The term adaptive expectations refers to the way economic agents adjust their expectations about future events based on past information and on some adjustment term. This implies some sort of correction mechanism: if someone’s expectations are off the mark now, they can be corrected the next time, and so on. Economists view decision rules that govern an agent’s behavior as being continuously under revision. As new decision rules are tried and tested, rules that yield accurate outcomes supersede those that fail to do so. In this sense, Robert Lucas (1986) refers to the trial-and-error process through which the models of behavior are determined as "adaptive."

Suppose we want to forecast the inflation rate (n) which is itself measured by variations in the price index over time, (P — Pf _ 1)/Pt _ 1. An example from an economics textbook (e.g., Arnold 2005, pp. 351-352) will help illustrate the principle of adaptive expectations. Let an individual forecast the future inflation rate for Year 5 based on the previous four yearly inflation rates. Observing the declining trend in the inflation rate over time, the forecaster assigns more weight to the more immediate past as follows:

Year 1: 5% inflation rate with weight 10% Year 2: 4% inflation rate with weight 20% Year 3: 3% inflation rate with weight 30% Year 4: 2% inflation rate with weight 40%

The individual’s expected inflation rate, E(n), will be: 0.05 (0.10) + 0.04 (0.20) + 0.03 (0.30) + 0.02 (0.40) = 0.030, or a 3 percent inflation rate forecast for Year 5.

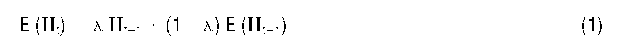

More generally, inflationary expectations can be calculated by using a weighted average of past actual inflation (n ) and past expected inflation measured by E(n – 1):

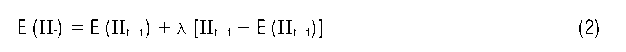

where: E (.) is the expectations operator; and 0 < A < 1 is the weight of past inflation on current inflation expectations. Algebraic manipulation of (1) yields:

where the second term (in brackets) is composed by the weight and a forecast error of the previous rate of inflation. Inflationary expectations are thus the sum of the previous term inflation forecast and the forecast error. The error term is going to have a large effect on current inflationary expectations if the parameter X is large. If X is zero, the adjustment term vanishes and current expected inflation matches past expected inflation. If, on the other hand, X is one, the current expected inflation rate equals the past inflation rate.

The adaptive expectations principle found plenty of applications in macroeconomics, such as in the analysis of hyperinflation by Philip Cagan (1956), in the consumption function by Milton Friedman (1957), and in Phillips curves for inflation and unemployment. The empirical success of the idea was ultimately challenged by the rational expectations hypothesis, developed by John Muth (1961) and extended by Thomas Sargent and Neil Wallace (1975) and Lucas (1976). More recent work, such as George Evans and Garey Ramey (2006), follows Muth (1960) and reconsiders the Lucas critique in the context of adaptive expectations.