RAND

Monetary unit of Lesotho, South Africa, and South West Africa. REAL COST OF HEDGING

The real cost of hedging is the extra cost of hedging as opposed to not hedging. A negative real cost would signify that hedging was more favorable than not hedging.

REAL EXCHANGE RATE

In contrast to nominal exchange rate, the rate adjusted for inflation is roughly nominal exchange rate minus inflation rate.

REGISTERED BOND

A bond registered in the owner’s name and listed on the records of the issuer as well as with the registrar. Transfer, as at the time of sale or if the bond is being possessed as collateral for a loan in default, requires power of attorney and the return of the physical bond to a transfer agent. The transfer agent replaces the old bond with a new one registered to the new owner. A bearer bond is an example of an unregistered bond.

REGRESSION ANALYSIS

Regression analysis is a statistical procedure for estimating mathematically the average relationship between the dependent variable and the independent variable(s). Simple regression involves one independent factor, such as inflation or interest rate differentials, in forecasting currency rate, whereas multiple regression involves two or more explanatory variables, e.g., inflation, interest rate differentials, and economic growth together. An example of simple regression is: A global fund’s return is a function of the return on a world market portfolio, i.e., rj = a + brm, where b = beta, a measure of uncontrollable risk.

EXAMPLE 107

To explain how beta can be computed, using regression analysis, the data presented in Exhibit 99 is used for an illustrative purpose.

EXHIBIT 99

ABC Global Fund Returns versus EAFE Index Returns

| ABC | |

| EAFE Index Returns (%) | Global Fund Returns (%) |

| 9 | 15 |

| 19 | 20 |

| 11 | 14 |

| 14 | 16 |

| 23 | 25 |

| 12 | 20 |

| 12 | 20 |

| 22 | 23 |

| 7 | 14 |

| 13 | 22 |

| 15 | 18 |

| 17 | 18 |

Exhibit 100 shows MSExcel output for regression analysis.

EXHIBIT 100

| Summary Output | |

| Regression Statistics | |

| Multiple R | 0.7800 |

| R Square | 0.6084 |

| Adjusted R Square | 0.5692 |

| Standard Error | 2.3436 |

| Observations | 12.0000 |

| Anova | |||||

| df | SS | MS | F | Significance F | |

| Regression | 1 | 85.3243 | 85.3243 | 15.5345 | 0.0028 |

| Residual | 10 | 54.9257 | 5.4926 | ||

| Total | 11 | 140.25 | |||

| Standard | ||||||

| Coefficients | Error | t Stat | P-value | Lower 95% | Upper 95% | |

| Intercept | 10.5836 | 2.1796 | 4.8558 | 0.0007 | 5.7272 | 15.4401 |

| EAFE Index | 0.5632 | 0.1429 | 3.9414 | 0.0028 | 0.2448 | 0.8816 |

| Returns |

From the Excel’s regression output, we see:

which indicates the beta for the particular global fund is 0.5632. It appears that ABC Global Fund is less risky than the world market, measured by the EAFE Index.

REINVOICING CENTER

A central financial facility designated by an MNC to centralize all payments and invoicing charges subsidiaries fees for its function. This way, it attempts to reduce transaction exposure by having all home country exports billed in the home currency and then reinvoiced to each operating affiliate in that affiliate’s local currency. The reinvoicing center determines which currencies should be used and where, how, and when. This reinvoicing activity can effectively shift profits to subsidiaries where tax rates are low.

REMBRANDT BONDS

Dutch guilder-denominated bonds issued within the Netherlands by a foreign issuer (borrower).

REPATRIATION

Repatriation is the process of sending cash flows from a foreign subsidiary to the parent company. Broadly, foreign affiliates make the following payments to the parent company: (1) dividends, (2) interest and repayment of parent company loans, (3) royalties for use of trade names and services, (4) management fees for central services, and (5) payments for goods supplied by the parent. A foreign government may restrict the amount of the cash that may be repatriated to the parent company. For example, the restriction may be in terms of a ceiling stated as a percentage of the company’s net worth. Such restrictions are intended to force multinational companies to reinvest earnings in the foreign country or/and to prevent large currency outflows, which might disrupt the exchange rate.

REPORTING CURRENCY

The parent company’s currency used in preparing and translating its own financial statements (e.g., U.S. dollars for a U.S. firm).

REPRESENTATIVE OFFICES

Representative nonbanking offices are established in a foreign country primarily to assist the parent bank’s customers in that country. Representative offices cannot accept deposits, make loans, transfer funds, accept drafts, transact in the international money market, or commit the parent bank to loans. In fact, they cannot cash a traveler’s check drawn on the parent bank. What they may do, however, is provide information and assist the parent bank’s clients in their banking and business contacts in the foreign country. For example, a representative office may introduce business people to local bankers or it may act as an intermediary between U.S. firms and firms located in the country of the representative office. Of course, while acting as an intermediary, it provides information about the parent bank’s services. A representative’s office is also a primary vehicle by which an initial presence is established in a country before setting up formal banking operations.

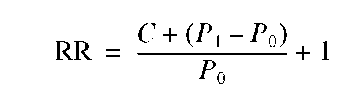

RETURN RELATIVE

It is often necessary to measure returns on a slightly different basis than total returns (TRs). This is particularly true when calculating a compound (or geometric) average return, because negative returns cannot be used in the calculation. The return relative (RR) solves this problem by adding 1.0 to the total return. Although return relatives may be less than 1.0, they will be greater than zero, thereby eliminating negative numbers.

This can be reduced simply to the following formula (by using the price at the end of the holding period in the numerator, rather than the change in price):

EXAMPLE 108

A TR of 0.10 for some holding period is equivalent to a return relative of 1.10, and a TR of -0.15 is equivalent to a return relative of 0.85.

REVOCABLE LETTER OF CREDIT

A letter of credit that the opening bank may revoke at any time without the approval of the beneficiary. Neither the issuing bank nor the advising and paying bank guarantees payment.

REVOLVING LETTER OF CREDIT

A letter of credit which contains a provision for reinstating its face value after being drawn within a stated period of time facilitates the financing of ongoing regular purchases.

RINGGIT

Malaysia’s currency.

RISK

Risk refers to the variation in earnings. It includes the chance of losing money on an investment. As a measure of risk, we use the standard deviation, which is a statistical measure of dispersion of the probability distribution of possible returns of an investment. The smaller the deviation, the tighter the distribution, and thus, the lower the riskiness of the investment. Mathematically,

To calculate a, we proceed as follows:

Step 1. First compute the expected rate of return (r)

Step 2. Subtract each possible return from r to obtain a set of deviations (ri – r) Step 3. Square each deviation, multiply the squared deviation by the probability of occurrence for its respective return, and sum these products to obtain the variance (a)2:

Step 4. Finally, take the square root of the variance to obtain the standard deviation (a).

EXAMPLE 109

To follow this step-by-step approach, it is convenient to set up a table, as follows:

| (step 1) | (step 2) | (step 3) | (step 4) | ||

| Return (r,) | Probability (p) | riPi | (r – r ) | (r, – r)2 | (ri - r fp, |

| Stock A | |||||

| -5% | .2 | -1% | -24% | 576 | 115.2 |

| 20 | .6 | 12 | 1 | 1 | .6 |

| 40 | .2 | 8 | 21 | 441 | 88.2 |

| r = 19% | a2 = 204 | ||||

| a = 7204 | |||||

| = 14.18% | |||||

| Stock B | |||||

| 10% | .2 | 2% | -5% | 25 | 5 |

| 15 | .6 | 9 | 0 | 0 | 0 |

| 20 | .2 | 4 | 5 | 25 | 5 |

| r = 15% | a2 = 10 | ||||

| a2 = 710 | |||||

| a = 3.16% |

Exhibit 103 shows average return rates and standard deviations for selected types of investments.

EXHIBIT 103

Risk and Return 1926-1995

| Geometric | Arithmetic | Standard | |

| Series | Average | Average | Deviation |

| Common stocks | 8.81% | 10.20% | 16.89% |

| Long-term corporate bonds | 5.03 | 5.58 | 11.26 |

| Long-term government bonds | 4.70 | 5.11 | 9.70 |

| U.S. Treasury bills | 6.25 | 6.29 | 3.10 |

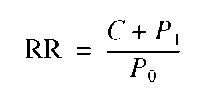

The financial manager must be careful in using the standard deviation to compare risk, as it is only an absolute measure of dispersion (risk). In other words, it does not consider the risk in relationship to an expected return. In comparisons of securities with differing expected returns, we commonly use the coefficient of variation. The coefficient of variation is computed simply by dividing the standard deviation for a security by its expected value, i.e.,

a/ r

The higher the coefficient, the more risky the security.

EXAMPLE 110

Based on the following data, we can compute the coefficient of variation for each stock as follows:

| Stock A | Stock B | |

| r | 19% | 15% |

| a | 14.28% | 3.16% |

The coefficient of variation is computed as follows: For stock A,

For stock B,

Although stock A produces a considerably higher return than stock B, stock A is overall more risky than stock B, based on the computed coefficient of variation. Note, however, that if investments have the same expected returns there is no need for the calculation of the coefficient of determination.

A. Sources of Risk

Different sources of risk are involved in investment and financial decisions. Investors and decision makers must take into account the type of risk underlying an asset.

1. Financial risk. This is a type of investment risk associated with excessive debt.

2. Industry risk. This risk concerns the uncertainty of the inherent nature of the industry such as high-technology, product liability, and accidents.

3. International and political risks. These risks stem from foreign operations in politically unstable foreign countries. An example is a U.S. company having a location and operations in a hostile country.

4. Economic risk. This is the negative impact of a company from economic slowdowns. For example, airlines have lower business volume in recession.

5. Currency exchange risk. This risk arises from the fluctuation in foreign exchange rates.

6. Social risk. This is caused by problems facing the company due to ethnic boycott, discrimination cases, and environmental concerns.

7. Business risk. This is caused by fluctuations of earnings before interest and taxes (operating income). Business risk depends on variability in demand, sales price, input prices, and amount of operating leverage.

8. Liquidity risk. It represents the possibility that an asset may not be sold on short notice for its market value. If an investment must be sold at a high discount, then it is said to have a substantial amount of liquidity risk.

9. Default risk. It is the risk that a borrower will be unable to make interest payments or principal repayments on a debt. For example, there is a great amount of default risk inherent in the bonds of a company experiencing financial difficulty.

10. Market risk. Prices of all stocks are correlated to some degree with broad swings in the stock market. Market risk refers to changes in a stock’s price that result from changes in the stock market as a whole, regardless of the fundamental change in a firm’s earning power.

11. Interest rate risk. This refers to the fluctuations in the value of an asset as the interest rates and conditions of the money and capital markets change. Interest rate risk relates to fixed income securities such as bonds. For example, if interest rates rise (fall), bond prices fall (rise).

12. Inflation (purchasing power) risk. This risk relates to the possibility that an investor will receive a lesser amount of purchasing power than was originally invested. Bonds are most affected by this risk because the issuer will be paying back in cheaper dollars during an inflationary period.

13. Systematic and unsystematic risk. Many investors hold more than one financial asset. A portion of a security’s risk, called unsystematic risk, can be controlled through diversification. This type of risk is unique to a given security. Business, liquidity, and default risks fall in this category. Nondiversifiable risk, more commonly referred to as systematic risk, results from forces outside of the firm’s control and is therefore not unique to the given security. Purchasing power, interest rate, and market risks fall into this category. This type of risk is measured by the beta coefficient.

RISK ANALYSIS

Risk analysis is the process of measuring and analyzing the risks associated with financial and investment decisions. It is important especially in making foreign direct investment decisions because of the large amount of capital involved and the long-term nature of the investment being considered. The higher the risk associated with a proposed project, the greater the return that must be earned to compensate for that risk. There are several methods for the analysis of risk, including risk-adjusted discount rate, certainty equivalent, Monte Carlo simulation, sensitivity analysis, and decision trees.

RISK-FREE RATE

Risk-free rate is the rate of return earned on a riskless security if no inflation were expected.

A proxy for a risk-free return is a rate of interest on short-term U.S. Treasury securities in an inflation free world.

RISK PREMIUM

1. The difference in the expected future spot rate versus forward rate for a currency.

2. The amount by which the required return on an asset or security exceeds the risk-free rate, rf. In terms of the capital asset pricing model (CAPM), it can be expressed as b(rm – rf), where b is the security’s beta coefficient, a measure of systematic risk, and rm is the required return on the market portfolio. The risk premium is the additional return required to compensate investors for assuming a given level of risk. The higher this premium, the more risky the security and vice versa.

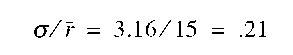

RISK-RETURN TRADE-OFF

Integral to the theory of finance and investment is the concept of a risk-return trade-off. All financial decisions involve some sort of risk-return trade-off. The greater the risk associated with any financial decision, the greater the return expected from it. Risk, along with the return, is a major consideration in investment decisions. The investor must compare the expected return from a given investment with the risk associated with it. Generally speaking, the higher the risk undertaken, the more ample the return, and conversely, the lower the risk, the more modest the return. Proper assessment and balance of the various risk-return trade-offs available is part of creating a sound financial and investment plan. In the case of investment in stock, you, as an investor, would demand higher return from a speculative stock to compensate for the higher level of risk. In the case of working capital management, the fewer inventories you keep, the higher the expected return (because less of your current assets is tied up), but also the greater the risk of running out of stock and thus losing potential revenue. Exhibit 101 depicts the risk-return trade-off, where the risk-free rate is the rate of return commonly required on a risk-free security such as a U.S. Treasury bill. Exhibit 102 illustrates risk-return trade-off of internationally diversified portfolios over the period 1976-1999.

EXHIBIT 101

Risk-Return Trade-off

EXHIBIT 102

Risk-Return Trade-off of an Internationally Diversified Portfolios over the Period 1976-1999

ROUNDING RULES

When a conversion between a national currency unit and the euro results in a figure that is 0.005 or above, each amount is rounded up ( 100.445 and FFr 45.675 become 100.45 and FFr 45.68). Intermediate products cannot be rounded.

ROUND TURN

Procedure by which a long or short position is offset by an opposite transaction or by accepting or making delivery of the actual financial instrument or physical commodity. This complete buy/sell or sell/buy is a round turn.

RUBLE

Soviet Union’s currency.

RUPEE

Monetary unit of India, Maldives, Mauritius, Nepal, Pakistan, Seychelles, and Sri Lanka.

RUPIAH

Indonesia’s currency.