft- HARTLEYACT.

boundary constraint

The limit to the value of a variable, e.g. zero or positive.

bounded rationality

A theory of decision making taking into account the capacities of the human mind, which has become a central theme of behavioural economics. It asserts that the rational choice of a decision-maker is subject to cognitive limits because human beings lack knowledge and have only a limited ability to forecast the future.

bourgeoisie

The capitalist middle class created by the industrial Revolution at the beginning of the nineteenth century and regarded as exploitative by marx. The bourgeoisie was accused of wrongly appropriating surplus value from the product of the proletariat.

bourse

Stock market of a European country. The term is derived from the Bruges commod- ity exchange founded in 1360 in front of the home of Chevalier van de Buerse.

Box-Jenkins

A methodological approach to the study of time series which has improved short-term economic forecasting by following the method of identification of economic relationships and then estimation of them and diagnostic checking.

boycott

1 Stopping trade by refusing to deal with a particular country or supplier. This form of protest, first used against Ireland’s landlords in the nineteenth century, was employed against South Africa when apartheid was in force, and in many trade disputes.

2 An action by a trade (labor) union which prevents a firm from distributing its goods in an attempt to force it to concede the union’s demands. However, industrial relations legislation and antitrust law in the USA have increasingly made this illegal.

bracket creep

The movement of income tax payers into higher tax brackets as the inevitable consequence of the growth of money incomes with the income bands for each rate of income tax remaining the same. The results of this are higher marginal and average tax rates. The tax reform act 1986 (USA) attempted to eliminate this creep by indexing tax brackets and reducing the number of tax brackets.

Bradbury

UK Treasury note of £1 or 10 shillings issued in 1914 to 1928 after the withdrawal of gold coins. These were named after John Bradbury, Permanent Secretary to the Treasury, and were also known as Treasury notes or UK currency notes. The Bank of England’s dislike of small denomination notes necessitated issue by the Treasury. The smallest Bank of England note until 1928 was a £5 note; in that year, £1 and 10 shilling notes were included in the Bank of England issue.

Brady Commission

US presidential commission which reported in 1988 on the Wall Street stock market crash of October 1987. Its principal recommendations were that one institution, preferably the federal reserve system, should have the task of co-ordinating financial regulation; that clearing systems should be unified as a means of reducing financial risk; that there should be better information, including the trade, time of trade and ultimate customer in each major market; that there should be a harmonization of rules on margins; and that ‘circuit breakers’ should be co-ordinated across markets.

brain drain

international migration of highly qualified persons, especially surgeons, physicians, scientists, information technology specialists and engineers, from low-income countries to more prosperous economies, especially the USA. Differences in salaries and research facilities, as well as an over-supply of specialized graduates in less developed countries, have occasioned this, resulting in an increase in the human capital stock of advanced countries. Some countries have proposed the repayment of state financed education as a deterrent to emigration.

branch banking

A system of banking which permits a banking institution to operate at many locations. This eighteenth-century scottish invention was slow to be copied by other countries: the USA only began to adopt it in 1933. Branch banking reduces the risk arising from an overcommitment to the financial needs to a single area. Major UK clearing banks expanded in the past through establishing large branch networks. In the USA in the late twentieth century, branches sprang up in response to the liberalization of state banking laws, the growth of suburbs, the movement of industry to peripheral locations and the difficulty of reaching banks situated in congested city centres. The Interstate Banking and Branch Efficiency Act 1994 permitted branch banking across US state boundaries.

branch economy

A national or regional economy substantially controlled elsewhere because many of its businesses are foreign-owned subsidiaries. The Scottish economy has acquired a branch status through the use of regional policies which encourage inward investment; in many less developed countries multinational corporations have substantially transferred economic power abroad.

branding

product differentiation that establishes individuality for a particular product. A producer hopes thereby to gain a measure of monopoly power through reducing the amount of substitution between its products and those of its competitors.

brand loyalty

A consumer’s continued purchasing of the same differentiated good for a considerable period of time. As firms benefit from a stable regular demand, they will make it an objective of their advertising to achieve this goal. Brand loyalty lowers the elasticity of demand for a good and gives firms a measure of monopoly power.

brand stretching

Applying the name of an established brand to other products. This is extensively practised by tobacco companies.

Brandt Commission

The independent commission on international Development chaired first by Willy Brandt, previous chancellor of West Germany, and then by Julius Nyerere, ex-President of Tanzania. Its first report, North-South: a Programme for Survival (1980), failed to produce any action; its second report, Common Crisis: North-South Cooperation for World Recovery (1983), responded to the third world debt problem by recommending the amortization of old debts.

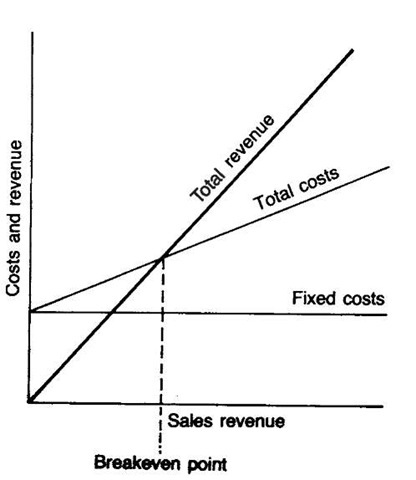

breakeven analysis

A graphical representation of the relationship between total costs and total revenue with breakeven taking place where total cost is equal to total revenue (i.e. average cost is equal to average revenue).

breakeven level of income

The level of income at which all income is consumed and no debts are incurred.

breakeven pricing

A firm’s policy of setting prices equal to average total costs with the consequence that neither supernormal profits nor losses are made. This was the original pricing policy laid down for UK nationalized industries.

breakthrough

A major technological change consisting of a new method of production, a new product or a new market.

Bretton Woods Agreement

An agreement signed in Bretton Woods, New Hampshire, USA, in 1944 that created the INTERNATIONAL MONETARY FUND. It set rules for exchange rate behaviour and created a pool of common currencies, thereby making the IMF the world’s ‘lender of last resort’. This agreement was a compromise between keynes’s proposals for an international clearing union and Harry White’s plan for an International Stabilization Fund. Par values for exchange rates were fixed in terms of gold. A country had to intervene if its exchange rate was 1 per cent above or below par. An adjustment of more than 10 per cent was permitted if the iMF thought there was a fundamental disequilibrium (a condition vaguely defined) in a country’s balance of payments. Temporary borrowings from the iMF were possible to support a currency. This gold exchange standard of Bretton Woods was abandoned on 15 August 1971.

Critics of Bretton Woods noted that the agreement did not provide a mechanism for changing inappropriate national exchange rate policies, that it failed to make national monetary and exchange rate policies compatible, and that it discouraged frequent changes in exchange rate parities. In practice, it was a dollar standard as most countries fixed their currencies against the US dollar. Its demise was hastened by the problems created by the Vietnam War for the US economy.

bridefare

A welfare programme in Wisconsin, USA, enacted in 1994 that increased welfare benefits to teenage mothers who got married. Originally this amounted to $91 extra for a single mother with one child on top of benefit of $440 per month.

bridging

short-term lending needed by a borrower prior to the receipt of permanent finance. This financing is a popular way of effecting a major purchase such as a house, or of adjusting an investment portfolio. it is often necessary as purchases are financed by the delayed proceeds from the sale of another asset.

Bridlington rules

trade union recruitment rules agreed by the UK Trades Union Congress in 1939 at its Bridlington conference to prevent trade unions competing with each other for potential members in the same occupational group.

Britannia

UK gold coin issued since 1987 in denominations of £10, £25, £50 and £100.

British depository receipt

A means of purchasing US Treasury bonds in New York and settling in London which was introduced in 1984.

broad money

M2 or M3.

brokered deposit

A deposit obtained by stockbrokers for a bank in order to increase its liquidity. As such deposits seek the highest yield, they are highly volatile and consequently unreliable as liquid assets.

broker loan rate

US money market rate, usually 1-1% per cent below the US prime rate, charged on the debit balances of margin traders; often regarded as an indicator of future changes in the prime rate of interest.

Brookings Institution

An independent centre founded in 1927 in Washington, DC, for research into economics, government, foreign policy and other social sciences. It is famous for its forecasting model of the US economy and for its influential studies of major economies, including those of Japan and the UK. Taxation, international economics, growth and stabilization have been major research concerns.

brownfield

Land previously used for industrial purposes which requires reclamation before new building can be undertaken.

brown good

A consumer durable used for leisure purposes, e.g. a television set or a compact disc player.

Brundtland Report

The 1987 report of the World Commission on Environment and Development which recommended that third world development projects should take into account environmental issues such as the destruction of forests and excessive farming which ruins agricultural land for a long time.

B share

1 chinese stock market share denominated in chinese currency but payable in foreign currency and designated for foreign investors.

2 An ordinary share of a UK company with voting rights.

bubble

1 An unsustainable rise in an asset price.

2 A speculative venture. Famous bubbles include the Dutch tulip mania of 162537 and the south sea Bubble in England of 1720. Unless there are an infinite number of traders, a bubble is irrational in nature.

bubble economy

1 An economy engaged mainly in marketing currencies and securities rather than in material production.

2 An unstable economy likely to be deflated after a burst of growth. The precarious nature of the new economy with different technologies is a modern example.

bubble policy

A policy which allows an emitter of pollutants to discharge more at one source if there is an equivalent reduction at other sources. An example would be a firm with two plants A and B being permitted to increase its emissions at A if it reduces them at B.

Buchanan, James McGill, 1919- (B3) US economist, educated at the Universities of Tennessee and chicago and professor of economics from 1956 at various universities in Virginia; appointed University Distinguished professor and General Director of the center for the study of public choice, virginia polytechnic Institute, in 1969. He is famous for founding public choice theory this unites the theories of market exchange and of the functioning of political markets. inspired by a year in italy (1955), where he read nineteenth-century European classics of public finance, he developed the concept of a democratic government receiving taxes from consenting citizens in return for governmental services by establishing constitutional rules to maintain majority consensus. His wide-ranging critique of public sector economics relies on the notion that costs are basically subjective; also he departs from the doctrine of the marginal cost pricing of public utilities. His analysis of choice is extended to cover the behaviour of politicians, legislators and bureaucrats.

Although a leader of the school of public choice economics, he recognized the early contribution of wicksell who discussed the distribution of the costs of proposed public expenditure. As Frank knight and Henry simons were his mentors when he was a postgraduate student at chicago, it is not surprising that his work has been loyal to the principles of capitalism and individualism. in 1986, he was awarded the nobel prize for economics for his work on public choice theory.

bucket shop

An agency selling goods, services or securities at a discount. The main examples of these are vendors of unsold newly issued shares, and travel agents selling low-priced air tickets of airlines operating their scheduled flights with many unoccupied seats.

Buddhist economics

An approach to economic growth which takes into account spiritual development and does not squander natural resources so that all have a ‘right livelihood’.