Abstract

This article provides a brief historical synopsis of the development of the electricity enterprise in the United States. The end of this article includes a reference list of more detailed accounts of the electricity enterprise, on which this summary is based.

INTRODUCTION

The organization of this synopsis corresponds with the stages in the Electricity Sector Life-Cycle shown in Fig. 1. The first three stages of the life-cycle are discussed in this article. A second article discusses the future of the U.S. Electricity Enterprise.

Electricity now powers American life to an unprecedented degree. In 1900, electricity’s share of the nation’s energy use was negligible. That share has now risen to nearly 40%. Electricity is produced from fuels through a costly conversion process so that its price per thermal unit has always been higher than that of the fuels themselves. So, something other than cost must account for the sustained growth in electricity’s market share. Simply put, electricity can be used in ways that no other energy form can. Technological progress over the past century has led to radically improved ways of organizing productive activities as well as new products and new techniques of production, all of which have been heavily dependent on electricity. As a result, electricity has become the lifeblood of the nation’s prosperity and quality of life. In fact, the U.S. National Academy of Engineers declared that “the vast networks of electrification are the greatest engineering achievement of the 20th Century.”

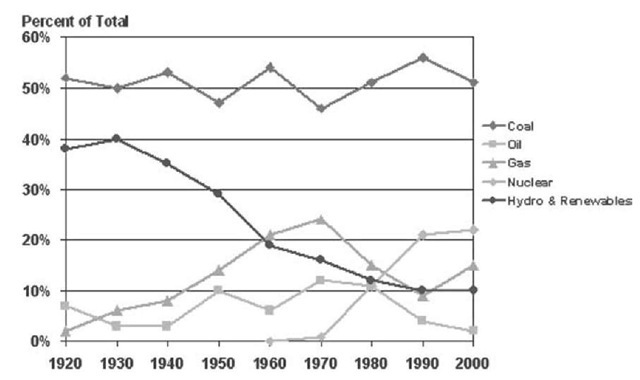

Fig. 2 summarizes the historical trends in the energy sources for U.S. electricity generation. Coal is notable in its persistence of as the dominant fuel.

Electricity, despite its mystery and complexity, is simply the movement of electrons. Each of these tiny sub-atomic particles travels only a short distance as it displaces another electron around a circuit, but this transfer occurs at the speed of light (186,000 mi per second). This invisible wonder occurs virtually everywhere in nature. For example, it transmits signals from our brains to contract our muscles. What’s relatively new is our ability to put electricity to work lighting and powering our world.

For example, steady advances during the course of the 20th century improved electric lighting efficiencies a great deal. Looking forward, full-spectrum light-emitting diodes (LEDs) may increase the efficiency of U.S. lighting by 50% within 50 years. At the same time, electric motors have revolutionized manufacturing through unprecedented gains in the reliability and localized control of power visa-vis steam engines. By 1932, electric motors provided over 70% of all installed mechanical power in U.S. industries. The proliferation of household appliances has also been primarily due to the use of small electric motors. Today, the ubiquitous electric motor in all its forms and sizes consumes two-thirds of all U.S. electricity production.

Electricity is indeed a superior energy form; however it is not a tangible substance, but rather a physical effect occurring throughout the wires that conduct it. Electricity must be produced and consumed in absolutely instantaneous balance and it can’t be easily stored. Its delivery, therefore, today requires the ultimate just-in-time enterprise that balances supply and demand at literally the speed of light. Yet the status quo suffers numerous shortcomings. Efficiency, for instance, has not increased since the late 1950s, and U.S. generators throw away more energy than Japan consumes. Unreliable power—the result of blackouts or even just momentary surges and sags— costs America more than $100 billion annually. This is equivalent to about a 500 surcharge on every dollar of electricity purchased by consumers.

Moreover, the U.S. bulk electricity infrastructure is aging and becoming obsolescent. The average generating plant was built in 1964 using 1950s technology, whereas factories that construct computers have been replaced and updated five times over the same period. Today’s high-voltage transmission lines were designed before planners ever imagined that enormous quantities of electricity would be sold across state lines in competitive transactions. Consequently, the wires are often overloaded and subject to blackouts. Yet demand is increasing at twice the rate of capacity expansion. Finally, the local distribution systems that connect the power supply to each consumer are effectively a last bastion of analog, electromechanically controlled industry. This is a particularly notable paradox given the fact that the nation’s electricity supply system powers the digital revolution on which much of the current and future value depends. Keeping the lights on 99.97% of the time is simply not good enough. That still means the average consumer doesn’t have power for 2.5 h a year. In today’s impatient, increasingly computerized world that is more than just a nuisance.

Fig. 1 Electricity sector life-cycle—a fork in the road.

In spite of these deficiencies, the traditional producers and deliverers of electricity—the nation’s electric utilities—hold assets exceeding $600 billion; with 70% invested in power plants, 20% in distribution facilities, and 10% in transmission. They form one of the largest industries in the United States—roughly twice the size of telecommunications and nearly 30% larger than the U.S. automobile industry in terms of annual sales revenues. The Achilles’ heel here is the fact that supplying electricity is also extremely capital intensive, requiring far more investment per unit of revenue than the average manufacturing industry. This investment challenge is further intensified by the fact that the U.S. electricity enterprise is made up of over 5000 commercial entities, both public and private. The largest individual corporate market cap in the enterprise today is that of Exelon at $32 billion. This compares with Exxon-Mobil, for example, with a market cap of $365 billion. In fact, only about 17 electric utilities have market equity value greater than $10 billion. As a result, the decision to invest the billion or more dollars needed to construct a major new power plant or power delivery (T&D) line is effectively an uncertainty-laden, long-term, “all or nothing” decision that is constantly avoided by most electric enterprise corporations today.

Meanwhile, the market for portable electric devices continues to grow dramatically from the traditional flashlights and auto ignitions to a diverse array of computers, communications and entertainment products, cordless tools, medical devices, military products, etc. This innovative diversity has been accomplished by exploiting the synergy between the products themselves, the electricity storage devices they employ—including batteries, ultracapacitors, and fuel cells—and the power-management systems that charge these storage devices. Today, the global portable electricity storage market is about $50 billion per year, of which, $5 billion is allocated to rechargeable (secondary) batteries. Demand growth in this market is estimated at 6% annually, compared to grid-supplied electricity demand growth of about 1.5% per year.

Fig. 2 Sources of energy for U.S. electricity generation.

A new generation of energy-hungry devices, such as digital cameras, camera phones, and high-performance portable computing devices, is expected to continue to drive this rapid growth in portable electrification. Notably, the kWh-equivalent price of portable electricity can be as much as $100, compared to about 10 cents for grid-supplied power. This is one indication of the potential for highly flexible, individualized electricity services to enhance electricity’s value beyond the commoditized energy value proposition and business model of the traditional electricity enterprise.

The history of this magical energy form, electricity, provides keen perspective on the real-world interplay among technical progress, business struggles, and political debates. Electricity’s ongoing evolution also suggests how the potential for renewed electricity-based innovation could curtail pollution and spur a wide array of electro-technical advances, while continuing to improve the U.S. quality of life, and that of billions more worldwide.

Electrification is not an implacable force moving through history, but a social process that varies from one time period to another and from one culture to another. In the United States electrification was not a thing that came from outside society and had an impact; rather, it was an internal development shaped by its social context.

Table 1A and B summarize some recent basic statistics for the U.S. electricity enterprise.

FORMATION

Neither electricity nor electric lighting began with Edison. In 1808, Sir Humphrey Davey sent a battery-powered electric current between two carbon rods to produce an arc of light. In 1831, Michael Faraday invented the dynamo, which, when turned by a steam engine, supplied a cheap electric current by means of electromagnetic induction. Davey’s arc lamp was used in a production of the Paris Opera in 1844 and was part of the Philadelphia Exposition in 1876. The development of the high vacuum Crookes tube served to rekindle interest in incandescent electric lamps that had begun in the 1820s.

Edison, with a characteristic vision that distinguished him from his competitors, worked not only on the incandescent lamp but on the entire system that powers the lamp. “The same wire that brings the light will also bring power and heat—with the power you can run an elevator, a sewing machine, or any mechanical contrivance, and by means of the heat you may cook your food.” Scientists and rival investors predicted failure. In 1879, Edison had a working incandescent lamp and, within months, patented a direct current (DC) electric distribution system.

The next question was: who would buy the lights and equipment? Edison conceived the central power station that would distribute electricity through lines to the customers. On September 4, 1882, Edison’s Pearl Street Station in New York City went into business to serve 85 customers with 400 lamps. This marked the beginning of the electric utility industry. Unfortunately, with Edison’s low-voltage DC system, it was too expensive to distribute electricity more than a mile from the power plant. Transformers that could raise and lower voltage did not work with direct current.

In 1888, Nicola Tesla, who had been previously employed by Edison, announced his polyphase alternating current (AC) power system. That same year George Westinghouse bought the rights to Tesla’s system. Westinghouse saw the potential for locating a central station at the source of water power or coal, shipping the power for great distances at high voltages, and then stepping down the power for distribution. But inventing a practical AC system created new problems. AC and DC systems could not be linked until Charles Bradley, another former Edison worker, invented the rotary converter in 1888 which converted DC to AC. Westinghouse also bought Bradley’s idea.

The Westinghouse engineers developed a universal system in which the polyphase AC generator at the central station produced electricity that went to a local substation where it was transformed to the voltage required by the user. This system had many advantages. First was a realization of economies of scale in power generation. The second was the need for only one wiring grid. The third was that the generating stations could serve a wider area. The fourth was that the new system’s productivity could benefit from load diversity; e.g., lighting in the evening, streetcars during rush hours, and factory motors during the periods in between. Interestingly, the introduction of practical electric streetcars in the late 1880s provided the major concentrated electricity demand that dramatically pushed the enterprise toward more powerful equipment and larger service areas favoring AC.

In little more than a decade, Edison had put more than a half century of research into practical applications, conceived and invented an entire industry, and then became a reactionary who threatened to stagnate the industry at in its primitive stage of development. In 1892, Edison’s financier, J.P. Morgan, stepped in and forced a merger with Thompson-Houston and put their management in charge of Edison’s General Electric Co. In 1896, General Electric and Westinghouse exchanged patents, a typical move in the age of trusts, so even General Electric used Westinghouse concepts. The age of Edison had ended.

Table 1A U.S. electricity industry statistics (2002)

| Generating capacity and generators | Capacity (1000 MW) | Net generation (billion kWh) | |

| Investor-owned utility | 398 | 1740 | |

| Government and cooperatives | 204 | 807 | |

| Non-utility (unregulated producers) | 380 | 1294 | |

| Total | 982 | 3841 | |

| Total net generation by fuel | (Billion kWh) | Percentage | |

| Coal | 1926 | 50 | |

| Nuclear | 780 | 20 | |

| Natural gas | 695 | 18 | |

| Hydroelectric and pumped storage | 253 | 7 | |

| Fuel oil | 92 | 2 | |

| Biomass | 72 | 2 | |

| Geothermal | 13 | 1 | |

| Wind | 9 | ||

| Photovoltaic | 1 | ||

| Total | 3841 | 100 | |

| Electricity sales | Customers (million) | Energy (billion kWh) | |

| Residential | 115 | 1267 | |

| Commercial | 15 | 1122 | |

| Industrial | 0.6 | 973 | |

| Other | 1 | 109 | |

| Total | 132 | 3471 | |

| Percent total electricity | |||

| Revenues | Sales ($billion) | energy (%) | Average/kWh (cents) |

| Residential | 107 | 37 | 8.4 |

| Commercial | 89 | 32 | 7.9 |

| Industrial | 47 | 28 | 4.8 |

| Other | 7 | 3 | 6.6 |

| Total | 250 | Average price 7.2 |

| Financial | ($Billion) |

| Total assets | 598 |

| Total operating revenues | 250 |

| Operating expenses | 220 |

| Operating income | 30 |

| Construction | 25 |

By 1892, Samuel Insull of Chicago Edison, another former Edison associate, had formulated an understanding of the economics of the electric utility business that was sustained through most of the 20th century. When Insull took over the Chicago Edison Co. in that year, it was just one of 20 electric companies in the city. Although Chicago had a population of more than one million, only 5000 had electric lights. He vowed to serve the entire population. Insull and other leaders of the Association of Edison Illuminating Companies (AEIC) realized that the industry had high fixed costs because of the infrastructure investment needed. At the same time, the cost of operating the plants was fairly low. The question was how to translate that into profits, especially in an industry that had concluded it was selling a luxury item.

Table 1B U.S. consumption of electricity (2001)

| A. Residential | Billion kWh | Percentage |

| Air conditioning | 183 | 16 |

| Refrigerators | 156 | 14 |

| Space heating | 116 | 10 |

| Water heating | 104 | 9 |

| Lighting | 101 | 9 |

| Ranges and ovens | 80 | 7 |

| Laundry | 76 | 7 |

| Color TV, VCR/DVD, Stereos | 55 | 5 |

| Freezers | 39 | 3 |

| Furnace fans | 38 | 3 |

| Dishwashers | 29 | 2 |

| Personal computers and communication | 28 | 2 |

| Pools and hot tubs | 17 | 2 |

| Othera | 118 | 10 |

| Total | 1140 | 100 |

| B. Commercial | Billion kWh | Percentage |

| Space cooling | 288 | 26 |

| Lighting | 255 | 23 |

| Office equipment/computing | 200 | 18 |

| Refrigeration | 100 | 9 |

| Ventilation | 78 | 7 |

| Space heating | 56 | 5 |

| Cooking | 22 | 2 |

| Water heating | 11 | 1 |

| Other | 100 | 9 |

| Total | 1110 | 100 |

| C. Manufacturing | Billion kWh | Percentage |

| Machine drive | 512 | 53 |

| Process heating | 104 | 11 |

| Electro-chemical | 86 | 9 |

| HVAC | 82 | 9 |

| Process cooling and refrigeration | 63 | 7 |

| Lighting | 62 | 6 |

| Other | 61 | 6 |

| Total | 970 | 100 |

Insull began a sales campaign, cut prices as necessary to get customers, and wrote long-term contracts for large customers. He utilized a demand meter (invented in England) and set the price of electricity to cover both fixed and operating costs. Insull also concluded that profits were maximized by keeping the power plant running as much as possible to exploit the diversity of load. As a result, the U.S. led the world in the rates of electrification. Insull in Chicago sold more electricity per capita, ran larger power stations, kept the plants running longer each day, and charged customers less. Insull also discovered that there were clear advantages to tying together urban and rural loads. For example, Chicago had a winter peak and the farm towns a summer peak.

By 1911, thanks to the development of the ductile metal filament lamp, electric lighting ceased to be a luxury, manufacturers developed new uses (e.g., refrigerators and sewing machines), and the demand for electricity skyrocketed. Also, Charles Parsons had recognized the limits of the reciprocating steam engine in 1884, and developed the steam turbine that produced rotary motion directly as high-pressure steam pushed against blades attached to a shaft. This elegantly simple machine occupied one-tenth the space, and cost one-third as much as the reciprocating engine of equivalent capacity. By 1911, 12,000 kW turbine generators also became the norm. Thus, the keys to the success of the traditional, declining cost commodity, grow-and-build electric utility business model were established, i.e., economies of increasing scale, rapidly rising consumer demand, and consumer diversity for load stabilization and higher capacity factors.

However, during much of this era of rapid sales growth and technological progress, electric utilities managed to earn unspectacular profits. This was addressed by consolidating the over-fragmented industry into ever-larger holding companies. Centralized ownership served to facilitate raising money and engineering the best systems. Also non-utility, industrial, electricity generation declined from more than 50% of the U.S. total as late as 1914 to 20% by 1932. Although states regulated the operating subsidiaries that sold electricity, none regulated the holding companies. By 1932 the eight largest holding companies controlled 73% of the investor-owned electric businesses. The Insull empire alone operated in 32 states and controlled at least a half billion dollars in assets with an investment of only $27 million. As a result of these excesses committed, the electricity holding companies were condemned in the wake of the Depression, and controlling legislation was passed that created the present structure of the electric utility industry.

Under this legislation, interstate holding companies had to register with the SEC. This included any company that owned 10% or more of the voting securities of an electric or gas utility. The Act also broke up holding company systems that were not contiguous and eliminated intermediate holding companies from the financial structure.

Table 2 Electrification of the U.S. economy

| 1902 | 1932 | |

| Percentage of population in electric-lighted dwellings | 2 | 70 |

| Percentage power in industry (horsepower equivalent) | 5 | 73 |

| Average power plant size (MW) | 0.5 | 8.5 |

| Electricity generation (109 kWh) | 6 | 100 |

| Residential service price (0 per kWh—1983$) | ~ 40 | 15 |

This Public Utility Holding Company Act of 1935 (PUHCA) also effectively marked the end of the formative period of the U.S. electricity enterprise. Table 2 summarizes the rapid progress of the electricity enterprise during this formation period.

GROWTH

In 1932, Franklin Roosevelt denounced the “Insull monstrosity” and proposed four Federal hydropower projects—The St. Lawrence, Muscle Shoals, Boulder Dam, and the Columbia. “Each of these in each of the four quarters of the United States will be forever a national yardstick to prevent extortion against the public and to encourage the wider use of that servant of the people— electric power.” In the same general time frame, Lenin also underscored the universal impact of electricity by declaring that “Communism equals the Soviet power plus electrification.”

Even during the Depression and through World War II, the U.S. electric utility industry continued to expand and to cut its costs. Government-supported entities, such as the Rural Electrification Administration, brought electricity to the farms. Although investor-owned utilities lost territory to governmentally owned (public power) utilities, the most significant change was the devolution of operating control from holding companies to locally operated utilities. These were incented to concentrate on customer service rather than on complex financial frameworks. Between 1935 and 1950, 759 companies were separated from holding company systems, and the number of registered holding companies declined from over 200 to 18.

During this period of industry consolidation and growth, utilities desired three features from new technology: reliability, greater power at lower costs, and higher thermal efficiency. As a result of this demanding market, manufacturers initially developed their new machines using a “design-by-experience” incremental technique. As with many other engineering endeavors then, the people who built these complex machines learned as they went along. This was reflected by steady increases in steam pressure and temperature in boilers and generators, providing corresponding improvements in thermal efficiency. Steam temperature and pressure in 1903 were typically 530°F and 180 PSI respectively. By 1930, water-cooled furnace walls permitted the production of steam at 750°F and upto 1400 PSI. By 1960, these parameters had increased to 1000°F and 3000 PSI, turning water into dry, unsaturated, supercritical steam, effectively exploiting the full potential of the Rankine steam cycle.

Improvements in transmission systems also occurred incrementally during the power industry’s first several decades. While comprising a relatively small portion of a power system’s total capital cost, transmission systems nevertheless contributed significantly to providing lower costs and more reliable service. They did this by operating at ever-increasing voltages and by permitting interconnections among different power plants owned by contiguous power companies. Transmission voltage increased from 60,000 V in 1900 to 240,000 V in 1930 and upto 760,000 V by 1960. Increased voltage, like higher water pressure in a pipe, allows more electricity to pass through a transmission wire. Doubling the voltage, for example, increased a line’s volt-ampere capacity by a factor of four. In short, the development of high-voltage transmission systems contributed as much to the steady increase in capacity of power production units as did advances in turbine speed or generator-cooling techniques.

U.S. energy consumption grew in lock-step with the economy after World War II, but electricity sales rose at double that rate until about 1970. The result, over the period of 1935-1970, was an 18-fold increase in electricity sales to end users with a corresponding 12-fold increase in electric utility revenues. This growth was stimulated by the dramatic and continuing drop in the real price of electricity, compared to other fuels. Much of the success in reducing costs was due to these continued improvements in the generating process and in higher voltages and longer distance transmissions, which together more than offset the impact of the break up of the holding companies. Over the post-war (1945-1965) period, the average size of a steam power plant rose fivefold, providing significant economy-of-scale advantages.

Efficiency improvements (heat-rate) did not, however, keep pace after the late 1950s, even with higher operating steam temperatures and pressures. The inherent limitations of the Rankine steam cycle coupled with metallurgical constraints caused this efficiency plateau. Electricity distribution system expense per customer year also increased over 100% during this period, from $8 to $17.

After World War II, the accelerated growth of the industry caused manufacturers to modify their incremental, design-by-experience approach to one of “design-by-extrapolation.” This enabled manufacturers to produce larger technologies more rapidly. The push for larger unit sizes reflected the postwar U.S. economic prosperity and the introduction of major new electricity uses including air conditioning, electrical space-heating, and television. The all-electric home loomed large on the horizon. The biggest concerted promotional push began in 1956 with the “Live Better Electrically” campaign employing celebrities such as Ronald Reagan, on the heels of the very successful “Reddy Kilowatt” mascot for modern electric living.

While the best steam turbine generating units only improved in thermal efficiency from 32 to a 40% plateau in the postwar period, turbine unit sizes jumped from about 160 MW in 1945 to over 1000 MW in 1965 through the design-by-extrapolation approach. Correspondingly, new plant construction costs declined from $173/kW in 1950 to $101/kW in 1965. Between 1956 and 1970, utilities operated 58 fewer plants to produce 179% more electricity. As regulated monopolies, electric utilities could not compete with each other for market share, but competition existed during this period as engineer-managers strived for technical leadership among their peers. This type of competitive environment contributed to rapid technological advances and production efficiencies. Utility managers encouraged manufacturers to build more elegant technology so they could get credit for using the “best” machines. The risks to gain customized technological supremacy often meant an economic tradeoff, but this was a price readily paid in the 1950s and 1960s by utility managers who retained their engineering values and goals as they became leaders of large business enterprises.

During this period of rapid expansion and success, a third participant—in addition to electric utilities and manufacturers—played a largely invisible supporting role. This third party consisted of the state regulatory bodies, which performed two tasks relative to the electricity enterprise. First, they protected the public from abusive monopoly practices while assuring reasonably priced, reliable utility service. Second, they guaranteed the financial integrity of the utility companies. Conflicts rarely arose because utilities were steadily reducing their marginal costs of producing power, and they passed along some of these savings to consumers. Thus, few people complained about a service where declining costs countered the general trend toward cost-of-living increases. Regulatory actions also tended to reinforce the industry’s grow-and-build strategy by permitting utilities to earn a return only on capital expenditures. This “social contract” served the industry and its stakeholders well for more than half a century providing a robust, state-of-the-art infrastructure. Although not articulated at the time, these stakeholders had forged an implicit consensus concerning the design, management, and regulation of a national technological system. As long as benefits continued to accrue to everyone, the consensus remained intact.

For electric utilities, this consolidation and growth period was, in summary, one of reorganization out of the holding companies, minimal need for rate relief, declining costs and prices, an average doubling in electricity demand every decade, incentives to add to the rate base, satisfied customers and investors, and acceptable returns for owners. That environment of few operating problems and little need to question the prevailing regulatory structure left the electricity enterprise and its stakeholders unprepared to either anticipate, or respond quickly to, the challenges that rapidly followed.

Table 3 Electricity enterprise growth

| 1932 | 1950 | 1968 | |

| Ultimate customers (million) | 24 | 43 | 70 |

| Net generation (109kWh) | 100 | 389 | 1,436 |

| Installed generating capacity (103 MW) | 43 | 83 | 310 |

| Average power plant size (MW) | 8.5 | 18 | 85 |

| Circuit miles of hi-voltage linea (103 mi) | NA | 236 | 425 |

| Residential service price (0 per kWh—1983$)

a 22,000 V and above. |

15 | 10 | 7.1 |

Table 3 summarizes the progress of the electricity enterprise during this period of growth and consolidation.

MATURITY AND STASIS

By the mid 1960s, the electricity enterprise and its stakeholders were beginning to experience the first cracks in the traditional business model and its associated regulatory compact. The fundamental concepts of the enterprise began to be challenged and investment started to erode. The most notable initial event was the November 9, 1965 Northeast Blackout that spread over 80,000 mi2 affecting 30 million people. This, and other outages that followed, forced utilities to redirect expenditures from building new facilities to improving the existing ones. Specifically, they had to upgrade the fragile transmission and distribution (T&D) system in order to handle larger power pools and more frequent sales among utilities. These new costs led to higher rates—for the first time, literally, in decades—and despite expensive public relations efforts, the public grew increasingly critical of utility monopolies.

1967 marked a second major turning point for the U.S. electricity enterprise—generation efficiency peaked. Rather than lower the average cost of electricity, a new steam power plant would henceforth increase it. Economies of scale ceased to apply (bigger was no longer necessarily better or cheaper) and continued expansion in the traditional manner no longer held the same consumer benefits. The grow-and-build strategy had seemingly reached the end of the line. A third turning point was Earth Day in 1970. This launched environmental activism and focused fresh attention on electric utilities, ultimately leading to further investment redirection for environmental control equipment, most notably for sulfur dioxide scrubbing on the industry’s fleet of coal-fired power plants. The Clean Air Act of 1970 made environmental concerns an integral part of the utility planning process while planning for growth became more difficult.

The fourth major turning point event for the electricity enterprise was the Oil Embargo of 1973. OPEC’s actions led to a rapid rise in the cost of all fuels, including coal. Accelerated inflation and interest rates resulting from the Vietnam War economy also led to higher borrowing rates for utilities. The sum of these turning point issues led to ever higher electricity prices, reducing the growth of U.S. electricity sales in 1974 for the first time since World War II. Consolidated Edison missed its dividend and utility stock prices fell by 36%, the greatest drop since the Depression.

In spite of these troubling events, the electricity enterprise’s commitment to growth was slow to respond. In 1973 electric utilities issued $4.7 billion in new stock, almost seven times that sold by all U.S. manufacturing companies combined. Finally in 1975, capital expenditures declined for the first time since 1962. The traumatic decade of the 1970s concluded with perhaps the most strategically serious turning point issue of all—three mile Island. On March 28, 1979, a cooling system malfunction at the 3 mi Island nuclear plant in Pennsylvania destroyed public and political confidence in nuclear power, which had been seen as a technological solution to restoring the declining commodity cost and financial strength of the electricity enterprise. This event fell immediately on the heels of the nuclear accident-themed movie, The China Syndrome, and seemed to validate nuclear power plant risks in the public mind. Although the lack of any core meltdown or even radiation leakage was testament to the quality and integrity of nuclear power plant design and construction, the demand for stricter safety regulations led to rapid cost escalation.

The first commercial nuclear power unit built in 1957 had a rating of 60 MW. By 1966, utilities were ordering units larger than 1000 MW, even though manufacturers had no experience with units larger than 200 MW at the time. This arguably over-aggressive design-by-extrapolation, plus uneven utility operations and maintenance (O&M) training and management, led to reactor cost overruns that were sending power companies to the brink of bankruptcy while average power prices soared 60% between 1969 and 1984. Utilities and manufacturers in 1965 predicted that 1000 reactors would be operating by 2000 and providing electricity “too cheap to meter.” The reality was that only 82 nuclear plants were operating in 2000, and no new U.S. orders had been placed in two decades.

These issues were profoundly impacting the electricity enterprise in the 1980s. The very ways electricity was generated and priced were being challenged for the first time in nearly a century. No longer could planners count on a steady rise in electricity demand. No longer could utilities count on low-cost fuels or the promise of the atom. They could no longer construct larger and more efficient generation, nor could they avoid the costs associated with environmental emissions. Competition from innovative technologies and hustling entrepreneurs could no longer be blocked, and the long-standing social contract consensus among the stakeholders of the electricity enterprise began to unravel.

The push for open power markets started when energy-intensive businesses began demanding the right to choose their suppliers in the face of rising electricity prices. Recognizing this pressure, the Energy Policy Act of 1992 also greased the skids for greater competition. The Act let new unregulated players enter the electricity generation market and opened up the use of utilities’ transmission lines to support wholesale competition. The deregulation of natural gas in the 1980s made gas a more available, affordable, and cleaner fuel for electricity generation. This, coupled with rapid advancements in aircraft-derivative combustion turbines, provided an attractive vehicle for new, independent power producers to enter the market with low capital investment. Notably, non-utility sources as late as 1983 supplied only 3% of the U.S. generation market. By 2003, however, unregulated non-utility generators had captured nearly 30% of the U.S. generation market, exceeding the combined share from rural coops, the federal government, and municipal utilities. Wholesale electricity trading also soared—from approximately 100 million kWh in 1996 to 4.5 billion kWh in 2000.

Between 2000 and 2003, about 200,000 MW of new natural gas-fired combustion turbine capacity were added to the U.S. electricity generating fleet. Sixty-five percentage of this new deregulated generating capacity utilizes a combined-cycle technology. However, the rate of new combustion turbine-based capacity addition has dropped off dramatically since then. In addition, the performance of this new capacity has suffered in terms of both heat-rate and capacity factor. These are all symptoms of the boom-bust cycle in power generation that now exists in the restructured industry. For example, the average capacity factor for the fleet of new combined-cycle power plants dropped from 50% in 2001 to below 30% in 2004 as electricity supply capability significantly exceeded demand, market access was physically limited by transmission constraints, and natural gas prices rose dramatically.

The 21st century has not begun well for the performance and integrity of the U.S. electricity enterprise. The biggest power marketer, Enron, collapsed amid scandal while facing a slew of lawsuits. Pacific Gas and Electric, one of the largest investor-owned utilities, filed for bankruptcy amid the chaotic power markets in California. 50 million people in the Northeast and Midwest lost electricity because of a cascading power failure in 2003 that could have been prevented by better coordination among utility operators. High natural gas prices and the U.S. economy’s overall slowdown caused electricity demand to falter and wholesale prices to fall. As noted, the natural gas-fired combustion turbine boom collapsed, carrying many independent generation companies with it.

The end result was a $238 billion loss in market valuation for the electricity enterprise by early 2003 and the worst credit environment in more than 70 years. Those companies able to maintain good credit ratings and stable stock prices bought nearly $100 billion in assets from weaker firms. Since the Energy Policy Act of 1992, competitive electricity generators have been able to charge market rates, while the transmission and distribution sides of the enterprise have remained regulated with relatively low investment returns. As a result, more power is being produced, but it is being sent over virtually a frozen grid system. The U.S. Department of Energy predicts that transmission investment is only likely to expand 6% compared to the 20% growth in electricity demand expected over the coming decade. Another rising controversy pits residential against business customers as electricity rates increase.

In summary, as shown in Fig. 3, the past 30 years have focused on efforts to restore the electricity enterprise’s declining cost commodity tradition. All have failed to meet this challenge and there are no “silver bullets” on the horizon that are likely to change this reality within the context of today’s aging electricity supply infrastructure. At the same time, electricity has become increasingly politicized as an essential retail entitlement where market price volatility is effectively allowed to operate only in one direction—downward. Thus, the essential foundation for restoring vitality to the electricity enterprise rests first and foremost on innovation, principally in the consumer/delivery interface and in end-use electro-technologies. This represents a profound transformational challenge for the enterprise, which, throughout its history following the Edisonian beginning, has focused on supply-side technology as the wellspring of progress.

Fig. 3 Average U.S. price of residential electricity service (in 1984 $).

This combination of rising costs and artificially constrained price creates an economic vise on electricity supply that is squeezing out more and more value from the enterprise and the nation. Unfortunately, the dominant financial imperative has been to contain immediate costs at the expense of infrastructure development and investment. Unless the resulting standstill is ended and the assets of the enterprise are urgently reinvented, they risk being left behind as industrial relics of the 20th century. For example, the total capital expenditure rate of the electricity enterprise, both regulated and unregulated, as a fraction of its electricity revenues is now about 10%, less than one-half of the historic minimum levels and, in fact, a percentage only briefly approached during the depths of the Depression (refer to Fig. 4).

Unfortunately, this emphasis on controlling costs at all cost has also resulted in a period of profound technological stasis throughout the grid-based electricity enterprise. This has not been for lack of innovative opportunity but rather the lack of financial incentives. Every aspect of the enterprise has both the need and opportunity for technological renewal. For example, although coal remains the backbone of the power generation fleet producing over half the nation’s electricity, the outdated technology being used is both inefficient and unable to keep pace with rising environmental demands, including carbon control. Integrated coal gasification-combined cycle (IGCC) technology which, in effect, refines coal into a clean synthesis gas for both electric power generation and synthetic petroleum production, could fundamentally address these constraints. Similarly, advanced nuclear power cycles could resolve the waste management, proliferation, and efficiency problems limiting the use of this essential clean energy source. Without considerably greater R&D emphasis and modernization of the power delivery system, renewable energy will also remain a theoretically attractive but commercially limited resource opportunity. The same is true of electrical storage.

Throughout the history of commercial electrification, large-scale storage, the long-sought after “philosopher’s stone” of electricity, has remained elusive and thus a fundamental constraint on addressing optimal load management and asset utilization. Pumped storage, the use of off-peak electricity to pump water behind dedicated hydroelectric dams, has gained acceptance where feasible within geologic and environmental constraints. Demonstrations of compressed air storage using evacuated salt domes and aquifers were also successful, although this technology has not yet achieved significant commercial acceptance. At the other end of the spectrum of electricity storage, small-scale devices, including batteries and capacitors, are used for short-term load stability purposes and to dampen current fluctuations that affect reliability. A variety of advances in storage, including super conducting magnetic energy storage (SMES) and flywheels are being explored, but all have suffered from the general technological malaise constraining the grid-based electricity enterprise.

Only in applications for power portability has innovation in electricity storage made significant technical and commercial progress during this period. This progress also represents quite a different set of players than those of the traditional electric utility-based industry. Also indicative of new players taking advantage of the growing value gaps in the nation’s traditional electricity supply capability is the trend toward distributed power resources. Consumers with urgent needs for high quality power are increasingly taking advantage of the emergence of practical on-site generation technologies. These include diesel power sets, microturbines utilizing natural gas or landfill methane, fuel cells, and hybrid power systems incorporating photo-voltaics. All of these are, in effect, competitors with the power grid, although ideally they could be integrated as grid assets within a truly modernized national electricity service system.

Fig. 4 Electric utility revenues and capital expenditures (in 2003 millions of $), 1925-1999.

Similarly, in terms of power delivery technology, a wide array of thyristor-based digital control systems (e.g., FACTS), wide-area monitoring and communications, and highly sensitive anticipatory condition monitors, have been demonstrated and could revolutionize the reliability, capacity, and operability of the nation’s electricity transmission and distribution network. Superconductivity represents another potential breakthrough technology that could fundamentally improve the efficiency of both power delivery and end use. This has been enabled by the recent development of so-called “high-temperature” superconductive materials operating at relatively modest liquid nitrogen temperatures. These materials, in effect, have no electrical resistance, thus eliminating transmission distance limitations, and are capable of significantly increasing the electrical capacity of existing distribution systems. The primary constraint today is the brittle ceramic nature of these superconducting materials and the resulting difficulties in manufacturing durable wiring, etc.

However, unless and until the electricity system advances from its current “life-support” level of infrastructure investment, all these potential advances remain, at best, on-the-shelf novelties. (These and others will be addressed further in the following entry on Transformation.) This investment gap is exacting a significant cost that is just the tip of the iceberg in terms of the electricity infrastructure’s growing vulnerabilities to reliability, capacity, security, and service challenges. In fact, since the mid-1990s, the electric utility industry’s annual depreciation expenses have exceeded construction expenditures. This is typical of an industry in a “harvest the assets” rather than an “invest in the future of the business” mode.

An even more dramatic measure of stasis is the minimal R&D investment by the electricity enterprise. In the wake of restructuring in the early 1990s, the enterprise’s R&D investment rate has declined to about 0.2% of annual net revenues. This compares to a U.S. industry-wide average of about 4%. Even with inclusion of federal electricity-related R&D, the total is still only equivalent to a fraction of one percent of annual electricity sales revenues. The bill for this mortgaging of the future has come due and will, unless promptly paid, impose a heavy price on the nation’s productivity, economy, and the welfare of its citizens.

Fig. 5 compares recent relative price trends among a variety of essential retail consumer goods and services. On the surface, the trend for electricity looks quite favorable but, after factoring in the rapidly growing cost of service unreliability (the shaded area), the real cost of electricity service has been increasing significantly and continues to do so at an escalating rate. This is an indelible reminder that it is only the lack of quality that adds to cost.

There is also a significant and growing stakeholder concern that the electricity enterprise, as currently constituted, is out of step with the nation at large. As economic growth resumes, will the enterprise be able to keep pace with energy quantity and quality needs, and can it also satisfy investor expectations without again resorting to questionable, high-risk financial schemes?

Fig. 5 Relative consumer prices, 1985-2001.

Table 4 Maturity and stasis

| 1968 | 1985 | 2002 | |

| Ultimate customers (in millions) | 70 | 101 | 132 |

| Net generation (109kWh) | 1,436 | 2,545 | 3,841 |

| Installed generating capacity (103 MW) | 310 | 712 | 981 |

| Average power plant size (MW) | 85 | 227 | 300 |

| Circuit miles of high-voltage linea (103 mi) | 425 | 605 | 730 |

| Residential service price (0 per kWh—1983$)

a 22,000 V and above. |

7.1 | 6.8 | 6.8 |

Table 4 summarizes the course of the enterprise during the maturity and stasis period of the last 35 years.

CONCLUSION

The past century has witnessed the creation of the electric utility industry, and the profound growth in electric use. Electricity is now consumed by virtually every residential, commercial, industrial, and institutional facility in the United States. For the first half century of this new technology, costs of electricity continually declined; and by the 50 year mark, a unified electric grid system reached the far corners of the nation. The electric power system in the U.S. had reached its zenith. But, by the mid-1970s, the electric industry was hit by several price shocks—the most damaging being the end of ever cheaper power plants and ever cheaper electric power. The more recent trend toward deregulation in the electric industry has had a significant impact on electricity customers, as well as on electric utilities. Cost increases for customers, economic problems for utilities, and reliability problems for the electric grid have all become serious problems for the electricity enterprise. A “reinvention” of the electricity enterprise is needed to control costs, increase the economic health of electric utilities, and prepare for the future uses of electricity. A modernized electricity enterprise would provide widespread benefits for the U.S. economy and society. The need for a transformed electricity enterprise in the U.S. is the topic of a second article in this area.