Geoscience Reference

In-Depth Information

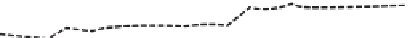

35

30

25

REG EXP

SE%GDP

20

15

TR%GDP

DEC TR

FCI

10

5

0

1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004

FIGURE 7.1. Evolution of Spain's Fiscal Structure

and the special one, applied only in the Basque Country and Navarra (Aja

1999

:

172-198; Monasterio et al.

1995

). These two AC collect their own income,

corporate, and VAT taxes, transferring after a fixed quota to the central state

administration. The rest of the ACs' revenues are apportioned by the central

state. Of the total revenues received by these regions, State transfers represent

more than 95%.

10

The remaining comes from the very limited number of taxes

that AC and local councils are entitled to impose. As a result of the dual

character of the institutions ruling fiscal federalism in Spain, only Navarra and

the Basque Country enjoy the necessary conditions to be fiscally accountable

and responsive. As for the other fifteen (including Galicia, Catalonia, and

Andalucia) the institutional design adopted generated a gap, growing over

time, between their capacity to spend and their capacity to collect revenues.

These are the political and institutional conditions that shape the evolution of

Spain's fiscal structure.

ECONOMIC GEOGRAPHY AND DISTRIBUTIVE IMPLICATIONS

OF FISCAL STRUCTURES

Figure 7.1

presents a number of indicators on the evolution of Spanish fis-

cal structure: REG EXP captures the share of regional expenditure over total

10

For more detailed information about the structure of fiscal revenues in Spain see Valle (

1996

:

2-26). On page 18, he analyzes the structure of fiscal revenues. The AC percentage is 1.72 %,

whereas local councils' is 2.76 %.