LABEL OF CONSUMER CONFIDENCE

This label was displayed in shop windows and in advertising during the transition period for the euro between January 1, 1999 and January 1, 2001, to inform customers that the prices of the products or services are displayed in both euro and national currency units.

LAG

As a means of hedging transaction exposure of MNCs, lagging involves delaying the collection of receivables in foreign currency if that currency is expected to appreciate, and delaying conversion when payables are to be made in another currency in the belief the other currency will cost less when needed.

LEADING AND LAGGING

Leading and lagging are important risk-reduction techniques for a wide variety of working capital problems of MNCs. In many situations, forward and money-market hedges are not available to eliminate currency risk. Under such circumstances, MNCs can reduce their foreign exchange exposure by leading and lagging payables and receivables, that is, paying early or late. Leading is accelerating, rather than delaying (lagging). This can be accomplished by accelerating payments from soft-currency to hard-currency countries and by delaying inflows from hard-currency to soft-currency countries. Leading and lagging can be used most easily between affiliates of the same company, but the technique can also be used with independent firms. Most governments impose certain limits on leads and lags, since it has the effect of putting pressures on a weak currency. For example, some governments set 180 days as a limit for receiving payments for exports or making payment for imports. When the MNC makes use of leads and lags, it must adjust the performance measures of its subsidiaries and managers that are cooperating in the endeavor. The leads and lags can distort the profitability of individual divisions.

LETTERS OF CREDIT

A letter of credit (L/C) is a credit letter normally issued by the buyer’s bank in which the bank promises to pay money up to a stated amount for a specified period for merchandise when delivered. It substitutes the bank’s credit for the importer’s and eliminates the exporter’s risk. It is used in international trade. The letter of credit (L/C) can be revocable or irrevocable. A revocable L/C is a means of arranging payment, but it does not guarantee payment. It can be altered or revoked, without notice, at any time up to the time a draft is presented to the issuing bank. An irrevocable L/C, on the other hand, cannot be revoked without the special permission of all parties concerned, including the exporter. A letter of credit can also be confirmed or unconfirmed. A confirmed L/C is an L/C issued by one bank and confirmed by another, obligating both banks to honor any drafts drawn in compliance. For example, “we hereby confirm this credit and undertake to pay drafts drawn in accordance with the terms and conditions of the letter of credit.” An unconfirmed L/C is the obligation of only the issuing bank. The three main types of letters of credit, in order of safety for the exporter, are (1) the irrevocable, confirmed L/C; (2) the irrevocable, unconfirmed L/C; and (3) the revocable L/C. A summary of the terms and arrangements concerning these three types of L/Cs is shown in Exhibit 77.

EXHIBIT 77

Arrangements in Different Letters of Credit

| Irrevocable Confirmed L/C | Irrevocable Unconfirmed L/C | Revocable L/C | |

| Who applies for | Importer | Importer | Importer |

| Who is obligated to | Issuing bank and | Issuing bank | None |

| pay | confirming bank | ||

| Who applies for | Importer | Importer | Importer |

| amendment | |||

| Who approves | Issuing bank, exporter, | Issuing bank and | Issuing bank |

| amendment | and confirming bank | exporter | |

| Who reimburses | Issuing bank | Issuing bank | Issuing bank |

| paying bank | |||

| Who reimburses | Importer | Importer | Importer |

| issuing bank |

There are also other types of letters of credit:

• Letter of credit (Cumulative)—A revolving letter of credit which permits any amount not used during any of the specified periods to be carried over and added to the amounts available in subsequent periods.

• Letter of credit (Non-Cumulative)—A revolving letter of credit which prohibits the amount not used during the specific period to be available in the subsequent periods.

• Letter of credit (Deferred Payment)—A letter of credit issued for the purchase and financing of merchandise, similar to acceptance letter of credit, except that it requires presentation of sight drafts which are payable on installment basis usually for periods of 1 year or more. Under this type of credit, the seller is financing the buyer until the stipulated time his drafts can be presented to the bank for payment. There is a significant difference in the bank’s commitment, depending on whether the negotiating bank advised or confirmed the letter of credit.

• Letter of credit (McLean)—A letter of credit which requires the beneficiary to present only a draft or a receipt for specified funds before he receives payment.

• Letter of credit (Negotiable)—A letter of credit issued in such form that it allows any bank to negotiate the documents. Negotiable credits incorporate the opening bank’s engagement, stating that the drafts will be duly honored on presentation, provided they comply with all terms of the credit. A negotiable letter of credit says specifically that the “Drafts must be negotiated or presented to the drawee not later than….” In contrast, the straight letter of credit does not mention the word negotiated.

• Letter of credit (Revolving)—A credit which includes a provision for reinstating its face value after being drawn within a stated period of time. This kind of credit facilitates the financing of ongoing regular purchases.

• Letter of credit (Standby)—One issued for the express purpose of effecting payment in the event of default. The issuing bank is prepared to pay but does not expect to as long as the underlying transaction is properly fulfilled.

• Letter of credit (Traveler’s)—A letter of credit which is issued by a bank to a customer preparing for an extended trip. The customer pays for the letter of credit at the time of issuance, and a bank issues the letter for a specified period of time in the amount purchased. The bank furnishes a list of correspondent banks where drafts against the letter of credit will be honored. The bank also identifies the customer by exhibiting a specimen signature of the purchaser in the folder enclosing the list of correspondent banks. Each bank, which honors a draft, endorses on the letter of credit the date when a payment was made, the bank’s name, and the amount drawn against the letter of credit and charges the issuing bank’s account.

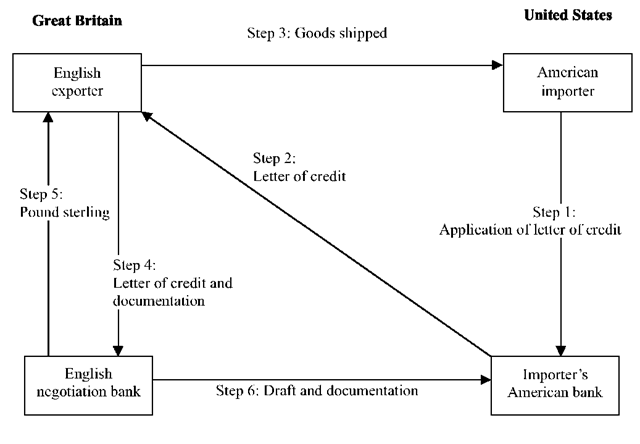

The steps involved in a letter of credit transaction are summarized in Exhibit 78.

EXHIBIT 78

Steps in a Letter of Credit Transaction

LIABILITY MANAGEMENT OF BANKS

Traditionally, banks have taken the liability side of the balance sheet pretty much as outside of their control in the short run. They have taken liabilities as given and have been concerned with asset management. Liability management involves actions taken by banks and other depositary institutions to actively obtain funds at their own initiative by issuing negotiable certificates of deposit (CDs), by borrowing federal funds, and by using other procedures. It means altering the bank’s liability structure (mix of demand deposits, time deposits, etc.) by changing the interest paid on nontransaction liabilities (such as CDs). The technique of liability management is certainly an important discretionary source of bank funds. However, the excessive use of the technique would make them vulnerable in future liquidity crises.

LIRA

Monetary unit of Italy, Turkey, San Marino, and Vatican City. LOCATIONAL ARBITRAGE

Locational arbitrage may occur if foreign exchange quotations differ among banks. The action of locational arbitrage should, however, force the currency quotations of banks to realign, and locational arbitrage will no longer be necessary.

LOMBARD RATE

The Lombard rate, one of the formal interest rates in Germany, is used to regulate the money market. Other countries use the term Lombard to describe rates which function somewhat like the Lombard rate. The Swiss, for example, have their own Lombard rate. In France, the Central Bank Intervention rate performs the same function.

LONDON INTERBANK BID RATE

London Interbank Bid Rate (LIBID) is the rate of interest paid for funds in the London interbank market. This rate has been used as a reference for floating rate payments for especially strong borrowers.

LONDON INTERBANK MEAN RATE

London Interbank Mean Rate (LIMEAN) is the midpoint of the LIBOR-LIBID spread. LIMEAN has been used as a reference for floating rate payments.

LONDON INTERBANK OFFERED RATE (LIBOR)

London Interbank Offered Rate (LIBOR), the most prominent of the interbank offered rates, is the rate of interest at which banks in London lend funds to other prime banks in London. LIBOR is frequently used as a basis for determining the rate of interest payable on Eurodollars and other Eurocurrency loans. The effective rate of interest on these Eurocredits is LIBOR plus a markup negotiated between lender and borrower. The rate, however, varies according to circumstances at which funds can be borrowed in particular currencies, amounts, and maturities in the market.

LONDON STOCK EXCHANGE

The London Stock Exchange is the largest stock exchange in Europe. In 1997, it introduced a new electronic settlement system called CREST, in which all trades are settled within five days. In the same year, it also installed an order-driven electronic trading system called SETS (Stock Exchange Trading Service).

LONG POSITION

An investment is long if an investor makes money when the price of a security or the price of its underlying security goes up. Generally, a long position is a position taken when the investor buys something for future delivery. This may be done in the expectation that the security bought will rise in value. It may also be done to hedge a currency risk.

LONG-TERM NATIONAL FINANCIAL MARKETS

Long-term national financial markets are markets for long-term capital markets trading stocks and bonds in different nations. Many countries allow the MNC to issue its own securities (stocks and bonds) or invest in the securities of other firms.