Geoscience Reference

In-Depth Information

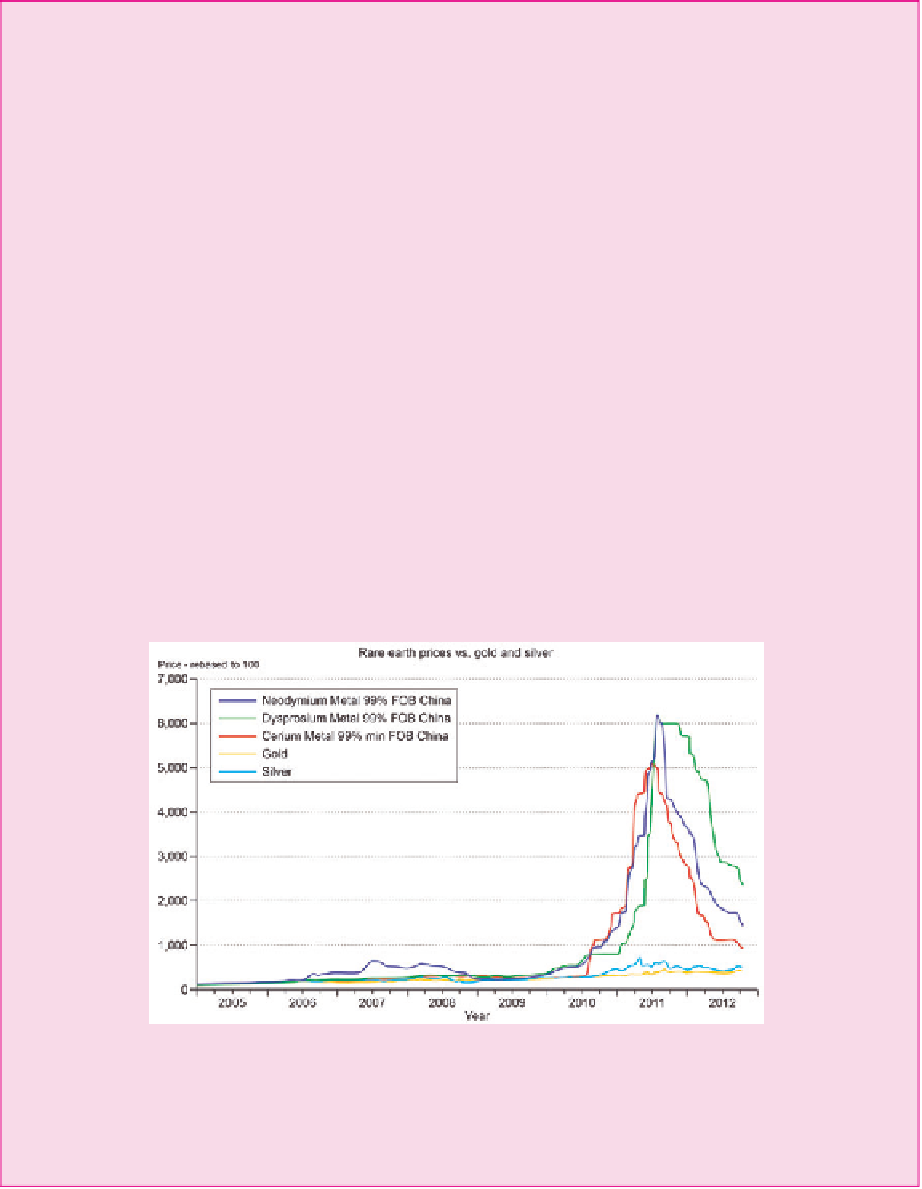

Box 2.2 The rare earth dilemma

Rare earth metals are a group of metals that you have probably never heard of before; cerium and

dysprosium are names that don't exactly slip off the tongue. Despite their obscure individual names,

as a collection of resources they have featured prominently in political debates and media

discussion over the last two years. As

Figure 2.8

illustrates, between the summers of 2010 and 2011

the prices of rare earth metals increased rapidly. Given that rare earth metals are vital components

within a range of modern products (including electronic goods and hybrid cars), it would be easy

to think that the price increase associated with these resources was a product of increasing demand

and declining availability. But the situation is more complex than this. Despite their name, rare earth

metals are actually relatively abundant in the Earth's crust (Washington Post, 2012). The recent

escalation in prices associated with these metals was thus not a product of scarcity, but of the fact

that in recent years China has somewhat cornered the rare earth metals market (China produces

somewhere in the region of 95 per cent of all rare earth metals on the global market place). This

cornering of the market was in part achieved by China's ability to keep production costs down by

only having limited 'environmental oversight' of its mining practices. The price hike in 2010/2011

was actually a product of the fact that China made the decision to restrict its export of rare earth

metals (Washington Post, 2012). As there was only limited capacity to extract these metals

elsewhere in the world, supply declined and prices inevitably went up. This price increase, however,

suddenly meant that it became economically viable to restart rare earth metal production in other

countries, which has led to increasing supply and declining prices for these metals since mid-2011

(se

e Figure 2.8).

The example of rare earth metals reminds us that price alone is an unreliable indicator

of absolute resource scarcity.

Source: Reuters Graphic

Key reading

Washington Post(2012) 'China's grip on world rare earth market may be slipping', 19 October 2012