Theories of demand and supply have their roots in the works of the English economist Alfred Marshall, who divided all economic forces into those two categories. In 1890 Marshall introduced the concepts of supply price and demand price functions to capture the demand and supply factors facing an individual firm or industry. Marshall’s demand price function relates the quantity of a specific good buyers would be willing to purchase at alternative market prices. The supply price function relates the quantity of goods sellers would be willing to sell at alternative prices. In equilibrium, market price and sales (equal to purchases) would be established at the intersection of these two micro-Marshallian functions.

In his The General Theory of Employment, Interest, and Money (1936), John Maynard Keynes aggregated these Marshallian micro-demand and -supply concepts to achieve an aggregate supply price function and an aggregate demand price function for the macroeconomy. Keynes called the intersection of these aggregate functions the point of effective demand. This "point" indicates the equilibrium level of aggregate employment and output.

AGGREGATE SUPPLY PRICE

Keynes’s aggregate supply price function is derived from ordinary Marshallian microeconomic supply price functions (see Keynes 1936, pp. 44-45). It relates the aggregate number of workers (N) that profit-maximizing entrepreneurs would want to hire for all possible alternative levels of expected aggregate sales proceeds (Z), given the money wage rate (w), technology, the average degree of competition (or monopoly) in the economy, and the degree of integration of firms (cf. Keynes 1936, p. 245). In other words, the aggregate supply price is the profit-maximizing total sales proceeds that entrepreneurs would expect to receive for any given level of employment hiring they reach.

Gross Domestic Product (GDP) is the measure of the gross total output produced by the domestic economy. For any given degree of integration of firms, GDP is directly related to total sales proceeds (Z). If all firms are fully integrated—that is, if each firm produces everything internally, from the raw materials to the final finished product—then aggregate sales proceeds (Z) equals GDP. If all firms in the economy are not fully integrated, then Z will be some multiple of GDP depending on the average degree of integration of all firms.

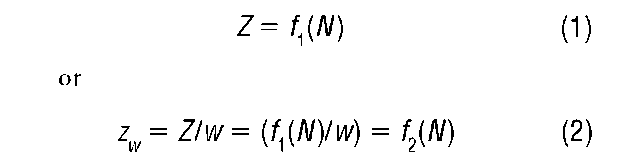

Keynes argued (1936, p. 41) that money values and quantities of employment are the only two homogeneous "fundamental units of quantity" that can be added together to provide meaningful aggregates. Accordingly, the aggregate supply price (expected sales proceeds) associated with alternative levels of employment should be specified either in (1) money terms (Z) or (2) Keynes’s wage unit terms (Z^, where the aggregate money sales proceeds is divided by the money wage rate (u). Hence the aggregate supply function is specified as either:

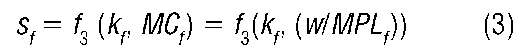

The Marshallian supply curve for a single firm (f.) relates the profit-maximizing output possibilities for alternative expected market prices. This supply price function (f) of any profit-maximizing firm depends on the degree of competition (or monopoly) of the firm (f) and its marginal costs (MC) In the simplest case, in which labor is the only variable factor of production, MCf = u>t MPL^ where u is the wage rate and MPLf is the marginal product of labor. Accordingly, the Marshallian microeconomic supply price function is specified as

Lerner’s (1935) measure of the degree of monopoly (f) is equal to (1 — 1/Ef where Ef is the absolute value of the price elasticity of demand facing the firm for any given level of effective demand. For a perfectly competitive firm, J = 0 and only marginal costs affect the position and shape of the firm’s supply price function.

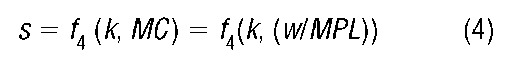

The Marshallian industry supply price function (s) is obtained by the usual lateral summation of the individual firm’s supply curves

where the symbols without subscripts are the industry’s equivalent to the aforementioned firm’s variables.

Although output across firms in the same industry may be homogeneous and therefore capable of being aggregated to obtain the industry supply quantities (as in equation 4), an assumption of output homogeneity cannot be accepted as the basis for summing across industries to obtain the aggregate supply price function of total output (Keynes 1936, ch. 4). Because every point on the Marshallian industry supply function (s) is associated with a unique profit-maximizing combination of price (p) and quantity (q), the multiple of which equals total industry expected sales proceeds (z) (i.e., pxq = z), and because every industry output level (q) can be associated with a unique industry hiring level n (i.e., q = j(n)), then every point of equation 4 of the s-curve in p vs. q quadrant space can be transformed to a point on a z-curve in z vs. n quadrant space to obtain

These equation 5 industry-supply functions are aggregated across all industries to obtain Keynes’s aggregate supply price function in terms of aggregate money proceeds (Z) and the aggregate quantity of employment units (N) as specified in equation 1. To achieve unique aggregation values of Z for each possible N, Keynes assumed that corresponding to any given point of aggregate supply price there is a unique distribution of income and employment between the different industries in the economy (Keynes 1936, p. 282).

Though Keynes describes the aggregate supply price function and its inverse, the employment function, in The General. Theory, he unquestioningly accepted Marshall’s microeconomic supply price concept as the basis for the aggregation he used to aggregate supply price function. Consequently, the bulk of The General Theory is devoted to developing the characteristics of aggregate demand price function, for it was the latter that Keynes thought was his revolutionary and novel contribution.

AGGREGATE DEMAND PRICE

Keynes’s "Principle of Effective Demand" (1936, ch. 2) attacked classical theory’s fundamental building block, known as Say’s Law. This law presumes that "supply (equal to total output produced and income earned) creates its own demand." Under Say’s Law all income, whether spent on consumption or saved, is presumed to be spent on the products of industry. Accordingly, the total costs of aggregate production incurred by firms (by definition equal to aggregate income earned) at any level of employment is presumed to be entirely recouped by the sale of output at every possible level of employment and output. The factors determining the aggregate demand price for products are presumed to be identical to those that determine aggregate output (aggregate supply price) for every possible given level of output.

Keynes justified his position by declaring that Say’s Law "is not the true law relating the aggregate demand price function and the aggregate supply price function____ [Such a law] remains to be written and without … [it] all discussions concerning the volume of aggregate employment are futile" (1936, p. 26). Keynes’s General Theory developed the characteristics and properties of the aggregate demand price function to explain why it was not identical with the aggregate supply function—that is, why supply does not create its own demand.

Keynes’s aggregate demand price function related the expected aggregate planned expenditures of all buyers for all possible alternative levels of aggregate income and employment. An expanded taxonomy for the components of the aggregate demand price relationship was necessary to differentiate Keynes’s analysis from the aggregate demand price function implicit in the classical Say’s Law. Under Say’s Law, all demand for producibles is collected in a single category (D1) that is solely a function of (and is equal to) income earned (supply) at all possible alternative levels of employment. Keynes split aggregate demand price into two categories, D1 and D2, where D1 represents all expenditures that "depend on the level of aggregate income and, therefore, on the level of employment N," and D2 represents all expenditures not related to income and employment (1936, pp. 29—30). These two categories make up an exhaustive list of all possible classes of demand.

Unlike the Say’s Law D1 category, Keynes’s D1 spending does not necessarily equal aggregate income, because some income might be saved—and in Keynes’s analysis, savings out of current income is never immediately used for the purchase of producibles. Keynes identified D1 as the propensity to consume (i.e., consumption expenditures) using current income. Keynes argued that some portion of current income was not spent on consumption, but was instead saved in the form of money or other liquid assets to permit the saver to transfer purchasing power to the indefinite future. Moreover, an essential property of money (and all liquid assets) is that it is not producible in the private sector by the employment of labor (Keynes 1936, ch. 17). Thus, the decision to save a portion of income as money or other liquid assets involves "a non-employment inducing demand" (cf. Hahn 1977, p. 39) that is incompatible with Say’s Law.

Because all income received goes either to planned consumption or planned savings, if Keynes’s second expenditure category, D2, were to be equal to the planned savings at every possible alternative level of employment, then Say’s Law would be reinstalled. To demonstrate why D2 is not equal to a planned savings function, Keynes assumed the existence of an uncertain future (i.e., a system in which the classic ergodic axiom is not applicable). By uncertain Keynes meant that the future can neither be known in advance nor reliably statistically predicted through an analysis of existing market price signals. Given an uncertain (nonergodic) future economy, future profits, the basis for current D2 investment spending, can neither be reliably forecasted from existing market information, nor endogenously determined via planned savings. Instead, the expected profitability of investment spending (D2) depends on the optimism or pessimism of entrepreneurs— what Keynes called "animal spirits." In such a world, neither in the short run nor the long run can D2 expenditures be a function of current income and employment.

Keynes’s general theory, therefore, implies that the aggregate demand price function is not identical with the aggregate supply function at every possible alternative level of employment. Thus, the possibility exists for a unique single intersection (the point of effective demand) at less than full employment.