SAMURAI BONDS

Yen-denominated bonds issued in Japan by a foreign borrower. This contrasts with Shogun bonds.

SCHILLING

Austria’s currency.

SCRIPTURAL MONEY

The form in which the euro can be used during the transition period—before it is available in notes and coins. It includes all forms of noncash money such as checks, money orders, credit cards, payment cards, and electronic purses.

S/D-B/L

Short form for sight draft and bill of lading attached. SECURITIZATION

Securitization is the process of matching up borrowers and lenders wholly or partly by way of the financial markets. Using this process, traditional bank assets, mainly loans or mortgages, are converted into negotiable securities. More broadly, it refers to the development of markets for a variety of new negotiable instruments.

SEIGNIORAGE

Seigniorage is the difference between the cost to the reserve country of creating new balances and the real resources the reserve country is able to acquire. It then is a financial reward accruing to the reserve currency as a result of the use of the currency as a world money.

SELLING SHORT

Short selling means selling a security (e.g., stocks, foreign currencies) that is not owned by the seller. This method has been used as a method for making profit from a fall in stock price. The rationale behind short selling is as follows. We all know that the simplest way to make money in the stock market is to buy a stock at a low price and sell it later at a higher one. In a short selling situation, investors are reversing the sequence; they are selling high, promising to buy back the stock later at what they hope will be a lower price. If the stock price falls, they make money. If it rises and they have to buy back their stocks for more than they sold it, they lose money. An investor who wants to sell short has to set up a margin account with a stockbroker and comply with rules established by the federal government, the SEC, and the brokerage house.

SETTLEMENT RISK

Also called Hersatt risk, settlement risk, a form of credit risk, is the risk that a bank’s counterpart will be unable to deliver money in a foreign exchange deal.

SHARPE’S RISK-ADJUSTED RETURN

Sharpe’s risk-adjusted return is a risk-adjusted grade that compares five-year, risk-adjusted returns. This measure, developed by Nobel Laureate William Sharpe, is excess returns per unit of risk. The index concentrates on total risk as measured by the standard deviation of returns (noted with the Greek letter a, read as sigma).

EXAMPLE 111

If a mutual fund has a return of 10%, the risk-free rate of 6%, and the fund and standard deviation of 18%, the Sharpe measure is .22, as shown below.

Mutual fund analysis by Morningstar Inc. (www.morningstar.net) and others use the Sharpe measure. An investor should rank the performance of his mutual funds based on Sharpe’s index of portfolio performance. The funds would be ranked from high to low return. For example, a fund with an index of .6 would be far superior to one with an index of .3. Sharpe’s index should be compared with other trends as well as with the average market. The larger the index, the better the performance. Note: The index should be used by investors with some mathematical knowledge. And remember, the portfolio with the best risk-adjusted performance will likely not produce the greatest profits. Formulas such as Sharpe’s take into account the risk undertaken to earn profits. See also TREYNOR’S PERFORMANCE MEASURE.

SHEKEL

Israel’s currency.

SHILLING

Monetary unit of Kenya, Somalia, Tanzania, and Uganda. SHOGUN BONDS

Foreign currency-denominated bonds issued within Japan by Japanese companies. This contrasts with Samurai bonds.

SHORT

An investment is short if the investor makes money when its price or the price of the underlying security drops.

SHORT-TERM NATIONAL FINANCIAL MARKETS

Also called national money markets, short-term national financial markets are markets, in different countries, for short-term instruments such as bank deposits and government bills in different nations. Typically, local bank deposits and short-term investments in government securities give the firm an interest-earning opportunity for its locally available funds. This contrasts with long-term national financial markets.

SIMEX

Singapore International Monetary Exchange.

SIMPLE ARBITRAGE

Also called a two-way arbitrage or locational arbitrage, simple arbitrage is the one that eliminates exchange rate differentials across the markets for a single currency. If the exchange rate quotations between two markets are out of line, then an arbitrage trader could make a profit buying in the market where the currency was cheaper and selling in the other.

EXAMPLE 112

Suppose that the indirect rates are £0.6603/$ prevailing in New York and £0.6700/$ prevailing in London. If you simultaneously bought a pound in New York for £0.6603/$ and sold a pound in London for £0.6700/$, you would have (1) taken a zero investment position because you bought £1 and sold £1, (2) locked in a sure profit of £0.0097/$ no matter which way the pound subsequently moves, and (3) eliminated the different quotes in New York and London.

SINGLE-COUNTRY FUNDS

Mutual funds invested in securities of a single country, single-country funds are the most focused and by far the most aggressive foreign stock funds. Almost all single-country funds are closed-end funds (exceptions are the Japan Fund and French Fund). Because of their aggressive investment style, single-country closed-end funds have been recognized to sell at both large discounts and premiums to their net asset value.

SOFT CURRENCY

Also called weak currency, a currency for which there is not much demand and whose values often fluctuate. The Nepal Rupee would be an example. See also HARD CURRENCY.

SOFT LANDING VS HARD LANDING

Soft landing means, in Fed speak, that the economy is slowing enough to eliminate the need for the Fed to further raise interest rates to dampen activity—but not enough to threaten a recession, which is what results when the economy contracts instead of expands. Hard landing, on the hand, could mean a recession.

SOFT LOANS

Soft loans are loans that have grace periods during which no payments need be made; they may bear low or no interest. Loans granted by the International Development Agency (IDA) are an example of soft loans.

SPECIAL DRAWING RIGHTS

Also called, paper gold, special drawing rights (SDRs) are the official currency of the International Monetary Fund (IMF). The SDR is the unit of account for all purposes of the Fund. Created in 1967, SDRs are a new form of international reserve assets. Outside the Fund, the SDR is widely used as a unit of account in private contracts such as SDR-denominated deposits with commercial banks. A number of the Fund’s member countries peg their currency to the SDR. Its value is based on a weighted basket of five currencies: U.S dollar, West German mark, U.K. pound, French franc, and Japanese yen. Unlike gold, SDRs have no tangible life of their own and take the form of bookkeeping entries in a special account managed by the Fund. They are used as the instruments for financing international trade.

SPECULATION

Also called risk arbitrage, speculation is the process that ensures the equality of returns of a risk-adjusted basis on different securities, unless market efficiency prevents this from happening.

SPECULATORS

Speculators are individuals who engage in speculation, that is, ones that seek to profit from differences in risk-adjusted returns on different securities. Speculators actively expose themselves to currency risk by buying or selling currencies forward in order to profit from currency movements, while arbitrageurs, traders, and hedgers seek to reduce or eliminate their exchange risks by “locking in” the exchange rate on future trade or financial operations. Their degree of participation is based on prevailing forward rates and their expectations for spot exchange rates in the future.

SPEED LIMITS

The economy’s speed limit is the rate at which it can grow without triggering inflation.

SPOT EXCHANGE RATE

Also called current exchange or cash exchange rate, the spot exchange rate of one currency for another for immediate delivery can be defined as the rate that exists in today’s market. A typical listing of foreign exchange rates is found in the business section of daily newspapers, and The Wall Street Journal. For example, the British pound is quoted at 1.5685 per dollar. This rate is the spot rate. It means you can go to the bank today and exchange $1.5685 for £1.00. In reality, for example, if you need £10,000 for paying off an import transaction on a given day, you would ask your bank to purchase £10,000. The bank would not hand you the money, but instead it would instruct its English subsidiary to pay £10,000 to your English supplier and it would debit you account by (10,000 x 1.5685) $15,685.

SPOT TRANSACTION

Also called cash transaction, a spot transaction involves the purchase and sale of commodities, currency, and financial instruments for immediate delivery. This is settled (paid for) on the second following business day. A spot transaction contrasts with a forward transaction which provides the delivery at a future date.

STANDARD & POOR’S 500 STOCK COMPOSIITE INDEX

The 500 Stock Composite Index computed by Standard & Poor’s is used as a broad measure of market direction. It is different from the Dow Jones Industrial Average (DJIA) in several respects. First, it is value-weighted, not price-weighted. The index thus considers not only the price of a stock but also the number of outstanding shares. It is based on the aggregate market value of the stock, i.e., price times number of shares. A benefit of the index over the DJIA is that stock splits and stock dividends do not impact the index value. A drawback is that large capitalization stocks—those with a large number of shares outstanding—significantly influence the index value. The S&P 500 consists of four separate indexes: the 400 industrials, the 40 utilities, the 20 transportation, and the 40 financial. They are also frequently used as proxies for market return when computing the systematic risk measure (beta) of individual stocks and portfolios. The S&P 500 Stock Index is one of the U.S. Commerce Department’s 11 leading economic indicators. The purpose of the S&P 500 Stock Price Index is to portray the pattern of common stock price movement. The total market value of the S&P 500 represents nearly 90% of the aggregate market value of common stocks traded on the New York Stock Exchange. For this reason, many investors use the S&P 500 as a yardstick to help evaluate the performance of mutual funds.

STANDARD & POOR’S GUIDE TO INTERNATIONAL RATINGS

Standard & Poor’s (S&P) debt rating is a current assessment of the creditworthiness of an obligor with respect to a specific obligation. The S&P ratings are based, in varying degrees, on the following considerations: (1) likelihood of default, (2) nature and provisions of the obligation, (3) protection afforded by, and relative position of, the obligation in the event of bankruptcy, reorganization, or other arrangements under the laws of bankruptcy and other laws affecting creditor’s rights. Debt obligations of issuers outside the U.S. and its territories are rated on the same basis as domestic corporate and municipal issues. The ratings measure the credit-worthiness of the obligor to repay in the currency of denomination of the issue. However, S&P does not assess the foreign exchange risk that the investor may bear. Exhibit 104 is a listing of the designations used by S&P (and the other well-known independent agency, Mergent, F.I.S., Inc.). Descriptions on ratings are summarized. Mergent now issues the Moody’s Bond Ratings. For original versions of descriptions, see Mergent Bond Record and Standard & Poor’s Bond Guide.

EXHIBIT 104

Description of Bond Ratings

| Moody’s | Standard & Poor’s | Quality Indication |

| Aaa | AAA | Highest quality |

| Aa | AA | High quality |

| A | A | Upper medium grade |

| Baa | BBB | Medium grade |

| Ba | BB | Contains speculative |

| elements | ||

| B | B | Outright speculative |

| Caa | CCC & CC | Default definitely possible |

| Ca | C | Default, only partial |

| recovery likely | ||

| C | D | Default, little recovery |

| likely | ||

| r | Assigned to derivative | |

| products |

Note: Ratings may also have a + or – sign to show relative standings in class.

STERILIZED INTERVENTION

A government intervention in the foreign exchange market, with simultaneous interference in the Treasury securities market, made to offset any effects on the U.S. dollar money supply; thus, the intervention in the foreign currency market is accomplished without affecting the existing dollar money supply. It contrasts with nonsterilized intervention.

STERLING

Great Britain’s currency. The monetary unit is the pound sterling.

You should pay careful attention to ratings since they can affect not only potential market behavior but relative yields as well. Specifically, the higher the rating, the lower the yield of a bond, other things being equal. It should be noted that the ratings do change over time and the rating agencies have “credit watch lists” of various types. Try to select only those bonds rated Baa or above by Moody’s or BBB or above by Standard & Poor’s, even though doing so means giving up about 3/4 of a percentage point in yield.

STATEMENT OF FINANCIAL ACCOUNTING STANDARDS NO. 8

Statement of Financial Accounting Standards No. 8. (FASB No. 8) is the currency translation standard previously in use by U.S. firms. This standard, effective on January 1, 1976, was based on the temporal method of translating into dollars foreign currency-denominated financial statements and transactions of U.S.-based MNCs.

STATEMENT OF FINANCIAL ACCOUNTING STANDARDS NO. 52

Statement of Financial Accounting Standards No. 52 (FASB No. 52), commonly called SFAS 52, was issued by the Financial Accounting Standards Board (FASB) and deals with the translation of foreign currency changes on the balance sheet and income statement. In recording foreign exchange translations, the Statement adopted the two-transaction approach. Under this approach, the foreign currency transaction has two components: the purchase/sale of the asset and the financing of this purchase/sale. Each component will be treated separately and not netted with the other. The purchase/sale is recorded at the exchange rate on the day of the transaction and is not adjusted for subsequent changes in that rate. Subsequent fluctuations in exchange rates will give rise to foreign exchange gains and losses. They are considered financing income or expense and are recognized separately in the income statement in the period the foreign exchange fluctuations happen. Thus, exchange gains and losses arising from foreign currency transactions have a direct effect on net income.

STRIPPED BONDS

Bonds created by stripping the coupons from a bond and selling them separately from the principal.

SUBPART F INCOME

A type of foreign income, as defined in the U.S. tax code, which under certain conditions is taxed by the IRS in the United States whether or not it is remitted back to the United States.

SUCRE

Ecuador’s currency.

SUSHI BONDS

Eurodollars-, or other non-yen-denominated bonds issued by a Japanese firm for sale to Japanese investors.

SWAP CONTRACT

In the context of the forward market, a swap contract is a spot contract immediately combined with a forward contract.

SWAP FUNDS

Also known as exchange funds, swap funds are not the same as ordinary mutual funds. They are highly specialized types of fixed investment pools, typically set up as a limited partnership or as a limited-liability company. They appeal to very wealthy investors with large holdings in a single stock who want diversification without having to pay capital taxes.

Suppose you own $5 million of stock in one company that you bought a long time ago at prices far below today’s values. Instead of selling these shares outright and paying taxes, you swap them for units of a swap fund, tax-free. Swap funds usually have stiff early-redemption penalties and very high minimum investment requirements. In one fund, for example, the minimum investment is $500,000 of stock.

SWAP RATE

A forward exchange rate quotation expressed in terms of the number of points by which the forward rate differs from the spot rate (i.e., as a discount from, or a premium on, the spot rate). The interbank market quotes the forward rate this way.

EXAMPLE 113

Suppose a French investor buys $100,000 at FFr 140/$. In order to reduce the currency risk, she immediately sells forward $100,000 for 90 days, at FFr 145/$. The combined spot and forward contract is a swap contract. The swap rate, FFr 5/$, is the difference between the rate at which the investor buys and the rate at which she sells.

SWAPS

A swap is the exchange of assets or payments. It is a simultaneous purchase and sale of a given amount of securities, with the purchase being effected at once and the sale back to the same party to be carried out at a price agreed upon today but to be completed at a specified future date. Swaps are basically of two types: interest rate swaps and currency swaps. Interest rate swaps typically involve exchanging fixed interest payments for floating interest payments. Currency swaps are the exchange of one currency into another at an agreed rate, combining a spot and forward contract in one deal.

SWAP TRANSACTION

A swap transaction is a combination of a spot deal with a reversal deal at some future date. A common type of swap is “spot against forward.” For example, a bank in the interbank market buys a currency in the spot market and simultaneously sells the same amount in the forward market to the same bank. The difference between the spot and the forward rates, called the swap rate, is known and fixed.

SYNTHETIC CROSS RATES

Synthetic cross rates are cross bid and ask rates that result from a combination of two or more other exchange transactions.

EXAMPLE 114

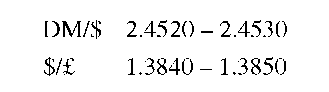

Given:

The synthetic bid and ask DM/£ rates can be determined as follows:

First, find the right dimension of the rate. The dimension of the rate we are looking for is DM/£. Because the dimensions of the two quotes given to us are DM/$ and $/£. The way to obtain the synthetic rate is to multiply the rates, as follows:

Second, let us now think about bid and ask synthetic quotes. To synthetically buy £ against DM, we first buy $ against DM, that is, at the higher rate (ask); then we buy £ against $, again at the higher rate (ask).

Thus, we can synthetically buy £1 at DM 3.397405. By a similar argument, we can obtain the rate at which we can synthetically sell £ against DM.

Thus, the synthetic rates are DM/£ 3.393568—3.397405.

Note: This example is the first instance of the Law of the Worst Possible Combination or the Rip-Off Rule. For any single transaction, the bank gives you the worst rate from your point of view (this is how the bank makes money). It follows that if you make a sequence of transactions, you will inevitably get the worst possible cumulative outcome. This law is the first fundamental law of real-world capital markets.

EXAMPLE 115

Given:

This example differs from Example 114 because it involves a quotient rather than a product. However, in this case, too, we end up with the worst possible outcome. The synthetic bid and ask DM/£ rates can be determined as follows:

First, from the dimensions of the quote we are looking for and the dimensions of the two quotes that are given to us, we need to divide DM/$ by £/$:

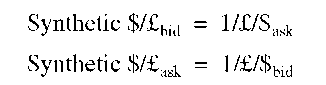

To identify where to use the bid and where to use the ask rate, we could explicitly go through the two transactions. The simpler way is to ask the bank to convert the £/$ quote into $/£. This transforms the problem into the problem we have already solved. The bank will gladly oblige and quote:

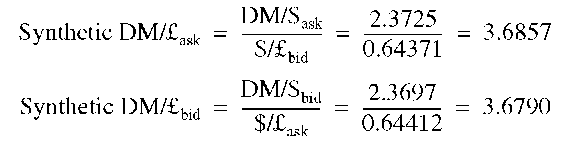

We can then simply feed these formulas into the solutions of Example 114, and obtain:

Thus, the synthetic rates are DM/£ 3.6790 – 3.6857.

Note: In this example, to get the correct DM/£ quote, we need to divide the DM/$ quote by the £/$ quote. Thus, to obtain the largest possible outcome (the synthetic DM/£ ask rate), we divide the larger number by the smaller; and to obtain the smallest possible outcome (the DM/£ bid rate), we divide the smaller number by the larger. This illustrates the Law of the Worst Possible Combination.

SYSTEMATIC RISK

Also called nondiversifiable, or noncontrollable risk, this risk that cannot be diversified away results from forces outside a firm’s control. Purchasing power, interest rate, and market risks fall in this category. This type of risk is assessed relative to the risk of a diversified portfolio of securities or the market portfolio. It is measured by the beta coefficient used in the Capital Asset Pricing Model (CAPM). The systematic risk is simply a measure of a security’s volatility relative to that of an average security. For example, b = 0.5 means the security is only half as volatile, or risky, as the average security; b = 1.0 means the security is of average risk; and b = 2.0 means the security is twice as risky as the average risk. The higher the beta, the higher the return required.