AAA

The top credit rating of the securities issued by corporations and companies, as judged by the US rating agency Standard & Poor. This rating is based on the view that default is likely to be minimal.

ability to pay

1 The principle of taxation that persons with equal incomes and equal capacity to pay a tax should be taxed the same. This alternative to a benefit tax was suggested as early as the mercantilist period because it appears to be a ‘just’ approach. John Stuart mill argued that equality in taxation meant equality of sacrifice: this is ambiguous as the sacrifice may be in absolute, proportional or marginal terms. As sacrifice means loss of utility, the theory can only work if different persons’ utilities can be compared.

2 An employer’s stance in wage bargaining of making offers according to a firm’s financial state.

abortive benefits

Social benefits which fail to achieve their purpose. There is no net increase in a recipient’s income as the benefits are outweighed by income taxation. Proposals for a negative income tax, which would merge benefits and taxation into a single system, attempt to ensure that benefits raise net income.

above the line

1 A type of expenditure and revenue of a government. For UK budgets from 1947 to 1963, it referred to spending out of current tax revenue.

2 A firm’s expenditure on direct advertising.

3 The items in the summary UK balance of payments which are within the current and capital balances.

Abramovitz, Moses, 1912- (B3) Educated at Harvard and columbia Universities. He was on the staff of the National Bureau of Economic Research from 1938 to 1942 and Director of Business Cycles Study from 1946 to 1948; principal economist of the War Production Board in 1942 before serving in the US Army; and professor at columbia University, 1940-2 and 1946-8, and of Stanford University, 1948-77. After early work on price theory, he turned to a study of inventories and business cycles. Later he examined determinants of long swings in growth, considering changes in the supply of factors of production and the influence of an initial level of productivity on subsequent economic progress.

absenteeism

A form of industrial unrest often used instead of a strike. Workers dissatisfied with their conditions take days off work without pay. Some industries have been noted for this practice, e.g. the UK coalmining industry. It is a form of expressing a grievance available to non-unionized workers.

absolute advantage

An early theory of trade which states that one country enters into trade with another because it has a greater productivity than that country in a particular industry or industries, e.g. its cotton industry is more productive than the foreign cotton industry. smith advanced this as the reason for trade because a nation, like a household, should specialize.

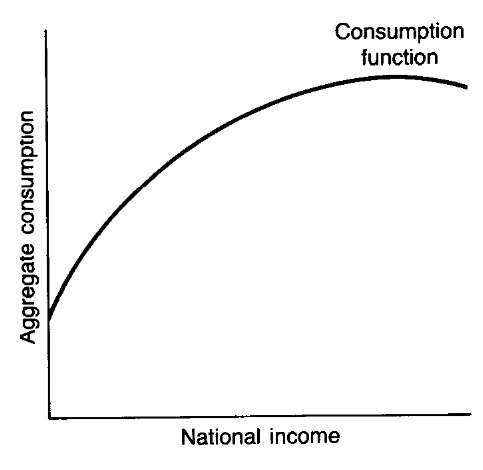

absolute income hypothesis

A theory of the consumption function stating that consumption is a function of current personal disposable income. This was keynes’s original view, later refined by tobin and Smithies. The consumption function is non-linear because the marginal propensity to consume declines as national income increases. Keynes asserted that ‘men are disposed, as a rule and on average, to increase their consumption as their income increases, but not by as much as the increase in their income’. The early approach was superseded by the relative income, permanent income and life-cycle hypotheses.

absolute poor

People with income below what is needed to maintain a minimum standard of nutrition.

absolute scarcity

The limited non-renewable nature of some resources, notably metals and fossil fuels.

absolute tax incidence

The burden of a particular tax compared with a situation in which there are no taxes or governmental expenditures.

absorption approach

A method of analysing a country’s balance of payments by comparing its total output with its ‘absorption’, i.e. its domestic expenditure on goods and services. There will only be an improvement in a country’s balance of payments if its total output is greater than its absorption of its own output. By the use of price elasticities and a multiplier, it is possible to examine the effects on output and absorption of the devaluation of a currency.

absorptive capacity

1 The physical limit to the amount of investment because productivity declines as the rate of investment increases.

2 The extent to which a country can increase investment without depressing returns to that investment.

abstinence

A justification for the payment of interest, first advanced by Nassau senior. An individual who abstains from current consumption is rewarded with interest for adding to the capital stock. Abstinence explains the supply of savings: that supply, together with the demand for capital, forms a theory of the interest rate.

abstract labour

Labour which is abstracted from expenditures of human labour power. marx regarded abstract labour as the creator of exchange values.

abundance

The opposite of scarcity. Abundant goods and services cost nothing to produce and are made freely available. Principal examples are some natural resources but increasingly as population has grown their scarcity has been discovered.

Accelerated Cost Recovery System

US federal tax allowance introduced in 1981 and subsequently modified. Most capital goods were assumed to have a life of three, five or ten years; as many were more durable, this system was a means of cutting corporate taxation. An example of supply-side economics.

accelerated depreciation

An initial depreciation allowance greater than the annual wear and tear of a fixed capital asset. For an asset with an expected life of ten years, under the straight-line method of depreciation the value of the asset would be deemed to depreciate by 10 per cent per year. But under accelerated depreciation, the value of the asset could perhaps be depreciated by 20 per cent in the first year. Governments have used this fiscal device to encourage private sector investment.

acceleration clause

A clause in many mortgage agreements making the principal and interest immediately payable on the occurrence of an event such as failure to make payments on time or to keep a covenant.

accelerator principle

A major theory of investment which asserts that the amount of net investment in a given time period will be equal to a coefficient approximating to the amount of capital needed to produce another unit of output multiplied by the change in income. An early writer using this principle was Aftalion in Les Crises periodiques de surproduction (1913); later Lundberg, harrod, samuelson, hicks and Goodwin included it in their investment equations. The basic principle, expressed in an equation where I is net investment in year t, a is the accelerator coefficient and AY is the annual change in income, has been modified to take into account different reaction times to a change in income and the existence of excess capacity:

where AYt_1 is the change in income in the previous year;

where b is the proportion of the capital stock which is excess capacity and K is the capital stock in year t.

In combination with the multiplier, ceilings and floors, the accelerator plays an important role in the explanation of business cycles, and is prominent in har-rod-domar models.

accepting house

A UK merchant bank which, by approving a commercial bill of exchange, created a short-term marketable asset. In the past such accepting was the major activity of many of these banks but now they have diversified into other activities, including corporate finance and portfolio management. In 1981, the Bank of England ended their special status as endorsers of bills: the Bank of England now regards other commercial paper as eligible for purchase.

access differential

A difference in access to goods and services and to their producers. This addition to monetary rewards was used in the soviet-type economy, so higher ranking officials could use shops, schools and clinics not open to the rest of society.

accession tax

A tax on the gifts and bequests received by heirs.

access-space trade-off model

In urban economics this theory sought to demonstrate that a household’s choice of location and amount of land depends on the trade-off between cheaper rent and a longer trip to work.

Cambridge, MA: Harvard University Press.

accommodating credit

A form of automatic credit, especially in international trade, consisting of the seller (exporter) financing the purchase by a buyer (importer).

account

1 A financial statement expressed in words and sums of money.

2 A standard time period used on the stock exchange for settling payments and delivering securities, referring to a fortnight (or three weeks if there is a public holiday). During an account, stocks and shares can be bought and sold without any cash settlement.

account days

The days on which London stock exchange transactions have to be settled, usually the second Monday after the end of an account.

accounting

The recording of the economic activities of firms and national economies. As early as 1494, double-entry bookkeeping, the basis of modern accounting, was explained in pacioli’s ‘The Method of venice’, although civilizations as early as the Babylonian practised intricate accounting. in the nineteenth century, the development of joint stock companies and corporations necessitated auditing, greatly expanding the role of the accountant. Accounting has moved from financial accounting (the historical recording of past activities) to management accounting (the frequent presentation of information to managers to help them in current decision making).

accounting balance of payments

A record of all the financial transactions between the residents of one country and the residents of foreign countries in a given time period (usually a quarter or a whole year).

accounting costs

All the costs of producing a good or service recorded in the accounts of a firm. These include most economic costs but are likely to omit the cost of the owner’s time and the opportunity cost of the financial capital used in the firm.

accounting cycle

The period from the start to finish of an operational sequence. Accountants typically consider periods of a month, three months, six months or a year.

accounting identity

A balance with each side of an equation equal to the other because of the accounting definitions used. In economics this identity is usually contrasted with equilibrium conditions. Thus, in basic macroeconomics, the accounting equations Y = C + I and Y = C + S entail that I = S, but planned saving and investment may diverge (Y is national income, C is aggregate consumption, I is net investment and S is aggregate saving).

accounting profit

The excess of total revenue over the costs and expenses of a productive activity in a given time period. Contrast with economic profit

accretion of a discount

The accumulation of capital gains on discount bonds anticipating payment of the bond at par when the bond matures.

accrual accounting

Accounts based on transactions when they occur, as opposed to when the cash is received or paid; not cash flow accounting.

accrual interest rate

The rate at which interest accrues on a loan as distinct from the rate at which it is actually paid. This accrual rate can be the current market rate or the original rate when the loan was made.

accrued expense

An expense incurred in a particular time period but not yet paid.

accrued income

Income earned in a particular time period but not yet received in cash.

accumulation

The increase in assets which creates capital. Individual persons and businesses do this for their own gain; governments accumulate with the future welfare of a country in view. smith and marx were early analysts of this process.

acid-test ratio

The ratio of liquid assets such as cash, accounts receivable and short-term marketable securities to current liabilities. Also known as quick assets ratio.

active fiscal policy

Frequently used discretionary fiscal policy. Using this, a government makes many changes in its spending and taxation, instead of relying on automatic stabilizers, to achieve a desired level of aggregate demand.

activist

An economic policy adviser who believes in the use of discretionary monetary and fiscal instruments for fine-tuning the economy.

activity rate

Official UK term for the labour force participation rate. If the female population is 100 million and the female labour force is 55 million, the female activity rate will be 55 per cent.

activity ratio

1 An accounting measure of the amount of activity of a firm: (standard hours for actual output/standard hours for bud geted output) x 100.

2 Net sales divided by total assets or net fixed assets.

3 Accounts receivable divided by daily credit sales.

actual budget

The national taxation and expenditure accounts of a government. They can be in balance, in surplus or in deficit; often contrasted with a full-employment budget.

acyclical

Not subject to fluctuations caused by various types of business cycle. Planned economies with little openness to the international economy, such as the former USSR, hoped to avoid the cyclical instability which they claimed to be an inherent feature of capitalism.

Adam Smith Institute

Free market economic policy research think-tank based in London, UK, and founded in 1977 by a group of like-minded graduates of St Andrews University, Scotland. It has published reports on economic policies since 1979.

adaptive expectations

The expected value of an economic variable at a future date measured by the weighted average of all previous values of the variable. The concept was first applied to the study of investment behaviour and the consumption function and then later to inflation. This approach to expectations, first advanced by Cagan, although easy for economic model-builders, ignores the fact that forecasters often take into account more information than the past behaviour of the variable being studied.