Abstract

In the United States, the same stock can be traded at different locations. In the case of listed stocks, each location is a node in national network called the Intermarket Trading System (ITS). Unlisted stocks also trade at different nodes on the National Association of Securities Dealers Automated Quotation (NASDAQ) network. Each node of these two networks may have rules for breaking queuing ties among competing orders. Orders may be routed on the networks according to official rules (as with ITS) or order preferencing arrangements (both networks). This paper examines the impact of priority rules on individual markets and networks. The development of the ITS and NASDAQ networks as well as the relevant literature is discussed. I conclude that network priority rules improve market quality if they result in consolidated markets.

Keywords: networks; nodes; priority rules; preferencing; consolidated; fragmented; market quality; Intermarket Trading System; NYSE; NASDAQ

Assume that an investor wants to sell 100 shares of stock and a number of people are willing to buy it. Who should get to buy the 100 shares? If asked, the average person would say, the trader offering the highest price. What if there is more than one trader offering the same price? The average person would answer the trader who quoted the price first.

However, many times, the trader quoting the best price first does not get to trade. An understanding of the determinants of trade sequencing (called priority rules) will assist investors in designing trading strategies. This paper will review the different types of priority rules as well as the literature on the subject.

Related to priority rules is the concept of order routing. The average person conceives of a market for stock as a single entity. While it is true that Microsoft is a The National Association of Securities Dealers Automated Quotation (NAS-DAQ)-listed stock, the NASDAQ system is only one node in a network, any one of which could execute a trade for Microsoft. Similarly, there are more than a handful of markets in the United States that trade New York Stock Exchange (NYSE)-listed GE. The markets for both Microsoft and GE can be thought of as networks with multiple nodes. Each node may or may not have similar priority rules to the other nodes in the network.

In addition, networks may have priority rules that govern the routing of orders within the network (as does the network for NYSE stocks) or may not have network-wide priority rules (this is the case on NASDAQ). In fact, recently, the U.S. Securities and Exchange Commission (SEC) and derivatively Congress have begun addressing the issue of whether networks should have priority rules. The SEC has proposed imposing network-wide priority rules on NASDAQ, while some market forces have tried to convince the Congress that not only should NASDAQ not have network-wide priority rules, they have also lobbied to eliminate NYSE-listed network priority rules.

From the brief discussion just presented, it is clear that a submitted order faces a maze of routing and priority rules. Therefore, this paper will address these issues in hopes of shedding light on the relevant factors in designing an optimal network with regard to network routing and node priority rules.

In the following section, I shall discuss different types of priority rules in use in markets today as well as the literature on the subject. In Section 44.2, I will present a history of how the networks for NYSE-listed and NASDAQ stocks developed, which includes routing rules. In the Section 44.3, I will discuss the current political and regulatory environment concerning stock networks. I will also discuss whether networks benefit from priority rules. In the final section, I conclude.

Priority Rules

Markets and network nodes use a variety of priority rules to match buyers with sellers.1 Typically, price takes the highest priority: The buyer willing to pay the most is entitled to trade with the next seller willing to sell at the buyer’s bid price and vice versa. However, if there is a tie in which more than one buyer is willing to buy at a different price, markets use a variety of different rules to decide who gets to purchase from the next seller. Here is a sample of the different secondary rules:2

Time priority represents a first-come, first-served model. The first order submitted at a given price is the first one to be filled. The American Stock Exchange, Paris Bourse, Tokyo Stock Exchange, and Toronto Stock Exchange Computer-Assisted Trading System (CATS) prior to 1996 used some variation of this method. However, it is by no means clear that time priority is the most desirable secondary priority rule for a market. Indeed, few financial markets use pure time priority.3

Class priority gives priority to certain classes of traders over others. For example, on the Toronto Stock Exchange the Registered Trader has a higher priority than orders on the topic in that he or she can participate in certain incoming trades up to half the minimum guaranteed fill. On the NYSE, however, the specialist cannot trade ahead of the limit order book. In a dealer market such as the old NASDAQ system (prior to the new order handling rules), dealers could take priority over customer orders – even if customer orders at a better price – because the customers have no means of bypassing the intermediaries. We will discuss dealer priority in more depth later in the paper.

Random priority randomly assigns an order among the traders willing to trade at a given price. Each floor trader willing to trade at a given price has an equal probability of filling the next order. This is effectively what happens in the ”open outcry” method found in floor-based futures trading pits such as the Chicago Board of Trade.

Sharing or pro rata priority is also a common practice on many trading floors including the Stock Exchange of Hong Kong and the old Toronto Stock Exchange floor-based system. A sharing priority rule could allocate equal shares to each order on the topic. Alternatively, the allocation could be proportional to the total size of a member’s orders on the topic (pro rata sharing.) However, even if a trading floor has a time priority rule, it may be virtually impossible to determine who was first. For example, a large order may arrive at a trading venue where there are several traders willing to fill the order. Therefore, a large order may be de facto shared among many traders.

Size priority grants priority to orders based on their size. Priority could be granted to the largest order, which has the advantage of giving traders an incentive to place larger orders.4 Alternatively, priority could be granted to the order that matches the incoming order in size. This minimizes the number of trade tickets to be processed. A variation of this secondary priority rule is used on the New York Stock Exchange.

Exposure priority grants priority to orders that are revealed to other market makers and reduces the priority for those traders who want to hide their orders. On the old CATS system and the Paris Bourse, traders can hide a portion of their orders from exposure on the electronic systems.

These different secondary priority rules have strong implications for the ways that investors compete to obtain an order fill. In a pure time priority market, an investor who is the first to put in a bid at a higher price is first in line to fill the next market sell order. With random or sharing priority there is much less incentive to pay up by bidding higher. This is because there is a positive probability that a trader can obtain a fill, within the same time to execution as bidding higher, by merely matching existing quotes.

Therefore, it can be seen that priority rules can have an impact on market quality. For example, in systems with time as the secondary priority rule, traders have incentives to improve on the price since merely matching a current best price puts them at the back of the queue. This could lead to narrower spreads. Similarly, in systems where public orders take priority over market maker or specialist orders, there will be more public orders submitted. This can lead to more liquidity being supplied.

Literature on Priority Rules

Cohen et al. (1985) find support for the notion that time priority leads to more price competition and, hence, narrower spreads. They use a simulated queuing model to show that systems that do not enforce time priority have wider spreads relative to those that enforce time priority.

Angel and Weaver (1998) and Panchapagesan (1998) compare market quality and investor behavior differences between systems that use time priority as their secondary rule with systems that use pro rata sharing. In particular, Angel and Weaver examine the 29 July 1996 switch from time to sharing priority for stocks in the Toronto Stock Exchange’s (TSX) CATS. Panchapagesan also examines the TSX but compares a matched sample of CATS stocks with stocks traded on the TSX floor. During Panchapagesan’s sample period the TSX floor used sharing priority rules while CATS used time priority.

Both studies find that a sharing priority rule results in less price competition compared with a time priority rule. They also find that a sharing priority rule results in more gaming behavior by investors in an attempt to get their orders filled. For example, a sharing priority rule encourages investors to submit larger orders and then cancel them when their desired volume is filled. Pancha-pagesan (1998) additionally concludes that the lack of price competition in sharing priority rule systems results in wider bid ask spreads than under time priority.

Cordella and Foucault (1999) develop a theoretical model of dealer competition and also conclude that spreads will be wider under a random allocation rule than under a price/time priority system. The intuition is that under a random allocation rule dealers can always match other dealers’ quotes without losing priority.

Harris (1994) addresses the relationship between priority rules, tick size, and depth.5 Harris points out that large ticks and time priority protect traders that place limit orders. If a trader wants to trade ahead of another in a time priority rule system, he or she must improve on the price. A large tick makes obtaining precedence costly.6 Harris then argues that time priority encourages traders to quote more size, which leads to greater quoted depth.

Two points are evident from the above discussion. First, traders will change their behavior as rules change. Second, the behavior of these traders impacts market quality and hence the terms of trade for unsophisticated traders.

Networks

Thus far, the discussion of priority rules has assumed that there is a single market for stocks. That is markets are consolidated. What if there are multiple markets? In this section, I will discuss networks of markets and how priority rules may apply to them. I will also consider the development of two major network structures: one for listed stocks such as those on the NYSE and another for over-the-counter (OTC) stock.

The Network for Listed Stocks

During the first half of the twentieth century, the role of regional stock exchanges changed and their number decreased dramatically. When regional stock exchanges like the Boston Stock Exchange were first established, there was poor telecommunications in the United States and travel was expensive. As a result, it was very difficult for investors away from a company’s headquarters to find out anything about the company. Therefore, regional stock exchanges were established as a place to trade local companies. As telecommunications improved and travel became less expensive, it became easier to find out about companies located in distant geographic locations. As companies grew, they switched listed on the American or New York Stock Exchanges where they could obtain the prestige of a national listing.

So, the regional exchanges experienced a dramatic drop in listings. Perhaps to provide another source of revenue, local traders began trading NYSE-listed stocks. Multiple trading venues for the same NYSE-listed stock led to frequent differences in prices across markets. Stories are abound of traders paying for open phone lines between the NYSE and one of the regional stock exchanges so that they could capitalize on the discrepancies. Over time, Congress observed that prices for NYSE-and Amex-listed stocks varied widely across the exchanges that traded them. This led to the passage of the Securities Act Amendments of 1975 in which Congress ordered the SEC to create a National Market System (NMS) that, in part, would allow investors to execute trades on markets that displayed the best price.

After deliberation, on 26 January 1978, the SEC issued the Exchange Act Release No. 14416 that required markets to create a network that would ”permit orders for the purchase and sale of multiple-traded securities to be sent directly from any qualified market to another such market promptly and efficiently.”7 Two months later, the American, Boston, NYSE, Pacific, and Philadelphia Stock Exchanges submitted a ”Plan for the Purpose of Creating and Operating an Intermarket Communications Linkage.” This became known as the Intermarket Trading System (ITS).

The ITS allowed exchanges to route orders to each other. It was in effect an e-mail system in which the specialist on an exchange could ask a specialist on another exchange if they would be willing to trade at their quoted price.8 A few months later, the SEC also created the Consolidated Quote System (CQS), which collected the best quoted prices to sell (called the offer) and buy (called the bid) securities. The CQS then constructed the best bid and offer (BBO) and disseminated it to the exchanges and data vendors who disseminated it to the public.

Although the ITS established a network and a method for routing orders, there initially was no rule indicating under what circumstances participants were to route orders to another exchange. Nor was the OTC market a part of the linkage. The NASDAQ traded many NYSE and Amex stocks. After the passage of the Securities Act Amendments of 1975, they began work on a Computerized Automated Execution System (CAES) to interface with ITS. Finally, on 28 April 1981, the SEC issued an order requiring that CAES become a part of ITS.

That same month, the SEC issued Securities Exchange Act Release No. 17703 that prohibited ITS/CAES participants from executing orders at prices inferior to those displayed on another network node. This requirement became known as the trade through rule and established a network-wide priority system for investor orders. The rule requires an exchange to either match a better price or route the order to the exchange displaying the better price.

The effect of the trade through rule was and is to establish price as the first priority rule across the ITS network. In turn, each regional exchange (a node) has its own priority rules.9 So, an order reaching any node of the ITS network was first subject to a network-wide price priority rule and then the node’s priority rules.

The Network for OTC Stocks

In the previous section, I discussed how a network for exchange-listed stocks developed. While exchanges list many stocks in the United States, the majority of stock issued are traded OTC, so-called because you went to your broker’s office and purchased them at the front counter. In the early part of the twentieth century, there was no organized way to buy and sell OTC stocks and so many times investors or brokers resorted to newspaper ads to accomplish the task.

In 1913, the National Quotation Bureau was formed by two businessmen who collected and published daily quotations from dealers of securities in five different cities. Their publication became known as the Pink Sheets because of the color of the paper they were printed on. For each stock the Pink Sheets listed the brokers trading the stock and representative quotes. The quotes were old, but at least brokers had a list of other brokers who were interested in trading a particular stock issue. Brokers would contact those listed in the Pink Sheets to get current quotes. Because of the large number of listed brokers for some stocks and the amount of time necessary to call each one, a rule was developed over time that required brokers to contact at least three (but not all) of the brokers listed on the Pink Sheets in order to try and find the best price for customers. Due to the lack of continuous investor interest in OTC stocks, the market developed as a dealer market who would act as intermediaries between investors – buying and selling stocks to earn a profit.

The vast majority of stock issues (but not stock volume) were traded this way for almost 60 years. As companies grew, they typically listed on an exchange. Over time, though telecommunications improved and the Pink Sheets expanded their coverage to nationwide. This increased the number of dealers making markets in a particular stock and made the goal of finding investors the best price more difficult. So, in 1971, the National Association of Securities Dealers (NASD) created an automated quotation system with the acronym NASDAQ for trading the more active OTC issues. The system allowed dealer members to input contemporaneous quotations for stocks they made a market in. NASDAQ was similar in its aggregating function to the CQS for listed stocks. Brokers still needed to telephone dealers to trade. And NASDAQ was a dealer market. While the exchanges established prices based on a combination of public limit orders and specialist quotes, NASDAQ displayed dealer quotes.10,11

Initially, NASDAQ dealers could ignore customer limit orders. Customers learned that limit orders were not executed and did not submit them. In 1994, an investor sued his broker and as a result NASDAQ established a rule which came be known as Manning I. The rule prevented NASDAQ dealers from trading through their customer limit orders at better prices – much like ITS trade through rules do.12 However, after the passage of Manning I, NASDAQ dealers could still trade at the same price as customer limit orders they held, i.e. there was no public order priority rule. This was in contrast to the exchanges that had public priority rules. NASDAQ customers were still reluctant to submit limit orders. A year later, another rule, Manning II, gave public limit orders priority, but only within a dealer firm. In other words, a customer submitting a limit order to Dealer X could still see trades occurring at other dealers at the same price as the customer’s limit order. Thus, Manning II still discouraged public limit order submission and as a result they were not a major supplier of liquidity on the NASDAQ market.

So it can be seen that although NASDAQ was a network of dealers, it had no market-wide priority rules as did the exchanges. In addition, proprietary trading systems were established that allowed NASDAQ dealers to trade between themselves at prices that were better than the best quotes on NASDAQ. Like it had for exchanges, Congress and the SEC acted and established a method for investors to access the best quoted prices. However, the landscape for NASDAQ stocks in the 1990s was different than that for exchange listed stocks in 1975. While a number of exchanges were trading the same stocks in 1975, there were really only two players for NASDAQ stocks by the mid-1990s. Other than NASDAQ itself, where dealers traded with the public, the only other place NASDAQ stocks were traded was on a proprietary system called Instinet.13

Most, if not all, NASDAQ dealers also were already connected to Instinet; so, rather than create a new network, the SEC required that Instinet quotes be made part of the BBO for NASDAQ stocks. The Order Handling Rules (OHR), enacted in early 1997, also required NASDAQ dealers to expose customer limit orders to the public by including them in their quotes. Rather than specifically including Instinet into the calculation of the BBO, the SEC generalized the rule to include any system for displaying limit orders for NASDAQ stocks. These systems were referred to as Electronic Communications Networks (ECNs) and a number of new systems were established in anticipation of the OHR or shortly after its passage.

These ECNs unleashed the potential of public limit orders. After the OHR, spreads dropped dramatically with most of the drop attributed to public limit orders competing with dealer quotes.14 ECNs grew in market share from around 20 percent in 1997 to 80 percent today. The OHR created a much larger network of systems than ITS ever faced. At the time of the OHR, the SEC did not require a trade through rule for the NASDAQ/ECNs network as it did for ITS.

Do Networks Need Priority Rules?

During 2004 the SEC proposed Regulation NMS. Part of the rule proposes to extend the ITS trade through rule to NASDAQ. On 10 February 2004, Congressman Richard Baker sent SEC Chairman William Donaldson a letter calling the ITS trade through rule “antiquated” and calling for its complete repeal. Congressman Baker suggested that execution speed was just as important as price and that investors should be allowed to choose whether they wanted price or speed to be the primary routing rule.

There is support for Congressman Baker’s position in the academic literature. For example Hatch et al. (2001) compare trade executions for NYSE-listed stocks between different nodes on the ITS/CAES network. They find that investors receive better prices on the NYSE, but the regional exchanges offer more speed of execution and larger execution sizes. In addition, Battalio et al. (2002) examined limit orders execution. They find that at-the-inside limit orders do better on regional exchanges in terms of speed of execution (perhaps due to shorter queues) than on NYSE, but quote improving limit orders do better on the NYSE where they execute faster and more profitably.

Congressman Baker’s letter then raises the question: Do networks need priority rules? On its face, it would seem obvious that investors should be allowed to send orders wherever they choose. However, overall market quality must be balanced against the needs of individual traders. If the needs of the individual do not cause harm to the overall population then the individual should be allowed to route orders as they wish. If however, the overall population of traders is harmed by the choices of the individual then the needs of the majority outweigh the individual’s needs.

A similar argument is used to justify nonsmoking areas. While an individual aware of smoking’s risks has the right to smoke, the impact of second-hand smoke on nonsmokers is such that nonsmokers will be harmed if smokers exercise their right to smoke around them. Therefore, various laws have been enacted to protect non-smokers from the harmful affects of second-hand smoke. The greater good comes down on the side of providing nonsmokers with a smoke-free environment.

Following the smoking analogy, the ability of traders to choose their priority rules should be weighed against overall market quality. For this purpose, the literature on consolidation and fragmentation becomes useful. In a consolidated market, order flow is concentrated in a single location. In a fragmented market, order flow is split up between multiple locations. The number of choices between consolidated and fragmented is a continuum not a bifurcation.

A number of papers have been written on the subject of fragmented versus consolidated markets. They generally conclude that consolidated markets offer better market quality than fragmented markets. For example, Madhavan (2000) developed a theoretical model that shows that fragmented markets have higher volatility than consolidated markets. Wei and Bennett (2003) find empirical support for Madhavan’s conjecture. In particular, they find that stocks that switch from the fragmented NASDAQ to the comparatively consolidated NYSE, experience a reduction in spread and vola-tility.15 Barclay et al. (2003) examined stock price and volume around quarterly expirations of the S&P 500 futures contract (so called witching days). They found that NYSE prices are more efficient than NASDAQ prices. They attributed the superior performance of the NYSE to the larger degree of order flow consolidation found there relative to NASDAQ.

Battalio et al. (1998) examined Merrill Lynch’s decision to route all orders for NYSE-listed stocks to the NYSE rather than to a regional exchange where they could effectively internalize the order flow. They found that, consistent with other studies, the NYSE routing decision resulted in investors obtaining better prices and spreads narrowing.

Murphy and Weaver (2003) examined the TSX rule that require brokers receiving market orders of 5000 shares or less, to either improve on price or send the order to the TSX for execution against limit orders. Following the adoption of the rule, the affected stocks experienced an immediate increase in depth and reduction in spread.16 In addition to the TSX, many other exchanges around the world have so-called concentration rules.

Therefore, the extant literature suggests that overall market quality is higher in consolidated versus fragmented markets. The NYSE market share of its listed stocks is around 80 percent and they display the best price over 90 percent of the time. Therefore the market for NYSE stocks can be considered relatively consolidated. Although never empirically tested, there appears to then be a link between percentage of the time a market displays the best price and its market share. So the ITS network price priority rule may be the mechanism that causes the consolidation of NYSE stocks. If orders are routed away from the NYSE to another exchange or market maker then the market for NYSE stocks will become more fragmented. The academic literature suggests that an increase in fragmentation will result in wider spreads and higher volatility. It has been shown, time and time again, that investors factor execution costs into their required cost of supplying funds to firms.17 Therefore, higher execution costs will translate into higher costs of capital for firms and stock prices will fall.

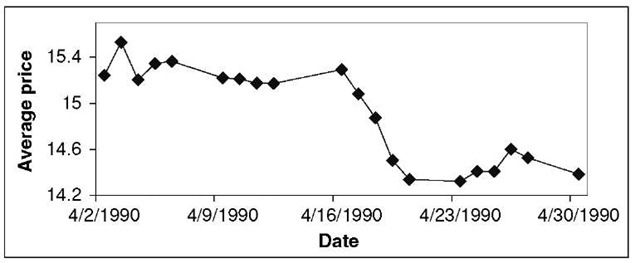

Figure 44.1 illustrates the relationship between execution costs and stock prices.18 On 11 April 1990, the TSX enacted rules that resulted in effective execution costs rising by about 0.25 percentage points. Within a week, prices declined by over 6 percent.

It can, therefore, be concluded that a network priority rule based on price results in improved market quality. Although a direct empirical link can only be proven by examining what happens if the network price priority rule is removed, logical inferences can be drawn from examining the behavior of those traders that supply liquidity to the market. The following section discusses the behavior of limit order traders who are the major supplier of liquidity on the NYSE.19

Figure 44.1. Average daily prices of stocks in our sample for April 1990

Liquidity Supplied by Limit Order Traders

There is an old adage that ”liquidity begets liquidity.” In other words, limit order traders will submit limit orders where market orders exist. It is similar to the fact that the more traffic exists on a highway, the more gas stations will exist. If the traffic goes away so will the gas stations. Similarly, if market orders get routed away from the venue with the best price, limit orders will leave that venue as well. There will be less price competition and, as a result, spreads will widen.

Limit orders are shock absorbers for liquidity events. Without limit orders to absorb trades from liquidity demanders, large orders will increasingly push prices away from current prices.20 While it may be argued that price impact is a fact of life for institutions, small traders who submit order in the same direction, but just behind the large order may suffer financial loss. The small order will execute at an inferior price before sufficient liquidity can be sent to the market by traders. It can then be seen that thin markets are more susceptible to liquidity event volatility than deeper markets.21 Thus, markets with more depth are desirable.

The TSX market concentration rules best illustrate the above points. Prior to the adoption of the rule, it was common practice for member firms to execute market orders and marketable limit orders from the member’s own inventory (called internalization). Limit order traders realized that even if they had the best quoted price, many orders would never reach them and they would not get timely executions.22 The TSX adoption of its concentration rules caused more market and marketable limit orders to be submitted to the exchange where they could execute against limit orders. The increase in order flow to the exchange caused more limit order traders to compete for the order flow. This, in turn, resulted in narrower spreads and more quoted depth.

This section of the paper suggests that networks without priority rules discourage limit order submission which results in higher effective execution costs for the average investor. A few large players may benefit from the absence of a network priority rule, but it will be at the expense of the majority of long-term investors. Therefore, it can be seen that overall market quality benefits from network priority rules.

A Final Note on the Need for Speed

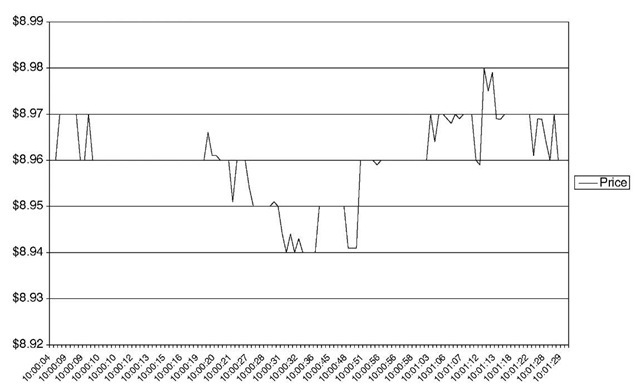

In the current drive to eliminate priority rules for the ITS network, the most common reason cited is a desire to get a trade done quickly – perhaps in a second or less. Is this advantageous? Perhaps examining a graph of a random stock on a random day would help. Figure 44.2 is the graph representing all trades in Juniper Inc. (JNPR) for 3 February 2003 from 10:00 AM until 10:01:30 AM.

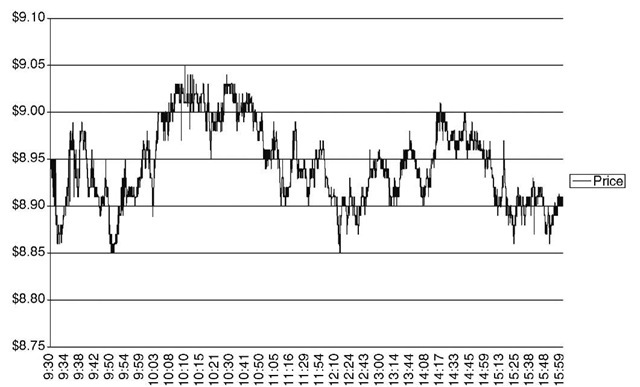

It can be seen that getting an order filled at 10:00:51 compared to 10:00:52 may save you $0.02 on that trade. However, if we examine JNPR over the entire day it can be seen that prices fluctuated by $0.20 over the day, a factor of 10. So, price changes over small-time increments are much smaller than over longer increments (Figure 44.3). In that case, what type of trader benefits from small price changes and, hence, needs speed? The answer is arbitrageurs and hedge funds. As mentioned earlier, if we allow orders to be routed for other than best price, then limit order traders will reduce the amount of liquidity they supply, increasing execution costs. It can then be seen that this ”need for speed” benefits the few at the expense of the many.

Figure 44.2. JNPR 3 February 2003 10:00 to 10:01:30 AM

Figure 44.3. Juniper corporation 3 February 2003

Conclusion

In this paper, I have considered priority rules as they apply to individual markets (nodes) and networks. The literature on priority rules suggests that the adoption of some priority rules can improve market quality within a node. After a discussion of the development of the ITS and NASDAQ networks, I consider whether network priority rules matter. Since a network’s priority rules (or routing rules) can result in a concentration of orders, I discuss the literature on consolidated versus fragmented markets. I conclude that network priority rules improve the market quality if they result in consolidated markets. This further suggests that the current price priority rule on ITS should, therefore, be retained and extended to the NASDAQ network as proposed by the SEC.