Taft-Hartley Act 1947

‘The Labor-Management Relations Act’, a major US federal labour statute amending the wagner act particularly by attempting to balance the rights and responsibilities of labour and management. Section 8(c) listed six unfair labour practices by unions: (1) restraining/coercing employees in their rights to engage in or refrain from collective bargaining; (2) causing an employer to discriminate against non-union workers; (3) refusing to bargain with an employer despite being the representative of its workers; (4) engagement in or inducement of workers to engage in strikes, refusals to work and boycotts when, for example, union recognition has not been certified by the national labor relations board; (5) charging an excessive or discriminatory fee to enter a union under a union shop clause; and (6) extorting a payment from an employer for services not performed or about to be performed.

Taft-Hartley also banned the closed shop, authorized states to have right-to-work laws, gave the US President the power to direct the Attorney-General to petition for an eighty-day injunction against a strike or lockout which constituted a national emergency, attacked communist infiltration of US labor unions by requiring union officials to swear anti-communist affidavits before they could use the National Labor Relations Board, and banning unions and corporations from political expenditures. Many of these new prohibitions could be enforced under the criminal law. For years, the labour movement attacked Taft-Hartley for creating ‘slave labor’ as organizing labour became more difficult.

take-off

The crucial stage of economic development when an economy ‘takes off’ into steady growth because its capital-output and savings ratios rise to at least 10 per cent of national income. This first occurred in the older industrialized countries – in Great Britain in the 1780s, in the USA in the 1820s, in France and Germany in the 1850s. Critics of this approach to development have asserted that it ignores the interplay between economic, social and technological determinants. However, the proponent of this theory, rostow, argued from an examination of economic trends that there are five stages of growth: the traditional society, preconditions for takeoff (e.g. inventions, the rise of entrepreneurs), take-off, the drive to maturity and the age of mass consumption.

takeover

A method of merging two firms by which one firm bids for another and, if successful, acquires it. Acquisition by the stealthy purchase of shares in public companies is now outlawed under the strict rules of major stock exchanges.

takeover panel

UK non-statutory committee founded in 1968 and supervised by the Bank of England. it regulates the code of takeovers in the uK having the power to suspend access by a company to securities markets temporarily or permanently. in its work it attempts to achieve fair play.

take-up rate

The proportion of those eligible for a particular benefit who claim it. pecuniary and psychic costs (including embarrassment) cause the rate always to be less than 100 per cent. Many voluntary organizations attempt to publicize benefits available to claimants, thereby increasing the take-up rate and making it more difficult to maintain the present rate of benefit.

tangible net worth

Shareholders’ equity minus intangible assets.

tangible wealth

The fixed capital and inventories of firms.

tap stock

A government bond issued, e.g. in the UK or USA, at a fixed price but not sold in its entirety as some of it is held back ‘on tap’ to be released gradually when market conditions are favourable. other government stocks are sold by tender.

targeting

The use of specific policy instruments to reach particular targets, e.g. a low rate of inflation. This principle of macroeconomic policy making is suboptimal if there are side effects from targeting which create distortions in allocation.

target price

The price of an agricultural product of the european community which is annually fixed by the agricultural ministers of member countries. This is higher than an INTERVENTION PRICE.

target variable

A quantified policy goal, e.g. 5 per cent unemployment.

tariff

1 A PRICE. A CHARGE.

2 An import tax. The superiority of a tariff to import licensing arises from its lower administrative costs and the production of revenue; few tariffs succeed in excluding all imports and so they earn revenue. As a form of taxation, tariffs have been used from earliest recorded history as in primitive economies they had the advantage of involving fewer valuation problems than taxes on income or on capital. In the post-war period, tariff reductions aimed to reduce the protectionism of the 1930s; most of these had withered away before the dillon, Kennedy, tokyo and URUGUAY ROUNDS.

In the figure, DD is the demand curve, ss is the supply curve, px — p is the tariff and p2 — p is a prohibitive tariff which excludes all imports. QQi is the protective effect, i.e. an increase in domestic production, Q2Q3 is the consumption effect, i.e. the reduction in total consumption, and QQ3 are the imports at price p before a tariff is imposed. a is the redistribution effect, i.e. additional economic rent to domestic producers continuing in production and economic rent to new domestic producers, b and d are deadweight losses of the tariff and c is the revenue effect, i.e. the tax revenue obtained by the government by imposing the tariff p! — p.

tariffication

The introduction of charges for services which were previously free. A recent example has been the introduction of bank charges for many client transactions.

tariff jumping

A response to protection. International companies avoid import taxes and restrictions by investing in the protected countries so that a local market can be supplied by local production rather than through international trade.

taste

The view of an individual of the relative merits of several things or possibilities. Assumptions about tastes are crucial to the analysis of choice in economics and are usually represented by indifference curves. In the study of consumer behaviour, tastes are depicted as a choice between goods with different utilities; in labour market analysis as a choice between work and leisure; in the analysis of risk as a choice between outcomes with different probabilities. Assumptions about tastes are central to neoclassical economics.

tatonnement

A process of market clearing in which, by bargaining, an equilibrium is reached between buyers and sellers. walras introduced this term, meaning ‘groping’, into economics with his example of bidding.

taxable capacity

The extent to which households and firms can pay a tax and a fiscal authority can collect it.

taxable income

Income subject to direct taxation. Personal and other allowances are deducted from total pre-tax income to ascertain what is taxable.

taxation

A method of raising revenue for a government by levies on persons and firms. Taxes can be direct or indirect and can be raised centrally or locally. A government will choose its taxation policy with reference to its effects on income distribution post-tax, on incentives and on investment and economic growth. Also, the taxation raised will be decided as part of its fiscal stance. Instead of taxation, a government can finance its activities by charging for the services it offers or by borrowing.

tax avoidance

Taxpayers’ careful arrangement of their activities and business affairs to minimize liability to taxation.

tax base

That which is taxed, especially income, wealth, property, expenditure or consumption. A government can raise its total tax revenue by using several tax bases. if the country has a federal structure, then a different tax base can be used for each level of government. originally little was taxed because of problems of valuation and collection; gradually, there has been a movement from indirect taxes on imports and various types of consumption to income TAX and PROPERTY TAX.

tax-based incomes policy

A method of controlling the growth of wages and salaries by increasing the taxation of firms which have paid more than the prescribed maximum for pay increases. Firms would be liable for taxation on the unauthorized addition to their average wage bills. In the USA, this policy has frequently been advocated on the grounds of its supposed administrative simplicity. The version of this policy suggested by okun was to offer an anti-inflationary tax credit of 1% per cent of salary (on salaries up to $20,000 per annum) in return for the employer not increasing pay by more than 6 per cent.

tax buoyancy

The growth of total tax revenue at the same, or a greater, rate of the growth of income or output.

tax burden

1 The ratio of the total tax revenues of a country to its gross domestic product.

2 The total effects of a country’s taxes on all its residents or on certain sectors or types of taxpayer, e.g. firms or households.

Although objectively this burden is the transfer to government of part of taxpayers’ resources, many taxpayers would subjectively regard the burden as greater. Governments impose taxes primarily to finance expenditure, but they can unintentionally inhibit the growth of incomes and the capital stock. A guide to tax burdens in oEcD countries is published annually in the May issue of Economic Trends (uK). The tax burden is high in industrialized Europe but low in less industrialized Europe, e.g. Portugal and Turkey. An approximate measure of the tax burden often used is the average rate of tax. More elaborate assessments of a tax burden take into account collection costs, the effect on productivity of a tax structure, the extent to which taxpayers can plan because the tax system is stable, and the degree of horizontal and vertical equity.

tax capitalization

The effects on the price of a taxed good, e.g. a house, of the discounted present value of future tax payments. Thus if a house is expected to be liable to high property taxes in the future, a present valuation of it will take that into account. As high local property taxes lower property values, residents are encouraged by this capitalization effect to move to other areas.

tax competition

The fiscal rivalry of national governments who attempt to have lower taxes than their competitors in order to attract investors.

tax credit

An amount subtracted from the taxes owed to a government to lower tax liability.

tax effort

The extent of success in collecting a tax from a tax base.

tax elasticity

The responsiveness of tax revenue to an increase in income or output. if tax revenue grows faster than the tax base, the tax is elastic.

tax erosion

The reduction in tax revenues brought about by exemptions from the comprehensive taxation of income, e.g. capital gains allowances and the tax exemption of fringe benefits.

tax evasion

Reduction of one’s tax burden by inaccurate statements of income and other circumstances relevant to tax liability. The amount of evasion depends on the probability of being detected in such conduct and the penalties for such offences.

Tax Exempt Special Savings Account

The savings incentive scheme, known as ‘Tessa’, introduced by the UK government in 1990 and effective from January 1991. Tax on interest was exempt provided that capital is not withdrawn for five years and no more than £9,000 was accumulated. If interest were withdrawn it was taxed at the basic rate of income tax. savings were accumulated in either bank or building society accounts.

tax expenditure

A tax incentive or tax subsidy, a departure from the normal tax structure, e.g. tax credit, deductions and deferrals of tax liabilities. This loss of a government tax revenue is intended to further social goals, e.g. raising the post-tax income of the lower paid, encouraging education or promoting residential investment. This concept was introduced in the USA by the Treasury in 1968 and is now a spending programme of the US Internal Revenue service.

tax farming

Delegation of the right to collect taxes to private tax collectors who then have the freedom to raise more than the quota requested by government. This ancient system is open to much exploitation of taxpayers.

Tax Freedom Day

The day in the year when people in effect stop working to pay taxes. This is determined by calculating the average tax rate for the population and applying that percentage to the number of days in the year. For national economies with an average tax rate around 40 per cent the day occurs in May or June.

tax harmonization

The standardization of tax rates, tax rules and tax definitions throughout a number of countries. usually, in a harmonization exercise the most common existing practice is adopted as the standard. sometimes harmonization is necessary to achieve other policy goals, e.g. in the european community the harmonization of indirect taxation is necessary if the goal of unimpeded movement of goods is to be achieved.

tax haven

A country with very low rates of taxation that attracts companies and individuals wishing to minimize tax liability. The countries benefit from the influx of currency and the consequential commercial activity. Most of these havens are small islands or countries off the USA, e.g. the Bahamas and the virgin islands, or on the perimeter of Europe, e.g. Monaco and the channel islands. Larger countries would find it difficult to finance public expenditure if they adopted such a low-tax policy.

tax incidence

Reduction of personal or corporate income caused by the imposition of a tax. incidence is classified according to the group or sector on which a tax falls. These groups can be producers or consumers, those with a particular size of income, regions, industries, countries or generations.

The incidence is shifted forward to the consumer if the price of the final good rises because of the tax; backward, if there is a decline in demand for final goods and the price of intermediate goods falls. The incidence is shifted to future generations if current public expenditure is debt financed. Tax incidence can be analysed through a partial equilibrium approach as is the case when taxes on goods are analysed and the demand and supply elasticities are calculated, or with a general equilibrium approach when, e.g. with a corporation tax, the effects on output and on capital-labour ratios are examined. statutory incidence shows liability under tax laws. Economic incidence shows how taxation affects economic behaviour, e.g. the number of hours worked or the amount saved: such incidence traditionally concentrated on the effect of taxation on the FUNCTIONAL INCOME DISTRIBUTION. Increasingly it has been examined in the context of the size distribution of income. Tax incidence was discussed as early as the eighteenth century by the physiocrats.

tax reform

A change in a tax system attempting to improve allocation, efficiency and equity. Tax reform usually takes the form of reducing the number of separate rates of tax and abolishing many tax allowances.

Because tax reform is motivated by a desire to reduce administrative costs, as well as to reduce tax avoidance, there have to be fewer tax allowances, a simpler progression of tax and the abolition of certain types of tax, e.g. on capital.

Tax reform is high on the political agenda of many countries, including the UK, Canada, New Zealand, France, Japan and sweden. common to many of these proposals is a switch from income to expenditure taxes and a reduction of the top marginal income tax rates. indexation of personal allowances is often removed, thus increasing tax yields in times of inflation. In the UK, the top marginal rate of income tax was reduced in 1979 from 83 per cent to 60 per cent and value-added tax was raised from two rates of 8 per cent and 12.5 per cent to a single rate of 15 per cent; in stages, corporation tax has been reduced from 52 per cent to 35 per cent. But in the Budget of 1988 income tax was simplified by the reduction in the number of bands to two – at 25 per cent and 40 per cent. In the USA, the Reagan Administration quickly reduced the top marginal rate of income tax from 70 per cent to 50 per cent and in 1986 the top rate was cut to 28 per cent. Japan reduced the top income tax rate from 85 per cent to 65 per cent; great reductions in corporate tax rates are envisaged and to maintain tax revenue a value-added tax at 5 per cent and a withholding tax of 20 per cent on postal savings and bank accounts are to be introduced. west Germany also cut income tax and corporation tax rates: the top income tax rate from 56 per cent to 53 per cent, minimum rates from 22 per cent to 19 per cent and corporation tax from 56 per cent to 50 per cent with cuts in many allowances. Australia proposed cutting top income tax rates from 60 per cent to 49 per cent in harness with an incomes policy. Tax cuts to a top rate of 50 per cent have no redistributive effect but a cut below 50 per cent does. curiously some countries, e.g. Japan, have known both high economic growth and high marginal tax rates.

The transition to a new system can produce undesired effects, e.g. a decline in the capital value of assets. To implement a tax reform, either a gradualist approach of dealing with a particular tax at a time or a package approach of widespread change can be adopted. civil servants prefer the former but it leads to more confrontation with lobbies; there is likely to be support for the package approach only if there is widespread discontent with the current system.

Tax Reform Act 1986

US federal statute that undertook the sweeping reform of the US tax system from January 1987. it simplified the structure of taxation by introducing two rates of individual tax at 28 per cent and 15 per cent instead of the fifteen rates previously in force; given the loss of previous allowances, in practice the top marginal tax rate became 33 per cent. The corporate rate was cut from 46 per cent to 34 per cent with a minimum rate of 21 per cent. To compensate for the loss of revenue from cutting tax rates, many tax deductions have been phased out. consumer interest on debt (except for housing), lower tax rates for capital gains, pension plans, real estate investments and business meals and entertainment ceased to attract concessions.

tax revenue

The yield from a particular tax, or of the tax system as a whole. The amount of revenue depends on the tax base chosen, the tax rates set and the amount of compliance with tax legislation. in some countries, there is a heavy reliance on one particular tax, e.g. the USA uses an individual income tax to raise a high proportion of federal government revenues. The growth in tax revenue can be measured by INCOME ELASTICITY OF DEMAND.

tax smoothing

1 The linear relationship between a forecast of future government expenditure and the current value of a variable consisting of the fiscal deficit, private saving and the average tax rate.

2 A fiscal policy minimizing the economic costs of raising taxes to finance varying amounts of public expenditure. it sets an average tax rate over a period to yield budget surpluses followed by budget deficits when expenditure rises.

tax structure

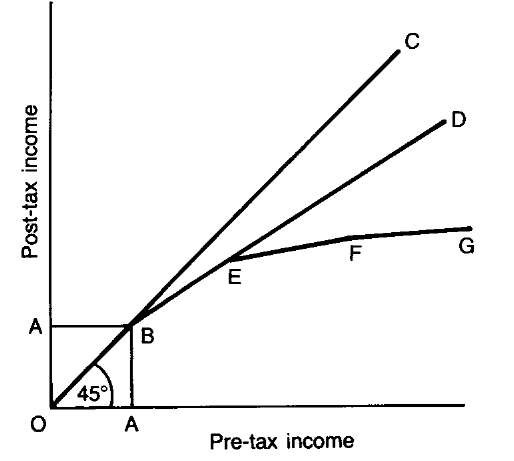

The set of tax rates applying to a particular tax base, e.g. different rates of income tax or different rates of value-added tax. For income taxes, the simplest tax structure is based on the principle of a constant average tax rate: this is rare as so many tax structures are regressive or progressive. in a diagram the tax structure is apparent by plotting post-tax income against pretax income (oc is changes in income in the absence of an income tax, OA is income exempt from tax, oBD shows the course of income when there is a constant marginal tax rate on incomes above OA and oBEFG shows the course of income under a progressive income tax with higher marginal rates on higher income bands).

Marginal tax rate on incomes above OA and oBEFG shows the course of income under a progressive income tax with higher marginal rates on higher income bands).

tax threshold

The income level where income becomes liable to taxation.

tax unit

The person or group subjected to taxation, e.g. a single person, a married couple or a household.

tax wedge

1 The difference between the marginal cost of producing a good and the marginal benefit from consumption in the case of indirect taxes.

2 The difference between the marginal value of leisure sacrificed by a worker and the marginal value to society of another hour of work in the case of personal income taxes.

3 The difference between gross and net, after tax, rates of return in the case of investors.

4 The difference between the total cost of employing a worker and the money wages the worker receives.

Tax wedges produce a distortion in economic welfare.

Taylorism

The us creed of scientific management suggested by F.W. Taylor (1856-1915) who applied at the Bethlehem steel company the principle of work study and a greater subdivision of labour as a means of achieving increased efficiency.

Taylor’s rule

A suggested reaction function for the federal reserve named after John B. Taylor concerning the appropriate federal funds rate to achieve full employment and price stability. The nominal federal funds rate should equal the targeted real funds rate + actual inflation. The real funds rate is to equal the potential growth rate + (actual — targeted inflation)/2 + (% actual — % potential GDP)/2.

team briefing

Direct communication between managers and employees as an alternative to indirect contact with workers via trade unions. Although it reduces the role of trade unions, it sometimes exists in unionized firms.

team theory

A study of the efficient joint choices of several persons. A team has common interests and beliefs and performs various tasks. The theory is concerned with the optimal allocation of tasks and information within the team.

team work

A method of organizing production which rejects a hierarchical organization in favour of collaboration.

TechMARK

part of the London stock Exchange which provides a market in the shares of innovative technology companies. This ‘market within a market’ began in November 1999 with over 100 companies quoted.

technical change

The process which begins with invention and then proceeds to innovation.

technical efficiency

production using a method that maximizes production from given quantities of factor inputs.

technical progress

The use of new techniques; the introduction of new products. Historically technical progress has taken the form of the saving of labour and of raw materials, mechanization and the application of inventions. in most cases, changes in the capital stock are necessary to achieve it. Technical progress can be measured by examining changes in the proportion of output using a particular technique, by increases in speed or by improvements in product quality. Technical progress is a major determinant of economic growth.

technological rent

That part of monopoly profits created by TECHNICAL PROGRESS.

telecommuting

working for a firm at home, connected by telephone lines to supply work from a personal computer. This is a major development in the small-firm sector.

temporary equilibrium

Hicks’s idea that over a short period of a ‘week’ variations in prices can be neglected. During this period both current prices and expected prices are allowed to influence plans for consumption and production. The stability of this equilibrium depends on the elasticity of price expectations. This concept of equilibrium is crucial to Hicksian dynamic analysis.