Geoscience Reference

In-Depth Information

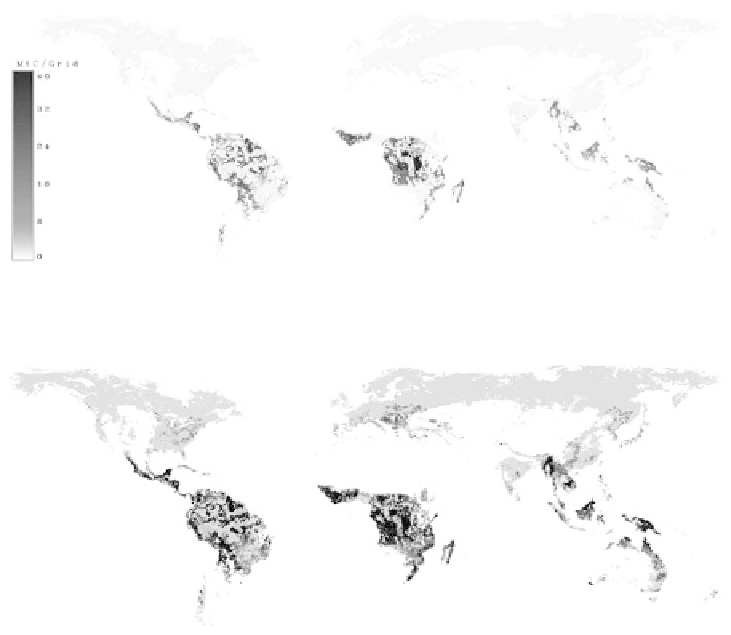

Figure 19.

Effectiveness (Corruption). Countries with high values of corruption are marked in red,

moderate countries in yellow and low values in green.

Figure 20.

Share of long living products. Countries which use their wood mainly for fuelwood are

marked in blue, those who use it for sawn-wood are in green.

CONCLUSIONS

Avoiding deforestation requires financial mechanisms that make retention of forests

economically competitive with the currently often preferred option to seek profits

from other land uses. According to the model calculations, even relatively low carbon

incentives of around 6 $/tC/5 year, paid for forest carbon stock retention or carbon

taxes of 12 $/tC would suffice to effectively cut emissions from deforestation by half.

Taxes revenues would bring about annual income of US$6 billion in 2005 to US$0.7

billion in 2100. The financial means required for incentives are estimated to range

from US$3 billion to US$ 200 billion per year, depending on the design of the avoided

deforestation policy. Our scenario, where incentives are payed in regions where de-

forestation will appear and the payment has an effect, estimates the necessary funds

to cut emissions from deforestation in half in the magnitude of some US$ 33 billion

per year, without including costs for transaction, observation, and illegal logging pro-

tection. Increasing the value of forest land and thereby make it less easily prone to

deforestation would act as a strong incentive to increase productivity of agricultural

and fuelwood production.